Wasan Tita/iStock via Getty Images

Performance

As reported by our fund administrator, the Master Account, in which I am personally invested alongside SMA clients, returned -14.7% net in Q2 2022 vs -16.1% for the S&P500. As of June 30, 2022, the top ten positions comprised approximately 69% of the portfolio, and the portfolio held approximately 3.50% in cash.

|

ACML |

S&P500 TR |

|

|

2019 |

18.9% |

31.5% |

|

2020 |

4.6% |

18.4% |

|

2021 |

13.9% |

28.7% |

|

2022 YTD |

-26.2% |

-20.0% |

ACML performance is net of fees and standard costs.

Know the game you’re playing

As I write this letter in July, we have a muddied economic outlook. On the negative side, high inflation, interest rate hikes, and ongoing geopolitical and supply chain issues could tip the US into a recession. All these factors are likely to weigh on markets further. High inflation could persist, changing consumer spending patterns and pushing the Fed to raise rates aggressively, triggering a “hard landing” by slowing growth too much.

On the more optimistic side, corporate earnings overall have remained strong so far, and the job market still seems healthy, with high home values and savings bolstering the consumer. In addition, slowing inflation could moderate interest rate hikes and relieve consumer pressure.

With the threat of increasing rates, investors have renewed their focus on profits. Alphabet (GOOG, GOOGL), for example, recently notified employees that there would be a significant reduction in new hires, except for critical engineering roles. Likewise, Uber (UBER) has asked its employees to prepare for more challenging times and notes that investors are no longer satisfied with companies burning cash in the pursuit of huge addressable end markets. While this is not surprising in retrospect, trying to time these sentiment shifts adds a further level of complexity.

Especially in times like this, I believe it is critical to know the game we, as investors, are playing.

In the book “What I Learned Losing a Million Dollars,” author Brendan Moynihan explains the differences between investing, speculating, betting, and gambling.

- Investing is parting with capital in the expectation of safety of principal and an adequate return on capital.

- Speculating in its simplest form is buying for resale.

- Betting is about being right or wrong. It is an agreement between two parties where the party proved wrong about the outcome of an uncertain event will forfeit a stipulated thing or sum to the other party. For example, people bet on the result of an election or a football game.

- Gambling is a derivative of betting, it is actually a form of entertainment. To gamble is to wager money on the outcome of a game, contest, or event or to play a game of chance for money or other stakes. Gambling usually involves a game or event of chance.

At Alphyn Capital, the vast majority of our activity is firmly in the investing camp, where we invest in an evergreen portfolio of high-quality companies that can succeed over the long term, with an “expectation of safety of principal and an adequate return on capital.” We limit our “speculating” to only 10% of our portfolio where I like the risk-reward, and hope to benefit from a material appreciation in price, but do not expect to hold positions indefinitely.

We try to be far removed from fads or the recent shenanigans in the market, brought upon by near low-interest rates and nearly “free money,” which could well be classified as gambling (e.g. short squeezes on AMC’S stock, NFTs, unrealistic valuations of growth companies).

We also try not to fall into the trap of “betting,” as this can be a dangerous approach for investors. I try not to take a position on a discrete event, such as interest rates or quarterly earnings, as the odds of getting these right are too low, and the costs of getting these wrong are too high. There is a broader nuance to this as well. An investor’s job is to compound capital rather than be right; in other words, to correct mistakes as soon as they become apparent, without embarrassment or ego.

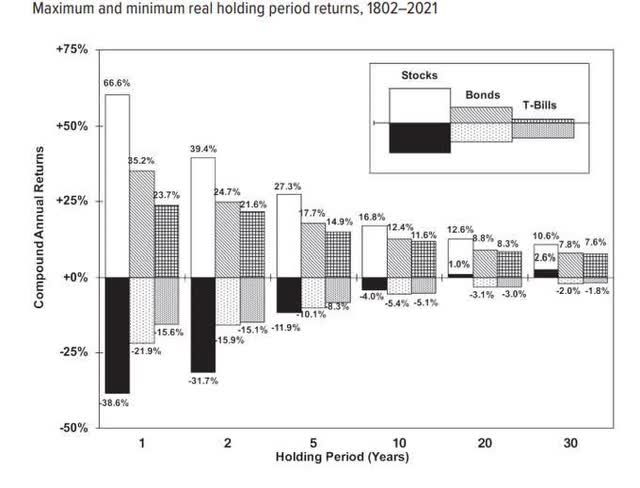

Various versions of the following chart have been doing the rounds on social media. It shows that while, in the short term, the range of potential outcomes in the US markets has historically been wide (the usual disclaimers that the past does not guarantee the future), holding for long periods has radically narrowed and improved the range of outcomes.

