ThomasVogel/iStock via Getty Images

When the Apes go marching in…

Oh, When the Apes go marching in…

How I want to be in that Short Squeeze…

When the Apes go marching in…

Source: The Good Old Days Of 2021

When we last covered AMC Entertainment Holdings Inc. (NYSE:AMC) we were clear on the outlook for this stock. While we did not expect an immediate demise, the longer-term outlook was far from sanguine.

AMC will make it through 2022. The extent of the cash burn in 2022 will be critical to assess whether we can make the same statement for 2023. Credit markets are still remarkably sanguine but any tightness there and you can rest assured that refinancing the 2023-2026 debt loads will tip the company over. We remain bearish and look for the stock to visit its intrinsic value in the low single-digits.

Source: Good To The Last Drop

Today, we examine the changed fundamental landscape as AMC has thrown in a rather unusual preferred share equity, AMC Entertainment Holdings, Inc. PFD EQT UNIT (NYSE:APE) into the mix.

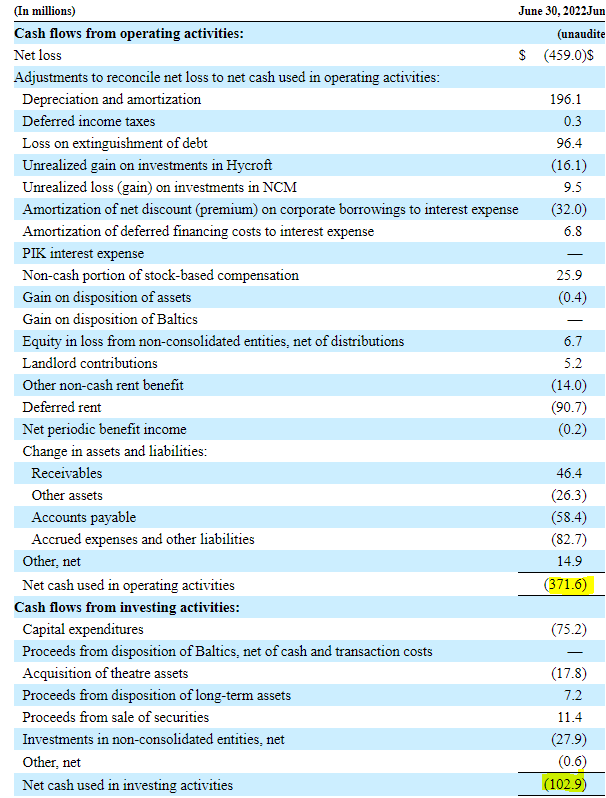

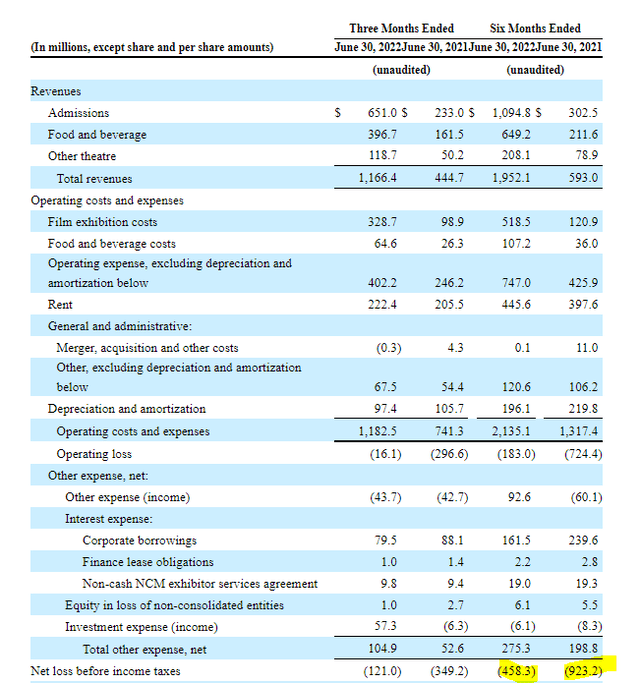

First A Look At That Cash Burn

The good news for AMC was that the numbers look far better than what we saw in 2021. Net loss for the first six months came in at just $458.3 million.

AMC burnt through almost half a billion in cash in the first six months of this year, which again was substantially better than last year.

