MixMedia

This is a long (APE)/short (NYSE:AMC) pair trade, based on two AMC Entertainment share classes that may ultimately be identical and should trade at a tighter spread than currently. Currently APE units trade at under a third of the value of AMC shares. This is unusual, typically similar classes of the same equity would trade in a tight range.

Similar Assets

The company explains here how AMC shares and APE units are similar. Of course, the market may not believe this, until they are literally identical and I expect management to propose conversion of APE units into AMC shares at a shareholder meeting in perhaps June 2023.

Illustrative Scenarios

Three scenarios may cause prices to converge:

Bankruptcy

Bankruptcy is one. With cash burn of around $100M-$200M a quarter and cash of $965M as of June 30, 2022 the company may have around 1-2 years to execute on a turnaround strategy. There is a risk that movie theaters are now structurally challenged given shorter release windows and accessibility of content on streaming platforms, which care far more about their own platforms than movie theater’s success.

Refinancing

Refinancing is another, if the company were to issue 425M APE units at perhaps $2/unit (the current price), then they could raise almost $1B to paydown debt and perhaps enable a more sustainable capital structure. Sustainability is something of a moving target and the company may need closer to $3B of debt paydown to ensure long-term survival depending on where operating profits trend, so it’s unclear if APE units are the full solution to AMC’s capital structure issues, but in an optimistic scenario they could be.

Nonetheless, you can clearly see how a higher price for APE units (as the only equity currency they can currently sell) would be helpful to management, even at the expense of a lower AMC share price if necessary.

Conversion Vote

Finally, even without a corporate event, AMC may simply hold a vote for APE units to convert into AMC shares. If some APE further units are issued (at the time of issuance the AMC/APE split was 50/50), then there would be a majority of APE units compared to AMC shares and the vote should be winnable by APE shareholders in the majority with equal voting rights.

Below is a rough model of the per share/unit returns as estimated in each scenario

| APE long | AMC short | Long/short return | |

| Bankruptcy | -1.95 | +6.20 | +4.25 |

| Major raise to achieve solvency | +0.1 | +4.15 | +4.25 |

| Shareholder vote to convert APE units to AMC shares | +2.125 | +2.125 | +4.25 |

source: author’s analysis

History

Some brief history helps how explain how AMC got here, AMC has benefited from being a meme stock in recent history (i.e. a stock bid up to lofty valuations by retail traders and/or short squeezes) and has used surges in its share price to issue equity and raise much needed capital given weak operational performance and high leverage.

However, the company has now issued virtually all the shares it can and shareholders blocked an attempt to create more AMC shares for further share issuance.

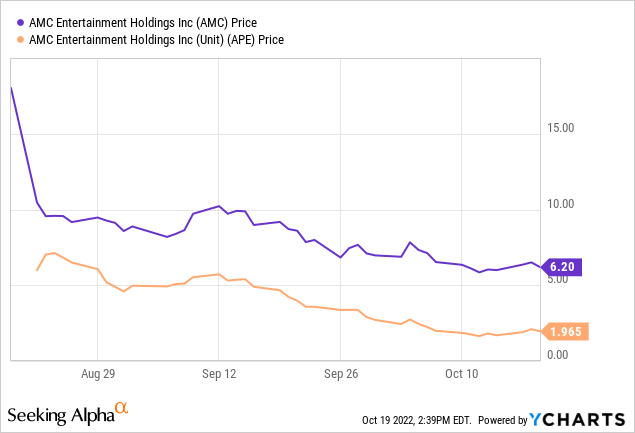

To get around this, AMC then created new preferred stock (a class of stock they could issue without a new shareholder vote), designed to be identical to AMC shares. This occurred in August, when a stock dividend gave every one AMC shareholder an equivalent interest in APE units. Then, on September 26, 2022, AMC filed a registration for up to 425M APE units to be potentially sold by Citigroup to raise further capital. APE units have persistently traded at a discount to AMC shares over their 2 months of trading history so far (see below).

Note that it’s hard to visualize from the chart below, but the spread between AMC shares and APE units has significantly widened over recent weeks. APE units were at times trading at 60% of the value of AMC’s shares in past months, now it’s 32%.

Operating Performance Presents Going Concern Risk

AMC appears distressed. It has $4.6B of net debt, much of which trades below par and the debt was recently rated CCC by S&P. Operating cashflow less capex was -$447M in H1. The company lost -122M on a net income basis in Q2. The company may see operating profit in the second half of calendar 2022, but the debt load is material with annual interest of around $360M and the company likely need to find further ways to restructure if it is to survive for the long-term. AMC is currently looking to refinance $400M of debt, and the market reaction will be interesting.

Spin-Off Dynamics

Another consideration is thinking about APE units as a spin-off. Many AMC shareholders received APE units in their brokerage accounts without too much fanfare, then these units have traded down relatively steadily.

In similar spin-offs, investors can often sell these shares that are new to them, perhaps not understanding their economic value or why they received them. This is fairly typical for spin-offs, which base rate studies suggest can tend to underperform the market for around 3 months after issuance, perhaps as investors learn about them.

Of course, APE units aren’t a true spin-off in that they are intended to be equivalent to the AMC shares that the investor already held. Still the instinct of new unit holders to instinctively want to sell shares they didn’t choose to buy may be similar.

Risks

One clear risk is that it may be better to simply short AMC if you see bankruptcy coming. In that scenario, APE units are perhaps just a complication.

Secondly, this is not a stock that has traded in relations to intrinsic value in the past, many investors have lost money shorting AMC during the height of the meme-stock phase.

The spread has diverged between AMC and APE in recent weeks and may diverge further.

APE units are may see increased supply with further issuance. That may push down the price of APE units which are actively being marketed to investors, whereas AMC shares issuance is largely capped. This may cause prices to continue to diverge as further APE units are sold and AMC shares are not.

Even for share classes that the market has accepted are the same, somewhat arbitrary differences in pricing can still exist.

The high borrow cost for AMC shares creates a clear holding cost that may offset the benefits, even were the trade to work as anticipated.

Shorting stocks carries material risks such as margin calls and risk of ongoing loss that is not necessarily capped at zero as a long position would be.

Conclusion

The divergence between two assets that appear basically identical appears odd. Furthermore, it’s not too much of a leap to foresee various events on a 12-month view that would “force” parity, including a successful shareholder vote on conversion or the bankruptcy of AMC.

The main concern is that short AMC may be a simpler trade in some scenarios, but I prefer the arbitrage here, which seems to better control risk and offers a broader set of scenarios where you potentially win as an investor. I also return to the very basic argument that one asset, with very similar properties to another, should not trade at a third of its value.

Be the first to comment