Robi Saputra/iStock via Getty Images

Various reasons caused us to be neutral on the Altria Group, Inc. (NYSE:MO) the last time we wrote on it. We laid them all out in that piece and concluded with:

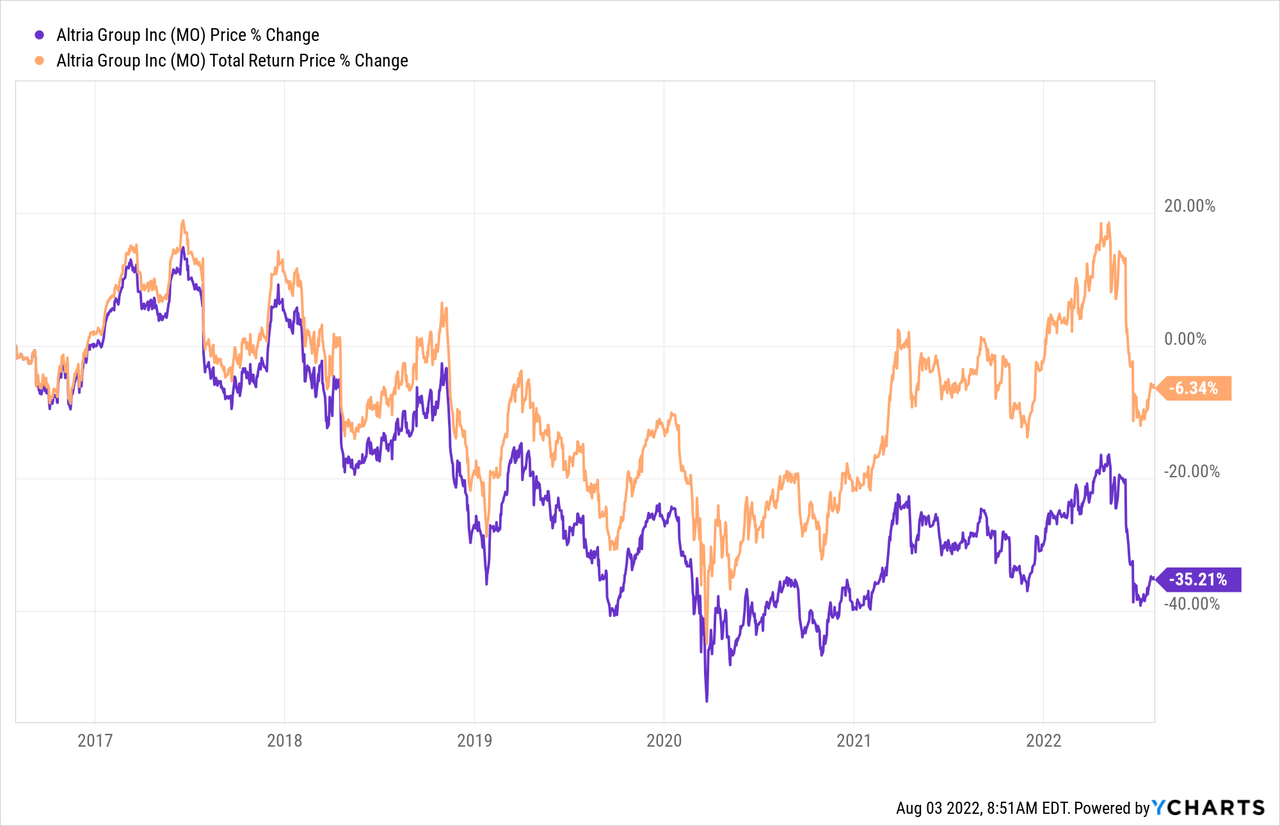

In all of this analysis, we have assumed a zero feedback loop from price hikes themselves. That is highly unlikely. Price hikes will likely accelerate declines themselves. We will hit a recession at some point, and you can expect states to levy a new armada of excise taxes. That too will accelerate declines. When the minority that smokes get really small, you can expect legislation to attack smoking with even more vigor. All of this gets us to continue to value Altria as a declining stream of dividends. None of this is rocket science, and we told you this four years back. Altria still has a negative total return from then.