AMC 10-Q

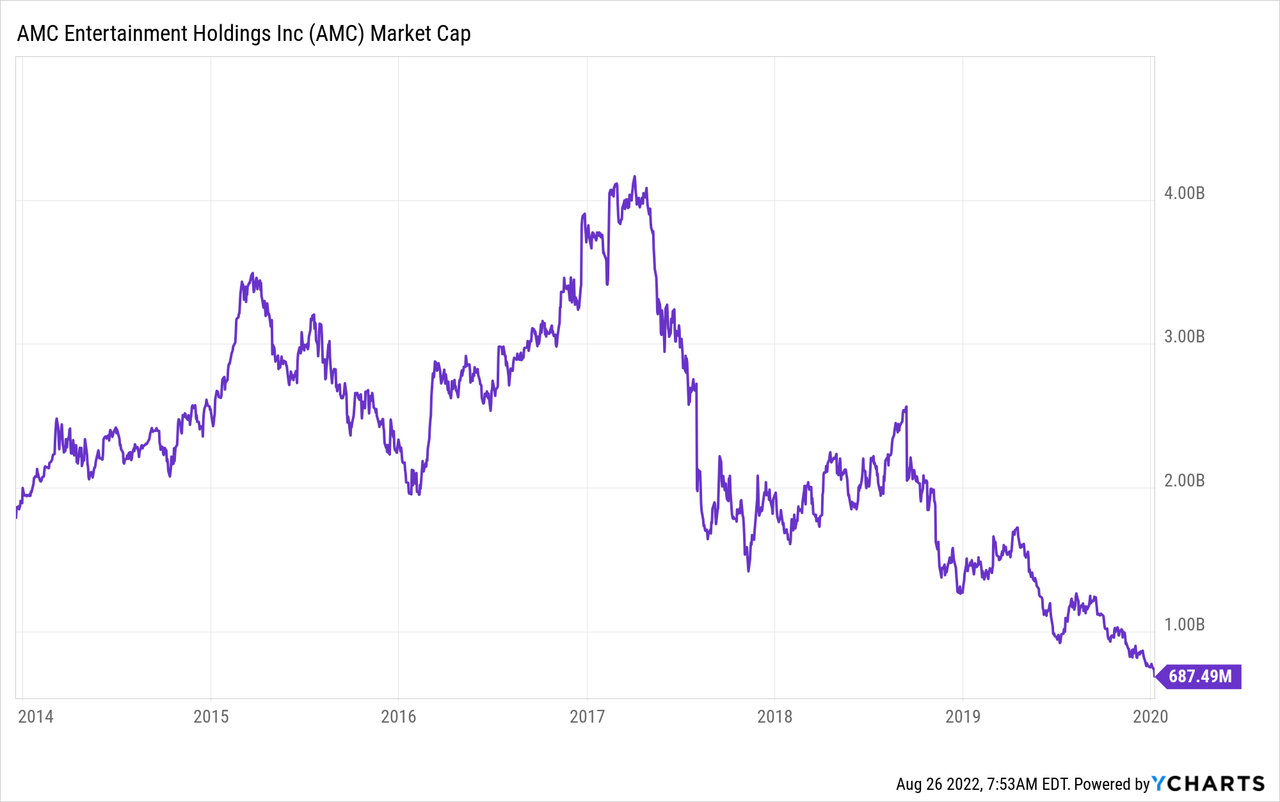

Even this burn rate number is so bizarre in the context of the fact that the company’s market capitalization in January 2020, prior to COVID-19 was just $700 million.

Despite a rather robust box office turnout, AMC is hemorrhaging. With $1.2 billion of current assets and just $962 million of cash AMC has between 12-18 months before things fall apart.

Enter The APE

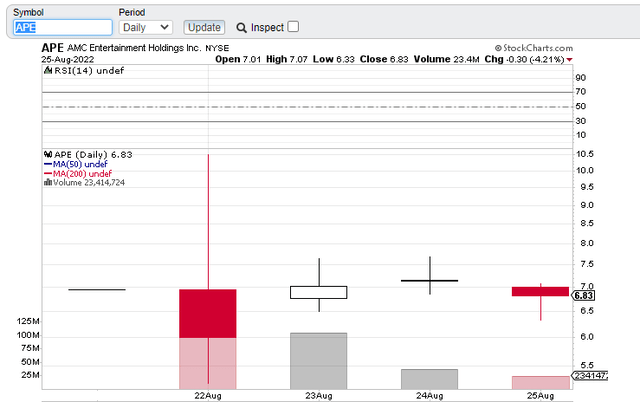

The APE issuance was met with a boatload of confusion and its first day trading was all over the place with a 100% trading range off the low price.

