HJBC

Amazon (NASDAQ:AMZN) has had a tough year in 2022, with the shares down 45% to date in 2022. As a result of the capitulation, it became the first public company in the world to lose its one trillion dollar market capitalisation status. Are the circumstances really so dire for Amazon in 2022? How will the company perform in 2023? This article aims to summarise the issues and challenges that Amazon faced in 2022 and what we should look for in 2023.

Investment thesis

I have written earlier articles on Amazon, including the most recent article analysing Amazon’s recent 3Q22 results. I continue to like the opportunity set and the risk reward profile for Amazon as the company is getting beaten down at a time when its fundamentals are improving. I reiterate my investment thesis for Amazon, which is as follows.

First, Amazon’s e-commerce business has reached a new phase where it has made significant investments into fulfillment capacity in the past two years and the current infrastructure for the business is more than enough for the demand of the e-commerce business in the near-term. As a result, the e-commerce business is ready for increasing demand while prioritising improvements in productivity and fixed cost leverage as the cost structure of the business continues to improve.

Second, AWS continues to be a bright spot for Amazon as a significant contributor to long-term growth and value driver. Given its leadership position in the industry and competitive advantages, AWS will likely continue to maintain its market share as the business gains scale and efficiency improvements. While its customers may be reducing their experimental budgets in the near-term due to macroeconomic uncertainties, I am of the view that AWS will continue to see long-term demand for its offerings.

Lastly, the incremental cost headwinds are still a challenge for Amazon but in 2023, I expect these cost challenges to alleviate as Amazon reaps the benefit of a more efficient and lean cost structure as it moves into 2023.

Biggest challenge in 2022

The year of 2022 was particularly challenging for Amazon due to the $6 billion in incremental costs headwinds highlighted in 1Q22 that I have elaborated on to great extent in an earlier article. To summarise, this is broken down into $2 billion of incremental cost headwinds from externally driven costs like wages, shipping costs and fuel costs, while $4 billion of incremental cost headwinds came from internally driven costs as a result of lower productivity and fixed cost leverage.

There are three main levers for management to pull to drive this $6 billion in incremental cost headwinds down to zero, which I have discussed in another article. The three main levers are productivity improvements, fixed cost leverage and easing of inflation.

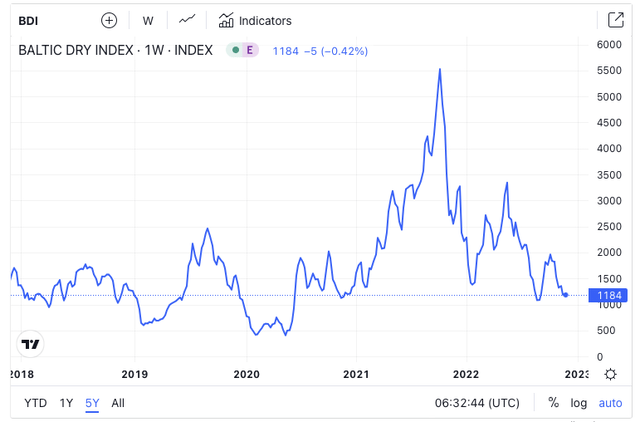

Of the three, easing of inflation is the one that is not within the control of Amazon’s management, but there are signs that inflationary pressures for Amazon are easing. As can be seen below, the Baltic Dry Index, a key measure that I track for the price of moving materials across the world by sea has somewhat normalised. At the peak of the supply chain mayhem, prices to ship goods across the world was almost five times more expensive.

Baltic Dry Index (Tradingeconomics.com)

The other two involve improving productivity in transportation and fulfillment as well as controlling capital expenditures and investments into the e-commerce business. This was where Amazon fell short in its recent quarter as the cost improvements for the quarter fell short of their goal. This shows how hard it is for Amazon to reign in costs as the scale of its e-commerce business is huge. For productivity improvement initiatives, this includes things like making the transportation route more efficient, optimising the number of deliveries made per hour and other initiatives to improve efficiency of the workforce and the assets. To improve its fixed cost leverage, Amazon has been reducing its investments into e-commerce infrastructure after the heavy investments it made into the business during the pandemic. As a result of an over capacity situation at the e-commerce business, the capital expenditures that were budgeted to be spent on the e-commerce business are now being shifted to its cloud business and content for Prime Video.

Incremental cost headwinds likely to improve in 2023

As we think about 2023, I am of the view that the inflationary pressures that caused an increase in externally driven costs for Amazon will likely ease further in 2023. The reason for this is simple: The Federal Reserve is determined to bring inflation down to their 2% inflation target and will continue to do what it takes to ensure that inflation remains under control. This means that as the supply side of the equation eases with supply chain constraints and tightness largely abating, the demand side of the equation will also be reduced as a result of the slowing growth caused by the rising rates.

In addition, we are likely to see a more material improvement in costs as a result of the improvement in internally driven costs as productivity improvements and fixed cost leverage helps to drive further efficiency gains and lead to reduction in cost headwinds. With the continued efforts to improve efficiency along the e-commerce supply chain, these improvements will drive improvements to Amazon’s cost structure as it looks to ensure that each part of its e-commerce business is streamlined. Furthermore, the company has announced that it will be laying off 10,000 workers, further reducing the excess labour in the business and improving the cost structure further as operating efficiency improves. The shift in investments towards other businesses will also drive fixed cost leverage as utilisation of its current capacity improves.

