4kodiak/iStock Unreleased via Getty Images

Why Do We Own Amazon Stock?

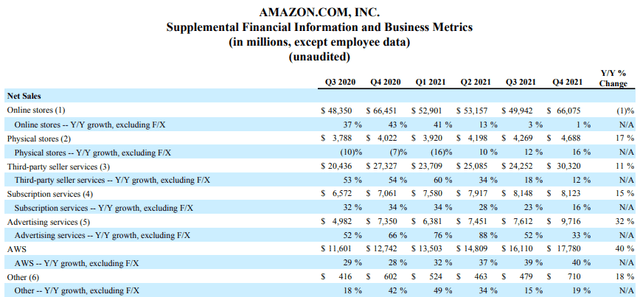

Amazon (NASDAQ:AMZN) is widely categorized as an e-commerce company due to the fact that the majority of its revenue comes from its retail ecosystem; however, our investment thesis for the company hinges on Amazon’s real profit centers – AWS (cloud) and Advertising Services (digital ads). As we saw in our last coverage on the company, Amazon’s retail ecosystem is struggling for growth in the post-pandemic world (amidst a tough macroeconomic environment – labor shortages, rising wages, supply chain issues, etc.). And as a result, Amazon’s growth rate has slowed down to single digits. With that being said, Amazon’s cloud and digital ads businesses are going from strength to strength, up 40% y/y and 33% y/y (in Q4 2021), respectively. In my view, each of these businesses could justify Amazon’s $1.5T market cap on a standalone basis. Here’s why:

- Amazon Web Services – Amazon: Here’s What You Should Be Monitoring

- Digital Ads – Amazon: The ‘Other’ Segment May Be Worth More Than AWS

Now that we have revised our investment thesis for Amazon, let’s discuss some of the latest events and news around the company that could potentially have a significant impact on its future. But before we do that, let us look into the recent weakness in Amazon’s stock.

Amazon Is trapped In A Box

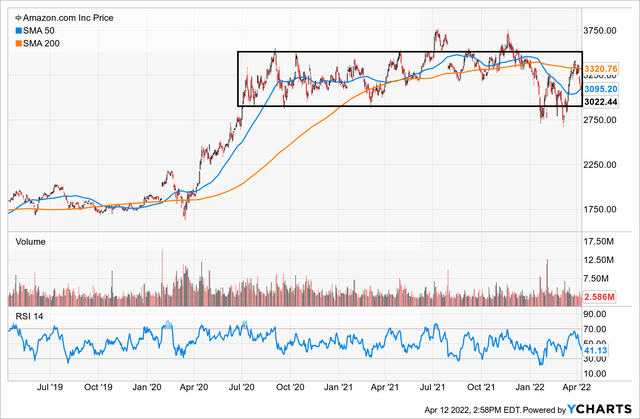

For nearly two years, Amazon’s stock has done absolutely nothing for investors. After a massive move in the first half of 2020, Amazon has traded in a wide range of $3,000 to $3,600. Now, we have seen a couple of false breakouts and a couple of false breakdowns, but the stock continues to hover within this trading range. While Amazon’s stock has stagnated, broader indices and fellow mega-cap tech stocks (except Meta (FB)) have performed pretty well, making Amazon’s shareholders nervous.

After a short-lived spike up to $3,400 on the announcement of a 20:1 stock split in March, Amazon is once again trading close to the lower end of the range. Well, none of us should be surprised by this (apparently weak) price action because we were expecting a stern test of this zone after studying Amazon’s Q3 numbers. Here’s an excerpt of the conclusion from my post-ER (Q3 2021) note on Amazon:

For the next quarter or two, Amazon’s stock is likely to remain in the penalty box as the company grapples with macroeconomic adversity. As we discussed today, Amazon is facing higher operating costs during a heavy investment cycle (damaging FCF generation). With sales growth subsiding, and profitability vanishing, Amazon’s stock could come under pressure for the foreseeable future. The $3,000 to $3,300 demand zone could be tested over coming months (a failure to hold could trigger an even greater sell-off); however, such dips would be fantastic buying opportunities for the long haul.