Since then prices have stabilized, but distressingly for the shareholders of AMC and APE, AMC share prices continue to drop.

How should investors make sense of this?

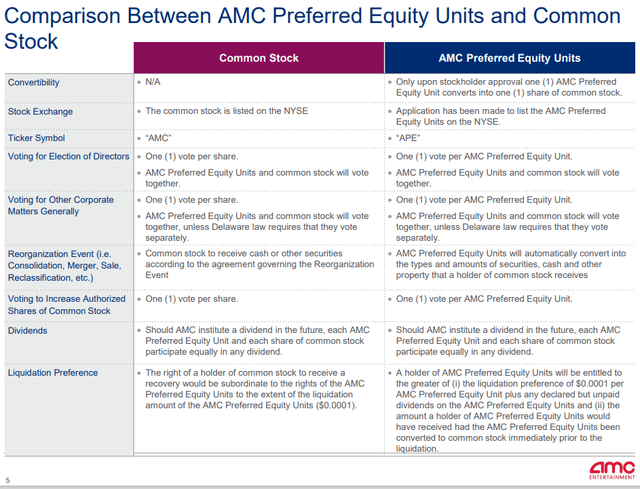

We will look at this through the lens of what APE shares are and what we think the rationale behind this move is. The first is a pure set of facts and extremely easy to decipher. APE shares are very similar to AMC shares and this is based on what the company itself says about them.

AMC has also answered a bunch of questions on the shares and we present the three most relevant points in our opinion.

How many AMC Preferred Equity units are there?

Theoretically, over the lifetime of the security, the maximum number of AMC Preferred Equity units that could be authorized over time is up to 5 billion (based on a total number of authorized preferred stock of 50 million).

However, the AMC Board currently has only authorized the equivalent of 1 billion of these AMC Preferred Equity units that can be issued now. 516,820,595 of these 1 billion AMC Preferred Equity units are being issued this month to shareholders as a dividend.

Do the AMC Preferred Equity units have voting rights?

Yes, the AMC Preferred Equity units are designed to have the same voting rights as common stock.

When do the AMC Preferred Equity units start trading and what will the price of the AMC Preferred Equity units be?

Because the AMC Preferred Equity unit is designed to have the same economic value and voting rights as a share of common stock, in theory, the common stock and AMC Preferred Equity unit should have similar market values and the impact of the AMC Preferred Equity unit dividend should be similar to a 2/1 stock split.

