jetcityimage

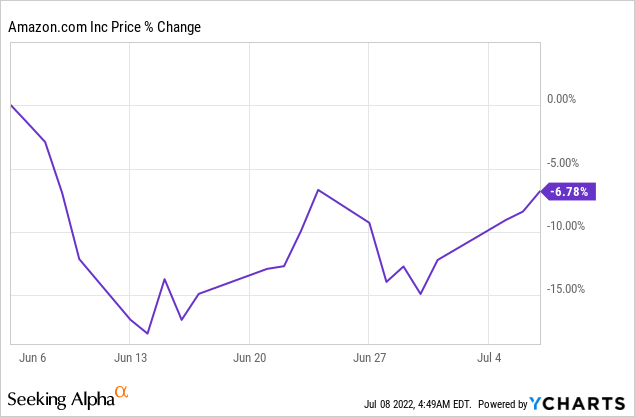

Amazon’s (NASDAQ:AMZN) 20-for-1 stock split misfired in June and the retailer’s shares have now declined 7% since the split was completed. While the stock split failed to produce positive returns so far, I believe a recession is going to cut deep into Amazon’s core e-Commerce business which is already seeing a significant decline in top line growth. Weak Q3’22 top line guidance must be expected. I also calculate that Amazon will reveal a $3.9B valuation loss related to its equity investment in electric vehicle manufacturer Rivian Automotive (RIVN) for the second-quarter. The stock faces multiple headwinds and is a value trap heading into earnings!

Amazon’s stock split misfired

Amazon’s 20-for-1 stock split — the first since 1999 — went into effect on June 6, 2022, but the split has so far failed to generate a positive return for shareholders. Amazon’s stock split has made shares significantly more affordable, although not cheaper. The stock split last month cut Amazon’s stock price from $2,447 before the split to $125 after the split. Since the split was completed on June 6, 2022, shares of Amazon have declined 7%.

Expected a mark-to-market loss on Rivian equity investment

Amazon is expected to submit its earnings card for the second-quarter on August 4, 2022 at which point the e-Commerce giant is set to reveal another billion dollar loss related to one of its equity investments.

Amazon invested $1.3B in electric vehicle manufacturer Rivian before the company’s IPO in the fourth-quarter of 2021. Amazon invested in Rivian’s preferred stock which was converted to Class A common stock at the time of the IPO and the firm’s total investment in Rivian represents an equity ownership of approximately 18%.

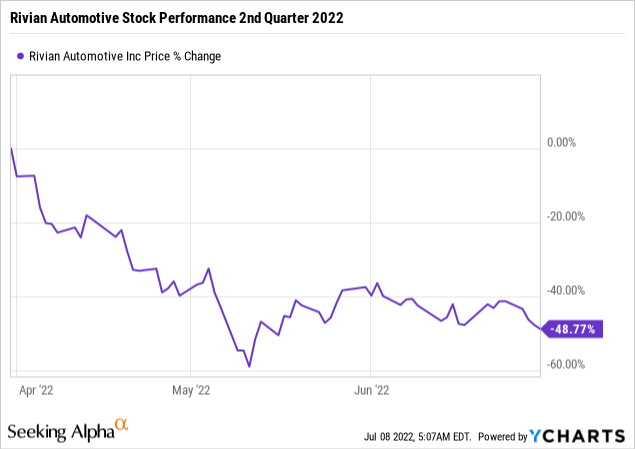

The steep decline in Rivian’s share price in 2022 resulted in a marketable equity securities valuation loss of $7.6B in the first-quarter which caused Amazon to report a $3.8B loss Q1’22. Since Amazon has chosen the fair value method to account for its equity investment in Rivian, Amazon is set to report another big loss for the second-quarter.

This is because Rivian’s share price has declined 70% in 2022 and 49% in the second-quarter. At the end of the first-quarter, Amazon’s equity investment in Rivian had a fair value of $8.0B, down from $15.6B at the end of FY 2021. A 49% decrease in Rivian’s share price in the second-quarter implies that Amazon will have to write down Rivian’s investment value by about $3.9B which is set to wipe out a good portion of Amazon’s Q2’22 net profit.

The U.S. economy may already be in a recession… and investors need to expect a weak Q3’22 revenue outlook from Amazon

The U.S. economy may already be in a recession which means risks in the e-Commerce industry are growing as well. The U.S. economy shrank at an annualized rate of 1.6% in the first-quarter and estimates for second-quarter U.S. GDP — according to the Atlanta Fed — firmly put the GDP growth rate into negative territory at -1.9%. With two consecutive quarters of negative GDP growth in 2022, the U.S. economy is very likely already in a recession now.

