Drew Angerer/Getty Images News

Investment Thesis

It is clear that Amazon (NASDAQ:AMZN) has experienced a revenue growth in all of its segments including online stores, physical stores, retail third-party seller services, subscription services, AWS, and other segments. Many analysts and investors suggest to buy more of its stock at the current price regardless of the prevailing market conditions. However, it has recently suffered from the deficiency of free cash flows, as well as an increase in downside volatility and tail risk. This will probably lead AMZN’s price to move lower in the mid-term future.

Investors’ Desire Towards Amazon

One of the first things that you might have heard about Amazon in recent time is that it has been scaling up its business by expanding more infrastructure and workforce. This is a plausible explanation for its weak capital structure and poor income that many Wall Street analysts have used to prove that Amazon is the best company and recommend investors to buy more at the current market price. I have conducted a survey and saw that many analysts and investors across several newspapers and trading & analytics platforms including Seeking Alpha are really bullish on AMZN through their articles and comments. This bullish sentiment may drive the price to go up further in a duration which is understandable for many reasons such as the impressive revenue growth and the dominance in the cloud industry.

Amazon Has Many Competitors

Although Amazon has partnerships with American Express and Synchrony, and will launch the first co-branded Visa credit card in 2022 with JP Morgan, it faces stiff competition in this space from Mastercard and Google. Amazon’s competitors in the segment of physical stores include Costco Wholesale and Barnes & Noble in addition to Walmart. While revenue from subscription services has gradually increased, Amazon is competing with popular video, music, and reading platforms such as Netflix, Disney, and iTunes.

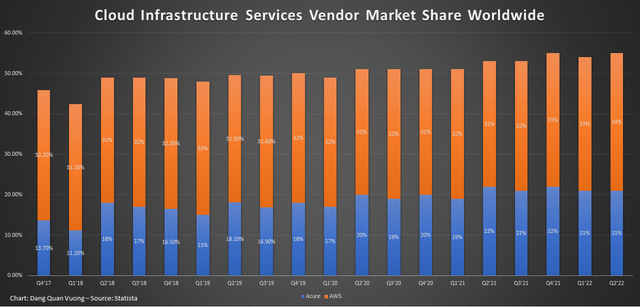

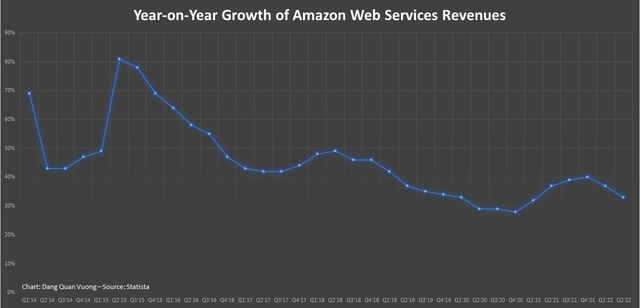

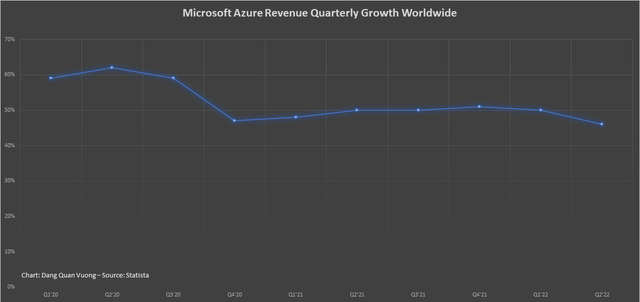

Despite the fact that AWS and Microsoft Azure offer different products and customer segmentation, they are formidable competitors. While AWS focuses on open source, Azure does not and instead supports Windows. Many know that open source is the future of programming, but Microsoft has an abundance of talents, so this isn’t a big deal. After years of being dominated by AWS, the market share of AWS in the cloud industry is now hovering around 32%. Given Azure’s rapid growth, its market share has risen to around 22% in the last few years. Because Microsoft Azure’s annual growth rate is higher than that of AWS, Azure could be on par with AWS in the not-too-distant future.