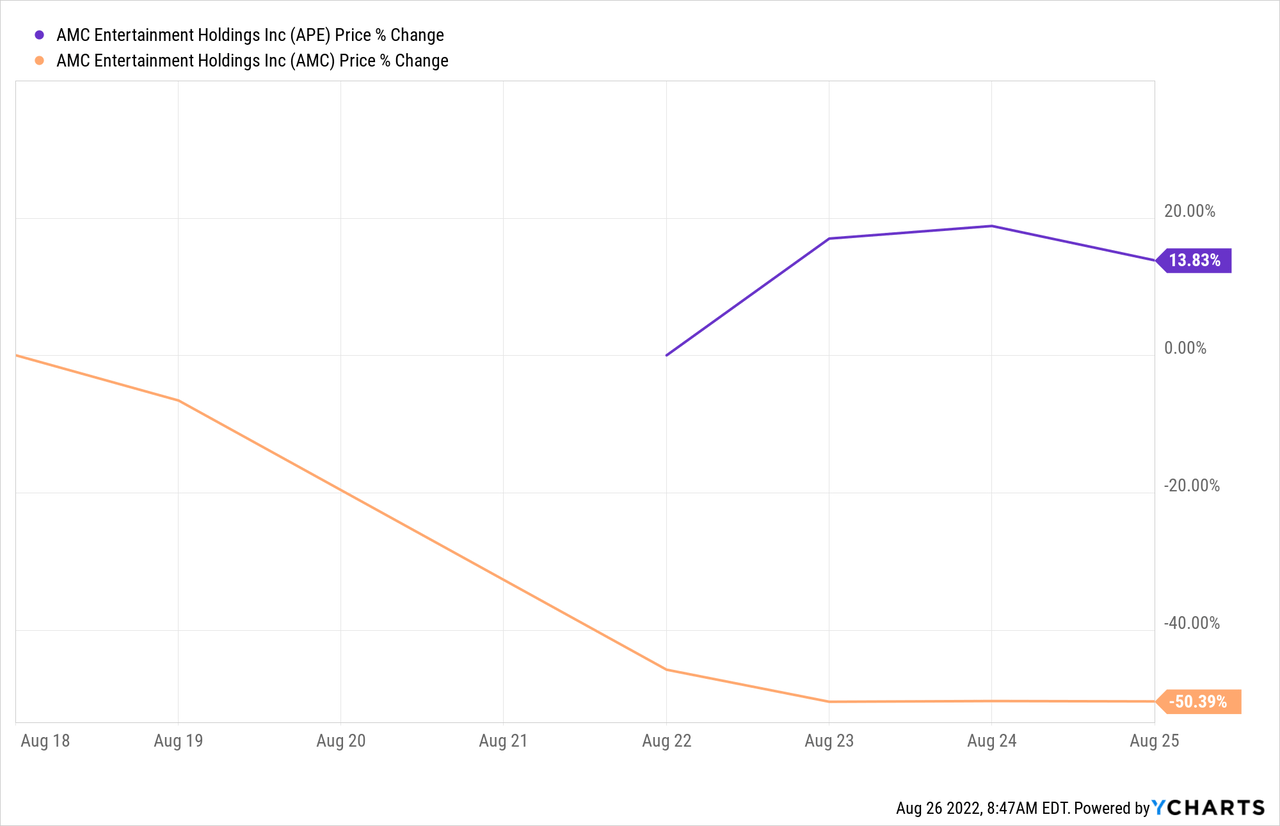

An investor owning one share of common stock on Aug. 19, 2022, will hold one share of common stock and one AMC Preferred Equity unit on Aug. 22, 2022.

An investor should therefore expect that the price of a standalone share of common stock logically should at least initially decline, however that investor’s economic interest will be the sum of the price of a share of common stock plus the price of an APE.

Source: AMC

Those facts above point us to what we think is happening.

There’s a pseudo stock split here alongside the opening up of almost infinite dilution.

Why did the company just not do a stock split instead of issuing APE shares? Stock splits have been done to reduce the price of an extremely high priced stock. In an age where you can buy 1 share or even fractional shares, stock splits are a gimmick for the most part. AMC’s sub $30 price was not even qualified for that gimmick. There was no real reason for a stock split. Instead, the company is hoping for an unusual backdoor capital raise via confusion. Here’s how that works.

APE creation has led to multiple new conspiracy theories including the one that it is designed to force short covering by naked short sellers. That one goes something along the lines that the naked short sellers cannot produce APE shares and failure to deliver will force an epic short squeeze.

Now assuming you buy into this latest groundbreaking conspiracy theory number 846, what do you do?

You sell your AMC shares and buy APE shares. Fundamentally this makes sense as well. This is a stock split and the two should trade identically. Yet APE is trading far cheaper. Even Jim Chanos has endorsed a similar view and he is in favor of going long APE and Short AMC.

But this plays right into what Adam Aron wants. He wants the AMC shares unloaded to “non-APES.” The ones that are not hanging on to the insane idea that a company that’s burning through cash at a $1 billion annualized rate is worth several fold more. He wants a confused base that finally relents to capital issuance. AMC has been locked in on 524 million total shares and that won’t change unless the majority of outstanding shareholders vote to change it. AMC proposal to add 500 million shares in May 2021, was eventually withdrawn after investors objected. However, this new AMC loophole of issuing an entirely new class of shares, has a higher probability of success. To add to the confusion, there is the additional idea thrown in that AMC wants to grow by buying cinemas off Cineworld (OTCPK:CNNWF).

Aron, for his part, has forcefully pushed back on dilution concerns, pointing out that the initial APE dividend does not change the ownership position for existing shareholders. He has also argued that dilution would be worth it if it helps AMC raise needed cash.

“There’s bad dilution and good dilution. If added liquidity gained from dilution is wasted, it’s bad. However, if wisely handled, it is good. Indeed, for AMC in 2021, it was actually great for our shareholders,” Aron tweeted on Aug. 6.

The extra cash could be used to fund acquisitions of other theaters, pay down debt or even push into unrelated businesses, like AMC’s 2021 purchase of a large stake in a gold mining company.

Source: CNBC

Verdict

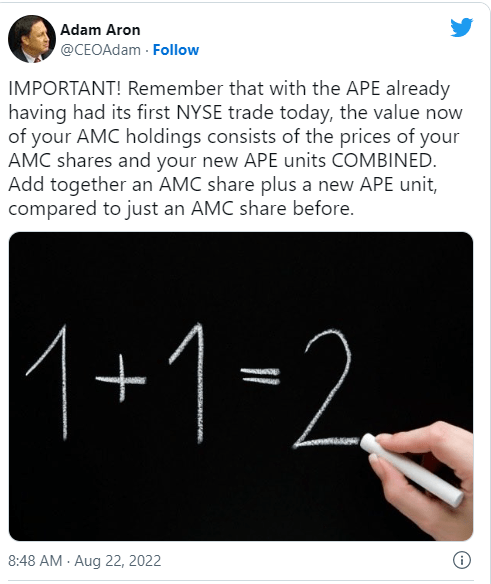

The CEO educated the retail meme community on some deep math after the listing of APE.

Twitter

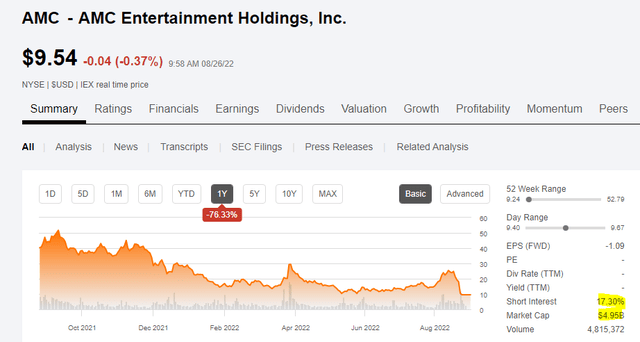

We have a company that’s bleeding cash and we are in an era of tightening liquidity. AMC still sports a $4.95 billion market capitalization and APE sports another $3.0 billion.

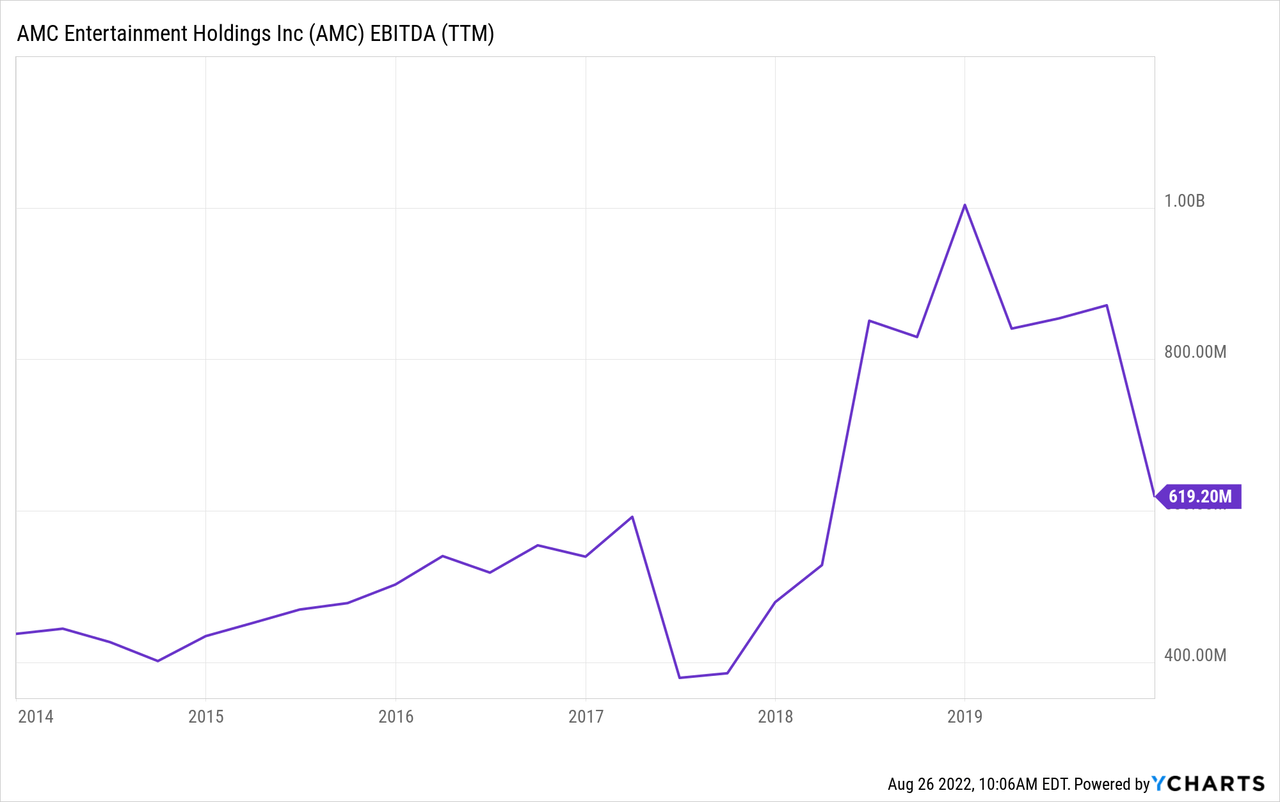

That combined is at least $7.5 billion more than in it needs to be. Ahead of that is more than $5.4 billion of debt (ignoring operating lease liabilities). AMC’s peak, pre-COVID-19 EBITDA was $1 billion.

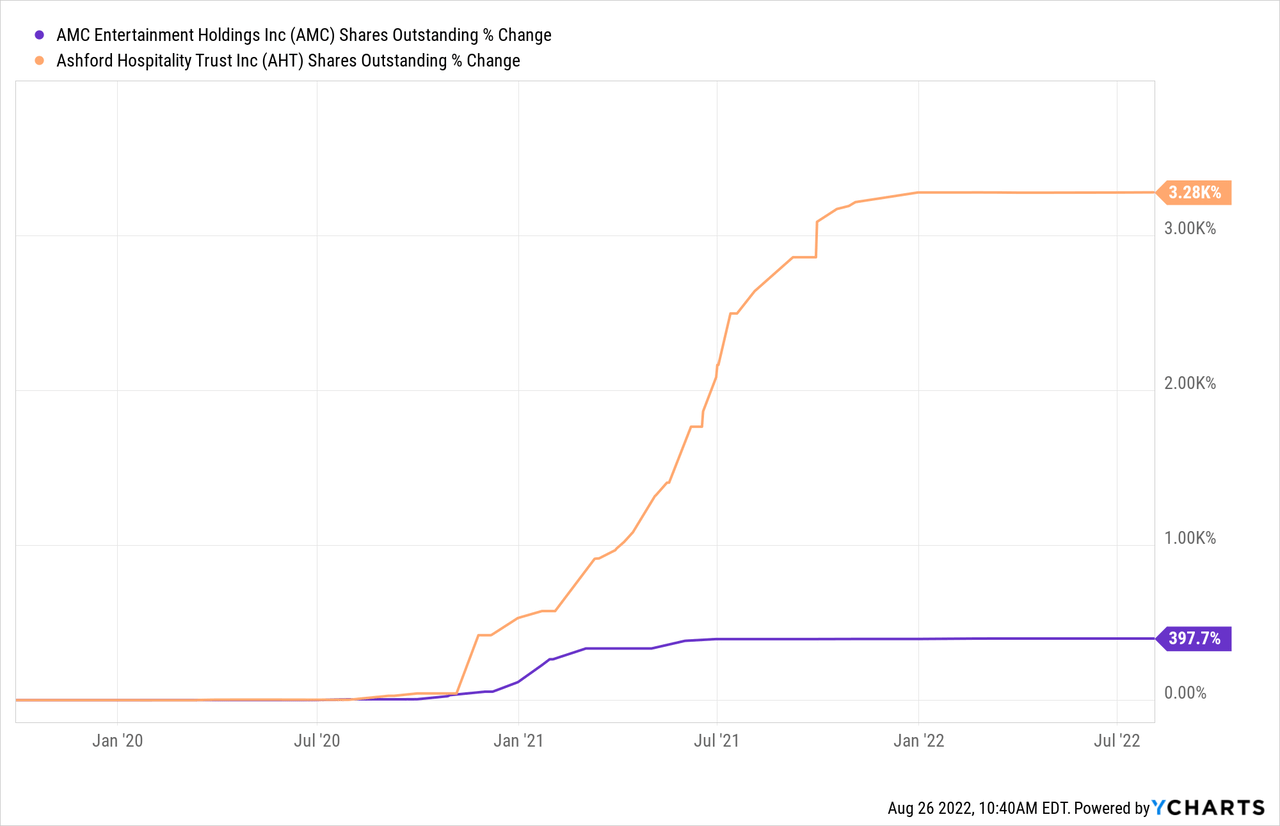

It’s hard to value this at even 6X EV to peak EBITDA let alone the implied 15X multiple today. Short interest is not too high, all things considered and we think both the AMC and APE shares are a “Strong Sell,” although we could see the logic in a Long APE, Short AMC trade. The best hope in preserving any value in the equity is via a massive dilution and we would look to Ashford Hospitality Trust (AHT) as a successful model of the same.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment