Mario Tama

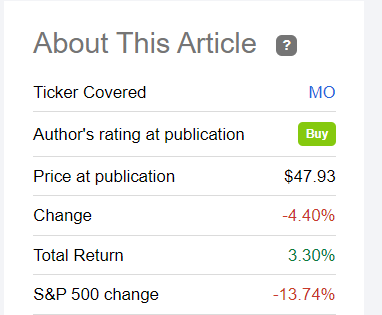

We wrote this article in December 2021 on Altria Group, Inc. (NYSE:MO) arguing that the stock’s then-recent strong performance was set to continue in 2022. A nice feature that Seeking Alpha introduced a while ago allows readers and authors to track the performance of a stock since the publication of an article recommending a buy or sell or hold.

And boy, aren’t we happy in hindsight about that call to buy Altria in December 2021. Although Altria’s share price is about 4% lower now than it was in December 2021, not including dividends, Altria has so far outperformed S&P by nearly 10%. Including Altria’s dividends (but not the S&P’s), the outperformance stretches to an even more impressive 17%.

Altria since December 2021 (Seekingalpha.com)

With that pat on the back out of the way, let us see how things are shaping up for Altria as we near 2023.

Market Conditions

it is a little eerie that the market conditions towards the end of this year are similar to the end of last year. Profitable and well-established names are once again expected to outperform as we head into the new year. Altria is a strong candidate to fit both the tags: profitable and well-established. Additionally, St. Louis Fed President James Bullard did stocks like Altria a major favor yesterday by reiterating that the Federal Reserve still needs to raise interest rates when the market was expecting a taper. That could mean the “risk-off” trade is likely back on cards and dividend stocks like Altria will outperform in such conditions.

Expected 54th Dividend Increase

Nothing is 100% predictable in the world of investing. But with its well-known target of paying 80% of its earnings as dividends, Altria makes it fairly predictable for investors when it comes to the expected payout. With the projected 2023 EPS of $5.05, an 80% payout will land the annual dividend at $4.04. That would represent a dividend growth of 7.50%. To err on the side of caution, we project a new annual dividend of $4.00 per share, which would place the yield at an astonishing 8.72% for someone buying here.

Grounded Valuation

Even though Altria stock has outperformed S&P handily this year, this was almost exclusively down to the fact that Altria didn’t fall in line with the over-valued stocks. Hence, Altria enters 2023 as reasonably valued as it has been in recent history with a forward multiple of 9 based on the projected 2023 EPS of $5.05.

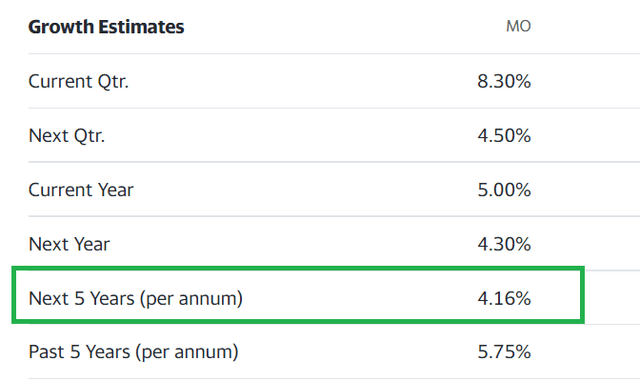

It is undeniable that Altria is in a declining industry and valuations deserves to be low, if not suppressed. However, with a growth rate of 4.16%, Altria’s PEG is not terrible too at about 2. Keep in mind, stocks like The Clorox Company (CLX), The Coca-Cola Company (KO) and The Procter & Gamble Company (PG) are trading at PEG of 3, 5, and 5 respectively. They are trading at a forward multiple of 25 with an expected per annum five-year growth rate of 5%. That gives these companies a PEG of 5. Factor in the near 9% yield and relative safety, Altria looks like a good bet going into 2023 as well.

MO Growth Rate (Yahoo Finance)

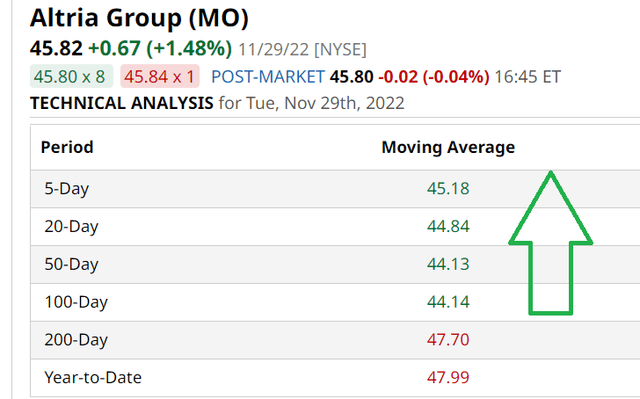

Technical Setup

From a technical perspective, it is clear that that stock is gathering steam as the 5-, 20-, 50-, and 100-Day moving averages have all been taken out. The 200-Day moving average is only about 4% away. Despite the recent strength, the stock is far from overbought, as the Relative Strength Index suggests with a value of 59.

Altria Moving Averages (Barchart.com)

Business Fundamentals

Last but not the least, none of the above factors matter much if the company is in shambles.

- Altria continues selling an addictive product that commands a premium price as well as customer satisfaction and loyalty.

- The company continues to raise prices as needed, to both offset the impact of inflation as well as declining volume. And so far, smokers haven’t revolved in protest. Odds are that this will continue well into the future.

- While we are wary of Altria’s foray into alternative products after the double whammy with JuuL and Cronos, the company is now free to sell its own E-Cigarettes. They didn’t waste much time by announcing the partnership with Japan Tobacco. While cautious, we believe Altria has the distribution and brand name to make “Moving Beyond Smoking” more than tagline.

Conclusion

Investing is challenging enough that almost every portfolio needs a predictable stock like Altria. But that predictability is a mixed bag. That Altria did not crash like the high-flying unprofitable stocks is likely to be offset by the stock not going up as much as the speculative names in “risk-on” years. But we don’t believe 2023 is setting up to be one such year.

Using the house analogy quoted in the 2021 article, Altria remains a cornerstone in our portfolio as we enter 2023. Altria still remains a stock that offers all three of these attributes: (A) deep value; (B) returns money to shareholders; and (C) inelastic demand in nature, thereby not impacted as much by inflation. We will continue reinvesting the high dividends to accelerate our Altria share accumulation.

Be the first to comment