Emma McIntyre/Getty Images Entertainment

Amazon (NASDAQ:AMZN) recently underwent a 20-for-1 stock split. While stock splits do not change the fundamental value of the company, they may lead to positive returns following the split due in part to the increased retail interest in the stock. That phenomenon played out initially for AMZN, but the stock has since fizzled as it remains pressured by the ongoing tech crash. AMZN remains a “fat pitch,” a term coined by Warren Buffett, as this is a company that has invested aggressively in long-term growth. The company has already embarked on its previously announced $10 billion share repurchase program, potentially signaling that investors are poised to begin reaping the fruits of those investments.

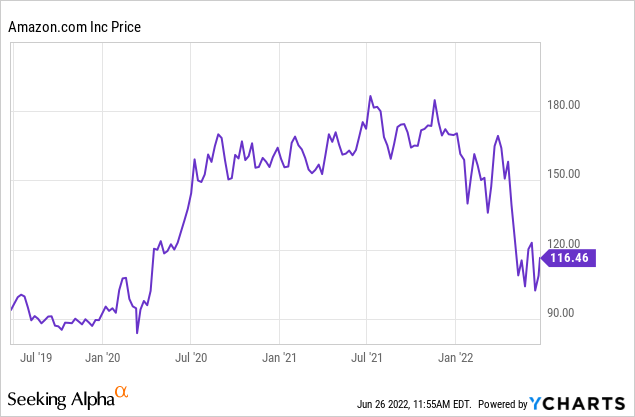

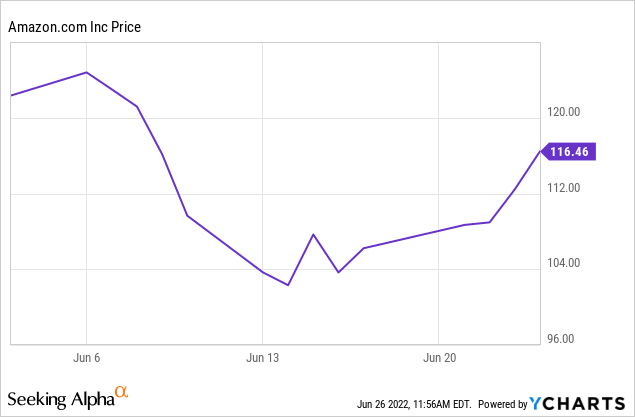

AMZN Stock Price

After the crash in tech stocks, AMZN is now trading not far from where it did before the pandemic.

I last covered the stock in March when I rated it a strong buy on account of the $10 billion share repurchase program. The stock has since pulled back another 29%, providing an even more attractive buying opportunity.

AMZN Stock Key Metrics

It is interesting that when markets are high, Wall Street is willing to look to the long term. Yet when valuations are low, Wall Street only wants to look at the near term. In theory, the opposite should be true, but AMZN stock cratered double digits after reporting earnings which did not vary so much from its historical policies.