Source: Altria: Tipping Point Revisited

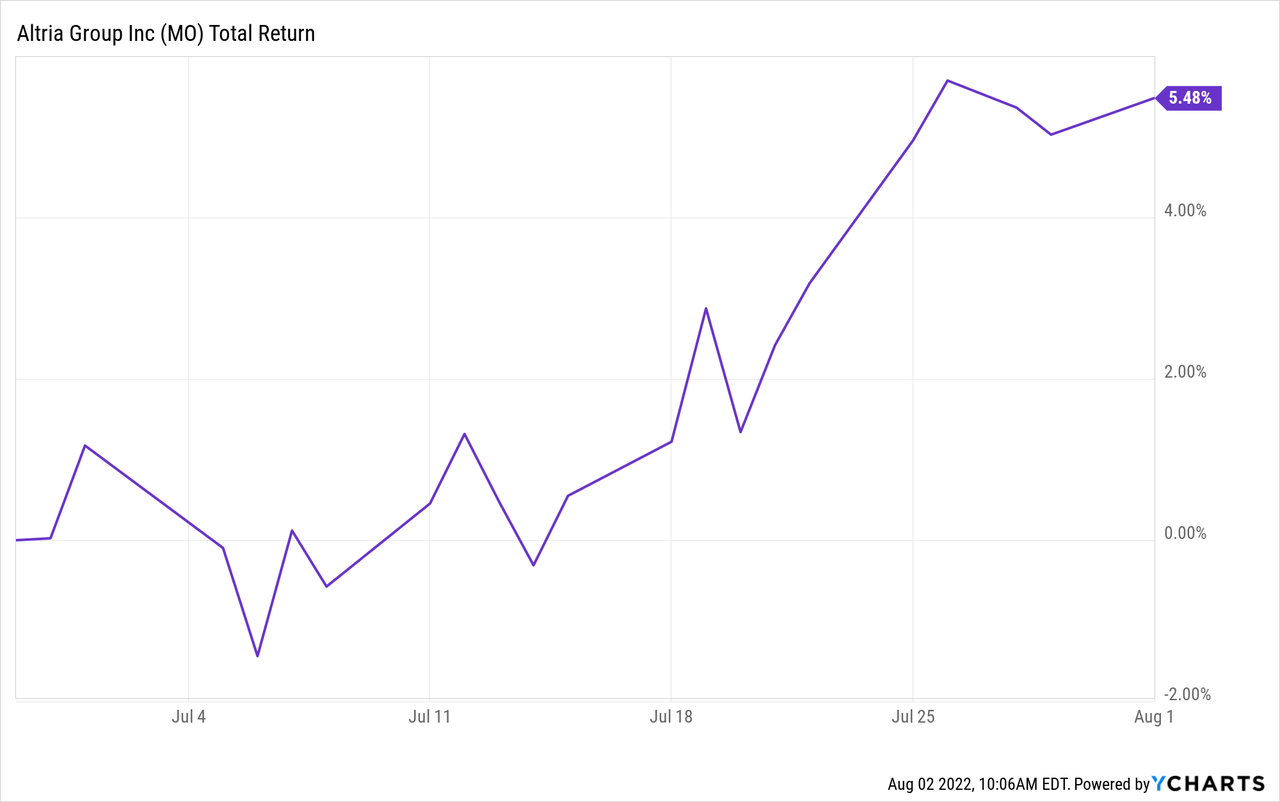

Aided by the recent two week market rally, the stock is in the green since that piece.

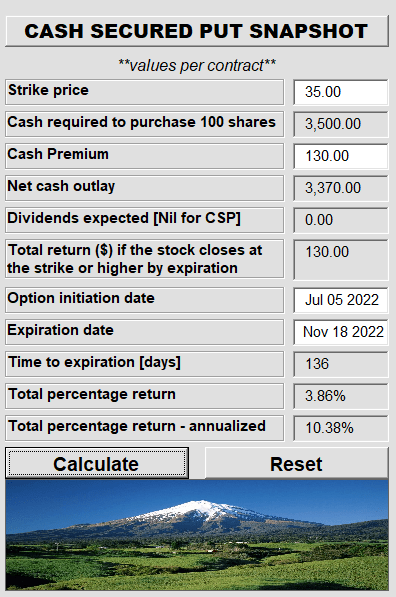

Instead of directly going long the stock, we had suggested selling $35-$37.50 cash secured puts to our readers. Lets review about the recent results and see if we still recommend options for this stock rather than the going direct long.

