Galeanu Mihai/iStock via Getty Images

On July 2020, I penned an article with the same title that explained:

“There always are risks involved in putting together and maintaining a portfolio. To invest is to risk. So is to live.

It’s all about managing that risk: Understanding what you’ve got going for you, what you don’t, what probably will happen, and what probably won’t.”

There was also this:

“The reason I decided to title this article “Protect Your Hard-Earned Principal at All Costs” is that I know how hard it is to generate wealth. I also know what it feels like to lose money. I’ve been on both sides of that coin. It’s one of the primary reasons I’m so passionate about not losing money.”

It’s hard to believe it’s been almost two years since I wrote that article. A lot has changed since then, including the potential for another recession.

Here’s the worry wall:

- Inflation is painfully high, as households and corporations are feeling the squeeze.

- Supply chains remain a mess.

- The global economy is struggling from the war in Ukraine, China’s COVID-19 crackdowns, and the like.

But then there are these economy-saving points to ponder:

- Low joblessness

- Extra savings from consumers

- Pent-up housing demand

This then begs the question of what could tip us backward. A hurricane? Severe wildfires, since the West is experiencing drier-than-normal conditions? The spread of war in Ukraine?

Those also are possible. But I can’t say they’re on my radar as much as the following warning signs. Over the next few weeks, I’ll be especially looking for:

- A pickup in the unemployment rate.

- An uptick in consumer debt defaults, including through subprime loans.

- Long-term bond rates falling below short-term rates.

Clearly, a lot has changed since my last always-protect-your-principal article. But the message remains the same.

It’s imperative for investors to understand that “you’re unlikely to succeed for long if you haven’t dealt explicitly with risk.” That’s according to well-known value investor Howard Marks.

In his book, The Most Important Thing, he wrote:

“Outstanding investors, in my opinion, are distinguished at least as much for their ability to control risk as they are for generating return.”

Meanwhile, in The Education of a Value Investor, Guy Spier said it this way:

“There are plenty of reckless investors with scant regard for the risk of loss, but they tend not to survive very long in the investing game. The long-term survivors possess a more sophisticated grasp of risk, including the ability to see when the situation is less risky than the stock price might suggest.”

Accordingly, I thought that I would once again provide readers with five timeless tips that could be valuable in this current cycle.

Risk-Management Tip #1: Always Pay Appropriately for Your Portfolio Picks

Ben Graham wrote in Security Analysis: “In security analysis, the prime stress is laid upon protection against untoward events.” He also said in The Intelligent Investor:

“The margin of safety is always dependent on the price paid. For any security, it will be large at one price, small at some higher price, nonexistent at some still higher price.”

Accordingly, when the financial markets fail to fully incorporate fundamental values into securities prices, an investor’s margin of safety is high.

We’re not yield chasers who are preoccupied on how much they can make. We’re more interested in protecting principal and how much we could lose.

In other words, we’re value investors focused on risk and return.

This weekend, I posted this image on LinkedIn:

(Source: Brad Thomas)

It’s an advertisement from Walmart for a shopping center that I helped build over 20 years ago. As I explained on LinkedIn:

“I saved this one-page ad that Walmart took out in the local paper (during the grand opening), which happens to also be the mantra at Wide Moat Research, “SAVING YOU MONEY IS PRIORITY ONE.”

It really is.

Risk-Management Tip #2: Always Diversify

In a recent Seeking Alpha article, I used a quote from the famous stock picker, Sir John Templeton: “The only investors who shouldn’t diversify are those who are right 100% of the time.”

It’s true that all investors should adequately diversify, even Warren Buffett.

“… the reason why Buffett has succeeded – apart from his excellent connections, solid research team, and the training he got as Benjamin Graham’s protégé – is that he has, in fact, diversified. Whether he admits it or not.

“He doesn’t own just one stock. His Berkshire Hathaway (BRK.A) (BRK.B) portfolio is spread across many companies, not just one or two or three.”

That’s just the best way to run your money-making show.

Risk-Management Tip #3: Always Consider Management Motives

We spend countless hours interviewing management teams. In fact, I’ll be attending REITWeek in New York City this week, meeting with over 25 different real estate investment trust management teams.

Over the years, I’ve found that my stock-picking capabilities are highly correlated to the time I spend with their executives. That’s why I conduct around three CEO interviews every week.

