Scott Olson

From 7 June 2022 to 16 August 2022, Altria Group (NYSE:MO) stock price decreased from $54 to $45 per share due to the FDA’s regulatory review of JUUL’s products. Moreover, tobacco consumers’ disposable income has been adversely affected because of the high inflation driven by higher energy prices. However, MO stock is a hold because of three reasons: 1) I expect the inflation rate to decrease by the end of 2022, 2) Altria’s customers are loyal, and 3) FDA decisions are temporarily suspended. My valuation shows that the stock is worth $47 per share.

Altria Q2 earnings highlights

In its 2Q 2022 financial report, Altria reported net revenues of $6.5 billion, down 5.7% YoY, driven by lower net revenues in the smokeable products segment, the sale of the company’s wine business in October 2021, and lower net revenues in the oral tobacco products segment. The company reported 2Q 2022 adjusted diluted EPS of $1.26, compared with 2Q 2021, up 2.4% YoY, driven by fewer shares outstanding. In the second quarter, Altria repurchased 10.1 million shares at an average price of $50.35. In 1H 2022, the company repurchased 21.4 million shares, worth $1.1 billion. By the end of 2022, Altria expects to repurchase another $750 million worth of shares to complete its $3.5 billion share repurchase program. MO’s adjusted diluted EPS in the first half of 2022 increased by 3.5% YoY to $2.38. Moreover, due to a significant decrease in the estimated fair value of Altria’s investment in JUUL and lower reported operating companies income (OCI), the company’s reported diluted EPS decreased by 58% to 49 cents.

In 2Q 2022 and 1H 2022, Altria paid a dividend of $1.6 billion and $3.3 billion, respectively. “We maintain our long-term objective of a dividend payout ratio target of approximately 80% of our adjusted diluted EPS,” the company declared. “Our tobacco businesses performed well in a challenging macroeconomic environment for the first half of the year,” the CEO commented. “The smokeable products segment delivered solid operating companies income growth behind the resilience of Marlboro,” he continued.

Outlook

Due to the high rates of inflation (caused by increasing global energy, commodity, and food prices, supply and demand imbalances, labor shortages, and the war in Ukraine), in the first half of 2022, Altria’s direct and indirect costs increased; however not significantly. Moreover, it is important to know that Altria’s sale of tobacco products has little exposure to Russia and Ukraine. Nonetheless, the company’s cost and availability of certain raw materials have been adversely impacted as a result of the war in Ukraine.

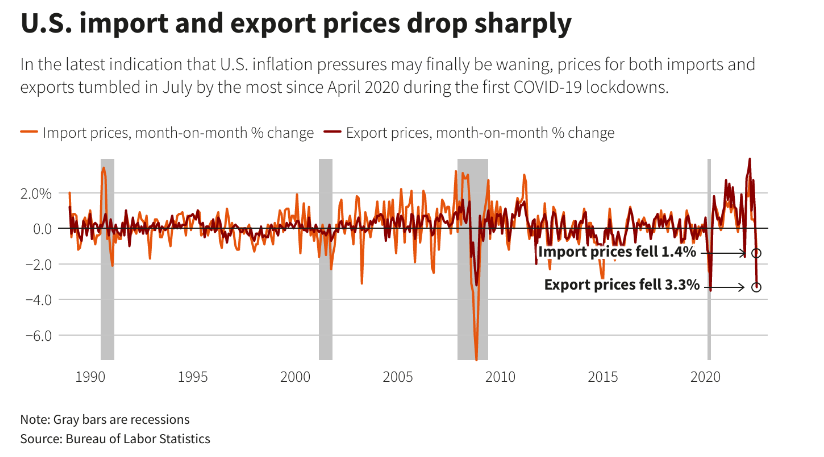

High inflation, high gas prices, rising interest rates, the COVID-19 pandemic, and the end of federal government stimulus, decreased ATCs’ disposable income in the second quarter of 2022 and lowered their tobacco consumption. What about the future? According to a report by Reuters, due to the dollar’s 10% appreciation against the currencies of the United States’ main trade partners and lower fuel and nonfuel costs, U.S. import prices fell for the first time in seven months in July (see Figure 1). It is worth noting that as a result of lower energy costs, producer prices declined in July 2022. A survey from the University of Michigan shows that one-year inflation expectations fell to a six-month low. On the other hand, the Federal Reserve is not lowering the interest rates yet as strong wage increases keep pressuring prices. It means that we can expect the inflation to decrease by the end of 2022; however, not to the before pandemic levels.