Earnings

The earnings release incorporated some unintended humor about inflation vigilantes aka tobacco users, which was nice.

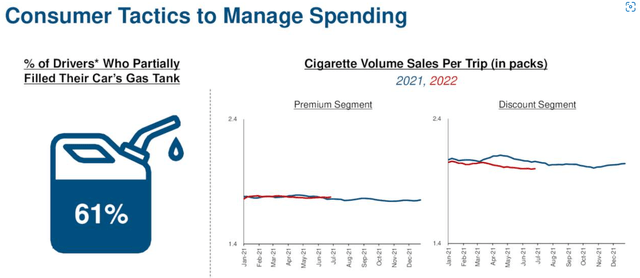

In the second quarter, rising gas prices and inflation continue to pressure tobacco consumers’ disposable income, resulting in volume declines across the tobacco space. However, we believe that tobacco consumers adapted their purchasing patterns across a variety of goods and services to compensate for the increases in prices. Some of the tactics used by consumers to manage their spending included only partially filling the gas tank and shifting their tobacco purchases from multipack towards single-pack purchases particularly among discount smokers.

Source: Altria Earnings Call Transcript

The slide below shows the graphic version of that comment.

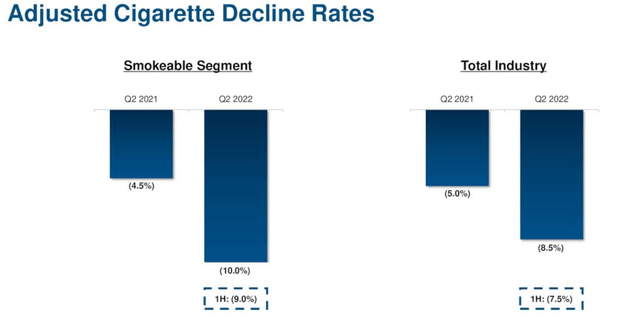

The big story for us though, were the decline rates in consumption. Total industry volumes were down 7.5% and Altria’s smokables segment volumes were down 9%.

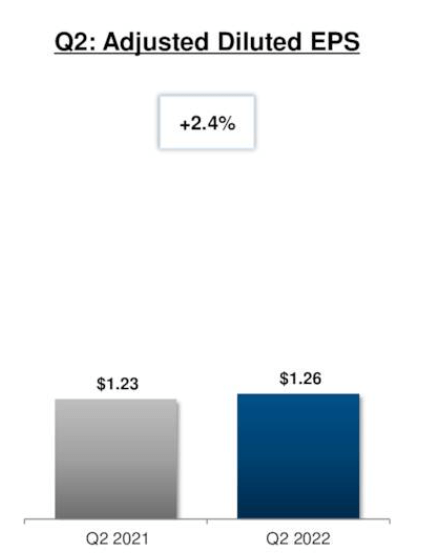

The 9% decline followed a quarter with a 8% decline. We cannot emphasize enough, how bad these numbers are. Altria has only one ace up its sleeve and that is repeated and punishing price hikes. That worked, once again in the quarter and the company was able to squeeze out a gain in adjusted EPS.