Last week, I interviewed Kyle Bass, who runs a hedge fund known as Hayman Capital Management. In the interview, he discussed “lessons learned” from his experience launching a short attack that landed four REIT execs in jail.

If that sounds fascinating, it’s only because it was!

Risk-Management Tip #4: Always Check the Dividend

We have safety scores for more than 150 REITs with an emphasis on dividend quality. We don’t use non-REIT metrics such as operating earnings, knowing that granular metrics such as adjusted funds from operations (AFFO) work much better here.

Along those same lines, we’re publishing the all-new iREIT Masterclass handbook this week (for iREIT on Alpha members) that will provide details on REIT earnings metrics and payout ratios.

And please remember to always consider the safety of the dividend. Don’t just buy shares because of the higher yield.

We know that can lead to very unpleasant things.

Risk-Management Tip #5: Always Do Due Diligence

As Howard Marks explains, “Loss is what happens when risk meets adversity.”

By examining all potential risks, “A skilled and sophisticated investor can look at a portfolio in good times and divine whether it’s a low-risk and high-risk portfolio.”

Thus, “controlling risk in your portfolio is important and worthwhile.” Our primary job is conducting due diligence because:

“It’s the investor’s job to intelligently bear risk for profit. Doing it well is what separates the best from the rest.”

That Marks really knew what he was talking about.

2 REITs We’re Buying Hand-Over-Fist, Starting With…

Medical Properties Trust (MPW) is a healthcare REIT that’s one of the world’s largest non-governmental owners of hospital properties. The company owns 440 properties with roughly 46,000 beds leased out to 53 different operators within 10 different countries.

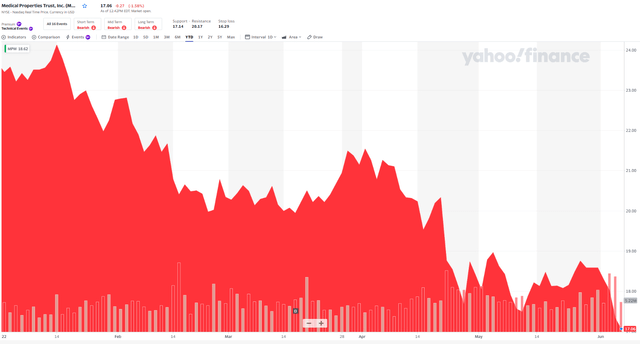

Yet, as seen below, shares have fallen off by over 27% year-to-date. This makes it more difficult to utilize its equity currency, with an AFFO yield now at 8.1%.

(Yahoo Finance)

On MPW’s recent earnings call, management made it clear this could cause it to acquire only a portion of the $4 billion to $5 billion worth of opportunities it intended to pursue.

To help finance the original expectation, MPW would have to sell assets and various joint ventures.

Admittedly, MPW has a good history of using JVs. It recently sold a 50% stake in a $1.7 billion Steward portfolio to Macquarie Asset Management.

Also on the earnings call, MPW took time to defend claims regarding straight-line rent write-offs and coverage ratio comparisons. As for the latter, detailed tenant disclosure is important for investors. That’s why I’ve often challenged the REIT to provide more transparency in that regard.

So this should be very helpful for analysts and investors – especially given how most of them are citing some signs of improvement. Here are its top five report coverages:

- Steward’s was 2.8x

- Median was 1.9x

- Prime was 5.2x

- Priory was 1.8x

- Springstone was 1.5x.

CEO Edward Aldag explained on the Q1 call:

“First, let me point out as I have numerous times, EBITDARM [earnings before interest, depreciation, amortization, rent, and management fees] in these calculations come straight from property level GAAP [generally accepted accounted practices] basis financial reports we received from our tenants, which include their annual audited financials at year-end.

“Except an extremely rare or unusual circumstances such as the Covid grants for 2020 and 2021, and some minor immaterial prior period updates, no adjustments have been made to these numbers.

“These EBITDARM numbers are trailing 12 months for the period ending 12/31/21. We use earnings before interest, depreciation, amortization, rent and management fees and the actual cash rent amounts owed to MPT.”

Here’s more:

“There have been a couple of recent reports from third parties outside of the company that have tried to use CMS cost report NOI [net operating income] numbers to show profit margins and equate that to a lease coverage comparison. CMS uses different definitions and allows different deductions for items such as depreciation, amortization, interest and other items than what is required in GAAP financial statements.

