georgeclerk/iStock Unreleased via Getty Images

I think that it is prime time to buy Amazon (NASDAQ:AMZN). Of course, Prime day will be in July and the 2Q22 results will not reflect this. However, I think that the current valuations that Amazon is sitting on right now actually, in my view, fully reflects the concerns that investors may have for Amazon for its revenues and profitability in 2022. To top that off, the company continues to be exposed to several broader secular growth trends even as the negative news has dominated the headlines in recent months. To make it clear, as elaborated in my earlier article, Amazon continues to be my top pick in the large cap space for 2022 as the risk reward skew for the company is one of the most positive in the space.

Investment thesis

I have written articles about Amazon which goes deeper into the company and elaborates why I think the company is a top pick in the large cap space in 2022, as well as another article depicting just how undervalued the company is after a brutal sell-off.

First, Amazon will likely maintain its leading position in e-commerce and taper off its investments and capital expenditures for its e-commerce segment as there is sufficient fulfilment capacity in the near term. The heavy investments made in the past 2 years will likely bear fruits in the near term as its current capacity is able to provide same day or next day delivery within the US.

Second, Amazon is moving to improve productivity and its cost structure after the $6 billion in incremental cost headwinds highlighted in 1Q22. I think we could see improvements in these cost headwinds in the next quarter and management’s more positive and confident tone for 2H22 should bring the stock higher.

Lastly, AWS continues to grow despite weakness in the e-commerce segment. Management is spending more capital investment dollars into AWS as it tones down on its capital spending for e-commerce. As such, AWS will continue to grow above the industry average and maintain its market leadership.

Leading position in e-commerce with sufficient capacity for future expansion

First, while Amazon may be subletting up to 30 million square feet in warehouse space due to its rapid expansion, I actually take the view that Amazon has done exceptionally well in expanding its warehouse space in anticipation of the rapid rise in penetration of e-commerce. According to the company, it is intending to sublet 10 million square feet, with up to 30 million square feet of warehouse space being sublet. This 30 million square feet may seem large to the average investor, but this is out of the 370 million square feet of industrial space Amazon has leased in North America, and thus, this minimal 10 million to be sublet only represents 2.6% of its total warehouse footprint in the US.

This reduction in 2.6% of its warehouse space comes on the back of its intense investments in fulfilment centre capacity which doubled in 2 years. As such, I would argue that Amazon has done a very good job in estimating the amount of capacity it would need in the future 2 years ago, with only a 2.6% “error” a rather small amount as a percentage of its total investments made.

Second, I also take the view that with this prior 2 years of investments made into fulfilment centres, Amazon has already made the necessary investments it needs to move towards next day or see day delivery and thus, there is less of a need for heavy investments towards this initiative in the near term. As such, there is increasing evidence that Amazon’s current excess capacity will mean that the current capacity is more than enough for its near term goals to drive top-line growth while there is a less need for capital expenditures to drive this growth in the near term, which I initially mentioned in my earlier article.

Lastly, with sufficient fulfilment centre capacity for its near term growth plans that enables e-commerce revenue growth to continue, I am of the view that Amazon will retain its lead in the e-commerce space and grow its leading position with 40% market share as it pursues next day and same day delivery and provides a strong value proposition to customers who value this speed in e-commerce deliveries. All these will be done with minimal need for additional capital expenditures in the near term which generates higher free cash flows for investors.

Improvement in productivity

As I highlighted in my previous article, Amazon has a unique problem of being overstaffed in 2022 after having a shortfall of staff in 2021. While management claims that layoffs are not happening, Amazon could improve the situation simply by not hiring. This is because of the high attrition rates in Amazon’s warehouses as working conditions are strenuous and these warehouses usually have a turnover of more than 100% in a year. Along with efforts to improve productivity along the business, we could see an improvement in the $2 billion in costs caused by staff shortages.

While the total cost headwinds of $6 billion highlighted in the last quarter should be reduced, some of it will remain and there is no doubt that these costs will take time to alleviate. However, I am of the view that markets are forward looking and after the announcement of 2Q22 results, management’s tone will likely be more positive and confident for 3Q22, especially with Prime day in the quarter. As such, in 2H22, we will really start to see margins improve sequentially due to the improvement in labour as well as externally driven costs like higher wage costs and shipping costs.