Cloud infrastructure services vendor market share worldwide from 4th quarter 2017 to 1st quarter 2022. (Statista)

Year-on-year growth of Amazon Web Services revenues from 1st quarter 2014 to 1st quarter 2022. (Statista)

Microsoft Azure revenue growth worldwide from financial year 2020 to 2022, by quarter. (Statista)

While JD.com and Walmart support online stores selling products on e-commerce websites, third-party selling services like eBay, and Alibaba provide the best online marketplace for their vendors. Also, Chinese marketplace is the largest and most profitable one that all companies want to put their foot into. However, it may be challenging if Amazon wants to dominate the retail sector and profit on its own. Amazon must compete not only with eBay in the US market, but also with Alibaba if it is about to expand to the global market. In fact, it has had to shut down its China domestic e-commerce marketplace business in 2019 because of stiff competition from Chinese e-commerce giants including Alibaba and JD.com. Think about what happens if a company is no longer able to scale up its business? With only the US market, the spike of Amazon’s profit and income in 2020 during Covid lockdown is just because of the unusual increase in online consumption which is not cyclical. As a result, Amazon is facing the risk of a saturation point wherein it is not capable of generating more income as shown in the following sections.

Amazon’s Competitive Advantage Has Been Challenged

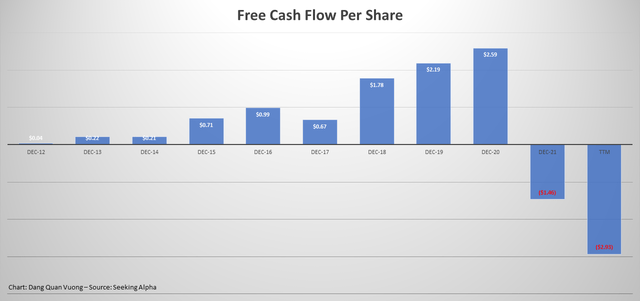

The unit used in the below table is in million dollars, except for free cash flow per share.

| Dec-12 | Dec-13 | Dec-14 | Dec-15 | Dec-16 | Dec-17 | Dec-18 | Dec-19 | Dec-20 | Dec-21 | TTM | |

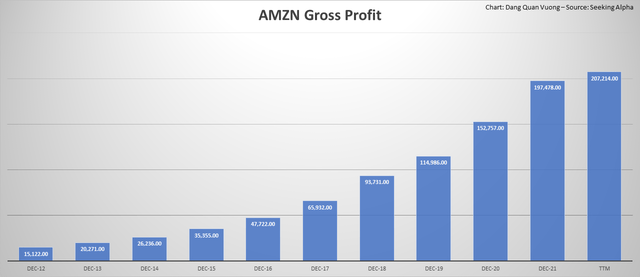

| Gross Profit | 15,122.00 | 20,271.00 | 26,236.00 | 35,355.00 | 47,722.00 | 65,932.00 | 93,731.00 | 114,986.00 | 152,757.00 | 197,478.00 | 207,214.00 |

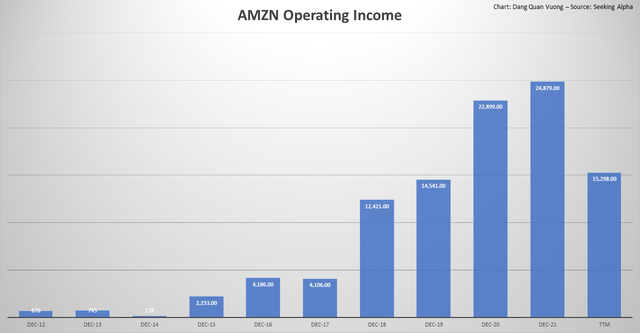

| Operating Income | 676 | 745 | 178 | 2,233.00 | 4,186.00 | 4,106.00 | 12,421.00 | 14,541.00 | 22,899.00 | 24,879.00 | 15,298.00 |

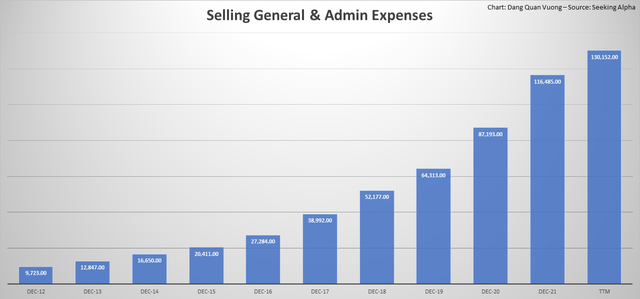

| Selling General & Admin Expenses | 9,723.00 | 12,847.00 | 16,650.00 | 20,411.00 | 27,284.00 | 38,992.00 | 52,177.00 | 64,313.00 | 87,193.00 | 116,485.00 | 130,152.00 |