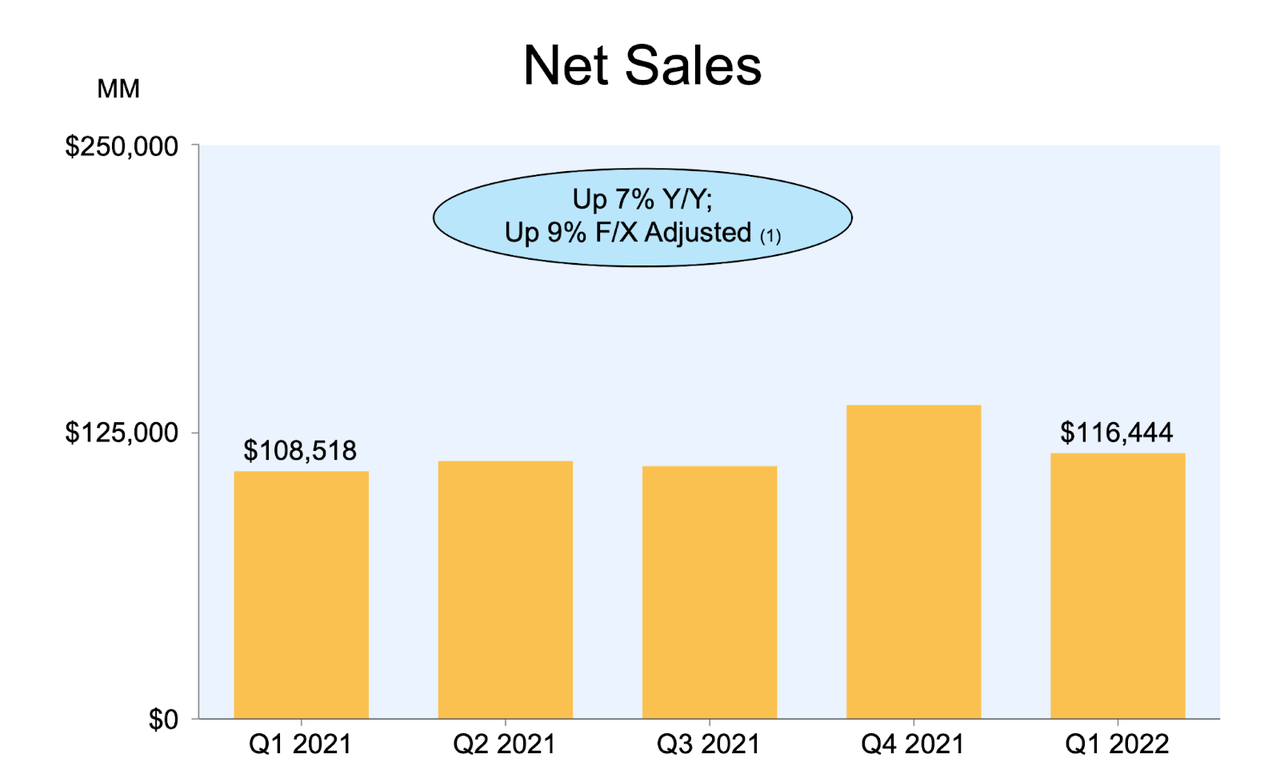

AMZN saw modest sales growth of 7% to $116 billion.

2022 Q1 Presentation

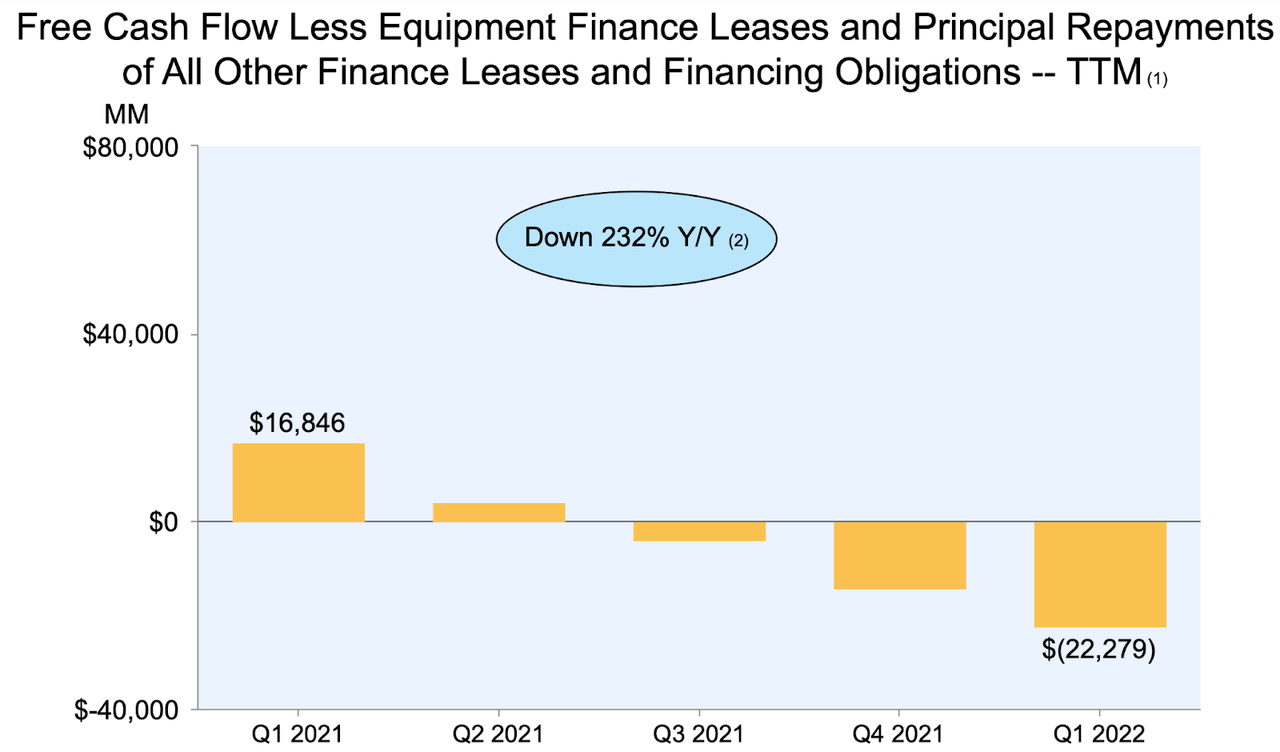

The headlines focused on the poor free cash flow losses. Free cash flow dropped from $16.8 billion last year to negative $22.3 billion this year.

2022 Q1 Presentation

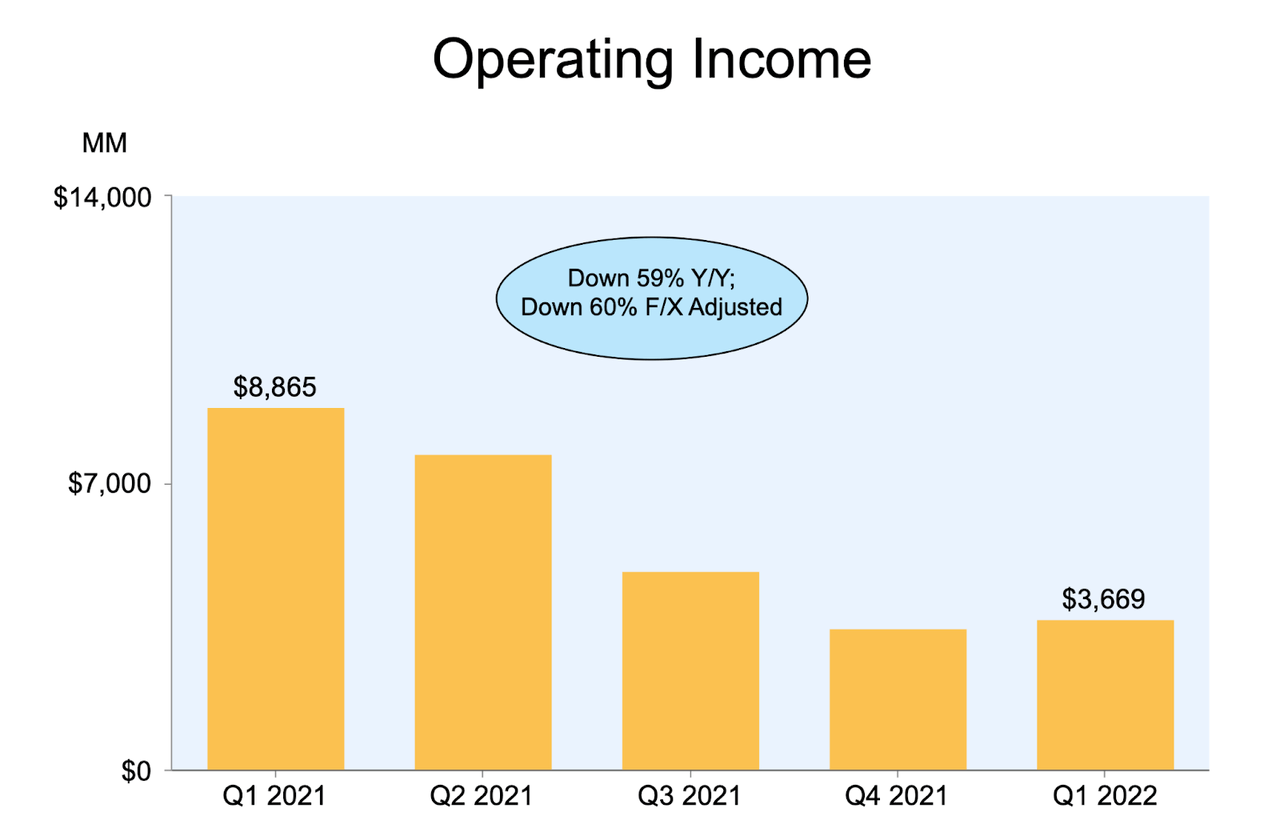

That was largely due to aggressive investment in capital expenditures, but declining margins also played a role. Operating income declined 59% year over year to $3.7 billion.

2022 Q1 Presentation

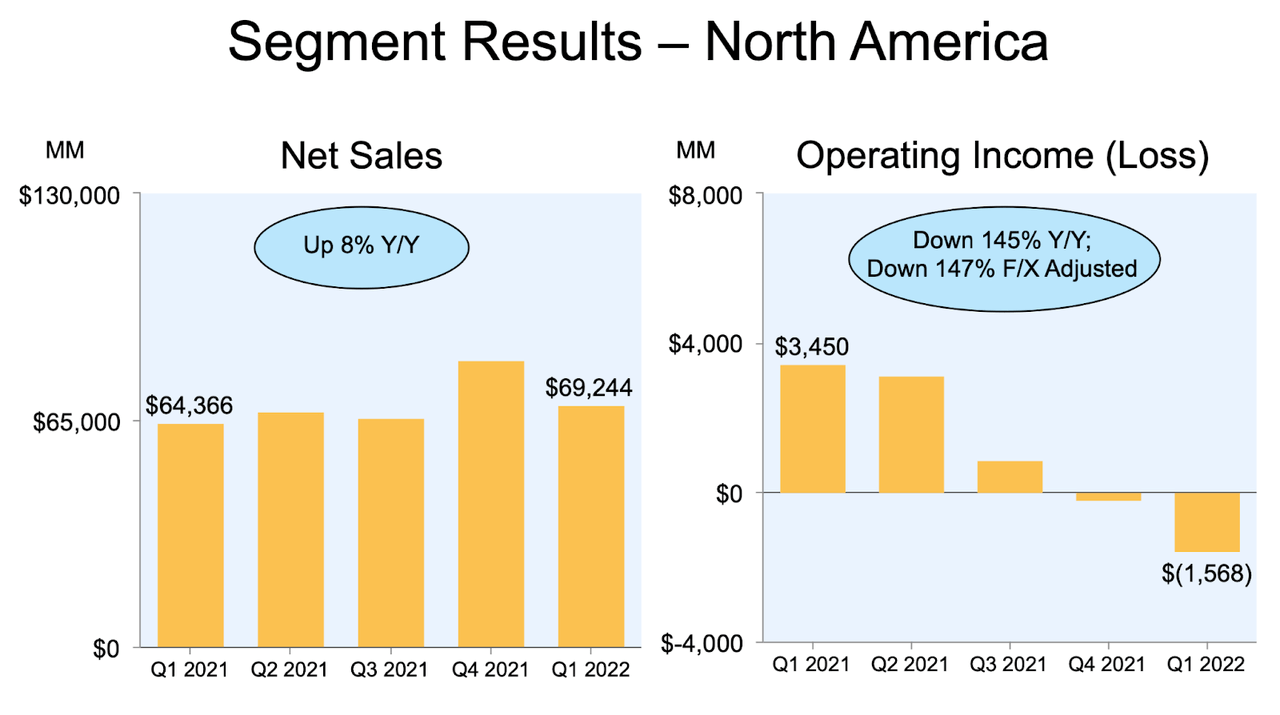

What happened? This isn’t a surprise as the company has telegraphed supply chain issues since last quarter. We can see that in spite of top-line growth, its marketplace operations saw operating income turn negative.

2022 Q1 Presentation

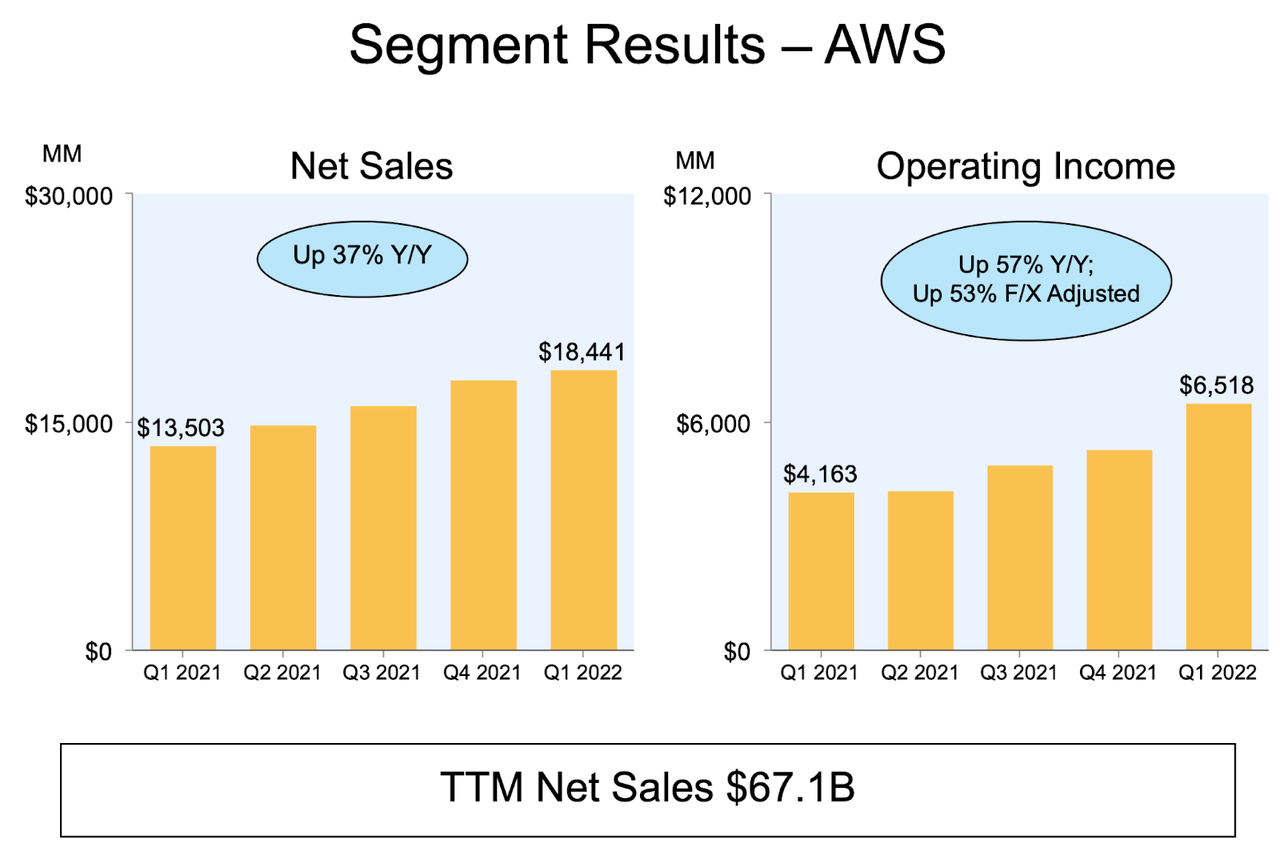

The lone bright spot from a profitability perspective was Amazon Web Services (‘AWS’), which saw 37% sales growth and robust profit margins.

2022 Q1 Presentation

AMZN did repurchase $2.7 billion of stock in the quarter – which may have surprised some investors due to the negative free cash flow. AMZN ended the quarter with $96 billion of cash versus $48.7 billion of debt. While I would like to see AMZN start to generate free cash flow to fund share repurchases, the company has plenty of cash on hand to fund share repurchases even as it continues to invest heavily amidst supply chain struggles.

When Was Amazon’s Stock Split?

AMZN split 20-for-1 on June 3rd. This means that for every 1 share owned, shareholders received 19 additional shares on that day.

How Many Times Has Amazon’s Stock Split?

Besides this latest split, AMZN has previously split three times. On September 1, 1999, AMZN had a 2-for-1 split. On January 5, 1999, AMZN had a 3-for-1 split. On June 2, 1998, AMZN had a 2-for-1 split.

How Did Amazon Stock Do After The Stock Split?

Immediately following the most recent split, AMZN did see a rally which was quite impressive considering that tech stocks were in general crashing during the same time period. However, the stock has since pulled back.

Is Amazon A Good Long-Term Investment?

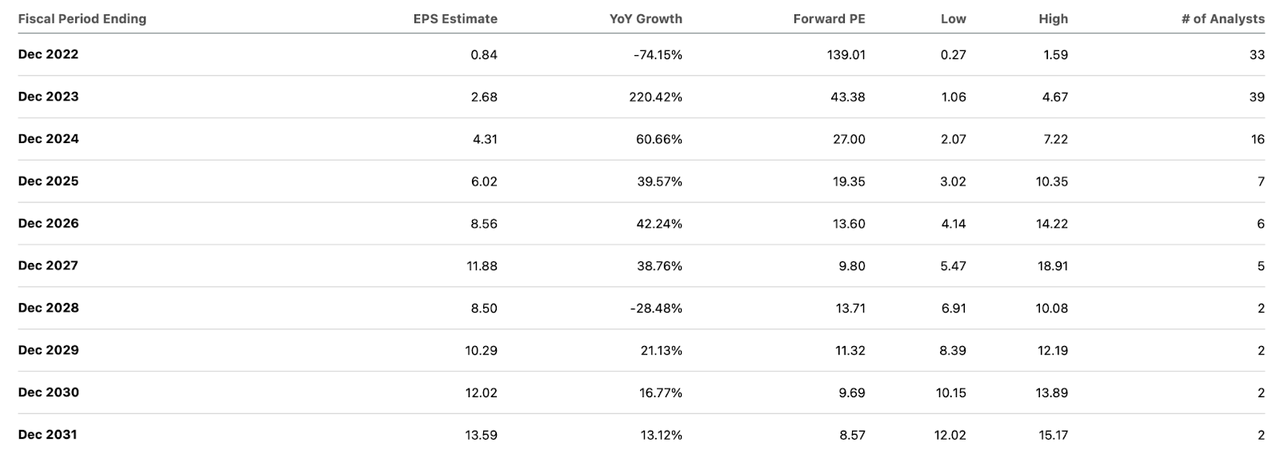

Long-time shareholders know that AMZN has been focused on the long term perhaps more than any other company. Its long-term focus has led to the company frequently prioritizing long-term growth versus near-term profits. That focus is evident even looking at decade-long projections as the stock is trading at 9x 2031e earnings.

Seeking Alpha

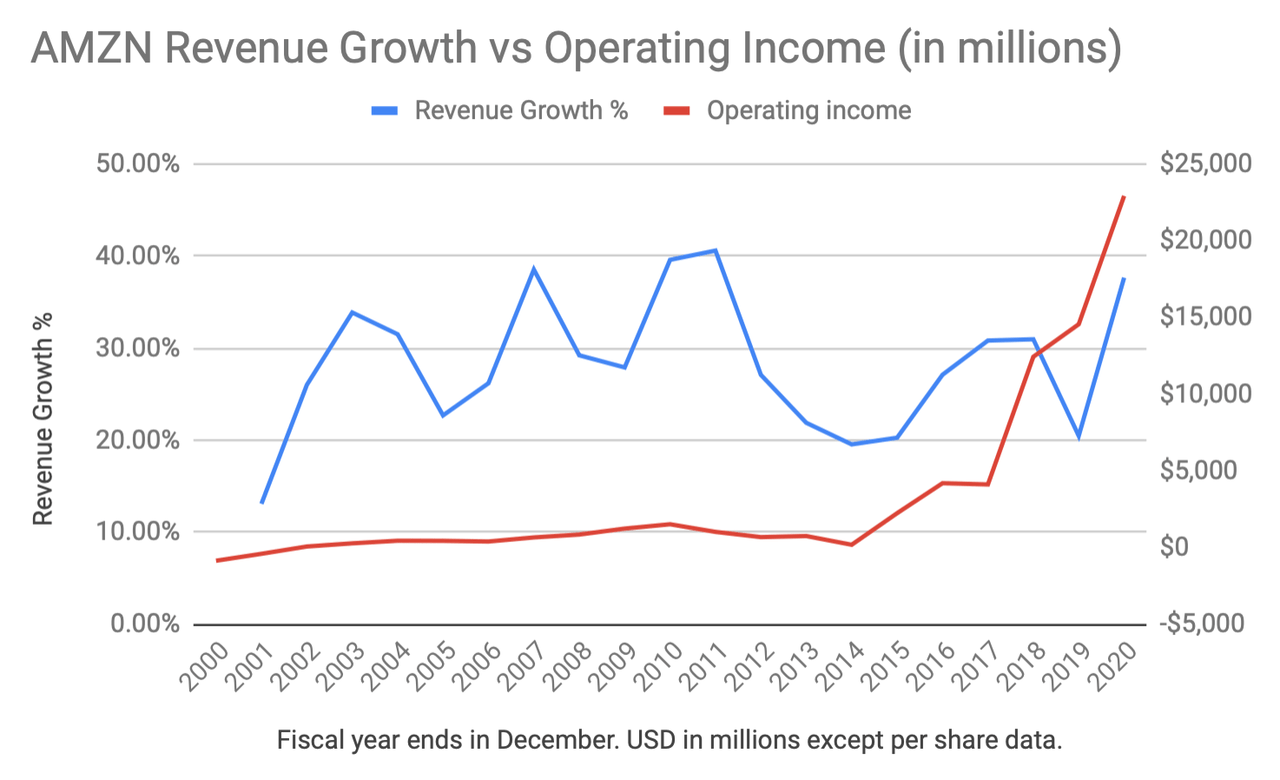

With AMZN, investors are counting on the aggressive investment to pay off with stellar growth in the future. Some investors had to wait more than two decades before the company even started generating consistent profits.

Best of Breed – data from company filings

While AMZN has seen free cash flow swing wildly over the past year, I expect the aggressive investment to pay off once again over the long term.

Is AMZN Stock A Buy, Sell, Or Hold?

Buying stocks, or even just staying long, can be hardest when sentiment is at the worst. That is no different here. People seem so willing to forget that AMZN has a virtual monopoly on online shopping as it single-handedly disrupted the brick-and-mortar retail model. Those operations aren’t profitable, but that does not mean that they won’t be in the future. AMZN has a historic tendency to invest aggressively even if it leads to operating losses. In fact, it often seems that the company prefers to operate with losses so that it can utilize tax loss carryforwards in the future.

Investors seem so focused on present profits (or lack thereof) that they may be missing the big picture. Let me explain it with a simple example. Let’s say that you can either earn $2 or $20 in per-share profits in 10 years. The difference is that you’ll earn $0.50 in current year per-share profits if you choose the first option, but if you choose the second option, then there won’t be any profits right now. Wall Street loves the first option because they see profits immediately, but it is the second option that creates more shareholder value over the long term, as it leads to greater earnings as well as greater multiples over the long term. AMZN continues to focus on improving the customer experience and, in turn, increasing its dominance on everything retail. This is a company that can choose when and by how much they want to be profitable.

How cheap is AMZN now? The stock currently trades at a $1.1 trillion market cap. Interestingly enough, if you value AWS at a conservative 15x sales multiple, then that already gets you to a $1.1 trillion valuation which would then give you the retail operations for free. I stress that 15x sales is very conservative considering the high profit margins at AWS. I assume that AWS can sustain a 45% net margin over the long term. Applying a 2x price to earnings growth ratio (‘PEG ratio’), AWS could be valued at 27x sales, or $2 trillion. Yet I have the view that the retail operations will be worth more than AWS over the long term, but the market is willing to price the stock this cheaply simply due to poor sentiment. Key risks here mainly revolve around failure to execute. AMZN is heavily investing in growth, using cash that could theoretically have instead been returned to shareholders through dividends and share repurchases. While this could lead to greater returns if its investments pay off, it could also lead to poor shareholder returns if those investments do not pay off. Investors are counting on AMZN to be able to eventually drive significant margin expansion at its retail operations. Further, AMZN is generating far less free cash flow than other mega-cap tech peers, with most of its value being derived from a sum-of-the-parts valuation. That means that it will not be able to support its stock price with share repurchases to the same extent as those peers – investors should be prepared for volatility even though AMZN has typically been less volatile than the average tech stock. At this point, I’d rate AMZN in line with Alphabet (GOOGL) in terms of attractiveness, both trailing only Meta (META) for the best mega-cap stock to buy today.

Be the first to comment