Mixmike/E+ via Getty Images

Introduction

Altria Group Inc. (NYSE:MO) shares fell 9.2% on Wednesday (June 23) after the Wall Street Journal reported that the FDA is preparing to order the removal of Juul e-cigarettes from the U.S. market, with a potential announcement this week.

Altria shares are now trading at just above their 52-week low, having fallen 27% from their peak in April. Compared to when we upgraded our rating to Buy in February 2020, Altria’s share price is now 13% lower, though including dividends our rating has still generated a gain of 4%.

|

Librarian Capital Altria Rating vs. Share Price (Last 1 Year)  Source: Seeking Alpha (23-Jun-22). |

We do not believe any U.S. ban on Juul would materially change our investment case on Altria, which has always been based on a continuing stability of the U.S. cigarette market. The FDA ban is not yet official and can be challenged in court, and in any case Juul was never that valuable to Altria. E-vapor penetration in the U.S. is still limited and the current #1, British American Tobacco’s (BTI) Vuse, is far from dominant.

Altria shares are now trading at an 8.9x P/E and an 8.7% Dividend Yield. Our forecasts indicate a potential 87% return (22.7% annualized) by 2025 year-end, and we reiterate our Buy rating.

Why is FDA Banning Juul Products?

All new tobacco products are required to submit PMTA (Premarket Tobacco Product Approval) applications to the FDA, except those that were on the market before February 2007, which were allowed to remain on sale but had to submit PMTAs before September 2021. The FDA has been processing these applications, issuing Marketing Granted Orders (MGOs) to some but Marketing Denial Orders (MDOs) to others.

The Wall Street Journal, citing “people familiar with the matter”, reported on Wednesday that the FDA is planning to issue an MDO to Juul, in effect banning its U.S. sales. The FDA has previously granted MGOs to a number of products from British American Tobacco (referred here as “BAT”) and Njoy, among others.

We believe the FDA’s rejection of Juul’s PMTA is likely to be based on the scale of youth usage of Juul’s products. FDA press releases on MGOs for BAT and Njoy emphasized that the need to consider the impact of any product for the entire population, with any benefit to adult smokers to be weighed against potential harm to new youth users:

Importantly, the FDA considered the risks and benefits to the population as a whole, including users and non-users of tobacco products, including youth. This included review of available data on the likelihood of use of the product by young people. For the authorized products, the FDA determined that the potential benefit to adult cigarette smokers who switch completely or significantly reduce their cigarette use, would outweigh the risk to youth – provided that the company follows post-marketing requirements to reduce youth access and youth exposure to their marketing.”

The reference to the need for a MGO recipient to follow “post-marketing requirements to reduce youth access and youth exposure” also suggests the FDA would include a company’s management as part of its assessment. Juul, believed to be responsible for an explosive growth in youth e-vapor use under a prior CEO, is likely at a disadvantage.

Any FDA Ban May Not Be Final

Any MDO issued by the FDA this week may not represent the final outcome, being subject to legal challenges.

Turning Point Brands (TPB) received MDOs on its e-vapor products in September 2021 under the same process, and challenged this in court, and by October the FDA had rescinded its MDOs and agreed to review TPB’s PMTA again. (TPB e-vapor products have remained on the market.) In its communications, the FDA conceded that “upon further review of the administrative record, FDA found relevant information that was not adequately assessed”.

Out of 262 MDOs listed on the FDA website under the current process, seven have been fully or partially rescinded, and another eight have been granted stays either by a court or by the agency itself.

How Juul could challenge the FDA’s MDOs depends on their stated reasons. While no MDOs have actually been issued yet and so we cannot know the FDA’s reasons, PMTA processes are rules-based and evidence-based, so there will almost certainly be grounds for the decision to be challenged in court.

Historically, FDA actions on tobacco products have nearly always been challenged in the courts and often defeated. One famous example is the defeat of the FDA’s attempt to ban menthol cigarettes in the 1990s, which was ultimately overturned by the Supreme Court ruling in FDA v. Brown & Williamson Tobacco Corp. in 2000. Since then Congress has passed legislation to strengthen the FDA’s authority, most notably with the Family Smoking Prevention and Tobacco Control Act in 2009; a clause in the omnibus spending bill passed in March 2022 also gave the FDA clear authority to regulate tobacco products containing nicotine from any source, including synthetic nicotine. However, the FDA’s authority to ban some nicotine products outright remains untested in court.

FDA May Ban Competitor Products

The negative impact to Altria from any ban on Juul products may also be offset by bans on competitor products.

Among key competitors, Imperial Brands’ (OTCQX:IMBBY) saw its myblu e-vapor device and several of its consumables banned in April (the company is appealing). BAT has received MGOs on some Vuse Solo, Vuse Ciro and Vuse Vibe products, but the application for its most popular Vuse Alto products remains pending.

|

Sample BAT Vuse Devices  Source: Vuse website (2019). |

The FDA has also consistently rejected products with non-tobacco flavors in all applications.

The more competitor e-vapor products are banned by the FDA, the more Altria’s cigarette sales stand to gain.

Juul Was Not That Valuable to Altria

The reaction in Altria’s share price looked overdone, as Juul was never a good answer to Altria’s strategic challenges.

Juul’s growth is dilutive to Altria’s earnings. Altria has a 48.1% share of the U.S. cigarette market by volume, and likely more than 50% of industry profits, due to Marlboro’s premium positioning; however, it only owns 35% of Juul, which is running at a net loss ($259m in 2021). Therefore, for every $1 of U.S. cigarette industry profits cannibalized by Juul, Altria is likely contributing more than $0.50 of the loss, while receiving nothing in Juul earnings in return.

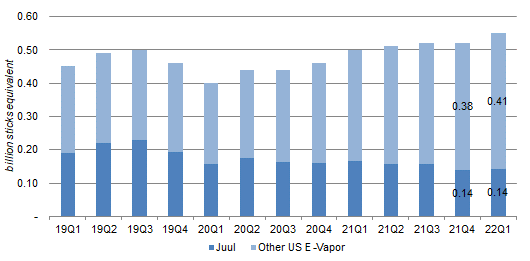

In any case, Juul has also been declining in both relative market share and absolute volume terms since late 2019:

|

U.S E-Vapor Category Volume by Quarter (Since 2019)  Source: Altria company filings. |

Altria’s ownership in Juul also continues to be challenged by the FTC in court, though Altria won a legal victory in February when an Administrative Law Judge dismissed the FTC’s complaint.

Should Juul products disappear from the U.S. market, Altria will likely see an immediate benefit in volume and earnings.

Limited Impact on Cigarette Volume to Date

E-vapor’s impact on U.S. cigarette volumes has also been limited to date.

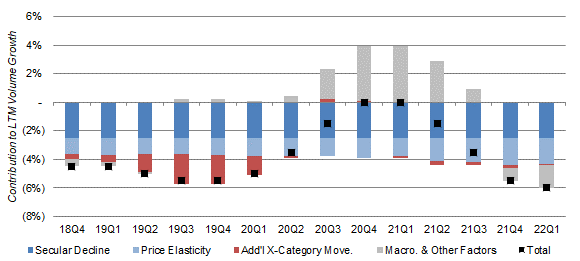

Altria estimates that “additional cross-category movement”, i.e. the movement of smokers into other nicotine categories beyond the long-term trend (and part of 2.5% long-term secular decline), has contributed just 0.1-0.3% (on a rolling 12-month basis) to overall cigarette industry volume decline in the past few quarters. “Additional cross-category movement” peaked at 2.1% in Q3 2019, largely attributed to Juul’s previous explosive growth, but fell dramatically after the FDA’s clampdown on flavored e-vapor products in late 2019 and never recovered:

|

U.S. Cigarette Industry Volume Decline by Component (Rolling 12 Months)  Source: Altria quarterly metrics (Q1 2022). |

While last-twelve-month industry volume decline has accelerated to 6.0% again, Altria has attributed this to “macroeconomic & other factors”, including higher gasoline prices and post-COVID normalization in consumer behavior (which contributed up to 4% to volume during the pandemic).

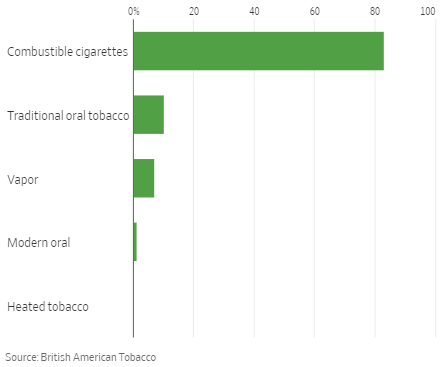

E-vapor growth rates quoted by executives should be seen in context of the category’s still relatively low share of the U.S. nicotine market. E-vapor currently represents approx. 7% of the U.S. nicotine market by value, compared to combustible cigarettes’ 83% – which means every 10% growth in e-vapor is only equivalent to a 0.8% decline in combustible cigarettes (before any offset by cigarette price rises).

|

U.S. Nicotine Industry Category Share by Value  Source: Wall Street Journal (22-Jun-22). |

The same can be said of modern oral tobacco (nicotine pouches), currently about 1% of the market by value (and 3% by volume). In addition, approx. half of new modern oral tobacco users came from traditional oral tobacco.

Heated Tobacco has a negligible share at present, as Philip Morris’ (PM) IQOS remains unavailable in the U.S. after an ITC import ban in 2020, though PM expects availability to resume in 2023.

Our base case remains that U.S. cigarette volumes will remain stable, underpinning Altria earnings.

Vuse’s Lead Can Be Challenged

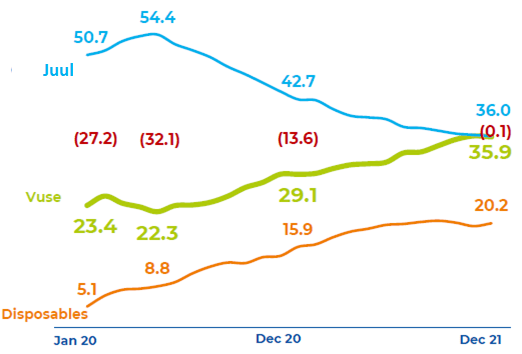

While BAT’s Vuse has reached #1 in category share by value in the U.S. in 2021 and will benefit further from a ban on Juul, its market position is not dominant and we believe can be challenged.

Vuse’s value share was 36.0% (based on closed systems only, so excludes open-tank e-vapor products) in December 2021, and was virtually unchanged for January-April 2022 at 35.9%.

|

U.S. E-vapor Value Share – Vuse vs. Juul (2020-21)  Source: BAT results presentation (2021). |

Vuse’s lead is thus much smaller than Swedish Match’s (OTCPK:SWMAY) ZYN (66.2% volume share in U.S. nicotine pouches) and Philip Morris’ IQOS (three times BAT’s share in Heated Tobacco in Japan) in their respective categories.

We believe Vuse’s lead in the U.S. can be challenged by new products in the future.

Few Good Options Outside Cigarettes

Unfortunately Altria’s strategic options in Reduced Risk Products are limited regardless of the outcome on Juul.

A U.S. ban on Juul products would free Altria from its current non-compete in e-vapor. Altria has “the option to be released from its non-compete obligation if Juul is prohibited by federal law from selling e-vapor products in the U.S. for at least a year”, or if the value of its Juul stakes falls below $1.28bn, thanks to a 2020 revision in their agreement.

However, developing a new e-vapor product “would take years”, partly due to the need for new PMTA applications – this was the internal view within Altria prior to their investment in Juul, as disclosed in court documents from the FTC case. The PMTA for PM’s IQOS took four years and that for Swedish Match’s ZYN took more than four. There would also be significant expenses – at the time, Altria estimated that Juul had spent more than $100m on its PMTAs and that PMTAs for its then MarkTen products would have costed $89-100m.

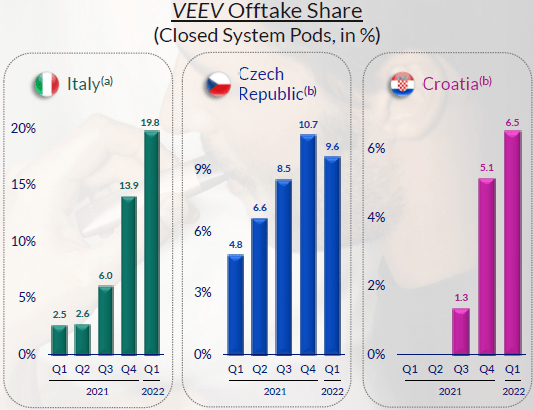

Altria may be able to license an e-vapor product from Philip Morris. Since 2020 PM has launched its new e-vapor product, VEEV, in several non-U.S. markets with good initial results.

|

PM VEEV Offtake Share in Closed System Pods – Selected Markets  Source: PM results presentation (Q1 2022). |

However, VEEV has not yet started its PMTA process (though PM intends to), and PM seems intent to launch VEEV through Swedish Match’s U.S. distribution platform once its acquisition of the latter closes in Q4 2022.

Altria can potentially expand its efforts in selling IQOS in the U.S., though this will not directly address the e-vapor market. As of Q1 2021, the last quarter when IQOS was on sale in the U.S., it had a share of approx. 1% in selected stores in Atlanta and Charlotte – a derisory result which we attribute to poor motivation. The long-term future of Altria’s IQOS license is also in doubt, as the current license runs out in 2024, and the two companies are in disagreement on whether Altria has met the conditions to extend it to 2029.

Closer collaboration with Philip Morris is not impossible, but will likely prove expensive for Altria shareholders.

Altria can potentially expand its efforts in selling On! nicotine pouches, but this also will not directly address the e-vapor market. Nicotine pouches’ ability to convert large numbers of cigarette smokers is unproven, and On! remains a distant #2 behind Swedish Match’s ZYN.

Altria has few good options in Reduced Risk Products. This is, however, immaterial to the Altria investment case provided the U.S. cigarette market remains stable.

Altria Dividend Yield and Valuation

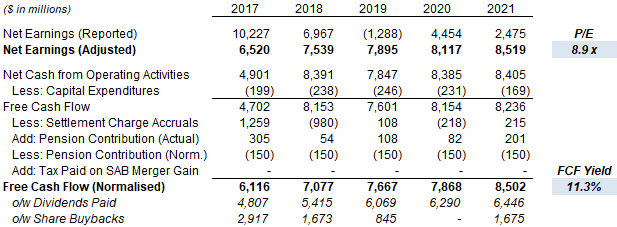

At $41.50, Altria shares are trading at an 8.9x P/E and an 11.3% Free Cash Flow (“FCF”) Yield (normalized), relative to 2021 financials:

|

Altria Valuation & Cashflows (2017-21)  Source: Altria company filings. |

Relative to the midpoint of the reaffirmed 2022 EPS guidance ($4.79-4.93), Altria’s P/E multiple is 8.5x.

The Dividend Yield is 8.7%, with Altria stock currently paying a dividend of $0.90 per quarter ($3.60 annualized). Altria targets an 80% Payout Ratio, and the dividend was raised 4.7% in August 2021.

Altria’s minority stakes in Anheuser-Busch InBev, Juul and Cronos are currently worth a combined $11.2bn, or 12% of its market capitalization. Management reiterated that BUD is a financial investment, and we expect this to be sold eventually to facilitate more buybacks and dividends.

The current buyback program has $1.2bn remaining after Q1 2022, equivalent to 1.2% of the current market capitalization, and is expected to be executed by 2022 year-end.

Altria Stock Forecasts

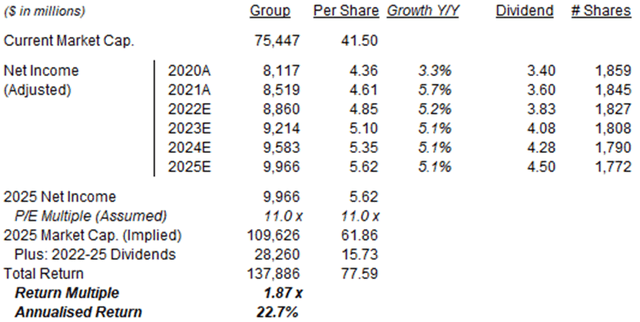

We reduce our exit P/E by 1.0x to reflect higher strategic uncertainty, but keep other assumptions in our forecasts unchanged:

- Net Income growth of 4% annually

- Share count to fall by 1% annually

- Dividend Payout to be 79% in 2022, and 80% thereafter

- P/E at 11.0x at 2025 year-end (was 12.0x), implying a 6.9% Dividend Yield

Our 2025 EPS forecast is unchanged at $5.62:

|

Illustrative Altria Return Forecasts  Source: Librarian Capital estimates. |

With shares at $41.50, we expect an exit price of $62 and a total return of 87% (22.7% annualized) by 2025 year-end.

Is Altria Stock A Buy? Conclusion

Altria shares fell 9.2% after reports of an upcoming FDA ban on Juul products, and now have an 8.9x P/E and a 8.7% Dividend Yield.

We believe investors over-reacted. Any FDA ban may not be final, and some announced bans have already been overturned or stayed.

Altria may actually stand to gain, as Juul’s growth has been dilutive to its earnings, and other e-vapor companies may also face bans.

E-vapor has had only a limited impact on U.S cigarette volumes in recent years. Our base case is U.S. cigarette volumes will remain stable.

With shares at $41.50, we expect an exit price of $62 and a total return of 87% (22.7% annualized) by 2025 year-end.

We reiterate our Buy rating on Altria Group Inc.

Be the first to comment