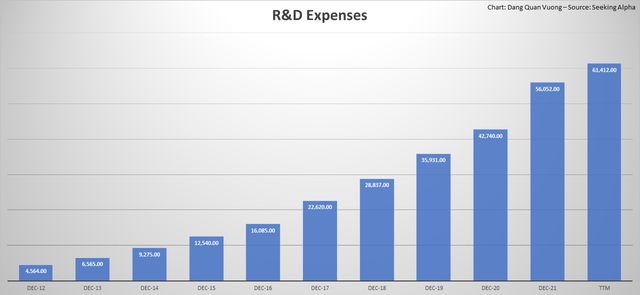

| R&D Expenses | 4,564.00 | 6,565.00 | 9,275.00 | 12,540.00 | 16,085.00 | 22,620.00 | 28,837.00 | 35,931.00 | 42,740.00 | 56,052.00 | 61,412.00 |

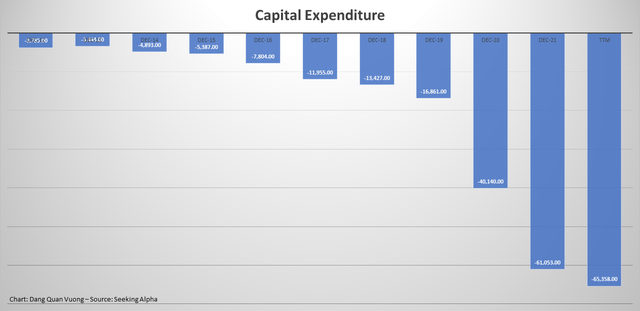

| Capital Expenditure | -3,785.00 | -3,444.00 | -4,893.00 | -5,387.00 | -7,804.00 | -11,955.00 | -13,427.00 | -16,861.00 | -40,140.00 | -61,053.00 | -65,358.00 |

| Free Cash Flow / Share | $0.04 | $0.22 | $0.21 | $0.71 | $0.99 | $0.67 | $1.78 | $2.19 | $2.59 | ($1.46) | ($2.93) |

The thing may surprise shareholders is that Amazon’s gross profit of TTM 2022 was higher 4.93% YoY than that of fiscal 2021, while the operating income (TTM) declined -38.51% YoY at the same time. This is mostly attributed to the rate of change in sudden upsurge of selling general & admin expenses and R&D expenses relative to the gross profit. If we divide operating income by gross profit in the fiscal 2021 and TTM 2022, we can get the values at nearly 12.60% and 7.38%, respectively. Put simply, $100 gross profit can generate $12.60 operating income in fiscal 2021 while $100 gross profit can only generate $7.38 operating income in TTM 2022. In other words, the probability to convert its gross profit to operating income has reduced by about -41.42%, or Amazon needed much more cost to generate a similar amount of income in fist days of 2022.

It can be seen more clearly by the capital expenditure when cash outflows towards purchase of plant, property and equipment have surged dramatically. This budget has not been used efficiently as the free cash flow was negative in the fiscal 2021 for the first time after over ten years of growth. It was even worse in the first half of 2022 when the free cash flow was -$2.93 per share. As claimed by Amazon CFO Brian Olsavsky, the investment in too much warehouses and workforce compared to demand has resulted in lower productivity.

There is no doubt that AMZN is a growth stock over the last decade. However, the most important feature that new investors would like to see in a growth stock is that the company is experiencing the growth cycle instead of the stage of reinvesting to the new development. It may be healthy for the long-term growth, but would lead the company to short-term financial burdens, especially in the sensitive time when consumer price inflation has increased alongside the decrease in consumer confidence and income expectation. This will directly affect the market price of its shares, potentially resulting in short-term losses for many new buyers.