Amazon’s balance sheet is a fortress, and I am confident that Amazon will get over this transitionary period without much damage. Once Amazon’s investments start paying off in the coming years, the stock will likely rally higher quickly, and you do not want to be sitting on the sidelines waiting for an entry on Amazon. Patience is a virtue in equity investing because the stock market is a proven mechanism of wealth transfer from the impatient to the patient. Hence, I would suggest Amazon’s shareholders stay the course for now. Personally, I plan to add to my long position in Amazon using a systematic investing plan [dollar cost averaging at ~$50 drops in price]. In my view, Amazon is a stock to own, not trade!

Source: Amazon Q3 Earnings: The Perennial Growth Machine Hits A Snag

While Amazon’s stock is struggling for momentum and direction, its fair value continues to climb higher as the business achieves new heights and extends its moat with every passing quarter. Let us quickly review Amazon’s valuation:

AMZN’s Fair Value And Expected Returns

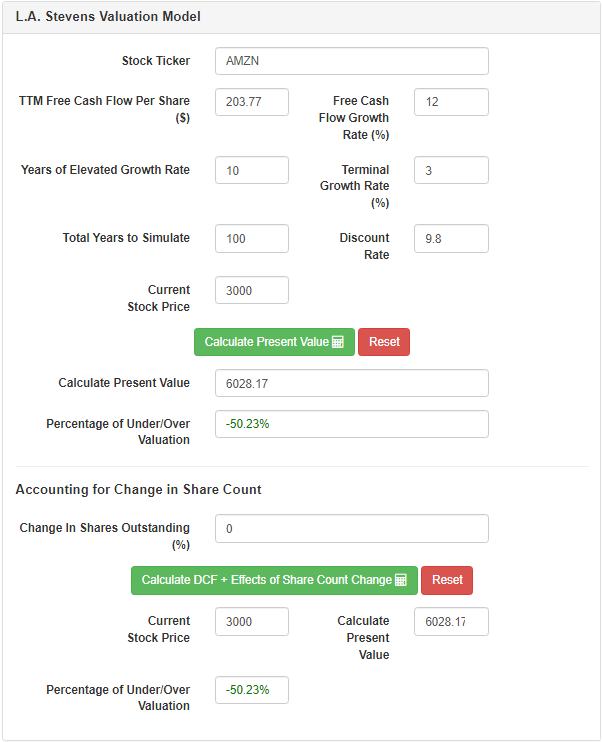

Assumptions:

|

Forward 12-month revenue [A] |

$540 billion |

|

Potential Free Cash Flow Margin [B] |

20% |

|

Average diluted shares outstanding [C] |

530 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$203.77 |

|

Free cash flow per share growth rate |

10% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

Results:

L.A. Stevens Valuation Model L.A. Stevens Valuation Model

According to my analysis, Amazon’s intrinsic value is ~$6,000 per share, i.e., it is undervalued by ~50%. Now, there are many questions – “Why is Amazon trading at half of its fair value? Will it ever catch up to its fair value? What could be a potential catalyst that propels Amazon higher?” Let’s tackle these questions one by one.

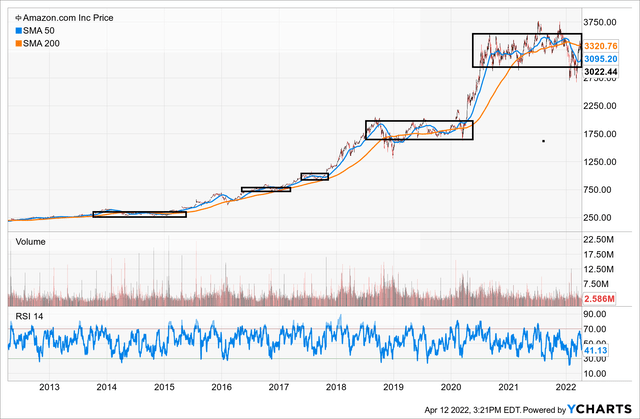

As we have discussed in the past, Amazon’s retail ecosystem is experiencing macroeconomic headwinds (rising wages & labor shortages) and supply chain issues. Furthermore, Amazon is in the midst of a heavy-investment spending cycle (across logistics, cloud, content, etc.) to boost its future growth. While the payoff on these investments will only be informed over a period of time, Amazon has undergone such cycles before, and the company has always delivered robust growth. As a result of these said spending cycles, Amazon’s stock chart is filled with trading boxes like the one we are in right now.