“Furthermore, they include all rental and lease payments and interest payments among other items. Therefore, when quoting the profit margins, one must keep in mind that all MPT rent and other rent and interest has already been accounted for in those numbers. By definition, the CMS cost reports could actually show a negative profit margin and all of the rent and interest being paid at the same time.”

This comment is specifically related to a short report where the analyst used CMS reported NOI numbers to back into lease coverage comparisons.

However, Aldag says CMS uses different definitions to calculate such ratios compared to GAAP requirements. As such, the CMS cost reports imply negative profit margins for all operators – which is negated by the EBITDARM coverage ratios (see chart below).

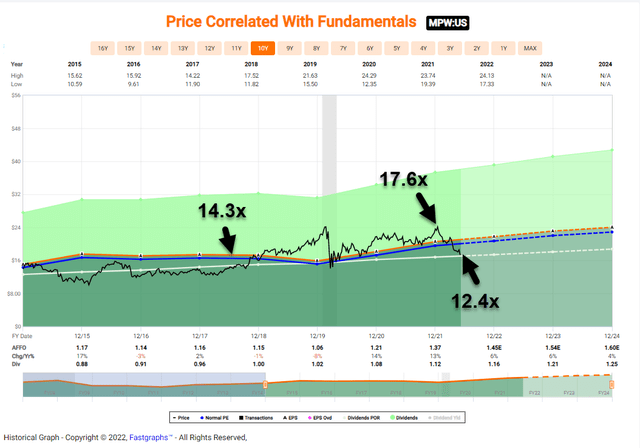

As noted earlier, margin of safety is one of the most useful ways to mitigate risk. And today, we find MPW trading at a very low multiple of just 12.4x p/AFFO.

Compare that to 17.6x just a few months ago, and its historical p/AFFO multiple of 14.3x.

(FAST Graphs)

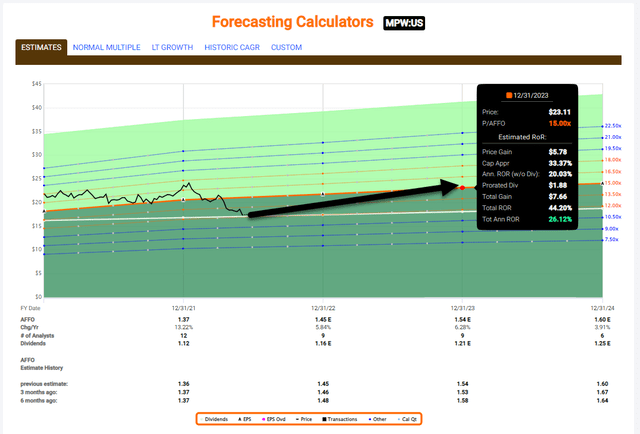

The dividend yield is also attractive, now at 6.7%, and well-covered with about an 85% payout ratio. As viewed below, MPW is in “Strong Buy” territory.

Shares could return at least 25% over the next 12 months. And analysts are estimating AFFO per-share growth of around 6% per year in 2022 and 20223.

(FAST Graphs)

And Our Second Such REIT

Innovative Industrial (IIPR) is a cannabis-focused REIT that owns 109 properties. Amounting to over 8.1 million rentable square feet in 19 states, these properties give it annual revenue of around $258 million.

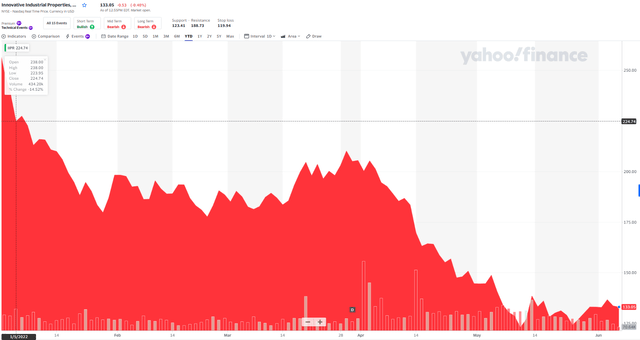

The company has maintained a steady pipeline of deal flow with commitments and investments totaling $2.2 billion. Yet, as seen below, IIPR has dropped by almost 50% year-to-date:

(Yahoo Finance)

IIPR’s platform is based on the need for U.S. cannabis operators with outsized needs for capital. U.S regulated cannabis sales are estimated to grow to $46 billion by 2026 – almost double 2021’s estimated $24 billion.

