Darieus/E+ via Getty Images

Investment Thesis

Despite Altria Group’s (NYSE:MO) excellent core business, its investments in Juul, Anheuser-Busch InBev SA/NV (ABI) (BUD), and Cronos (CRON) have been a general disappointment in the past few years. Juul has proven to be a massive cash drain of $11.2B, with ABI adding another $6.2B worth of problems by now. Assuming a further decline in valuation, ABI would be another source of cash burn moving forward, with a residual carrying value of $11.1B in FY2021.

In addition, given the ongoing Juul saga with the US FDA and the temporary headwinds for the tobacco industry in general, MO’s stock valuations could potentially decline to new lows, worsened by the bearish market sentiments. Therefore, despite the appearance of an “attractive” entry point, we do not advise any investors to add at this level.

Despite The Excellent Core Business, MO’s Investments Have Been Disappointing

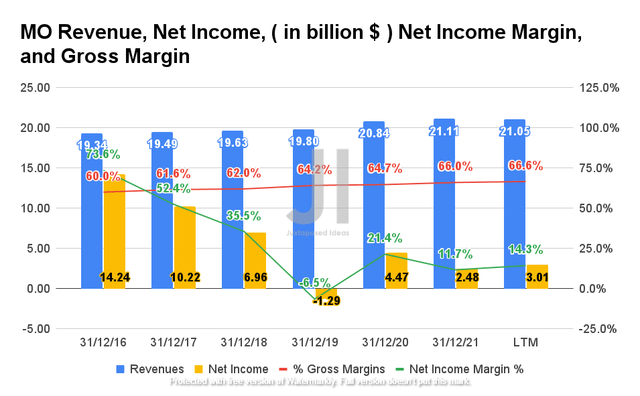

MO Revenue, Net Income, Net Income Margin, and Gross Margin

MO’s revenue growth has been in a steady state in the past six years, boosted by the robust consumer demand during the COVID-19 pandemic. Nonetheless, despite the slight improvement in its gross margins, from 60% in FY2016 to 66.6% in the last twelve months (LTM), its net income margins have been declining from 73.6% in FY2016 to 14.3% in the LTM. MO reported net incomes of $3.01B in the LTM, representing a massive decline of -32.6% from FY2020 and -56.7% from FY2018.

However, it is also important to note that this is mostly attributed to MO’s declining investment in Juul Labs, Inc, previously worth $12.8B in FY2018 to the final carrying value of $1.6B by now. Specifically, the company recorded impairment charges for Juul worth $8.6B in FY2019 and $2.6B in FY2020. Nonetheless, with the withdrawal of the US FDA authorization, we may expect MO to report a further reduction in Juul’s carrying value for FY2022, which would potentially bring the eventual value below the contractual agreement of $1.28B. Therefore, we may expect to see MO finally enter the e-vapor market with its own products earlier than the December 2024 deadline. We shall see.

In addition, MO recorded another impairment charge of $6.2B for its investment in Anheuser-Busch InBev SA/NV (ABI) and $205M for the Cronos Group Inc in FY2021. These resulted in the final carrying value of $11.1B for ABI and $617M for Cronos. Therefore, investors must be aware of the potential headwinds to MO’s future net income profitability due to its massive exposure to the ABI investment, assuming a further decline in valuation.

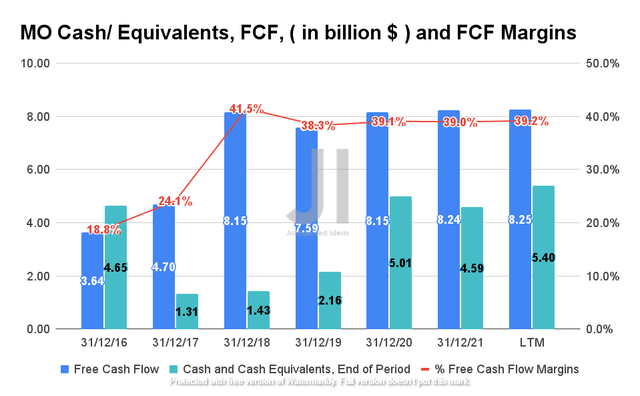

MO Cash/ Equivalents, FCF, and FCF Margins

On the other hand, MO has been generating robust Free Cash Flows (FCF) in the past few years, with an FCF of $8.25B and an FCF margin of 39.2% in the LTM. With a growing war chest of $5.4B in cash and equivalents on its balance sheet, the company still has more than enough capital for its operational and capital expenditures. Nonetheless, we have to lament the potential gains on its balance sheet attributed to the negative impacts of its investments.

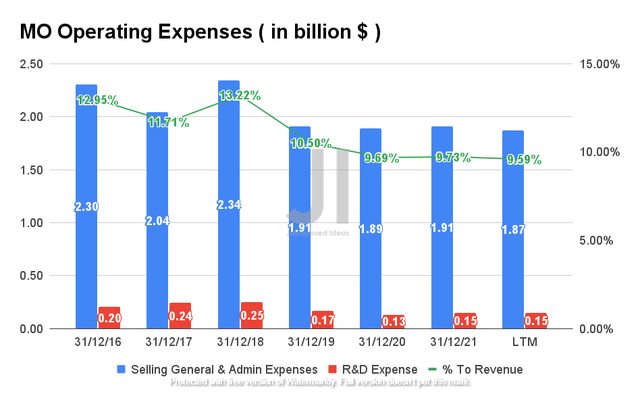

MO Operating Expense

In contrast, MO has been rather prudent in its operating expenses in the LTM, at a total of $2.02B, representing only 9.59% of its revenues. Nonetheless, given the minimal R&D expenditure, we do not think that the company would be looking at releasing any e-vapor product under its own brand, therefore, the potential M&A activity, as suggested by the Bernstein analyst Callum Elliott.

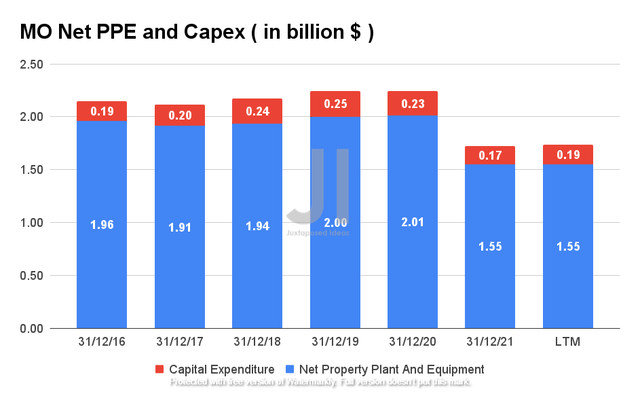

MO Net PPE and Capex

MO also spent $0.19B for its capital expenditure in the LTM, while gradually reducing its net PPE assets to $1.55B at the same time, indicating its decent capability in capital management in the current bear market.

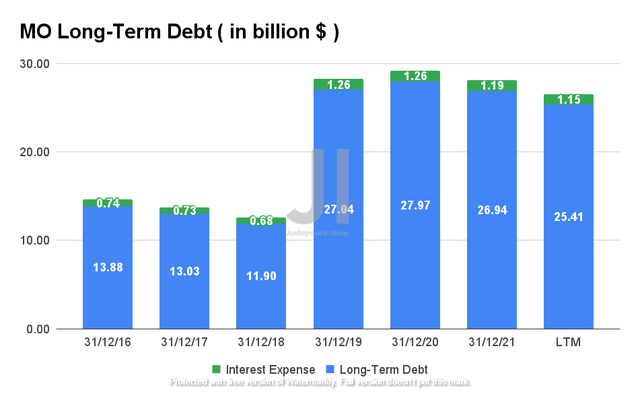

MO Long-Term Debt

MO has also been reducing its debt leveraging over time to $25.41B with interest servicing expenses of $1.15B in the LTM. Therefore, given its robust net income of $3.01B and FCF profitability of $8.25B in the LTM, we are not concerned about its cash flow and the financing of its dividend payouts moving forward, worth approximately $6.4B annually.

Nonetheless, assuming another M&A activity to increase its exposure in the e-vapor market, we may expect MO to rely on further debt leveraging moving forward. Therefore, increasing its capital liabilities in the intermediate term, despite its underperforming investments in Juul, ABI, and Cronos.

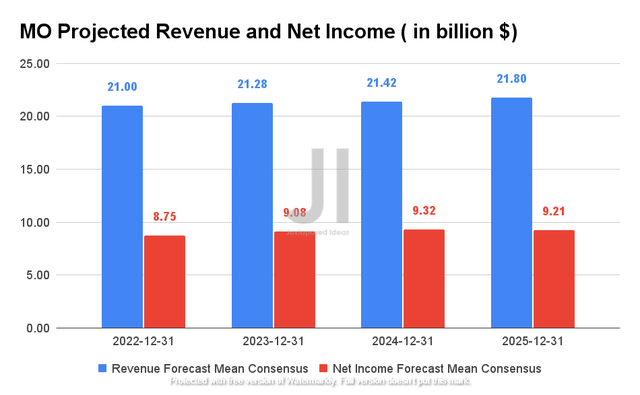

MO Projected Revenue and Net Income

MO is expected to report broadly in-line revenue and net income growth for the next four years. For FY2022, consensus estimates that the company will report revenues of $21B and a net income of $8.75B, broadly in line with FY2021 as well, barring any further impairment charges for its Juul and ABI investments. For FQ2’22, the market will be basing MO’s financial performance based on consensus revenue estimates of $5.44B and EPS of $1.25B. We shall see by the end of July 2022.

MO Is Still An Excellent Dividend Stock

MO 10Y Share Price (adjusted) and Dividend Yield

MO has had a discernible long-term stock price uptrend over the last ten years, discounting the volatility due to the Juul saga. Nonetheless, the company continued to increase its dividend yield from 6.2% in 2013 to 8.3% in 2022, while increasing its dividend payout at a CAGR of 8.28% in the past nine years, from $0.44 to $0.90 per share.

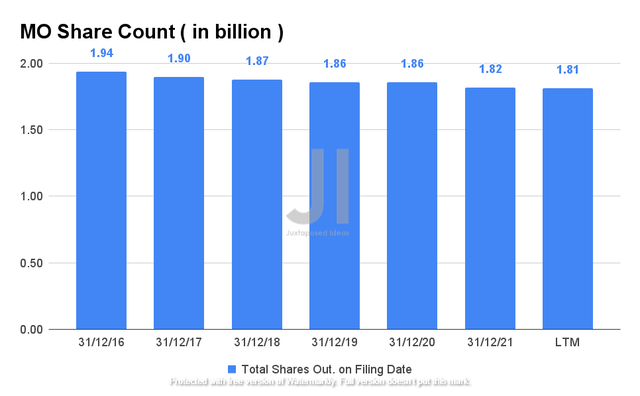

MO Share Count

The fact that MO has been regularly repurchasing shares also helped reduce its total shares outstanding in the past six years. With approximately $1.2B left in its existing $3.5B share repurchase program, we may expect the company to further reduce its share count meaningfully by the end of FY2022. Therefore, long-term MO investors would be well advised to hold on to this stock long-term, given its steady dividend payouts and regular share buyback programs.

So, Is MO Stock A Buy, Sell, or Hold?

MO 5Y EV/Revenue and P/E Valuations

MO is currently trading at an EV/NTM Revenue of 4.82x and NTM P/E of 8.39x, lower than its 5Y mean of 5.75x and 12.2x, respectively. In addition, the stock is trading at $43.19, down 24.2% from its 52 weeks high of $57.05, nearing its 52 weeks low of $41. Given the recent drastic fall, the stock also lost much of its gains during the COVID-19 pandemic, while nearing August 2014 levels.

MO 5Y Stock Price

Therefore, despite the consensus estimates price target of $53.25 with a 23.29% upside, we believe the time of maximum is not here yet. Given the potentially protracted legal proceeding on the Juul e-vape, we may expect to see a further retracement to new lows in the short term. In addition, with the US FDA looking to limit the nicotine levels in cigarettes sold in the US, we may see more unwelcomed volatility in the tobacco market over the next few years. As a result, we would advise patience and even more patience for those looking to add more exposure to the stock.

Therefore, we rate MO stock as a Hold for Now.

Be the first to comment