ryasick

What to do with a non-stock part of your portfolio? Solutions vary but today certain Treasury Inflation-Protected Securities (TIPS) offer salivating yields without any credit risks. What about duration risks? Please read on.

Shortly about TIPS

This is a short introduction for those who are not familiar with TIPS.

TIPS are government bonds currently offered in 5-, 10-, and 30-year maturities and like all Treasuries, they do not carry credit risks. The coupon rate is fixed at the time of issuance but the principal is being adjusted in line with changes in the Consumer Price Index (CPI). For example, since the current CPI is 8.5%, the bond principal will grow at 8.5%/12 ~ 0.7% during the month. Consequently, TIPS’ return is the sum of two numbers – its yield to maturity (YTM) today and future inflation adjustments. These adjustments are not known in advance and TIPS can return more or less than regular Treasuries with the same maturity.

The current yields

Since inflation is currently high, one may think that this is a perfect time to invest in TIPS. But not all TIPS are created equal.

An investor has two main ways to invest in TIPS: either by buying individual TIPS on the secondary (or primary) market or by buying a specialized ETF (or mutual fund). In any case, an investor has to decide the maturity she prefers.

In the current macro environment, all fixed-rate instruments with long maturities face material duration risks as their market value will decline with growing interest rates. At the same time, the current yields are not high enough to compensate for these risks. For example, reliable investment grade bonds (with BBB credit rating) yield about 6% at best with maturities of 5 years and longer. For this reason, we will discuss only short-term instruments with maturities of less than 5 years in this post.

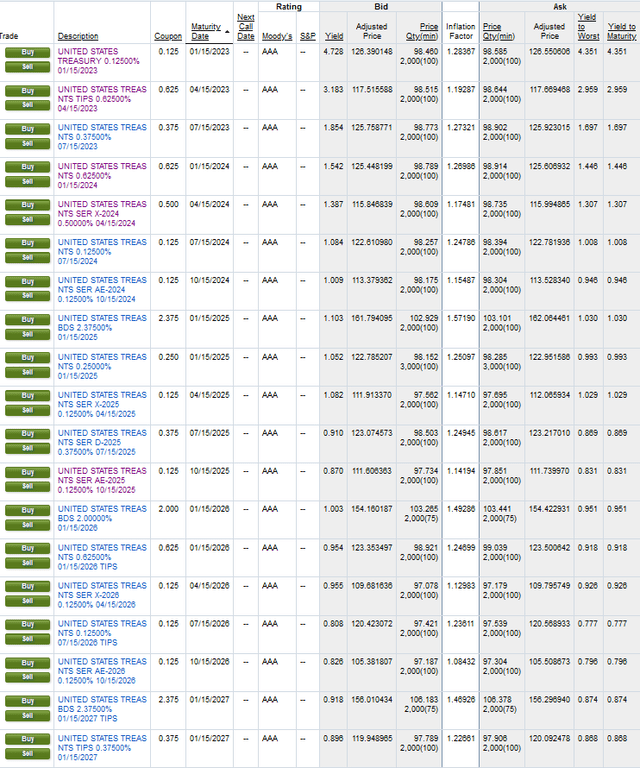

Let us review yields currently offered by short-term TIPS:

Yields for TIPS (Fidelity Investments)

In this table, positive YTM (Yield-To-Worst column in the table – for non-callable bonds Yield-To-Worst is equal to YTM) should draw immediate attention. Normally, TIPS are trading at negative YTM and deliver positive returns due to inflation adjustments. YTM changed its sign (for 5-year maturities) only in July. YTM for regular Treasuries maturing in 1-5 years is hovering around ~3.5%. Since TIPS will return YTM plus CPI (currently at ~8.5%), they may represent a superior choice as compared not only with regular Treasuries but perhaps, with any investment-grade bond.

This is especially striking for the bond maturing on January 15, 2023 (CUSIP 912828UH1). Its YTM is ~4.4% at the time of writing and we cannot expect inflation for the next several months to be less than, say, 5-6%. It means that this bond will return risk-free at least 9-10% annualized and even more if inflation on average remains 7-8% for the next four months.

Granted, this bond will mature in just 4 months, so the whole fuss is only about several percentage points. But first, we can increase maturity at the cost of a reduction in YTM. The bond maturing on April 15, 2023 (CUSIP 9128284H0) yields ~3%.

Secondly, to the best of my knowledge, it is much better than any other alternative short-term fixed-income option including banks. Please note that these bonds are very liquid with a negligible duration risk. In four months, regular bonds are likely to yield more than today and investors can reinvest proceeds from ultra-short TIPS into higher yields.

Finally and most importantly, these 4 months are expected to be the period of quickly increasing rates when stocks and longer-term bonds can easily produce negative returns. It is very tempting to sit this period out (or with decreased allocation to risk-on assets) earning 9-10% annualized returns risk-free meanwhile.

VTIP and STIP

There are two popular short-term TIPS’ ETFs sponsored by Vanguard (NASDAQ:VTIP) and BlackRock (NYSEARCA:STIP). They are very convenient to trade and plenty of retail investors are using them to invest in TIPS. But convenience alone does not mean that this choice is justified.

VTIP and STIP are very similar: they both hold TIPS maturing in 0-5 years, benefit from negligible expense ratios, and have almost equal durations. There are minor differences between them in duration (2.6 vs 2.7 for VTIP/STIP) and expense ratio (0.04% vs 0.03% respectively), but for practical purposes, they are almost indistinguishable. For the rest of this post, we will ignore these differences and be talking only about VTIP (implying the same for STIP).

Bonds in VTIP’s portfolio are being replaced when they mature leaving the duration more or less constant (currently it is 2.7 years). And this makes VTIP susceptible to interest rate risks.

Oversimplifying, one can visualize VTIP as a bizarre single bond yielding 2.7% (this is VTIP’s YTM today) that does not change its maturity with time. This maturity (and duration) always remains close to 2.5 years. It means that if interest rates go up, say, 1-2%, VTIP’s price should decline by ~2.5-5%. And it will keep negatively affecting VTIP returns as long as interest rates keep climbing as VTIP never matures!

Thus, VTIP should return less than the bond maturing on January 15, 2023, because a) it has lower YTM; b) its price is likely to decline because of rates going up. The inflation adjustments will be the same for both.

The same logic applies to several Vanguard mutual funds holding the same short-term TIPS – VTAPX, VTIPX, VTSPX.

Conclusion

We recommend TIPS maturing on Jan 15, 2023, or April 15, 2023, as a superior fixed-income choice to replace bank deposits, VTIP/STIP, and most other fixed-income tools. This recommendation assumes that interest rates will be rising over the next several months.

If we are lucky enough to see a drop in interest rates over the next several months, longer-term bonds or reliable preferred stocks may be a better choice. But under this scenario (which is not very probable), the stock part of portfolios should perform very well. Thus, our ultra-short TIPS promise a lower (as compared with regular bonds) correlation with stocks in addition to likely better yields.

Be the first to comment