Amazon’s gross profit in million dollars has gradually increased. (Seeking Alpha)

The operating income (TTM) in million dollars declined in the first two quarters of 2022. (Seeking Alpha)

The sudden upsurge of selling general & admin expenses. (Seeking Alpha)

The sudden upsurge of R&D expenses. (Seeking Alpha)

Cash outflows towards purchase of plant, property and equipment has surged dramatically. (Seeking Alpha)

The free cash flow was negative after ten years of growth. (Seeking Alpha)

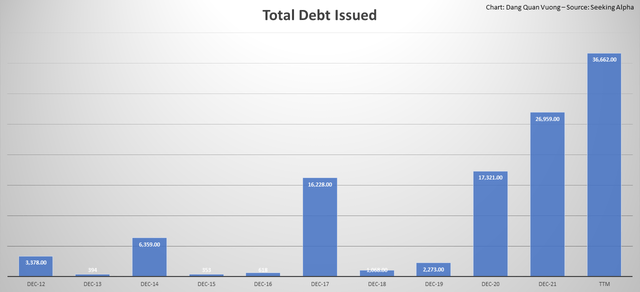

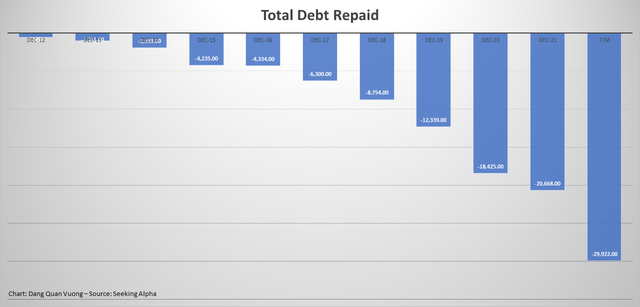

There May Be Problem in Short-term Debt

Surprisingly, Amazon’s net income dropped by roughly 65.21% from 33,364 million dollars in fiscal 2021 to 11,607 million dollars in TTM 2022, whereas gross profit increased by about 4.93% at the same time. Meanwhile, the total debt issued and total debt repaid have risen rapidly, mainly because an increasing amount of short-term debt has been issued and repaid suspiciously. This raised the question of liquidity which has not been cyclically seen in the past. Perhaps, Amazon is swayed by short-term financial obligations due to the lack of free cash flows.

The total debt issued in million dollars has risen rapidly (Seeking Alpha)

The total debt repaid in million dollars has risen rapidly. (Seeking Alpha)

The following tables use the unit of million dollars.

|

Dec-12 |

Dec-13 |

Dec-14 |

Dec-15 |

Dec-16 |

Dec-17 |

Dec-18 |

Dec-19 |

Dec-20 |

Dec-21 |

TTM |

|

| Total Debt Issued | 3,378.00 | 394 | 6,359.00 | 353 | 618 | 16,228.00 | 1,068.00 | 2,273.00 | 17,321.00 | 26,959.00 | 36,662.00 |

| Total Debt Repaid | -588 | -1,011.00 | -1,933.00 | -4,235.00 | -4,334.00 | -6,300.00 | -8,754.00 | -12,339.00 | -18,425.00 | -20,668.00 | -29,922.00 |

|

Dec-19 |

Mar-20 |

Jun-20 |

Sep-20 |

Dec-20 |

Mar-21 |

Jun-21 |

Sep-21 |

Dec-21 |

Mar-22 |

Jun-22 |

|

| Short-term Debt Issued | – | 617 | 2,433.00 | 1,311.00 | – | 1,926.00 | 1,176.00 | 2,187.00 | – | 13,743.00 | 4,865.00 |

| Long-term Debt Issued | – | 76 | 9,918.00 | – | – | 111 | 18,516.00 | 176 | – | – | 12,824.00 |

|

Dec-19 |

Mar-20 |

Jun-20 |

Sep-20 |

Dec-20 |

Mar-21 |

Jun-21 |

Sep-21 |

Dec-21 |

Mar-22 |

Jun-22 |

|

| Short-term Debt Repaid | – | -631 | -1,906.00 | -1,349.00 | – | -2,001.00 | -1,176.00 | -1,917.00 | – | -6,231.00 | -7,610.00 |

An increasing amount of short-term debt in million dollars has been issued and repaid suspiciously. (Seeking Alpha)