Altria Q2-2022 Presentation

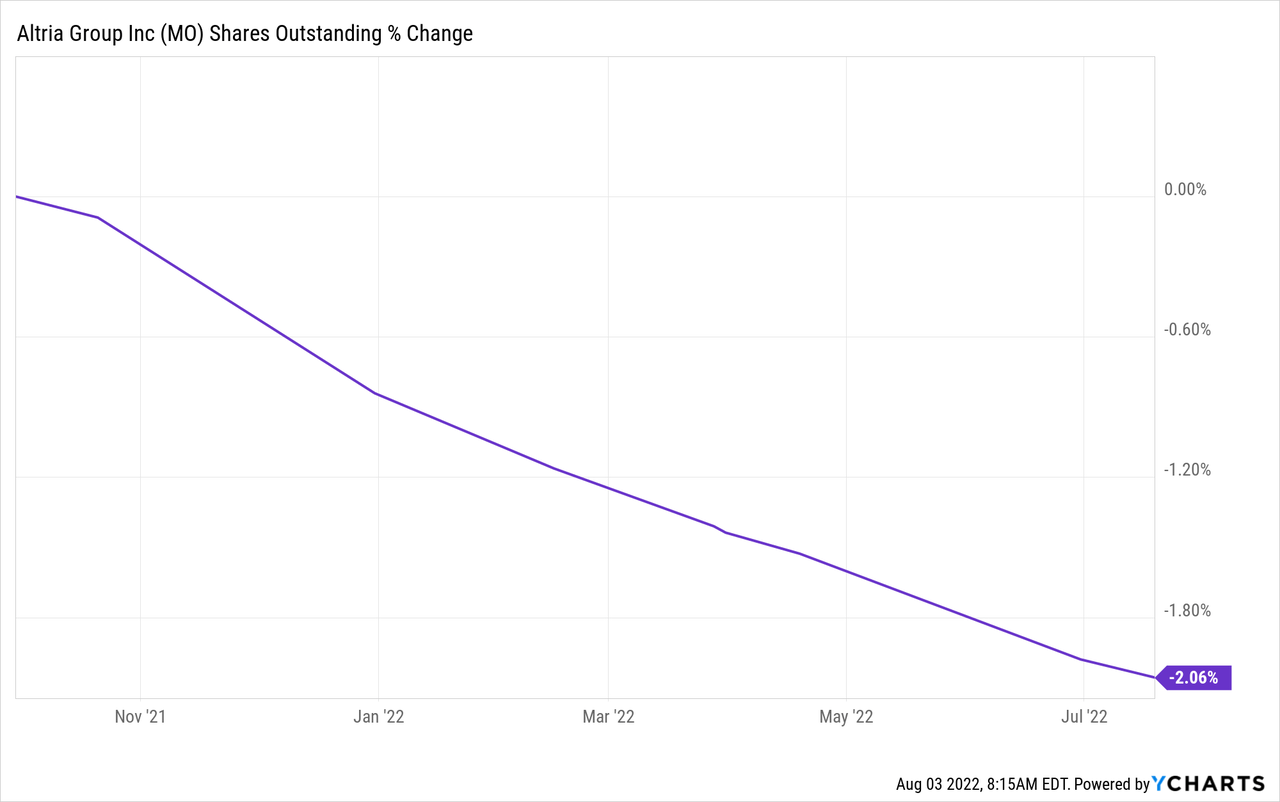

This was one of the smallest gains in adjusted EPS per share and driven entirely by reduction of the float.

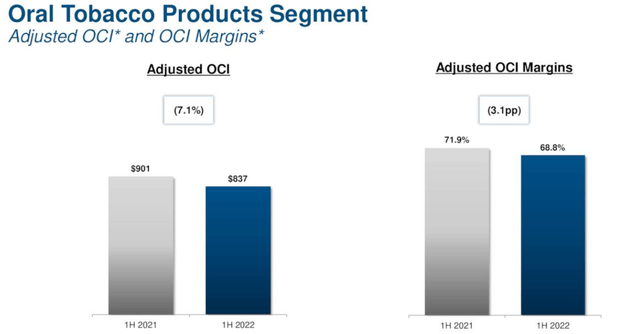

Altria’s headaches were not confined to its smoking segment, and the oral tobacco also showed lower margins and adjusted OCI.