Amazon has been a growth machine for more than two decades now, and this compounding was made possible through heavy re-investments into the business. While investors have come to appreciate Amazon’s past achievements, they seem to be doubting the company’s initiatives once again. As Amazon goes through another heavy spending cycle, its cashflows have become lumpy and even turned negative in the last couple of quarters. In simple words, Amazon’s re-investments are masking its true profitability, but the short-term oriented market participants do not like this behavior from the company.

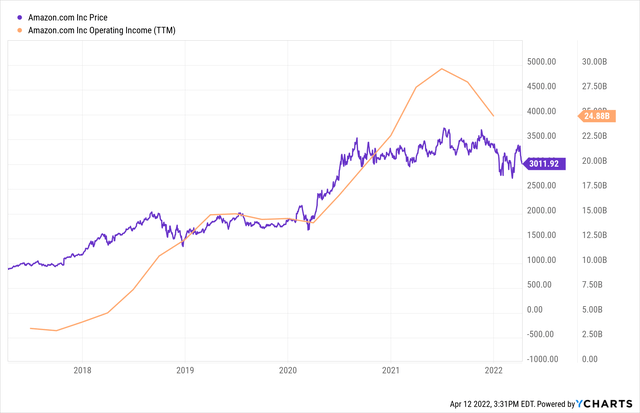

The easiest way to visualize Amazon’s stock performance is to look at it through the lens of this chart:

As we know, cash flows generated by assets are the single most important driver of their price. During periods of heavy investment, Amazon’s operating income (a proxy for profitability and cash flow generation) tends to flatten off due to temporary masking. However, the business continues to grow, and as we get closer to the end of the spending cycle, operating income shoots off higher rapidly. If you look at the chart closely, the stock price tends to lead operating income. Hence, we must buy and hold patiently to ensure that we don’t end up missing out on the next leg higher in Amazon.

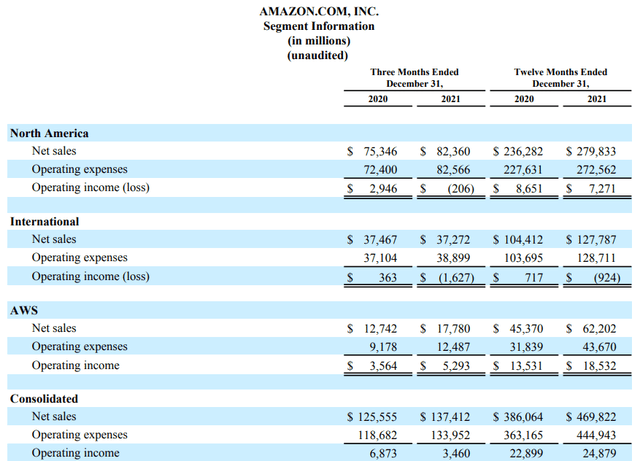

In Q4 2021, Amazon’s operating income declined by ~50% y/y to $3.46B. While this figure was above management’s guidance of $0-3B, the weakness in Amazon’s retail business growth and profitability is quite clear.

Amazon Q4 Earnings Release Amazon Q4 Earnings Release

As you can see, online store sales are nearly flat y/y. Considering Amazon’s massive logistics expansion (doubling of fulfillment capacity over the last two years), a slowdown (possibly, a reversal) in e-commerce adoption is causing operating losses in North America and more so in international markets. However, Amazon’s cloud services and digital ads businesses are growing at robust rates of 40% and 33%, respectively. Both of these businesses have a long runway for growth, and since these business lines have higher margins, we are likely to see an expansion in Amazon’s profit margins over the coming quarters and years.

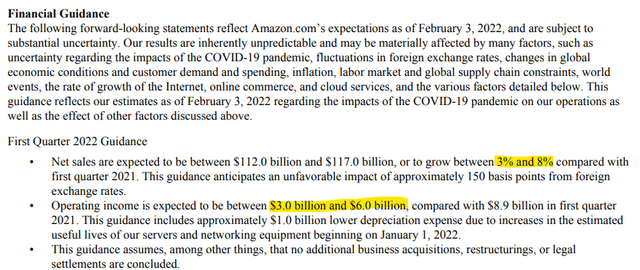

For Q1 2022, Amazon’s management is guiding for ~$115B in revenue, which represents y/y growth of just about 6%, and that is another quarter with single-digit growth rates. Is Amazon’s growth story over? Not so fast.