Of course, the chart presents a simplified picture, and does not account for significant volatility in intermediate years and the difficulty in enduring it for 20-30 year periods. But the message ties nicely with our strategy of holding a range of high-quality companies that positions us to tax-efficiently compound our capital.

Portfolio – top and bottom performers1

Top Performers |

Contribution |

Bottom Performers |

Contribution |

|

|

Cash |

1.70% |

Exor NV (OTCPK:EXXRF) |

-2.75% |

|

|

Naspers LTD (OTCPK:NPSNY) |

1.39% |

Enovis Corp (ENOV) |

-2.44% |

|

|

Burford Capital LTD (BUR) |

0.49% |

Vaneck Gold Miners (GDX) |

-1.86% |

|

|

Prosus NV (OTCPK:PROSY) |

0.48% |

Wayfair Inc. (W) |

-1.72% |

|

|

Crossroads Impact Corp (OTCQX:CRSS) |

0.01% |

Amazon.com (AMZN) |

-1.72% |

As calculated in the Master Account brokerage statement.

Naspers / Prosus

On June 27, Prosus announced a significant change to its capital allocation strategy. The company will start an open-ended program to sell Tencent shares and use the proceeds to buy back Prosus shares, for as long as the NAV discount remains at “elevated levels.”

The board and management have recognized that the ROI from buying back deeply discounted Prosus shares far exceeds that of investing in its portfolio of fast-growing yet loss-making tech companies, especially in the current environment. With approximately 50% of the CEO and CFO’s remuneration now coming from Short Term Incentive options directly tied to the discount, it is clear where their focus now lies. On the earnings call, management hinted further actions would follow to simplify the company structure and improve NAV per share.

Importantly, because Prosus is selling Tencent shares at full market value and buying Prosus shares at deeply discounted prices, the value of Tencent per remaining Prosus share increases, and so Prosus will continue to benefit from a strategic connection to Tencent and attractive dividends to fund operations.

There has not been much change in the fundamentals of the business. Most of the private businesses continue their strong revenue growth (ranging from 45% to 93% per annum), and several divisions have a clear line of sight to profitability in a few years. Moreover, in a more difficult funding environment, they should benefit more than many of their competitors from having the cash and resources of parent company Prosus. With management sharpening its focus on capital allocation, the perception from investors has changed, which has begun to unlock value that has been hiding in plain sight (the discount).

Burford Capital

The most significant event affecting Burford will be the outcome of its YPF case against Argentina. Should Burford win, it could receive net proceeds between $1.1bn and $5.6bn. These numbers are derived from a formula written in YPF’s prospectus and bylaws and depend on several assumptions, hence the wide range, but in any case, are significant when compared to Burford’s current market capitalization of approximately $3bn.

In a recent lengthy interview, an Argentinian legal expert concluded that based on what we know, the case should be a home run for Burford, but “we don’t know 70% of what is said, we don’t know the private documents, we don’t know the private positions. We don’t know lots of things. Experts have testified in both sides; we don’t know what’s there.” 2 Hardly conclusive.

Nevertheless, I believe Burford remains an attractive investment regardless of the outcome of this one case. To understand why it is helpful to consider how Burford’s litigation finance works. Each case Buford funds has one of three outcomes, a win, a loss, or a settlement. A loss typically results in Buford losing its entire investment. Which has, historically, occurred 10% of the time. Given this risk, Buford actively assesses a case’s merits and potential return. A high payout on wins, typically 5x, increases the expected payout of the whole portfolio.

In this way, litigation financing somewhat resembles venture capital investing, where VCs expect only a handful of big wins to make up for lost investments and still provide a reasonable return on the overall portfolio.

A key difference to venture capital is that most litigations defendants decide to negotiate a settlement rather than risk hefty penalties at the hands of a judge and jury. Moreover, the legal system ensures an eventual resolution to every matter, and Burford’s cases generally have resolved in 2-3 years. As a result, Burford’s portfolio generates a fairly reliable, though irregularly timed, stream of profits over time. Ex-YPF Burford has produced mid-20% IRRs on matters that have concluded.

