4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) is playing a high-stakes game in the streaming content industry. Billions of dollars are being invested in this business by competitors to gain additional subscribers and build a more attractive library. Disney (DIS) wants to increase its content budget to a staggering $33 billion in 2022. Netflix (NFLX) is expected to invest $17 billion in streaming. After the merger of Discovery (DISCA) and WarnerMedia, the company is planning to invest close to $20 billion in content. We could see a further increase in the content budget in the next few years as the competition heats up.

However, Amazon has a big advantage over other competitors. The Prime membership provides customers a wide variety of benefits that cannot be matched by streaming players. In the trailing twelve months, Amazon reported $30 billion in revenue from its subscription segment. Hence, the company can easily fund its $13 billion content spending in 2021 through subscription revenues.

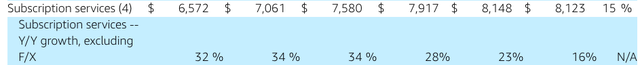

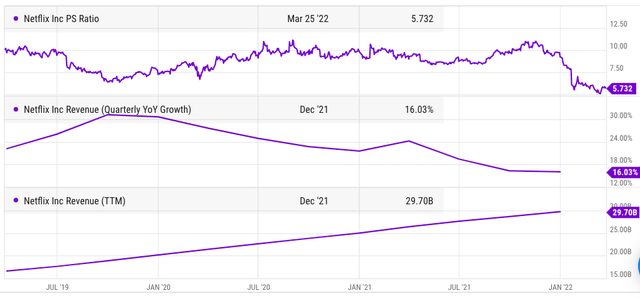

The recent price hike in Prime should further increase the revenue from subscription segment. This segment is growing at 20% to 30% which should allow Amazon to ramp up its content spending. Amazon’s subscription growth is higher than Netflix’s revenue growth. Netflix was trading at P/S ratio of 10 prior to the recent correction. Rapid growth in Amazon’s streaming library and subscription business could increase the revenue from this business to $100 billion by 2025 with a standalone valuation of $1 trillion.

Standing out from the crowd

Amazon’s Prime membership has allowed the company’s streaming business to stand out in a very crowded industry. All the big players are investing tens of billions of dollars to build their original content and gain new subscribers. Disney+ has close to 130 million subscribers while Netflix has 221 million subscribers. However, a slowdown in net subscribers had caused a big correction in Disney and Netflix stock. This shows that Wall Street is giving valuation to streaming players based on their future growth potential as well as current subscriber base.

Amazon is in a good spot because it has been able to deliver highly stable subscriber growth over the last few quarters. The company has last mentioned that its Prime membership has crossed 200 million. The churn rate within Prime membership is also quite low according to Bloomberg.

Figure 1: Amazon’s subscription segment showing stable and strong growth.

The trailing twelve-month revenue of Amazon’s subscription business is more than $30 billion. This is close to Netflix’s ttm revenue base. On the other hand, Amazon’s Y/Y subscription growth is significantly ahead of Netflix for the past few quarters.

Figure 2: Netflix’s revenue, growth, and P/S ratio in the past 3 years.

Ability to ramp up investment

Amazon has invested $13 billion in its streaming business in 2021. The company’s subscription revenue in 2021 was close to $31 billion. Hence, the company is spending 42% of its subscription revenue on its streaming business. We can also see that Amazon’s subscription revenue growth is much more stable than Netflix’s. A big reason is the lower churn rate in Prime membership and the ability of Amazon to add new services to its subscription business. On the other hand, most streaming players can increase revenue only through new net subscriber additions or raising prices.

If the current trajectory of Amazon’s subscription growth is maintained in the next few quarters, the company should be close to $100 billion level by 2026-27. This would be a big milestone for Prime membership as well as its streaming business. By this time, Amazon could invest over $40 billion on streaming content. It is difficult to predict the success of future content but we can say that with this kind of streaming budget Amazon should easily net several awards, major hits and become one of the key streaming options for customers.

Previously, Costco (COST) had considered launching its own streaming business. Similarly, Walmart (WMT) also thought about it but dropped the idea after acknowledging that it would take tens of billions of dollars in investment to have any competitive service. It would be difficult for any retail player to copy Amazon’s streaming business. It would also be impossible for the streaming companies to provide delivery and other services similar to Amazon Prime. Hence, we should continue to see a good economic moat for Prime membership within the domestic US market as well as other international regions due to the benefits of e-commerce and streaming content segment.

Impact on Amazon stock

Amazon’s streaming business will be the main competitor to other players like Netflix, Disney+, and Warner Bros. Discovery. Netflix has been trading at close to 10 times its P/S ratio prior to the recent correction. Amazon’s subscription business could get a premium compared to Netflix due to higher growth rates, the halo effect of Prime membership, and a much longer growth runway in the future. Even if we take a modest P/S ratio of 15, Amazon’s subscription business would already be valued at close to half a trillion dollars.

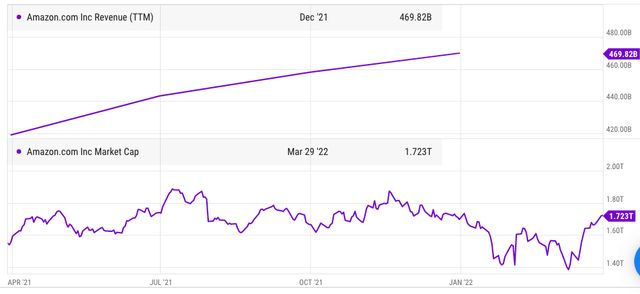

Figure 3: Market cap and ttm revenue of Amazon.

If current growth rates are maintained, Amazon’s subscription revenue would be hitting $100 billion by 2026-27. At a lower P/S multiple of 10, the standalone valuation of this business should easily hit $1 trillion. Amazon has a market cap of $1.7 trillion and it has traded at this level for the past 18 months. Wall Street requires to see a strong performance by Amazon in a segment that can move the needle for the stock. If the future trajectory of subscription business and streaming content move according to the above estimates, we should see a strong bullish sentiment towards the stock.

It is likely that Amazon would be ramping up the streaming content investment to over $40 billion in the next five years as the subscription revenue keeps on increasing. It is very important to note that these investments are spread to international regions like Europe, India, Latin America and others. This trend should help Amazon build a strong moat for its services in domestic as well as international markets.

Hence, we can see that Prime membership and the streaming business will play a key role in the future direction of Amazon stock. It would be very important for the company to deliver solid original content in the next few quarters to increase the belief of Wall Street in management’s ability to deliver quality streaming service.

We can see that Amazon’s streaming business has a unique competitive advantage. Together with the Prime membership, it should become one of the main subscription platforms in the future which should help in increasing the bullish sentiment toward the stock.

Investor Takeaway

Amazon’s streaming platform along with Prime membership benefits will be very attractive to customers compared to other players. Amazon is already showing ttm revenue of $30 billion in its subscription business which is higher than Netflix’s. The growth rate of Amazon’s subscription business is also more than Netflix. At the current growth rate and revenue base, Amazon’s subscription business should have a standalone valuation of half a trillion dollars with a clear path to $1 trillion over the next few quarters.

Amazon is investing close to 40% of its subscription revenue in its streaming business. At the current growth rates, the subscription revenue should hit $100 billion by 2026-27 which should allow Amazon to increase its streaming budget to a whopping $40 billion. This would be difficult to match by big players like Disney, Netflix, or Warner Bros. Discovery. Amazon is in a perfect spot to take advantage of the changing dynamics within the streaming industry and become the clear winner in this race.

Be the first to comment