Figure 1 – U.S. import and export prices drop sharply

Reuters

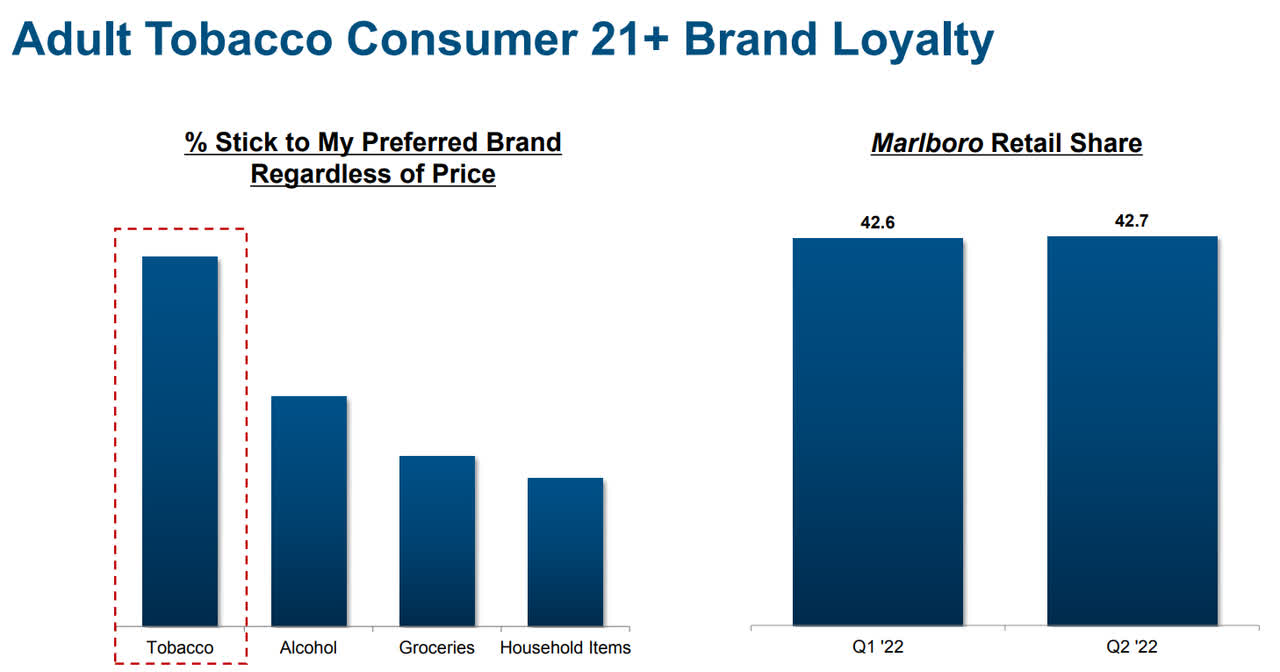

Also, it is worth noting that ATCs stick to their preferred brand regardless of price more than people often stick to their preferred brands when it comes to alcohol, groceries, and household items (see Figure 2). Thus, despite the inflation in the first half of 2022, Marlboro’s retail share even increased slightly from 42.6% to 42.7%. Even with higher rates of inflation, I do not expect Altria’s revenues to drop significantly.

Figure 2 – ATCs’ brand loyalty

JUUL-related issues

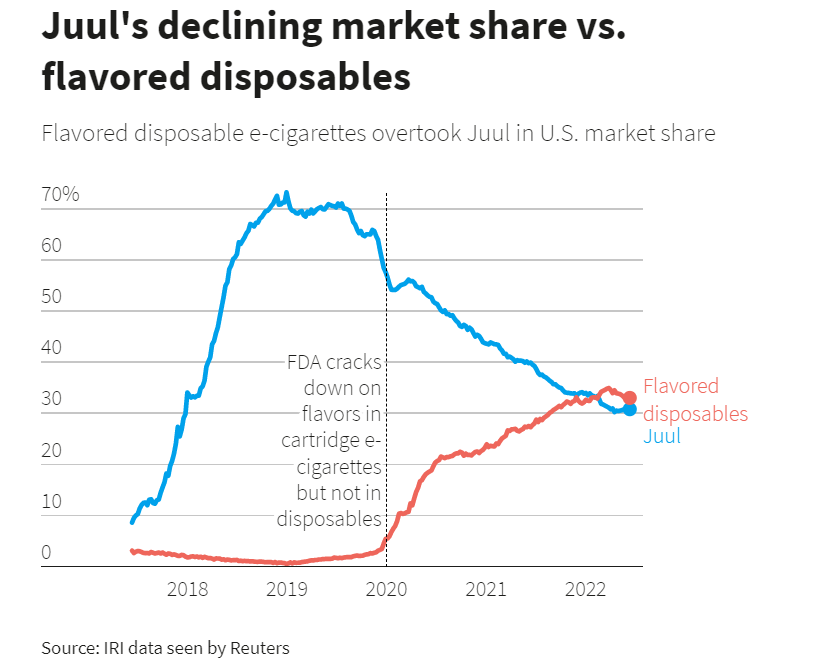

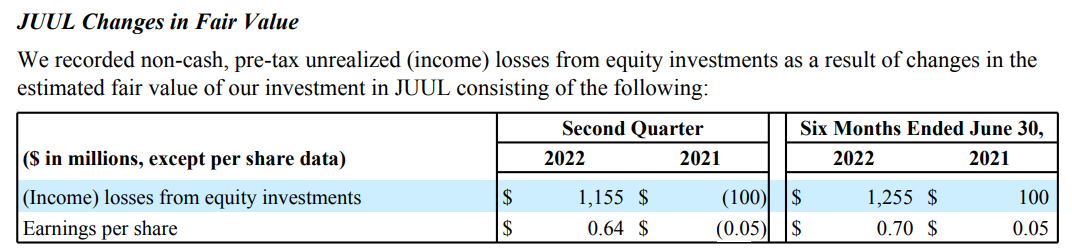

Altria has a large stake in e-cigarette company JUUL. In 2019, JUUL’s market share in the United States was 70%. However, as sales of flavored disposable devices have soared, JUUL’s market share dropped to 30% and flavored disposable e-cigarettes overtook JUUL (see Figure 3). In June 2022, The FDA declared that there are scientific issues unique to the JUUL pre-market tobacco product and issued marketing denial orders (MDOs) to JUUL ordering all of JUUL’s products currently marketed in the U.S. off the market. However, the FED’s decision is now temporarily suspended due to additional regulatory review, and JUUL’s products currently remain on the market. Because of these challenges, Altria’s estimated fair value in JUUL plunged. In 2Q 2022, Altria recorded a non-cash pre-tax unrealized loss of $1.2 billion. The estimated fair value of MO’s investment in JUUL dropped from $1.6 billion on 31 March 2022 to $450 on 30 June 2022. Figure 4 shows that due to the significant change in MO’s investment fair value in JUUL, Altria reported a loss of $1155 million in 2Q 2022, compared with an income of $100 million in 2Q 2021. However, if FDA allows JUUL to sell its product, the estimated fair value of Altria’s investment in JUUL will increase to more than $1.5 billion.

Figure 3 – JUUL’s market share vs. flavored disposables

Reuters

Figure 4 – Estimated fair value of MO’s investment in JUUL dropped significantly

2Q 2022 financial report

MO Stock Performance & Valuation

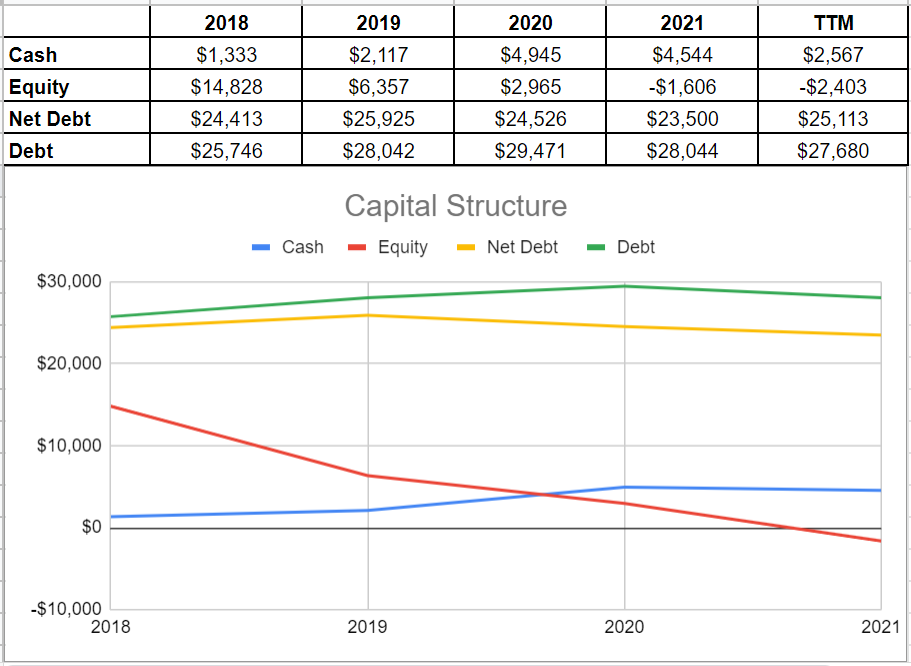

To investigate Altria Group’s performance during the previous years, I analyzed its capital structure. Analyzing Altria’s capital structure shows that after a slight increase in total debt in 2020, up 5% from $28,042 million in 2019 to $29,471 million in 2020, it dropped back to $28,044 million during 2021 and then $27,680 in TTM. On the other hand, we observe that MO’s net debt in TTM has boosted to $25,113 million compared with its previous amount of $23,500 million at the end of 2021. Such an increase in net debt could be due to the decline in the company’s cash balance. Altria’s cash has shrunk considerably to $2,567 million in TTM versus its level of $4,544 million at the end of 2021. Moreover, 2021 and 2020 saw a negative amount of total equity, which were $(1,606) million and $(2,403) million in respect. Thus, Altria’s capital structure represents a moderate performance (see Figure 5)

Figure 5 – Altria’s capital structure (in millions)

Author (based on SA data)

To estimate Altria Group’s fair value, I investigated its EBITDA growth during the last five years. The company’s EBITDA grew by 4.75%, on average, during recent years. Also, its net debt increased in the previous years. Based on my estimation, Altria is expected to generate an EBITDA of circa $12.85 billion and net debt of $26.2 billion at the end of 2022. According to the 2022 estimations and EV/EBITDA ratio in TTM, Altria Group’s fair value is around $47 per share. The stock thereby is a Hold (see Table 1).

Table 1 – Altria stock valuation

Author’s calculations

Summary

Due to lower net revenues in the smokeable products segment and lower net revenues in the oral tobacco products segment, Altria’s revenues decreased in the second quarter of 2022. Also, due to a significant drop in the estimated fair value of Altria’s investment in JUUL, the company recorded a loss from equity investment of more than $1 billion in 2Q 2022. However, I do not expect MO’s quarterly revenues to decrease further in 3Q 2022. Also, as long as FDA’s decision on JUUL’s product is not final, there is still hope in Altria’s investment in JUUL. The stock is a hold.

Be the first to comment