Consumer confidence and sentiment in 2023

This remains to be a wildcard for 2023 as Amazon’s e-commerce business is certainly very much influenced by consumer demand, which is in turn influenced by consumer confidence and sentiment.

From what we see today, consumer sentiment weakened further in November 2022 even as inflation eased slightly. This was particularly so for the larger ticket items that saw a decline of almost 20% for the group. US Consumer Confidence also fell to a three-month low, indicating pessimism for the next three to six months.

That said, it seems that 2023 could also be the turnaround year as some experts think that consumer confidence could remain in the later part of the year. One of the sell-side bank analysts for consumer stocks thinks that 2023 is the year when American spending power will return, after a year of negative cash flows in 2022. Specifically, there is the expectation that wages will be the key driver for cash flow improvement for consumers in 2023, and these gains will accelerate throughout 2023, implying a return for consumer demand strength in the second half of 2023.

AWS: Watch energy costs and cloud demand

For AWS, Amazon’s cloud business, I think that the business continues to show strength in the most recent quarter, with AWS commitments increasing 57% year on year.

The main concern likely comes from the deceleration of five percentage points for AWS in the recent quarter as well as margin compression as a result of rising energy costs.

For the deceleration in revenue growth for AWS, I am not very concerned by this as I know and have written in past articles the strong competitive advantage AWS has as a leader in the cloud computing market. The recent deceleration in growth was a result of customers pulling back their experimental budgets as a result of macroeconomic uncertainty, which is understandable. For me, I continue to see long-term structural growth drivers for AWS, which is likely to continue to post strong growth in the years to come. The deceleration we saw in the recent quarter is only a result of external macro factors that the company cannot control, in my view.

The compression in operating margins by 400 basis points was largely due to rising energy costs. However, the energy crisis around the world is largely easing as energy costs are expected to be lower in 2023 than in 2022.

Valuation

To derive my 1-year target price for Amazon, I use the equal weight of both the EV/EBITDA method and the DCF method. Amazon has been trading at an average EV/EBITDA of 19x over the past 10 years. As a consequence of wanting to be more conservative, I applied a 17x EV/EBITDA multiple for my target price. In addition, for the DCF model, 15x terminal multiple and an 8% discount rate are my key assumptions. The higher discount rate is a function of the rising rate environment.

My 1-year price target for Amazon is $159, representing a 69% upside from current levels. I regard the risk/reward profile of Amazon as positive as the company remains well positioned as a leader in key markets that continue to grow. The near-term challenges remain for Amazon as a long and deep recession could result in further downside to the stock. However, my base case scenario for 2023 is a recession that is likely to be short and shallow, with recovery as soon as the second half of 2023. In addition, my valuation does skew conservative with the lower multiples and higher discount rates used. I continue to see Amazon as an attractive investment for 2023.

Risks

Recessionary scenario

Amazon would be negatively affected by a recessionary scenario given that the e-commerce business is affected by consumer demand. If the economy were to slide into a global recession, the length of this recession would also pose a risk to Amazon. A prolonged, deep recession would certainly not end by the second half of 2023 and the recovery of consumer demand by the second half of 2023, as mentioned earlier in the article, will not materialise. As a result, a long and deep recession is definitely a downside scenario for Amazon for 2023.

Competition

While Amazon remains a leader in the e-commerce and cloud space, it is competing against large peers that may ramp up competitive pressures to win market share. In the cloud computing space, AWS competes with big tech firms Microsoft (MSFT) Azure and Google (GOOG, GOOGL) Cloud. In addition, many companies see the opportunities that e-commerce brings as the industry matures, bringing new and old consumer and e-commerce companies like Walmart (WMT) and eBay (EBAY) that could ramp up pressure in Amazon’s e-commerce business.

Conclusion

For 2023, I expect that the company will see the e-commerce business emerge as a stronger one from the current challenges as the cost structure of the business becomes more efficient and lean. The AWS business is currently experiencing external challenges that management cannot control and I continue to take the view that the AWS business will drive long-term shareholder value. Lastly, while consumer confidence and sentiment remains a wildcard, there is evidence that the impending recession could be a shallow and short one, with some experts expecting consumer sentiment and demand to improve through 2023. As inflationary pressures ease, this should not just reduce externally driven costs like wages, shipping costs and fuel costs, but should also bring incremental demand back from consumers.

My 1-year price target for Amazon is $159, representing 69% upside from current levels. As I think that the risk/reward perspective for Amazon skews to the positive, and that my valuation is rather conservative, I think that the valuation set up for Amazon looks good. Given that I expect the incremental cost headwinds to improve in 2023, consumer confidence and sentiment to improve over 2023, and AWS to be a long-term growth driver, I continue to see Amazon as an attractive investment for 2023.

Author’s note: I am starting a marketplace service, Outperforming the Market, which will be launching on 10 Jan 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a barbell portfolio that outperforms the market.

Mark your calendars, because early subscribers can reserve a spot as a Legacy Discount Member, which gives you generous introductory prices. Thank you for reading and following my work. See you there!

Be the first to comment