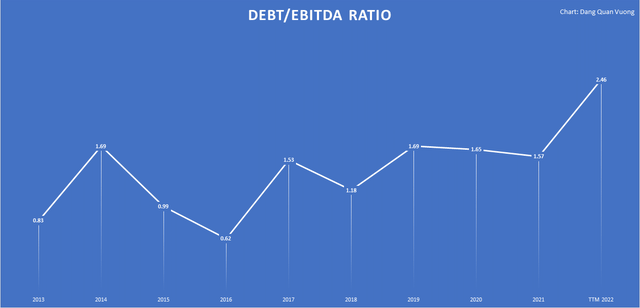

Liquidity and Working Capital Are Not Used Efficiently

The Debt/EBITDA ratio gauges the relativity between debt and earnings before interest, taxes, depreciation, and amortization expenses. This ratio indicates a company’s financial health and liquidity state by measuring its ability to repay incurred debt. Unfortunately, AMZN’s Debt/EBITDA ratio has increased by nearly 56.69% from 1.57 in fiscal 2021 to 2.46 in TTM 2022. It implies that the amount of debt relative to earnings is extremely high, and Amazon is less capable of effectively managing its debt.

The company is less capable of effectively managing its debt. (Chart: Dang Quan Vuong)

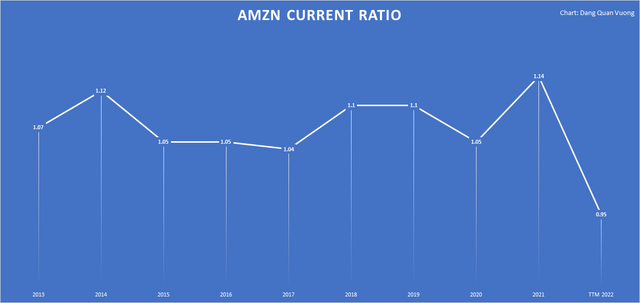

The current ratio is calculated as dividing a company’s current assets by its current liabilities. AMZN’s current ratio was healthy until 2021, and its value has plummeted to 0.95 in TTM 2022. It is worst in comparison to its peers in the ecommerce industry where the values of BABA, PDD, JD, PROSY, and MELI are 1.72, 2.05, 1.27, 3.46, and 1.30, respectively. It indicates that Amazon is less able to pay off short-term financial obligations that due within one year.

Amazon is less able to pay off short-term financial obligations that due within one year. (Chart: Dang Quan Vuong)

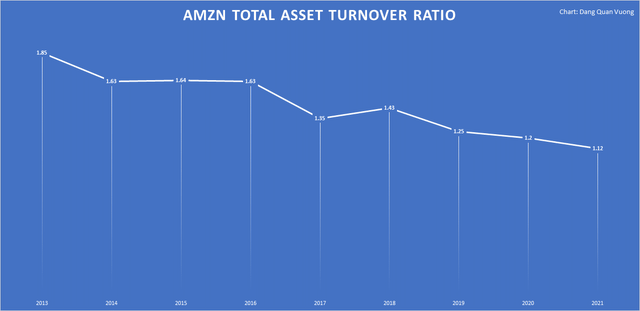

The total asset turnover ratio is calculated by dividing total sales or revenues by total assets. It measures the amount of sales or revenues that can be generated from each dollar of assets. AMZN’s total asset turnover ratio has gradually decreased over the past years and recently reached 1.12 in TTM 2022, while Alibaba’s has increased. It implies that Amazon is less efficient in deploying its assets to generate sales and revenues.

Amazon is less efficient in deploying its assets to generate sales and revenues. (Chart: Dang Quan Vuong)

Profitability Return Has Been Poor

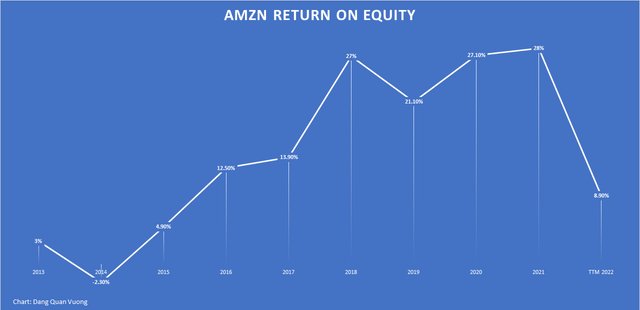

The return on equity (ROE) is the ratio of net income divided by average shareholders’ equity. It measures the probability or how efficiently a company converts its equity into profits. Amazon’s ROE greatly dropped from 28% in fiscal 2021 to 8.9% in TTM 2022 which is not bad when comparing to its peers. However, an approximately 68.21% drop in the probability to covert its equity to profits indicates that this industry is fiercely competitive. For example, $100 in equity can generate $28 profit in fiscal 2021, but it can only generate $8.9 profit in TTM 2022.