AWS to maintain leadership position

While its 1Q22 results were a disappointment, AWS was one bright spot with revenues growing 37% year on year and operating income margins at 35%, both of which were above consensus and shows the leadership AWS has in the cloud computing industry. New agreements with AWS includes customers like Verizon (VZ), Boeing (BA), MongoDB (MDB) amongst others.

More importantly, management continues to be investing heavy investment dollars into the cloud computing business, with 40% of capital expenditures in 1Q22 going to AWS infrastructure. Furthermore, they expect this figure to go up to 50% of its total capital expenditures in 2022, implying a back end weighted investments into AWS infrastructure as the company slows down on spending on e-commerce.

The backlog of AWS also continues to grow, with $89 billion in backlog, which grew 68% year on year.

Valuation

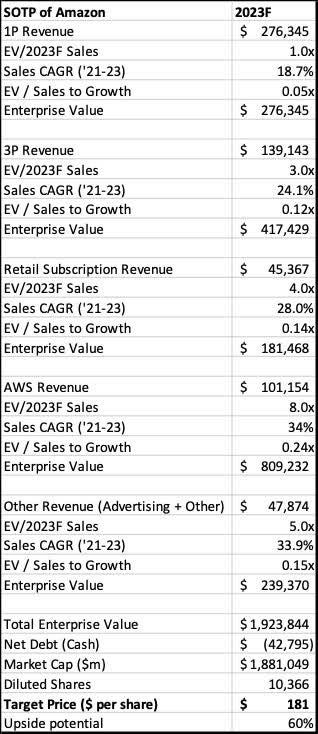

Based on my estimates of the respective segments of Amazon in 2023F, I arrived at a target price of $181 for Amazon, which implies a 60% upside from current levels. I have adjusted my 2023F numbers to reflect the risks of macroeconomic headwinds that may impact Amazon’s business.

SOTP of Amazon (Author generated)

Risks

Global macroeconomic environment

The market sentiment has been rather poor in 2022, with risks of stagflation and recession fears dominating headlines. For Amazon, negative macroeconomic impacts demand for e-commerce particularly as consumer demand shrinks. Furthermore, its cloud business could be impacted by slowdown in business activity. Of interest to Amazon is also the impact of inflation and particularly, labour, logistics and shipping costs, which impacts its margin profile. If these costs remain elevated into 2023, this could pose significant risk to the recovery in margins that market is expected Amazon to experience in late 2022.

Competition

Amazon may have a dominant market share in e-commerce, but there are other competitors in the space like Walmart (WMT), eBay (EBAY). While these companies pose a relatively small threat to Amazon at the moment due to the company’s strong competitive advantages, there is a risk that these competitors may engage in more competitive behaviour that could undermine Amazon’s revenues and profits.

Similarly, Amazon has large, established competitors like Microsoft (MSFT) and Google (GOOG) that competes with the cloud computing space. If these competitors manage to innovate or become more competitive, this could pose a threat to Amazon’s market share in the space.

Risk of unanticipated investments

While it is my view that management will likely slow down the pace of investments and capital expenditures, the company may announce unexpected investments that may affect and risk diluting my margin assumptions and cause further headwinds for gross and operating margins.

Risk in inability to scale its higher margin businesses

With Amazon’s advertising, cloud and third party selling and subscription business commanding the higher margins in the business, if Amazon is unable to scale successfully, this could have a material impact on its bottom line.

Conclusion

This is probably one of the best opportunities to buy Amazon given just how unfavourable the company has become over the past year. That said, when looking deeper into the fundamentals of the company, we see several silver linings and potential upside from current levels. In fact, the risk reward skew for Amazon is one of the most positive within the large cap space and thus, I have a buy rating for the company with a target price of $181, implying a 60% upside from current levels.

With the opportunity to capitalise on the heavy investments in capacity it has accumulated in the past 2 years, Amazon’s e-commerce segment is set to continue to maintain its leadership position with less need for heavy capital spending. Also, AWS continues to perform well and management is continuing to spend in AWS infrastructure to continue to grow and scale the business. In addition, the cost headwinds highlighted in 1Q22 will continue to alleviate in 2Q22 and likely gradually be more positive for the company in 2H22 and beyond. as such, I am of the view that it is indeed a prime time to buy Amazon with the great risk reward opportunity before us.

Be the first to comment