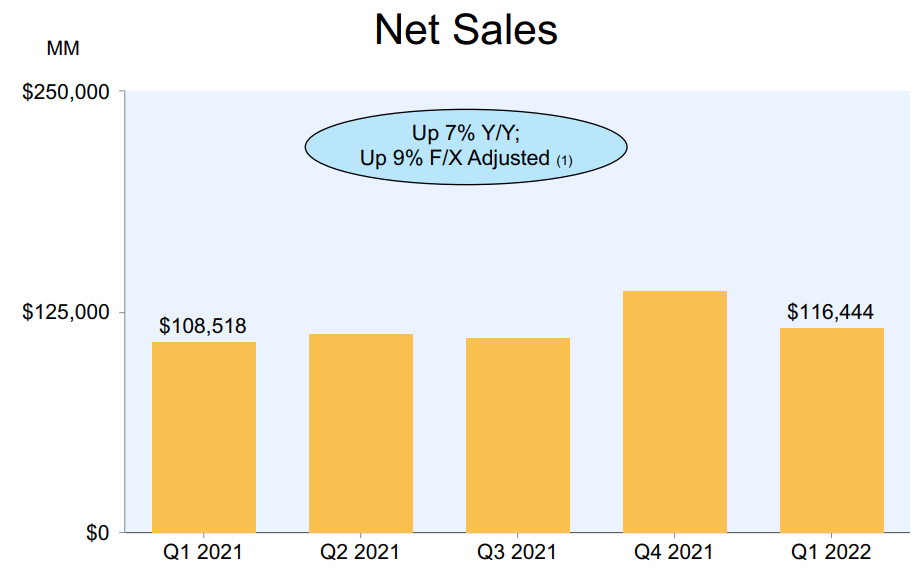

A recession would have serious consequences for all U.S. companies, including large e-Commerce companies that depend on consumer spending. High inflation also poses a challenge for the American consumer and could result in a cutback in e-Commerce purchases going forward.. which will affect Amazon’s top line growth. In the first-quarter, Amazon revealed revenues of $116.4B , showing just 7% year over year growth: Amazon’s weakest growth since the early 2000s. Net sales decreased 15% quarter over quarter, largely because the fourth-quarter is typically is strong quarter for e-Commerce companies due to holidays.

Amazon

Amazon is likely also going to submit a weak revenue forecast for Q3’22 that reflects concerns over the potential of the U.S. economy.

Amazon projected net sales of $116.0B and $121.0B for Q2’22, indicating top line growth of 3-7%. This outlook marks a further revenue deceleration for Amazon from the first-quarter and the firm’s revenue guidance for the third-quarter could even see slower revenue growth rates.

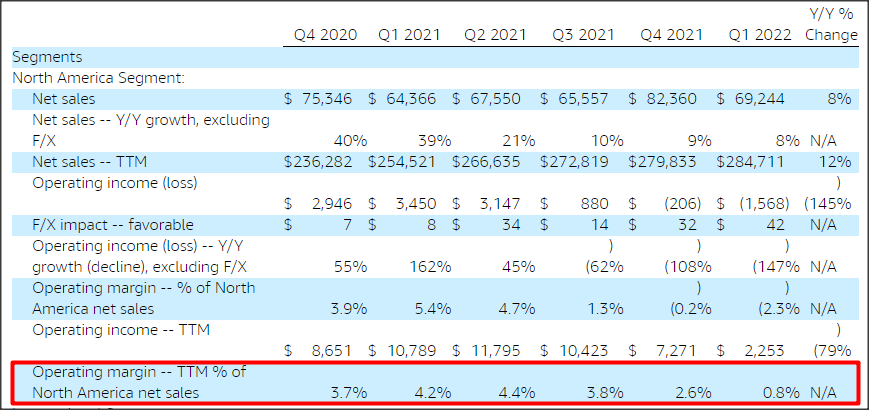

A continual deceleration of Amazon’s revenue growth comes at a time when margins in Amazon’s core e-Commerce business in North America have seen a dramatic decrease over the last year and the segment may not be profitable at all shortly. Amazon’s operating margin related to North American e-Commerce net sales declined from 4.2% in Q1’21 to just 0.8% in Q1’22. Since the USD kept appreciating in the second-quarter and is now very close to parity with the EUR, Amazon’s consolidated margins are set for another sequential decline in the second-quarter.

Amazon

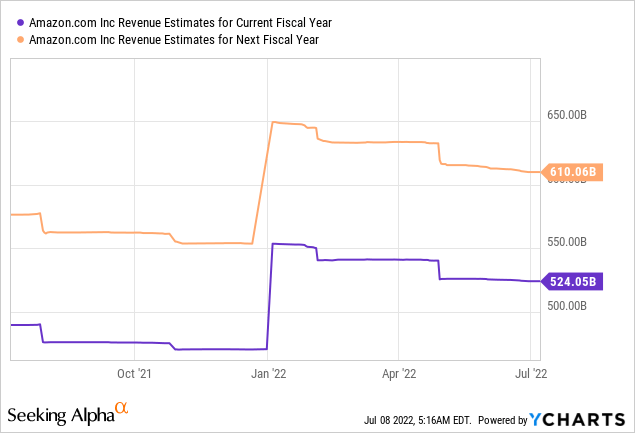

Expect additional downward corrections in Amazon’s revenue estimates if Q3’22 revenue outlook is weak

Revenue estimates have already decreased for Amazon, but a weak Q3’22 guidance regarding top line growth and margins could spark a new round of estimate refreshments. With economic risks increasing lately, those trends are not going to look much better in the short term.

Currently, Amazon is expected to generate $610.1B in revenues in FY 2023, implying 16.4% year over year growth. Given Amazon’s realized Q1’22 top line growth rate of 7%, Q2’22 outlook of only 3-7% growth and growing economic risks, these estimates may still be too high.

Risks with Amazon

Amazon faces a couple of challenges, the biggest of which is likely going to be a recession which could result in a serious slowdown in the firm’s e-Commerce business and a continual drop-off in margins and profits, especially in the North American business. A stronger USD is also an issue for the company as it makes non-U.S. profits less valuable for U.S. companies. The presentation of Amazon’s Q3’22 revenue guidance could in itself be a negative event for the stock.

Final thoughts

Amazon completed a stock split last month and the stock has failed to make a positive effect, although the firm’s large 20-for-1 split made Amazon more affordable for investors. Besides Amazon’s stock split misfiring, the firm is set to reveal a major loss on its Rivian investment next month while Q3’22 revenue risks have considerably increased after new GDP estimates suggest that the U.S. economy is already in a recession.

For those reasons, I believe Amazon is a value trap heading into earnings. A severe recession is likely to lead to a continual deceleration of Amazon’s top line and investors should expect a weak guidance for Q3’22 as well!

Be the first to comment