Amazon’s ROE greatly dropped from 28% in fiscal 2021 to 8.9% in TTM 2022 (Chart: Dang Quan Vuong)

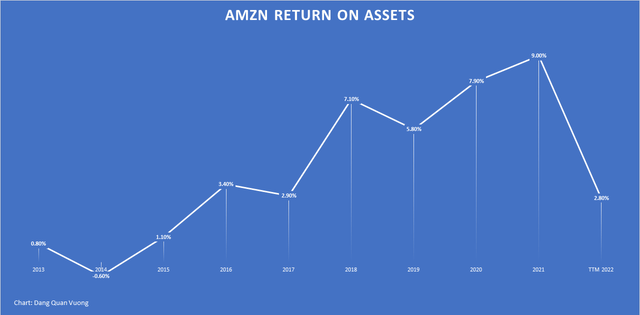

The return on assets (ROA) is the ratio of net income to total assets aimed at measuring the efficiency of converting a company’s assets to profits. Amazon’s ROA has recently declined from 9% in fiscal 2021 to 2.8% in TTM 2022. Obviously, this estimation is not really bad when Alibaba’s ROA stands at 2.3% concurrently, but it is a massive drop. For instance, $100 in assets can generate $9 profit in fiscal 2021, but can only generate $2.8 profit in TTM 2022 reducing more than three times.

$100 in assets can generate $9 profit in fiscal 2021, but can only generate $2.8 profit in TTM 2022. (Chart: Dang Quan Vuong)

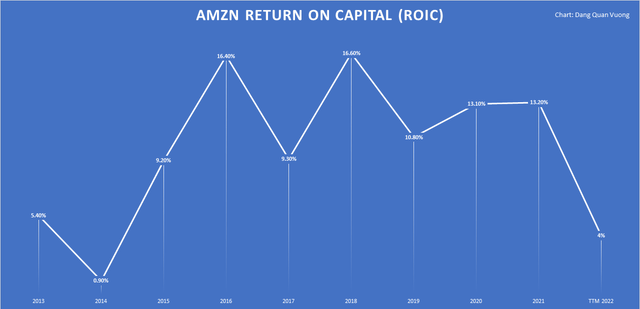

The return on invested capital (ROIC) is the ratio calculated as dividing net operating profit by invested capital, or (net income – dividends)/(debt + equity). Because Amazon has increasingly invested in infrastructure space and equipment, this ratio makes sense when estimating the firm’s valuation. Amazon’s ROIC ratio has suddenly dropped from 13.2% in fiscal 2021 to 4% in TTM 2022. So, it suggests that Amazon was less efficient to convert the amount of money that has raised externally by issuing securities to returns. For instance, $100 capital raised externally can generate $13.2 returns in fiscal 2021, but can only generate $4 returns in TTM 2022. Looking at the P/E ratio, we can see that AMZN’s market price is trading at a premium that is higher than its earnings more than one hundred times. However, its ROIC stands at 4% while its weighted average cost of capital (WACC) is at around 8.31% in TTM 2022. In other words, the ROIC is lower than WACC by about 51.86%. So, we should wonder whether AMNZ deserves to trade higher at the P/E premium.

Amazon’s ROIC ratio has suddenly dropped from 13.2% in fiscal 2021 to 4% in TTM 2022. (Chart: Dang Quan Vuong)

With reference to the poor profitability returns and weak capital structure, Amazon seemed to lose its advantage amongst its peers in the competition this year.

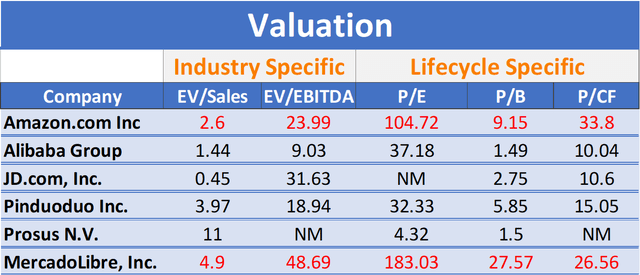

AMZN Is Highly Overvalued

With regards to the valuation multiples, Amazon’s financial ratios such as EV/Sales, EV/EBITDA, and P/B are all high in comparison to its opponents. It is currently trading at nearly 105 times its earnings per share, far exceeding the valuations of Alibaba, Pinduodou, and Prosus. As it has struggled with the shortage of free cash flows, the price to cash flow ratio is the highest one among its peers, at 33.8. Hence, Amazon’s valuation multiples appear to be highly expensive relative to the e-commerce industry.

Amazon’s valuation multiples are extremely high. (Table: Dang Quan Vuong – Source: Seeking Alpha)

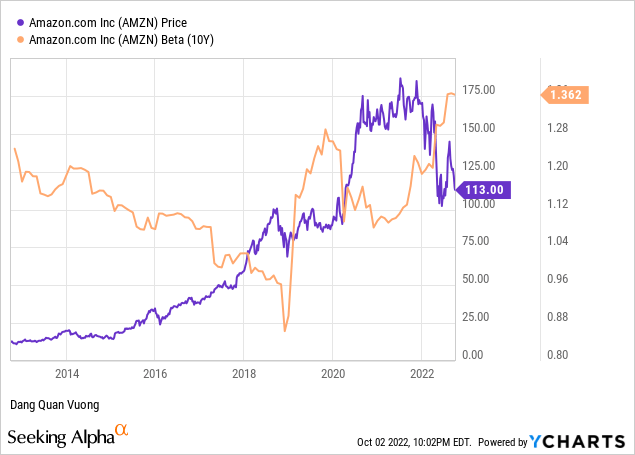

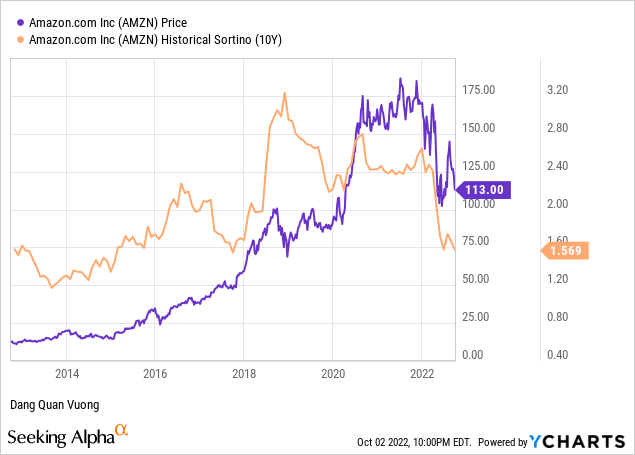

Downside Risk Is Increasing

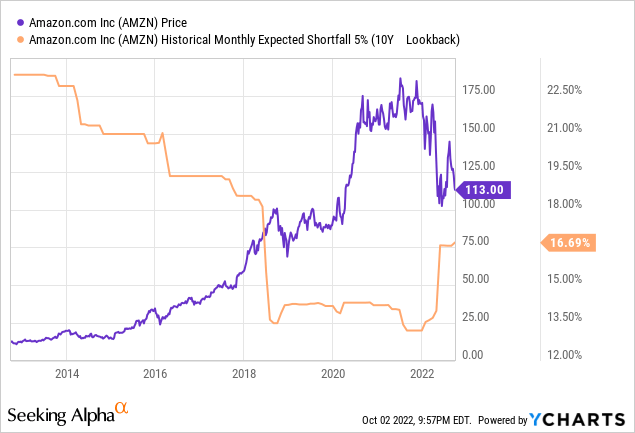

In terms of downside risk, AMZN’s Beta (10Y) has increased since 2021 and currently reached 1.362. It indicates that this stock is far more volatile than the overall market. Meanwhile, the risk-adjusted performance for the downside volatility is relatively low as the Sortino ratio (10Y) has fallen from its peak to 1.569. The Sortino ratio is a variation of the Sharpe ratio, but it only considers the standard deviation of the downside risk. It simply means that the Sharpe ratio calculates the risk-adjusted performance of the entire downside and upside volatility while the Sortino ratio only accounts for the risk-adjusted performance of the downside volatility. Therefore, this stock is less able to adjust the risk of the high downside volatility.

In the interim, the monthly expected shortfall 5% regarding 10 years lookback has soared sharply since early 2022, and its value now stands at 16.69%. This is the probability by which the return on investment will exceed the confidence level of 5%, or simply that 16.69% of the time the return on investment will lose 5% on average in a month. Additionally, it is about 4.58% for the historical daily expected shortfall 5% (10Y). Thus, the tail risk has increased since early 2021 that investors should not take it for granted.