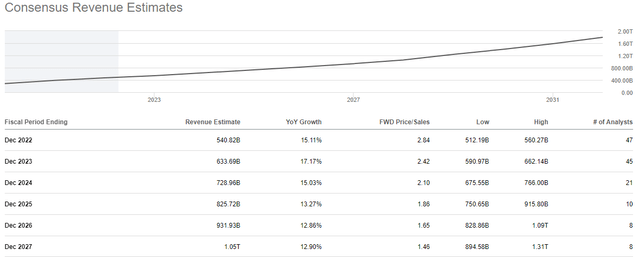

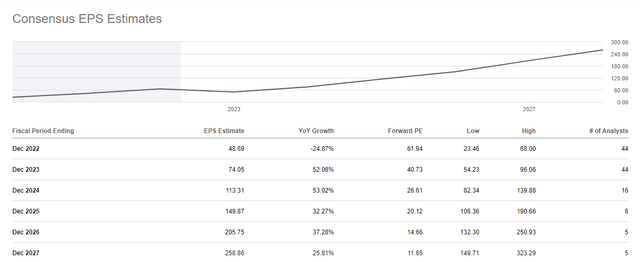

As we lap over periods with tough comps, Amazon’s growth rates are set to re-accelerate in the second half of this year. In 2022, Amazon is projected to register sales of $540B at a y/y growth rate of 15%. According to consensus analyst estimates, Amazon is set to reach the $1T annual revenue milestone by 2027; my bet is that it will get there by 2026.

Seeking Alpha Estimates Seeking Alpha Estimates

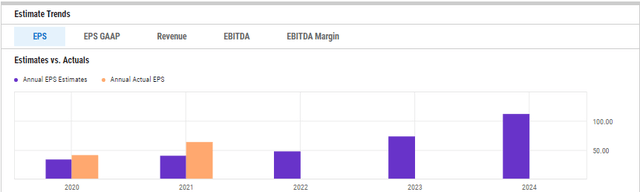

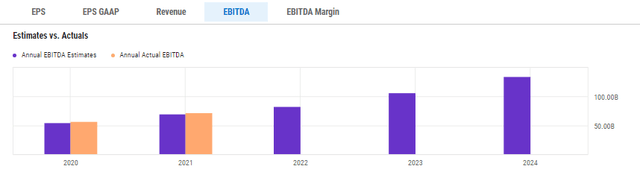

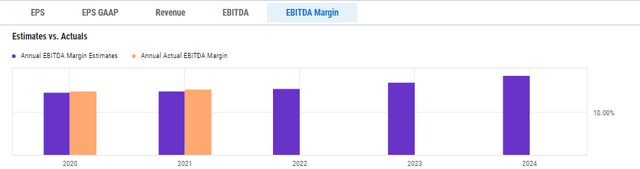

Over the medium term, Amazon may no longer be a revenue growth story as the company grows in the mid-teens every year. However, Amazon is set to be an operating leverage story, with earnings growth expected to outpace revenues significantly. The expansion in operating margins will come from greater revenue contributions from AWS, Ads, and Prime subscriptions.

In the next three years, Amazon’s EBITDA is projected to grow from $72B to $134B (nearly ~2x in 3 years). With potential margin expansion and healthy revenue growth, Amazon looks like an easy ~2-4x bet (in 3 years) from here.

Checking Up On Some Of The Latest Developments

Alright, that’s enough talk about financials; let’s move on to some interesting developments around the company. These developments have been discussed widely in the news media, but I still think that sharing my take here is worthwhile.

In early March, Amazon quietly announced a 20:1 stock split along with a $10B buyback program. While stock splits do not affect the market cap of businesses, they do tend to increase the liquidity of the stock while also increasing retail investor demand. Hence, Amazon’s stock split could quite easily become the catalyst for a breakout to the upside.

Amazon’s buyback program is too small to have any sort of impact; however, this may be a signal from management about future capital allocation plans for the company. Five years from now, Amazon could be making more than $100B in free cash flow every year, and at that point, Amazon could become an infinite buyback pump like Apple (Apple: The Infinite Buyback Pump) and Microsoft (Microsoft: The Next Infinite Buyback Pump) are today.

