Tomas Ragina/iStock via Getty Images

Failed Fujian Sanctions

In October 2018, the U.S. Commerce Department put Fujian Jinhua Integrated Circuit Co. Ltd. on a list of entities that cannot buy components, software and technology goods from U.S. firms amid allegations the firm stole intellectual property from U.S. semiconductor company Micron (MU).

I discussed this in a November 6, 2018 Seeking Alpha article entitled “U.S. Restricts Exports Of Some Chip Production Equipment To China – Impact On Memory And Equipment Suppliers.”

Fujian recently purchased equipment from domestic supplier Kingsemi, which manufacturers products that include photolithography process coating and developing equipment, and single-chip wet process equipment, as well as single-wafer processing equipment. Fujian’s Q1 2022 revenue was 180 million yuan (US$22.7 million), a year-on-year increase of 62%. As of the end of Q3 2021, the company announced nearly 1.3 billion yuan in orders in hand.

Failed SMIC Sanctions

U.S. sanctions against China’s SMIC (OTCQX:SMICY) haven’t worked in the last 18 months as SMIC moved to the 7nm node using DUV lithography. I first reported SMIC moving to the 7nm node more than two months ago in a May 18, 2022 Seeking Alpha article entitled “Applied Materials: SMIC Move To 7nm Node Capability Another Headwind.”

This was confirmed by semiconductor analyst firm TechInsights, which recently bought a cryptocurrency-mining ASIC manufactured by SMIC and found that it uses a 7nm process after doing a study of the chip’s die. The ASIC is designed by a company called MinerVa.

TechInsights also noted there appears to be a “close copy” of the one used by Taiwanese foundry giant TSMC. This is also consistent with what I said in my SA article two months earlier, that TSMC had made its first 7nm chip without EUV, and SMIC was able to do the same.

China Equipment Suppliers

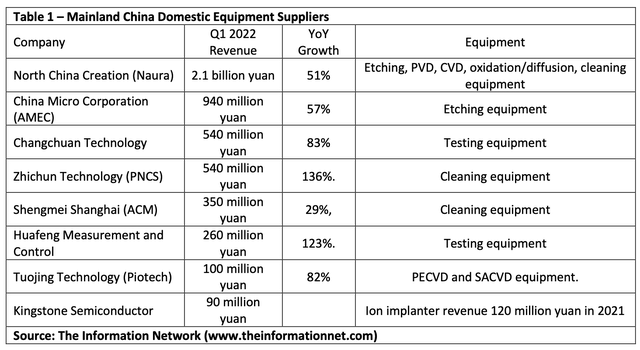

According to The Information Network’s report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends,” the major domestic Chinese semiconductor equipment manufacturers in Q1 2022 generated revenues of nearly 5 billion yuan (US$740 million), a YoY increase of 63%.

Two metrics are derived from this:

- In Q1 2022, $7.57 billion in equipment sold by non-Chinese companies was imported into China. This means that Chinese company sales represent about 10% of the China market.

- Chinese companies grew 63% YoY in Q1 while China equipment imports increased 27% YoY, indicating the 2X growth of domestic Chinese companies.

The Information Network

Chinese equipment is not only sold to Chinese semiconductor manufacturers. Technical capabilities of the equipment have enabled equipment be put in production lines of foreign semiconductor companies.

AMEC’s etch system is used in TSMC’s 5nm fab and AMEC is developing a high aspect ratio etcher and staircase etcher for 128-layer 3D NAND manufacturing at YMTC. Other customers include SMIC, Huahong, and Huali.

At the same time, NAURA is developing etchers and deposition equipment for 7nm and 5nm nodes. NAURA has a large product offering, and its customers consist of SMIC, Hua Hong, YMTC, and GTA Semiconductors.

Chinese equipment companies supply nearly all the types of systems used to make a semiconductor chip. One type is furnace systems. NAURA also makes thermal furnaces and have a 45% share of China’s memory maker YMTC purchases.

Shenyang Piotech supplies PECVD and ALD deposition equipment and has received orders from YMTC, and is also receiving repeat orders from Hua Hong and SMIC.

What it Means for Non-Chinese Semiconductor Equipment Companies

About 20 years ago, China was forced to make chips two nodes bigger than the companies outside China, and on 8″ wafers. SEMI, the industry consortia whose members include ASML and AMAT and every equipment company, lobbied congress to eliminate these restrictions because (1) China said they wouldn’t make chips for military, (2) SEMI wanted members who pay fees to make more money. As a result, Congress eliminated the restrictions and now China is free to make the chips with the latest nodes on 12″ wafers.

Now the U.S. is scrambling to impede China’s growth with sanctions, entity lists, and CHIPS acts. Sanctions have not impeded China, as SMIC is already at 7nm and China domestic equipment suppliers are making equipment at the 5nm node, selling to foreign chip companies, and growing 2x the rate of foreign competitors. The greed exemplified by SEMI on behalf of its members and U.S. sanctions have accelerated the determination and resolution for China to excel.

With domestic Chinese equipment companies now representing 10% of China’s needs, foreign competitors are already impacted, and that extent of impact will grow.

The semiconductor industry is facing a slowdown in consumer end products, largely as a result of a macroeconomic slowdown. But I also forecasted back in June 2021 a meltdown of semiconductor equipment that will occur in 2023, which I wrote about in my June 25, 2021 Seeking Alpha article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.”

Incidentally, like my article in May 2022 discussed above where I disclosed SMIC’s 7nm achievements that were confirmed two months later, analysts are now lowering their forecasts for semiconductor equipment for 2023 – one year after my analysis.

Who will be most impacted by this surge in Chinese domestic equipment growth to gain self-sufficiency?

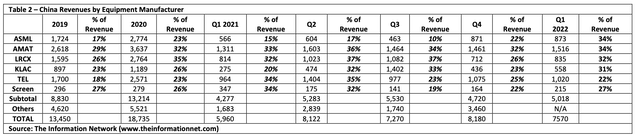

Table 2 shows sales of equipment to China by the top foreign companies. It also shows the percentage of total company revenues coming from China. Applied Materials (NASDAQ:AMAT) will be the biggest loser. Its large exposure to China, 34% in Q1 2022, coupled with its largest revenue means that equipment revenues will erode.

The Information Network

Table 2 above showed that AMAT has Chinese competitors in each of its equipment segments, and many of these are selling equipment capable of 5nm patterning.

ASML (ASML) is in a different situation. It already has sanctions imposed on it by U.S. Commerce, specifically preventing the export of EUV lithography to China. As I discussed in a July 6, 2022 Seeking Alpha Article entitled “ASML: Impact Of U.S. Government Attempt To Block DUV Lithography Systems To China,” the U.S. is considering putting ASML’s DUV lithography systems on the embargo list.

Currently China’s SMEE manufacturers DUV equipment, but because of fear of U.S. sanctions, the company is not divulging its node capabilities.

Be the first to comment