Based on existing cases alone, ex-YPF, Burford projects it could generate over $3.2bn in realizations. Furthermore, suppose we assume Burford operates in run-off mode, where it incurs operating costs until it concludes all outstanding matters in, say, five years. In that case, it could generate cumulatively $8 per share in pre-tax profit, compared to a share price of approximately $10. In other words, even in an unrealistically negative case, we should get 80% of our investment back in 5 years.

Of course, as the biggest litigation funder with a strong brand in the market, Burford is in a commanding position to win more business, so I expect it to do better than this in practice.

If Burford wins the YPF case, our investment will be a home run. If it loses, I fully expect mid-term volatility in the share price. Still, I expect that as its cases come to resolution and generate profits, the share price will continue to compound.

Crossroads Impact Corp.

The company’s PPP operations from last year are winding down as loans are forgiven, with a $1.5bn loan balance remaining out of an initial $6.3bn. What remains is the company’s traditional mortgage lending business, and an expanding small business loans book.

Crossroads $133 million loan book has continued to perform steadily, with under 1% in delinquencies and a net interest margin of approximately 5%. The company credits its performance to its deep connections in the community, manual underwriting process with conservative debt-to-income ratios, and focus on underserved first-time borrowers who “have shown the financial discipline to operate without debt.”

The company has been moving forward with its plans to expand its book of business from a single-family mortgage lending institution in Texas to a broader lender focused on serving minority individuals and small businesses through environmental and responsible social lending. To that end, it acquired an asset lending firm and a non-bank direct lender. It also signed a $250m agreement with Enhanced Capital, a subsidiary of P10 Holdings (PX, a related company that shares a chair and several shareholders with Crossroads).

Shortly after year-end, Crossroads announced a $180m equity injection from P10, with the option to add a further $350m, and a $150m debt facility led by Texas Capital Bank (TCBI). Crossroads has deployed $70m so far in 2022 and expects its loan book to approach $500 million. It is too early to judge results, but we know that Crossroads is targeting “in excess of 20% return on equity.”

Exor NV

At its investor day meeting in November of 2021, Exor announced an investment focus on three sectors, Healthcare “non-cyclical with structural tailwinds,” Luxury, “a highly resilient sector with demographic tailwinds,” and Technology “under-represented in our portfolio and has substantial growth potential.” It is encouraging to see Exor has made its first significant investments in the healthcare space. €67 million to purchase 45% of Lifenet Healthcare, which manages hospitals and outpatient clinics in Italy, and €833 million for 10% of Institut Mérieux, a large family-controlled healthcare holding company with substantial public and private operations in diagnostics, food safety, contract research, and immunotherapies.

I expect to see Exor continue to diversify its exposure away from cyclical vehicle manufacturing order time.

Exor will soon have €9 billion of cash to deploy from the sale of PartnerRe (OTCPK:PTNPF, this actually closed soon after quarter end), just as valuations have come down. In fact, the longer we remain in a drawdown or recession, the better the opportunities Exor will have to make attractive investments. Moreover industry heavyweights Ajay Banga, formerly CEO of Mastercard (MA), and Axel Dumas, CEO of Hermès International (OTCPK:HESAY) have joined as Chair and board member, respectively. Exor appears to be the beneficiary of both good timing, and good counsel.

Enovis Corp

The headline drop in Enovis shares is mainly a result of its successful spin-out of 90% of ESAB shares to shareholders on April 4. Adding back ESAB, the companies’ combined value has, in fact, held up well. After the spin, Enovis announced its CFO Chris Hix would retire. While Mr. Hix was a generalist, and a Colfax and Danaher veteran, his replacement, Ben Berry, had an 18-year career in the medical technologies sector with Alcon, a sizeable Swiss eyecare company. So far, Enovis has navigated its transition to a pure-play med-tech business well and is growing ahead of its market while expanding margins as promised.

Gold Miners

Inflation, rates, and monetary debasement are still top of mind for investors. I recognize the immense importance of these factors while also acknowledging the difficulty in trying to predict any of them. If the Fed, with its army of analysts and economists, admits “we still have much to learn about inflation,” what hope do the rest of us have of making accurate predictions? I’ll defer to Mr. Buffett when he says, “if you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker but not your partner.”

As my investors know, my strategy in this seemingly unwinnable scenario is to have an allocation to gold as some protection against “monetary disorder” or a loss of faith in the Fed’s ability to stabilize markets.

While the price of gold was roughly flat for the first half of the year, gold miners have declined approximately 20% and are significantly undervalued relative to the price of the metal. With a gold price of approximately $1,800 an ounce, and all-in sustaining costs for the miners of approximately $1,100, the miners are currently making an impressive $700 in profit per ounce of gold they sell. If the market is indeed a “weighing machine” over the longer term, I expect this favorable situation eventually to be reflected in the gold miners’ share prices.

Wayfair

With the benefit of hindsight, it is clear that the timing of my investment in Wayfair left something to be desired. I had underestimated the degree to which going from a “covid beneficiary” to a post-covid would hurt the share price. As the market frequently does, it extrapolates recent performance too far. When things are going well, positive momentum hits the stock; when the environment is more challenging, companies can be priced as if they are imminently going out of business. At times like this, it is good to re-assess a position to decide if the issues are likely transient or fundamental.

Wayfair has compounded revenue at over 30% per year to a substantial $14bn. However, as with many fast growth tech companies, it did not turn a profit, except in 2020 when Wayfair generated approximately $900m operating profit. (I deduct stock compensation and depreciation from their reported EBITDA numbers, as these are real expenses to my mind). I believe this shows the company can and will be profitable. Unlike many of its tech peers, Wayfair was never valued at obscene sales multiples, reaching a modest 2.6x revenues at its maximum.

At today’s approximate $6bn market capitalization, we do not need any heroic assumptions of future profitability to drive a good return. Management has always had a very long-term focus, investing well ahead of the company’s size to prepare it to take a share of the online furniture retail market. Some of these investments, such as its supply chain logistics, which is especially suited for bulky furniture items, have served the company well and positioned it to continue competing effectively in the future.

On the other hand, it has been too aggressive with hiring its technology staff, many of whom work on projects that won’t impact the company for several years to come, which has inflated operating costs. This isn’t the first time Wayfair has over-hired. Nevertheless, I am pleased that management, most likely due to shareholder pressure, noted the need to “balance our long-term focus on the massive market opportunity and the shorter-term realities of the environment in which we are operating.” I will be looking for evidence of better operational controls over the next few quarters.

Amazon

It is interesting to see how sentiment on Amazon went from positive to negative in one quarter, as it transpired that it too was not as immune to post-covid slowdowns as some, myself included, had expected. However, I feel confident that Amazon, as the apex predator in the e-commerce space, will navigate market softness better than most other retailers. Moreover, once it finishes with its current capex cycle, it will continue to improve margins.

Andy Jassy is reportedly spending one-third of his time focused on capacity and supply issues in the retail division.[3]

In any case, most of the value of the business resides in the AWS and advertising divisions, which are high-growth, highly profitable businesses operating in large markets. In the event the company is forced to break up by regulators, AWS and the advertising business would be more valuable than the current $1.1T market capitalization of the entire company. This would imply the retail business has a negative value, which is not likely true. We took advantage of the share price weakness to purchase more shares.

The price may decline more in the interim, it is impossible to perfectly time purchases to the exact low. Still, I believe in time, we will reflect happily on the opportunity we had to purchase more of this wonderful company at good prices.

Portfolio – other changes

This quarter we added to Amazon and exited our investment in Countryside Properties (OTC:CUSPY).

Countryside Properties – exit

I exited our investment in Countryside Properties. The original thesis was that activists had led the company to divest its slower-growth Homebuilding division, leaving behind a capital-light Partnerships business. The combination of a simplified, higher-quality business, a new chairman with a credible track record of operating excellence, and a plan for significant share buybacks from the proceeds of the divestment, seemed like a good setup. However, I became disappointed with the lack of execution, particularly with two critical points in the company’s latest trading statement.

First, the company continued to experience “significant operational challenges” in its Northern division. This was a surprise as management had assured investors at the company’s investor day last year that they had addressed these issues. Second, perhaps more importantly, management admitted that the company’s expansion into new regions had been too ambitious, its growth expectations too optimistic, and it now had excess manufacturing capacity.

After our exit, yet another activist investor made a lowball offer for the shares, and a few weeks later, the Chairman abruptly resigned. While I feel validated in my decision to exit, I wish I had come to this decision sooner.

Samer Hakoura, Alphyn Capital Management, LLC

Footnotes

1 There is no assurance that any of the securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. See “Disclaimers” at the end for more details.

2 Transcript from www.inpractise.com

3 Amazon CEO Andy Jassy’s First Year on the Job: Undoing Bezos-Led Overexpansion

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment