Massimo Giachetti/iStock Editorial via Getty Images

AMC Entertainment Holdings (AMC) recently agreed to buy a large stake in Hycroft Mining Holding (NASDAQ:HYMC) for $27.9 million, as part of a much larger $138.6 million equity raise, which likely saves the cash-strapped gold miner from bankruptcy.

AMC will invest alongside Eric Sprott, who will also contribute $27.9 million, and both investors will receive shares as well as 1 warrant per share, entitling them to buy another share at a price of $1.07.

However, investors should steer clear of investing in Hycroft, a risky gold miner with a troubled past.

This is clearly a puzzling, if not shocking, development: Why on earth is a movie theater chain investing in a gold miner?

“To state the obvious, one would not normally think that a movie theatre company’s core competency includes gold or silver mining,” said AMC CEO Adam Aron in a recent interview.

Is it because Hycroft is deeply undervalued? The mine does contain about 15 million ounces of gold and 600 million ounces of silver in resources – a tremendous precious metals deposit – especially when compared to Hycroft’s minuscule market cap of $110 million.

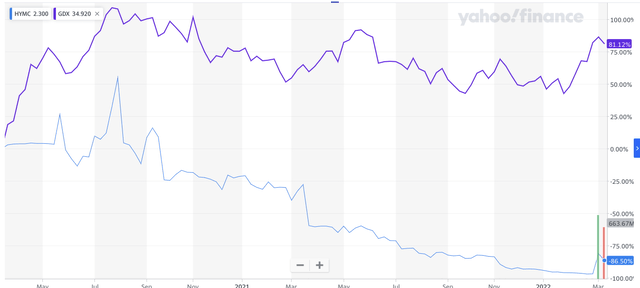

Hycroft’s performance compared to GDX (Yahoo Finance)

Yet, Hycroft Mining shares are down 86% over the past year, during a time which the gold miners index (GDX) returned over 81%, so investors have largely steered clear of Hycroft.

Does AMC know something gold mining investors don’t? Did AMC catch a smoking-hot deal in Hycroft and should investors follow the movie theater chain into Hycroft Mining?

I don’t believe so.

1. The Hycroft mine has a long, troubled history

This is not a new asset. Allied Nevada tried to produce profits from Hycroft for years, unsuccessfully, and went bankrupt in 2015. (Here’s an article I published back in 2015).

This was a low point for gold prices, to be fair, trading around $1,200/oz gold.

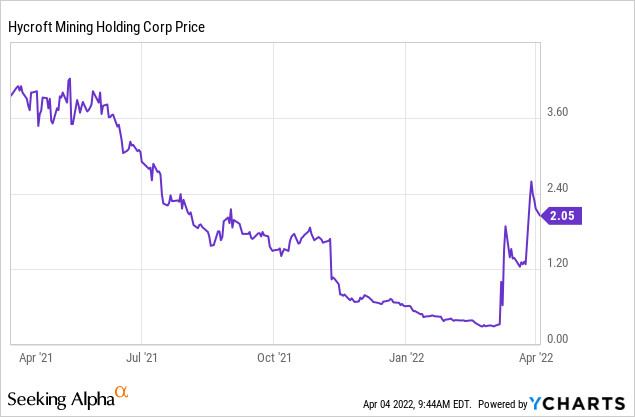

However, the company was re-listed a few years ago as “Hycroft Mining” but has still performed very poorly, as its shares are down 86.50% since then.

Again, this underperformance comes during a bull market in gold and gold miners, with the VanEck gold miners index returning 81% in that timeframe!

In February, Hycroft reported annual gold production of 55,668 ounces, and in Nov. 2021, it reported Q3 2021 financial results – but in both cases, it appears that the miner didn’t include its cash costs in either news release and doesn’t exactly make it easy to find this information.

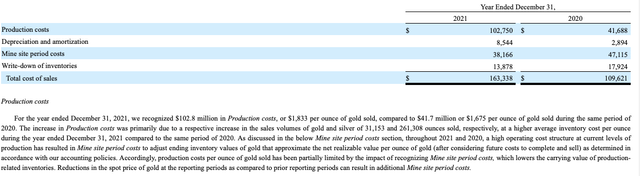

Hycroft’s production costs for 2021 (Hycroft Mining 10-K )

Looking at its 10-K, Hycroft reported cash costs of $1,833/oz gold, up from $1,675/oz a year ago. This led to a net loss of $88 million for 2021.

2. Hycroft has lot of gold and silver, but it is very low grade

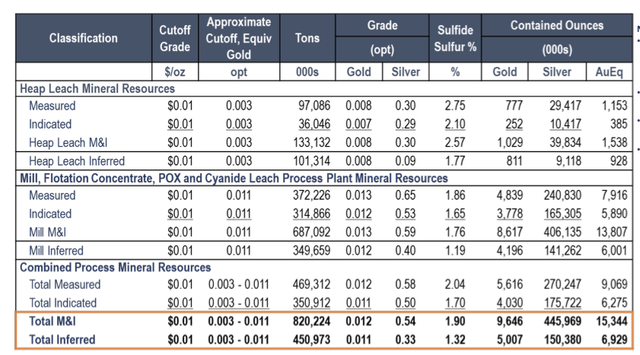

Hycroft touts a massive gold resource base 15 million ounces of gold and 600 million ounces of silver.

However, they are not actual gold reserves – most of the resource is in the measured and indicated category, and a large part in inferred resources, which are consider too speculative to be counted as economical.

Also, Hycroft’s resource grades are a maximum of .012 opt or .31 g/t, which is very low.

According to the World Gold Council, large and high-quality underground gold mines contain average grades of around 8 to 10 g/t gold, while marginal underground mines average around 4 to 6 g/t gold. Open-pit mines usually range from 1 to 4 g/t gold.

Hycroft’s grades are very low (Hycroft Mining)

I believe the mine needs much higher metals prices to produce a profit. It is not a profitable asset by any means (if it was, it would already be producing profits with gold at $1,900/oz).

3. AMC is investing a relatively tiny amount of money

The investment of $28 million compares to $1.8 billion it has raised from investors over the past year or so.

The $28 million sum is also tiny compared to AMC’s $11 billion market cap. This is pretty low risk for AMC since $28 million is a drop in the bucket.

It’s hardly a newsworthy amount, in my opinion, yet the news was met with great media attention and was covered by outlets like CNBC, Reuters, MarketWatch, and others.

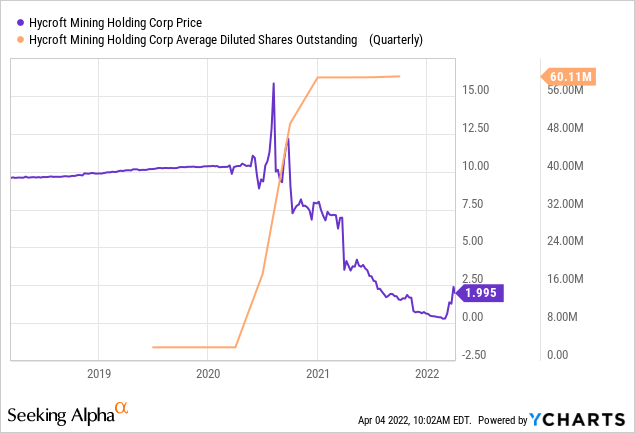

4. Extreme share dilution

The size of the investment pie has decreased substantially for existing Hycroft Mining shareholders.

Hycroft just diluted existing shareholders when it issued 89.5 million new shares at a price of $1.19, generating proceeds of $138.6 million.

This is not the best time for the company to be diluting shareholders given its stock price performance since re-listing in 2020.

The company now has 196,803,459 shares issued and outstanding – up from 60 million last year and less than 10 million shares when it re-listed.

Hycroft also issued 23.4 million warrants to Sprott and AMC, giving them the right to purchase an additional share at $1.068 with a 5-year term. Assuming the exercise of the warrants, it would bump up Hycroft’s share count to over 220 million shares.

Bottom line: Avoid Hycroft

If Hycroft was such a great asset worthy of investment, I believe a gold miner would have participated in the recent private placement. But we didn’t see any mining company step up to the plate.

There are literally dozens of other producers who would be thrilled to add a large Nevada gold mine to their portfolio. But Hycroft is just not a good asset in my opinion.

The bulls may argue that Hycroft could end up turning a huge profit if gold prices soar to $3,000/oz or higher from current spot prices – but that’s the case for literally any producing gold miner, and you can earn better returns elsewhere (with much less risk).

I recommend investors avoid speculating in this stock, as there are far better opportunities in the gold mining sector.

Be the first to comment