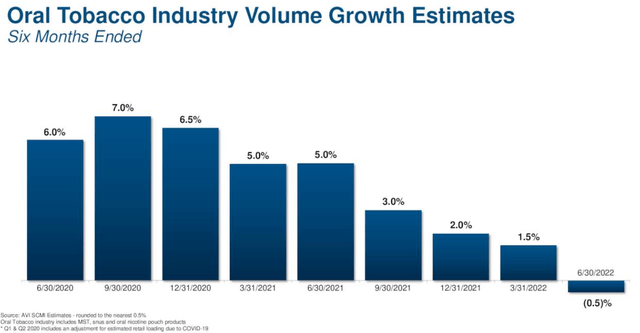

This was not surprising as eventually inflationary pressures were likely to show up even for a pricing powerhouse like Altria. Oral tobacco which was saving grace for the industry, actually saw volume declines as well.

Company once again confirmed its EPS guidance for 2022 of $4.79 to $4.93 and we think this was one of the best pieces of news within the press release.

The JUUL saga (see, JUUL Of Denial) is now coming to an ominous conclusion.

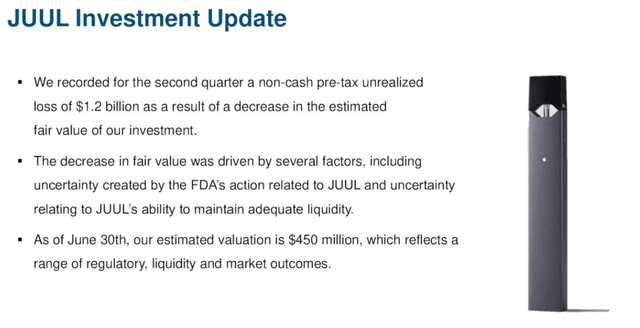

The company is now in so much trouble that Altria has marked its fair value to just $450 million.

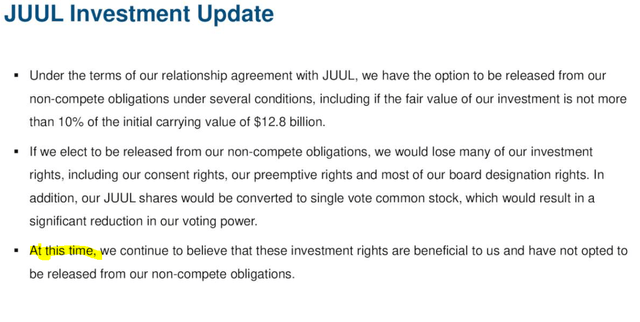

That is $450 million too high, but Altria will get down to marking it to zero eventually. Interestingly, Altria actually brought up the idea of being released from its non-compete clause with JUUL. In plain English, Altria’s investment in JUUL had done so poorly that it had now had a right to actually go back into the e-cigarettes category that it had shuttered by taking a $200 million charge in 2018. So $200 million to shutdown own e-cigarettes, $12.8 billion loss on JUUL (eventually, right now it is just $12.3 billion) and then Altria brought up the idea of going back in there. Why not?

Fortunately for shareholders, Altria has decided not to go down this road, at least for today.

Outlook & Verdict

Altria likely gets some relief from peaking energy prices and that might allow it to continue its relentless price hikes. This is counterbalanced by a very real possibility of a recession with real impacts, regardless of the technical definition of the term. States are likely to deliver another round of excise taxes on cigarettes in 2023 and we could see an easy 7-9% volume decline once more, just based on that. If Altria tries to hold its profit up, that would require, yet another 10% price hike, we could finally see the fall into the abyss where volume declines really accelerate. The pool of smokers continues to be whittled down, from the three certainties in life; death, excise taxes and Altria price hikes. This is not the Altria of the past and the last 6 years have produced negative price and total returns.

So please spare us the “if you invested $1 in Altria in 1822”. Besides the fact that we would need to carbon date you to get your age, that past is irrelevant today. This should be valued with a terminal value of $0 in 7-10 years and investors should use a discounted cash flow analysis to figure out what price makes sense. For us, it is currently $35-$37.50 and that number will only trend lower over time. We did trade this in our marketplace portfolio and sold the $35.00 Cash Secured Puts.

Author’s App

As always, such trades create a big price buffer and tend to offer a stronger “yield” versus going long the stock.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment