chainatp/iStock via Getty Images

Investment Thesis

AMC Entertainment Holdings, Inc (NYSE:AMC) is uninvestable. That is the most straightforward conclusion we have had to make in a long time. The reasons are simple. The business has not, is not, and will likely not be profitable for the next three years. Given the mounting capital needed to maintain its heavy Capex business, AMC will continue to rely on debt leveraging and share dilution moving forward. In addition, the stock still has a long way down to its pre-pandemic prices of $4 to $6s, given the over-hyped momentum in the past two years.

Thus, investors holding onto AMC should sell their entire holdings and run away with whatever capital they have left, at the next dead cat bounce.

AMC Is A Sunset Business With A Lack of Profitability

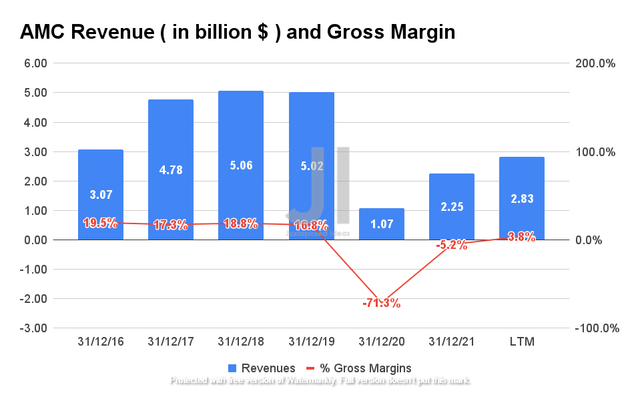

AMC Revenue and Gross Income

It is no secret that AMC was decimated during the COVID-19 pandemic, since the company is still struggling to recover to FY2019 levels, despite the global reopening cadence. In the last twelve months (LTM), the company recorded $2.83B of revenues, representing only slightly more than half of its FY2019 revenues. Though we may expect much improvement to its FQ2’22 revenue due to the multiple blockbusters in the theatres now, full recovery seems unlikely for FY2022.

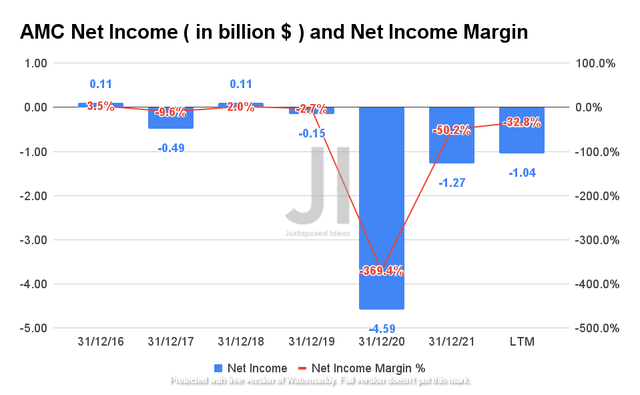

AMC Net Income and Net Income Margin

As evident from the chart, AMC had reported minimal net income profitability pre-pandemic. Its net losses further deepened in the past two years with little hope of recovery for FY2022, at -$1.04B of net losses in the LTM.

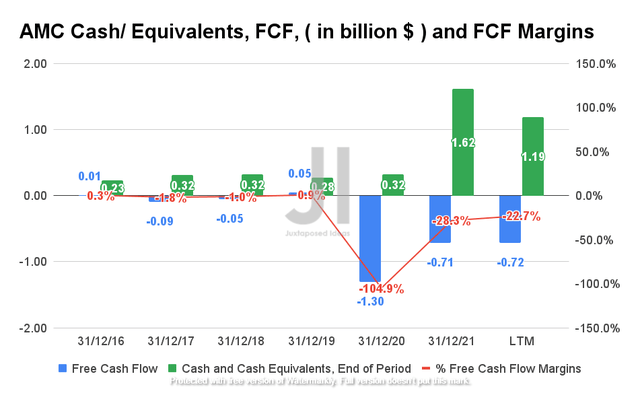

AMC Cash/ Equivalents, FCF, and FCF Margins

In addition, AMC is also unable to generate positive Free Cash Flow (FCF) pre-and during the pandemic, with FCF of -$0.72B and FCF margins of -22.7% in the LTM. Though the company had $1.19B of its cash and equivalents on its balance sheet, there is no doubt that the sum would not be sufficient to fund its operations, debt servicing, and Capex for more than a few quarters.

Through no fault of its own, AMC’s biggest rival is no longer another movie distributor, but the online streaming industry that has boomed in the past two years. Unfortunately, with the trend unlikely to reverse anytime soon, the company would probably be left in ashes, given its lack of profitability. Even then, streaming services have also suffered in recent months, given the slowing growth and deceleration in subscriber acquisition. The bear market had no mercy indeed.

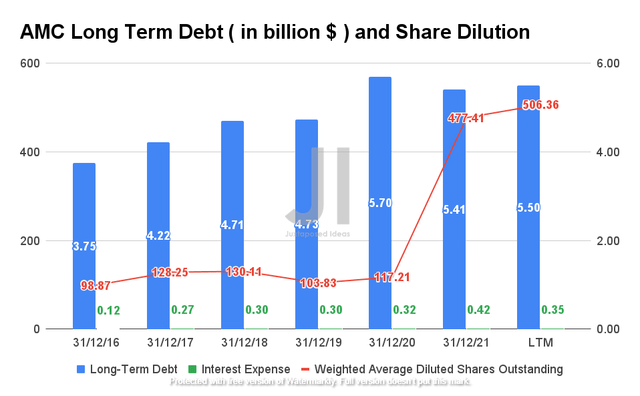

AMC Is A Debt Monster With Share Dilution Problems

AMC Long Term Debt and Share Dilution

AMC has increasingly relied on long-term debt in the past five years, especially so during the COVID-19 pandemic. Nonetheless, the quick solution was not sustainable, since the company reported $5.5B of long-term debt with $0.35B of interest expenses in the LTM. The interest alone easily translates to half of its negative FCF and a third of its net losses in the LTM.

In addition, AMC had given in to the meme stock hype during FY2021, by massively diluting its shareholders by 407% then. The company also recorded $43.1M in share-based compensation in FY2021, with another $6.5M incurred in FQ1’22. Assuming a similar rate, we may expect a decent moderation in its SBC expenses for FY2022, at a projected sum of $26M. Nonetheless, given the continuous decline in its stock prices, AMC may also potentially report higher SBC expenses moving forward, to make up for the difference. We shall see.

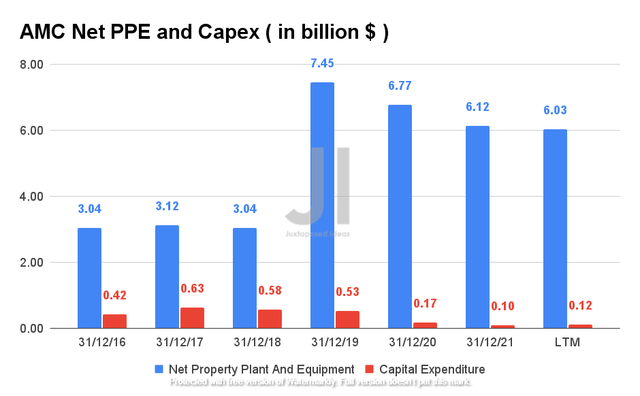

AMC Net PPE and Capex

Based on the chart above, AMC also reported a massive net property, plant, and equipment of $6.03B in the LTM. Though the company has been diligently divesting its underperforming locations, it is evident that the efforts are minimal against the mounting capital needed to maintain these assets. AMC reported $0.41B in Depreciation/ Amortization expenses in the LTM, representing more than half of its negative FCF and nearly half of its net losses.

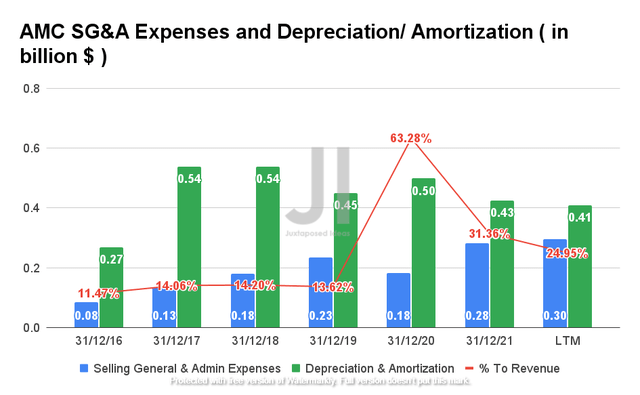

AMC SG&A Expenses and Depreciation/ Amortization

Given its aggressively increasing SG&A expenses of $0.3B in the LTM, it is not far-fetched to surmise that AMC would need to continue to rely on both debt leveraging and share dilution, to support its high capex business moving forward. Therefore, potentially further triggering another sell-off then.

AMC’s Future Looks Bleak – Marking The End Of The Theatre Era

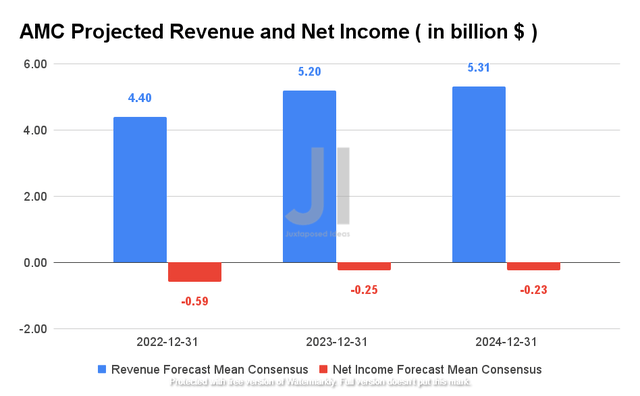

AMC Projected Revenue and Net Income

AMC is expected to report revenue growth at a CAGR of 33.14% over the next three years, though unfortunately, its net income profitability will not occur in the same time frame. For FY2022, consensus estimates that the company will report revenues of $4.4B, representing a 95% recovery YoY though a decline of -12.3% from FY2019’s levels. It is evident that the COVID-19 pandemic has indeed changed the entire movie experience globally, with the increased proliferation of online streaming.

Though AMC is expected to report pre-pandemic revenue levels from FY2023, its net income profitability will continue to take a hit, given its heavy Capex investments and massive debts. Therefore, it is inevitable that we may have to bid goodbye to a dying era of theatre magic sooner than expected.

So, Is AMC Stock A Buy, Sell, or Hold?

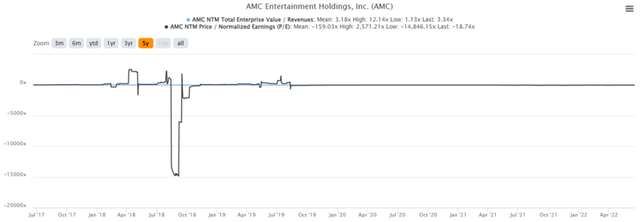

AMC 5Y EV/Revenue and P/E Valuations

AMC is currently trading at an EV/NTM Revenue of 3.34x and NTM P/E of -18.74x, higher than its 5Y mean of 3.18x and -159.03x, respectively. The stock is also trading at $12.50, down 80.1% from its 52 weeks high of $63.01, though at a 28.8% premium from its 52 weeks low of $9.70.

AMC 5Y Stock Price

It is apparent that AMC has been overhyped as a meme stock during the pandemic, given the massive support from the retail investors, also known as the AMC apes. In addition, since the stock still looks inflated based on pre-pandemic standards, we believe the time of maximum pain is yet to come, further worsened by its lack of net income and FCF profitability. The recent crash in the cryptocurrency market does not help as well, since the decentralized concept was highly popular with the AMC apes.

Even consensus estimates have rated AMC stock as a strong sell with a price target of $6, indicating a -52% downside. Moreover, the fact that the stock is mainly owned by retail investors should also indicate a significant possibility for a sentiment-driven market, pointing to unpredictable volatility moving forward.

Therefore, we rate AMC stock as a Sell.

Be the first to comment