After completing its acquisition of MGM, Amazon decided to dip into the capital markets to raise $12.75B in debt with different maturities at a spread of 1.55% over treasury rates. Last year, Amazon raised $18.5B at rates much lower than this latest capital raise. While Amazon has more than $95B of cash and short-term investments on its balance sheet and less than $50B of debt, I believe the fresh capital was raised to finance the buyback program. Amazon’s management must surely feel that its stock is currently undervalued.

I view Amazon’s stock split and buyback announcements positively. However, all is not hunky-dory at one of the largest employers in the world. Today Amazon has more than 1.6M employees globally (1.1M in the US).

According to Amazon’s website, the company is striving to be the ‘Best Employer on Earth.’ In the post-pandemic era, the great resignation is a very real thing, with the US suffering from labor shortages and the war for talent among businesses driving massive wage inflation. Amazon has certainly played ball, and the company recently bumped up its maximum base salary by 100% (to $350,000) to offer competitive salaries that can attract and retain talent in this environment.

GeekWire

Amazon has ranked No. 1 in LinkedIn’s ‘Top Companies To Work For’ list for two years in a row now. So clearly, people want to work for Amazon, right?

Well, not everyone is happy with Amazon. Right since the pandemic started, Amazon’s frontline workers have been complaining about multiple issues ranging from safety protocols to work hours and, most importantly, compensation. Amazon’s $18 per hour minimum wage is already above the industry average, and the company also offers good health and 401K benefits for all full-time employees; however, unionization efforts are gathering pace at Amazon. Recently, employees at JFK8 – an Amazon warehouse in Staten Island, voted to form the first-ever union at the company. Is this vote set to trigger a domino effect?

As an Amazon investor, I hope not because unionization could lead to increased operating expenses for the company (at least in the near to medium term). According to a report from Morgan Stanley, every additional 1% of unionization of its frontline workforce (750K employees) would lead to a $150M increase in annual operating expenses. At 100% unionization, Amazon would face additional operating expenses of $15B. Scary, right?

Overall, I am not too worried about unions at Amazon because rising employee costs are going to push Amazon toward automation of its delivery networks, and eventually, costly employees could be replaced with cheaper technology. Now, I do not want people to lose their jobs, but if unions get too greedy, we know what will happen. I think the assumption of a $29 per hour wage used in the above-mentioned report is just too high, and getting to 100% unionization would take many, many years. Hence, I would like to buy more of Amazon’s stock if it keeps dropping on negative news headlines around unionization.

Concluding Thoughts

Amazon is an incredible business with monopolistic dominance in multiple trillion-dollar markets. While the company is facing temporary growth headwinds, Amazon’s cloud and digital ad businesses are performing very well, keeping our investment thesis intact. As Amazon’s operating cash flows recover post its spending cycle over the coming quarters, the stock will likely get out of its two-year-long slumber and shoot higher in a jiffy. Hold on tight.

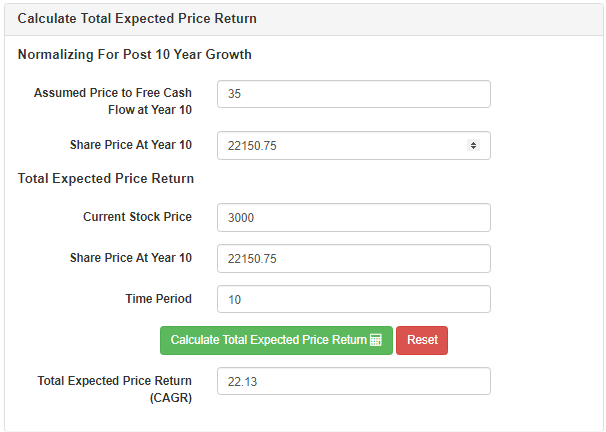

| Current Price | Fair Value | Undervalued (-) or Overvalued (+) | 2031 Share Price Target | Total Expected CAGR Return | Rating | |

| Amazon | $3,015 | $6,028 | -50% | $22,150 | 22.13% | Strong Buy |

Key Takeaway: I rate Amazon a strong buy at $3,000.

Thanks for reading. Please share your thoughts, questions, and/or concerns in the comments section.

Be the first to comment