The Bottom Line

There is no doubt that Amazon is a tech giant that has maintained a high level of profitability while growing through several economic downturns. Even so, Amazon has grown into various sectors and faced many leading and strong competitors. This is fine in most cases, but it may be a bit challenging if the company runs into short-term financial difficulties, especially if a recession occurs with decreased demand.

It does not really mean that Amazon has no long-term competitive advantage over its peers. Instead, high CapEx, R&D, and S&M is a must for the competition in this e-commerce industry. However, when investing in a growth stock, we wish to see its market price is still in an upside potential. And that the company should be in a growth of revenue, profit, and income in consistent.

With that said, the common business cycle includes four stages: consolidation, growth, saturation, decline, and consolidation again. Perhaps, Amazon has been at the saturation point where it needed to invest more in fundamentals and then we would see a decline as now. The decline period needs some time to consolidate the business development before the next growth. It would be irrational to invest in a company when it is in a decline stage because we may be suffering from short-term losses.

As previously stated, Amazon is witnessing a negative free cash flow, weak capital structure, and poor profitability return, as well as an increase in downside volatility and tail risk. These factors would have a negative impact on the re-valuation of AMZN because it is optimistically overvalued. Many may argue that AMZN is a growth stock, so trading at a premium that is higher one hundred times its earnings is normal. But remember that P/E ratio must be traded in conjunction with ROIC and WACC. As a result, it would be a sensible line of action for shareholders to hedge against the downside risk.

Risk Discussion

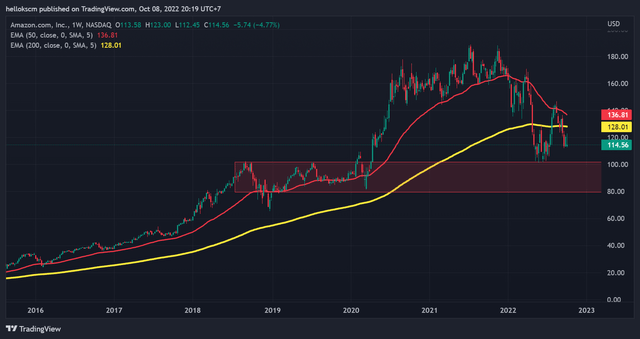

Many may say that all the aforementioned figures have been fully reflected in the stock price since then. But it is unlikely because the price action even went up in the July rally. Perhaps, it was just partially reflected in price during the April sale off, in my opinion. You can compare it yourself with the following chart.

$80 – $100 is a strong support for AMZN. (TradingView)

This article doesn’t aim at suggesting you to go short AMZN. In case you would like to do so, for traders, we can quickly open “sell” position through CFD brokers with high liquidity, but this trading activity involves significant risk. And that it is not suitable for beginning traders as it requires intensive risk management. Likewise, shorting against a corporation by borrowing stocks from your brokers is also associated with the high risk of short squeeze and short covering when the owners need back the stocks that you borrowed, while you must pay the cost of borrowing.

With the impressive revenue growth and the dominance in the e-commence and cloud industry, Amazon has full potential to continue to be the best growth stock. In addition, the most important factor that may drive AMZN’s price upwards further is that it is encountering the solid support at $100. Technically speaking, the area of $80 – $100 will likely play as a strong support if a sale off occurs. So, it would be illogical to sell or short AMZN here as you may get squeezed. However, if the price goes below $80, it will highly continue to fall. As my personal analysis, option markets are heating and it may be the matter of time that this support is likely to be broken. You can check some of my articles on Seeking Alpha to get more insight into how can do it. There could be no need that it should be repeated here.

For investors, it may be the best choice to not bet on the downside this instant due to the strong support. However, it should be reasoned to buy some put option contracts as you have the right to sell at the right time if AMZN’s price goes below $80. Why? Because AMZN will likely continue falling if its market price is under $80. Unfortunately, no one can tell exactly what is the time horizon that AMZN could go below that level of price. If we are still in the bear market, we are likely to see AMZN to go down after Q3’s earnings report. Perhaps, 30-day expiration options should be carefully considered in this case, from my perspective, because it may save you from a huge downside risk with a small cost. Finally, the feasible bottom from my personal analysis would be updated in the future if AMZN falls to below $80, but the possible drop may not be less than 30% from here.

Be the first to comment