J. Michael Jones

Last week, movie theater chain AMC Entertainment (NYSE:AMC) reported its second quarter results. The firm has been working its way back from the brink of bankruptcy during the pandemic, as an energetic CEO has fired up the company’s investor base. The Q2 report was rather mixed, with something for both the bulls and bears, but the key takeaway was that more capital needs to be raised in the coming quarters.

For the second quarter of 2022, total revenues came in at $1.166 billion, which was more than double the pandemic impacted year ago quarter. Unfortunately, the top line number did come in a little light of street expectations, even though we know the overall domestic box office numbers going in. Interestingly enough, this was only the second miss in the past five years, as analysts are usually very conservative when it comes to revenues for the company.

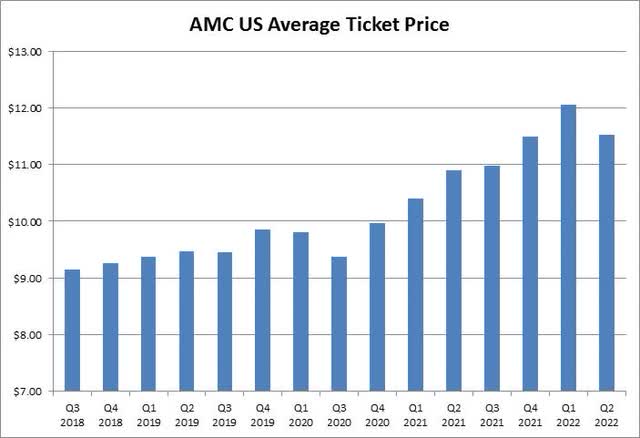

Perhaps the miss can be explained by average ticket prices in the US, which after nearly two years of gains as seen below, ticked down more than 50 cents sequentially. With US attendance over 43.5 million in the quarter, even holding ticket prices flat sequentially would have put the company just above street estimates for the period. A return to pre-pandemic levels for average ticket prices would be a major headwind for the company, especially as attendance levels remain pressured overall.

US Average Ticket Price (Company Earnings Reports)

On the flip side, the company did a little better on the bottom line than the street expected, with a 20 cent per share loss beating by three cents. While the company isn’t losing as much as it was a year ago, the GAAP loss was still over $100 million in the quarter. The company is almost back to operating profitability, but interest expenses remain the main challenge to getting the net income line back above zero. A major write-down of the firm’s investment in Hycroft Mining (HYMC) for Q2 also pressured the bottom line during this quarter, after that position was a big benefit in Q1.

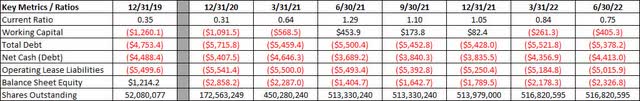

AMC management spent a good portion of the conference call talking about how great the quarter was. CEO Adam Aron also appeared on various financial media trying to fire up the crowds. What he didn’t really talk about, however, is how the company’s financial situation got quite a bit worse during the quarter. AMC burned through $117 million in cash during Q2, and as I’ve discussed in a number of prior articles, this is despite capital expenditures running at a fraction of their pre-pandemic levels. In the graphic below, you can see some key balance sheet metrics, with dollar values in millions.

Key Financial Metrics (Company Filings)

At the end of June 2022, AMC had $965 million of cash on the balance sheet, but that was down from more than $1.81 billion a year earlier. With the outstanding share count brushing up against its authorized limit, management has not been able to raise new equity capital in the past couple of quarters. This was a key funding method during the pandemic, especially as interest rates for the company have been well over 10% in the past few years. Overall, the balance sheet is in its worst shape since Q1 2021, especially with working capital now being more than $405 million in red and balance sheet equity at its most negative point since the end of 2020. Management on the call talked about more cash burn coming in Q3 due to seasonality and some other factors, so the balance sheet is likely to look even worse at the end of September holding all else equal.

With the company’s financial position not exactly in great shape, it seems that management has been looking for a way to raise some fresh capital. Included in the earnings report was the announcement that AMC has declared a special preferred stock dividend for shareholders of the common stock. This new class of shares will trade under the symbol “APE”, in a nod to the company’s retail investor base, with the ex-dividend date being August 22nd. By going this route, AMC management will then likely hit the market with an equity offering of preferred shares to raise capital. In the future, the preferred shares may be convertible to common, if shareholders eventually approve an increase in the number of outstanding shares of common equity.

As for AMC shares, they ended up rallying on Friday to their highest point in a number of months. Part of the rally was in sympathy with some other highly shorted names who also have bad balance sheets and reported not so good quarters Thursday afternoon. It remains to be seen where the stock will go after this preferred class comes out, but one thing is certain here. Wall street does not like this stock at all, with the average price target on the street being under $5 currently, implying massive downside from here. On a price to sales basis, AMC trades at a valuation that’s significantly higher than its pre-pandemic level, and that’s despite a massive amount of dilution since combined with shaky financials right now.

In the end, AMC reported a set of mixed Q2 results last week. The overall numbers weren’t terrible, but continued losses and cash burn mean the balance sheet has weakened to its worst point in at least a year. Management announced a preferred stock dividend, which will allow the company to raise more capital in the coming months. Shares jumped on Friday along with some other highly shorted names, but the street still believes there is a lot of downside ahead.

Be the first to comment