As of Feb. 4, 2022, 38 states and Washington, D.C., had legalized cannabis for medical use. And 18 states and Washington, D.C., legalized it for adult use.

Last week, for instance, Rhode Island’s Governor Dan McKee signed the Rhode Island Cannabis Act, joining that latter club. Effective immediately, anyone 21 and over can possess up to one ounce of cannabis and grow six plants (only three of which can be mature) for personal use.

Importantly, regulated cannabis operators must still obtain proper licensing from the state – a highly competitive process in many places, giving IIPR a moat-worthy business model.

The company continues to deliver exceptional growth fueled by a successful history of acquisitions. Yet it has a very low 15% debt to asset ratio. So it can increase leverage to enhance AFFO per share later on if it needs to.

Today, IIPR is trading at a lower multiple than it did during March 2020. In essence, Mr. Market is these IIPR shares as if cannabis is going up in smoke.

But we know that ain’t gonna happen when IIPR is in the best shape ever from a business perspective. It has collected 100% of rents, after all.

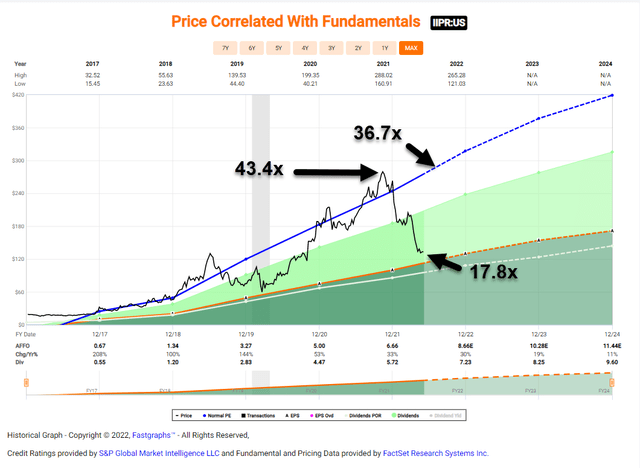

Once more, you can see that IIPR has an enormous margin of safety:

(Fast Graphs)

As shown above, the stock trades at 17.8x p/AFFO, around 50% below the normal range of 36.7x. Note that the all-time high multiple was 43.4x just six months ago.

IIPR’s dividend is safe, with a payout ratio of around 85%, and a 5.2% yield. Analysts are forecasting AFFO per share to grow by 30% in 2022 and 19% in 2023.

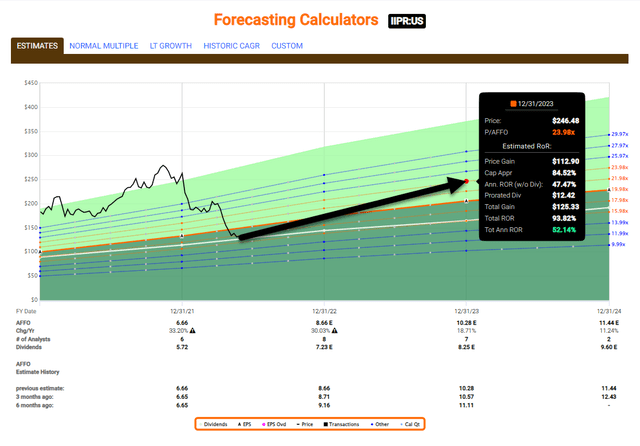

Our conservative model has it returning 50%+ over the next 12 months.

(Fast Graphs)

In Conclusion…

These REITs are highly attractive based on their fundamentals and overall cheapness. We have:

- Carefully analyzed these companies

- Visited properties they own

- Conducted interviews with management

- Debated the merits with our team members.

We’ve found that adhering to a checklist is an important element to our risk-management processes. So I’ll close with the bullet points I referenced in the above article:

- Always pay appropriately for your portfolio picks.

- Always diversify.

- Always consider management motives.

- Always check the dividend.

- Always do due diligence.

As always, thank you for reading and commenting. Happy REIT investing!

Be the first to comment