Florent Molinier

Article Thesis

The FAANG stocks have been major backbones of the stock market in recent years, thanks to their very large market capitalizations. They aren’t equal, however. In this article, we’ll compare Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) and Apple (NASDAQ:AAPL) to see which company is the better choice at current prices.

Performance Differential Is Noteworthy

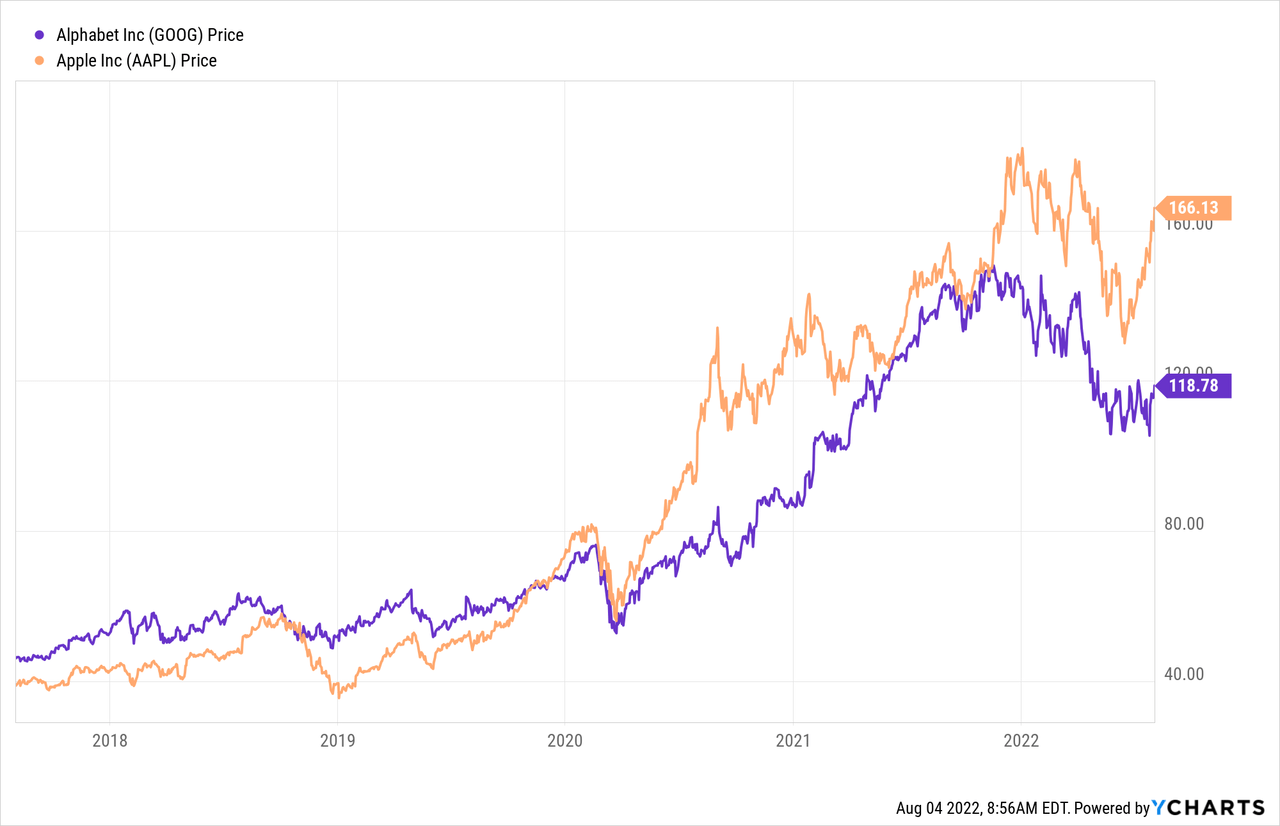

Both Apple and Alphabet are leaders in their respective spaces, and both are fundamentally strong and healthy companies. Their share price performance has differed, however. Apple, which is the slower-growth company among these two, has actually outperformed Alphabet over the last couple of years, as can be seen in the following chart:

It is noteworthy that this performance difference has widened in recent weeks — Alphabet is still trading close to its 52-week low, while Apple has rebounded in a big way, and is now trading less than 10% off its 52-week high, whereas GOOG trades more than 20% below last year’s highs. It thus looks like history could be indicating that it’s a good time to buy Alphabet as it has not rallied off recent lows yet, whereas Apple has already become way more expensive again.

Alphabet Versus Apple: Recession Resilience And Cyclicality

Since economic concerns are mounting and since the US has technically entered a recession due to two consecutive quarters of negative GDP growth, let’s first look at the recession resilience and cyclicality of these two companies.

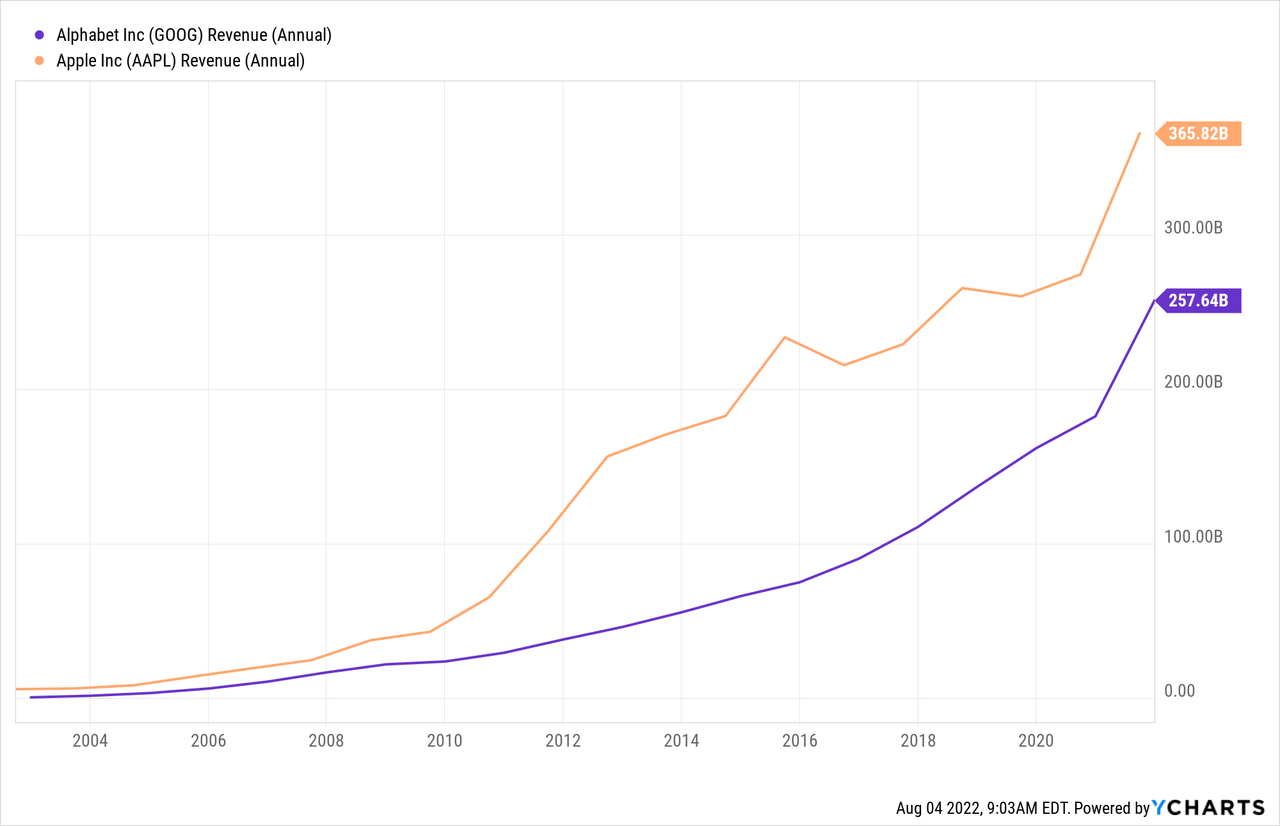

We see that both companies have generated massive business growth over the last 20 years. Apple has been a strong compounder, but Alphabet performed even better when it comes to generating reliable growth. Its revenues never declined on an annual basis during any year, no matter what type of macro crisis we have seen. Apple, on the other hand, has seen several down years in that time frame. It always managed to get back to new highs eventually, but it has not grown as consistently as Alphabet has.

That isn’t too surprising, as Apple’s business model is more cyclical. Most of its revenues are generated from hardware sales, whereas Alphabet makes most of its money via services. During a recession, cash-strapped consumers will keep their old phones a little longer or may opt to buy a value-oriented tablet instead of a premium one. But there isn’t really any good reason for consumers to watch less YouTube, or not use Google’s Search function during a recession. In theory, advertisers may cut their spending on Alphabet’s platforms, but historic patterns indicate that this isn’t a concern — after all, the company has managed to do just fine in any environment.

Apple’s business model is more cyclical due to an additional reason: Its hardware releases aren’t equally attractive all the time, which is why some models will have higher sales numbers compared to others. Some ups and downs in revenues are to be expected for Apple in the future, too. Alphabet, by comparison, has delivered ultra-consistent and high growth at the same time, in any macro environment — recession, pandemic, times of high inflation, and so on.

We see this pattern in the current year as well. During the most recent quarter, Apple managed to generate growth of just 2%, which represents a steep decline versus the last couple of quarters before that. Alphabet, on the other hand, still grew its revenue by 13% during the period. That’s below its longer-term average, but still easily in the double-digits and also ahead of the rate of inflation — which is not the case for Apple. We don’t know yet what the current quarter will look like, but there are some indications that a deteriorating macro environment could hurt the sales performance of Apple further. In China, one of the most important markets for Apple, the company is offering discounts on its phones due to high inventories — Apple rarely does that. Discounts point to ASP pressure, and high inventories might indicate that demand is weaker than previously thought. Apple may very well manage to avoid a revenue decline in the second half of the year, but I do believe that the likelihood of a negative top line print is significantly higher for Apple, compared to Alphabet, due to the reasons mentioned above.

Alphabet Versus Apple: Growth Outlook

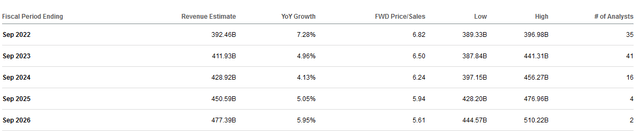

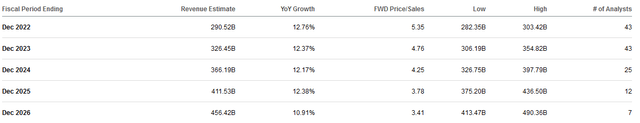

With Apple being the more cyclical company, does it outperform growth-wise? Unfortunately, the answer is no. Alphabet has generated more business growth in recent years, and the same will likely hold true in the future, too:

Apple is forecasted to grow its revenue by 4% to 7% a year through 2026. That’s far from a disaster, but it isn’t really outstanding, either. Meanwhile, Alphabet is forecasted to grow at more than twice Apple’s growth rate over the same time frame:

If Wall Street is correct, Alphabet will not have a single single-digit growth year through 2026, meaning its worst year would still be significantly better than Apple’s best year in that time frame.

Looking at the business models, that’s not too surprising. Apple primarily sells hardware. Those with phones will continue to replace them regularly, but that doesn’t make for a growth market. If Apple sells a new iPhone to every iPhone user every couple of years, its volumes stay roughly the same. Revenue growth then rests on price increases, but those aren’t sufficient to drive double-digit growth. Apple’s Services business performs better and has a better growth outlook, but it is way smaller than the hardware business in absolute size, which is why its better growth rate can’t lift up the company-wide performance too much.

Alphabet isn’t limited by its hardware business, as it mostly generates revenue via software and services. Here, like with Apple’s Services business, the growth rate is better. Consumers will in most cases not buy a second phone, but they are spending more time on their phones, watching more videos, and so on. Apple benefits from that trend in its Services business, but not too much on a company-wide base. Alphabet, however, benefits from that trend with most of its business units, which is why its longer-term growth outlook for the core business is better. Alphabet also has exposure to additional high-growth themes, such as cloud computing, where a high market growth rate results in plenty of growth opportunities for Google Cloud.

Investors care for earnings per share growth on top of revenue growth, of course. Both companies have high margins already, and I do not believe that those will expand massively. But since gross margins are higher at Alphabet (due to a better software/hardware mix), operating leverage might be more impactful at Alphabet, so I’d give GOOG a small advantage in the margin-growth-potential space. Earnings per share can also be grown via buybacks, of course. Apple is famous for its buybacks, and those truly were very impactful in the past. More recently, however, Apple’s buyback pace has slowed down dramatically. Apple’s share count has declined by just 2% over the last year, according to YCharts, which is well below the historic 4%-5% annual reduction range. Due to Apple’s high valuation, its buybacks have become way less efficient — keeping a hefty buyback pace is easier when shares are trading at 15x net profit instead of 27x net profit.

Alphabet has historically not been much of a buyback machine, but that seems to be changing. Its valuation has declined, and its cash position has grown. In fact, Alphabet’s net cash position is larger than that of Apple, both in absolute terms and relative to their respective market capitalizations. That allows Alphabet to accelerate its buyback pace, and the company has done so by introducing a $70 billion buyback program this year — which is equal to around 5% of the company’s market capitalization.

All in all, Alphabet thus seems to be positioned to deliver stronger growth than Apple, both on a company-wide basis and when it comes to the two companies’ earnings per share, which are most important for long-term share price growth.

Alphabet Versus Apple: Valuation

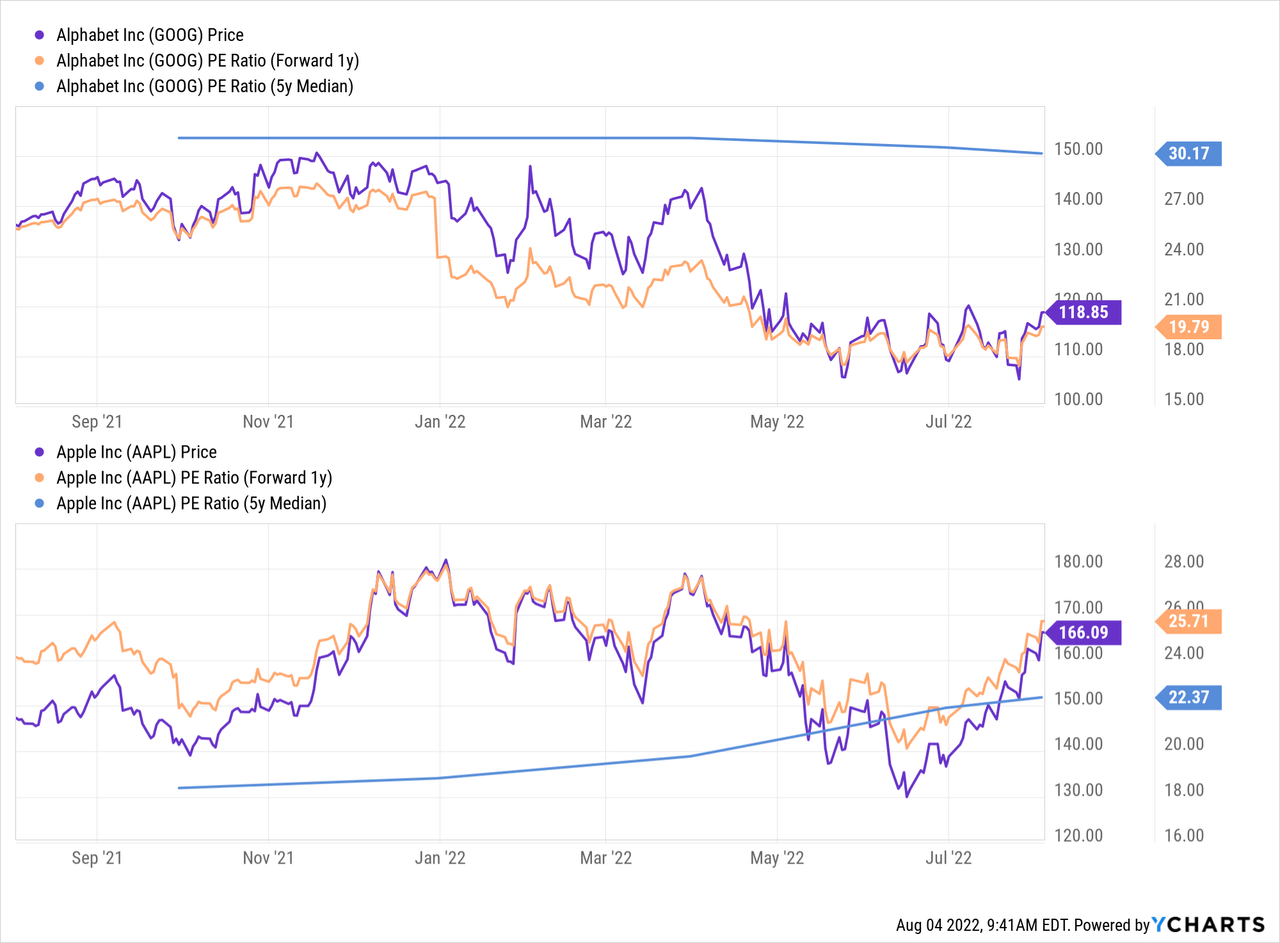

I do believe that Alphabet is the more resilient, less cyclical company, and that it is better positioned for longer-term growth. Surprisingly, it trades at a discount compared to Apple:

Alphabet is trading at a 2023 earnings multiple that is 23% lower than Apple’s 2023 earnings multiple. Even more telling, Alphabet trades at a clear discount compared to its own valuation in the past, at around 30%, whereas Apple trades at a 15% premium compared to how Apple was valued in the past.

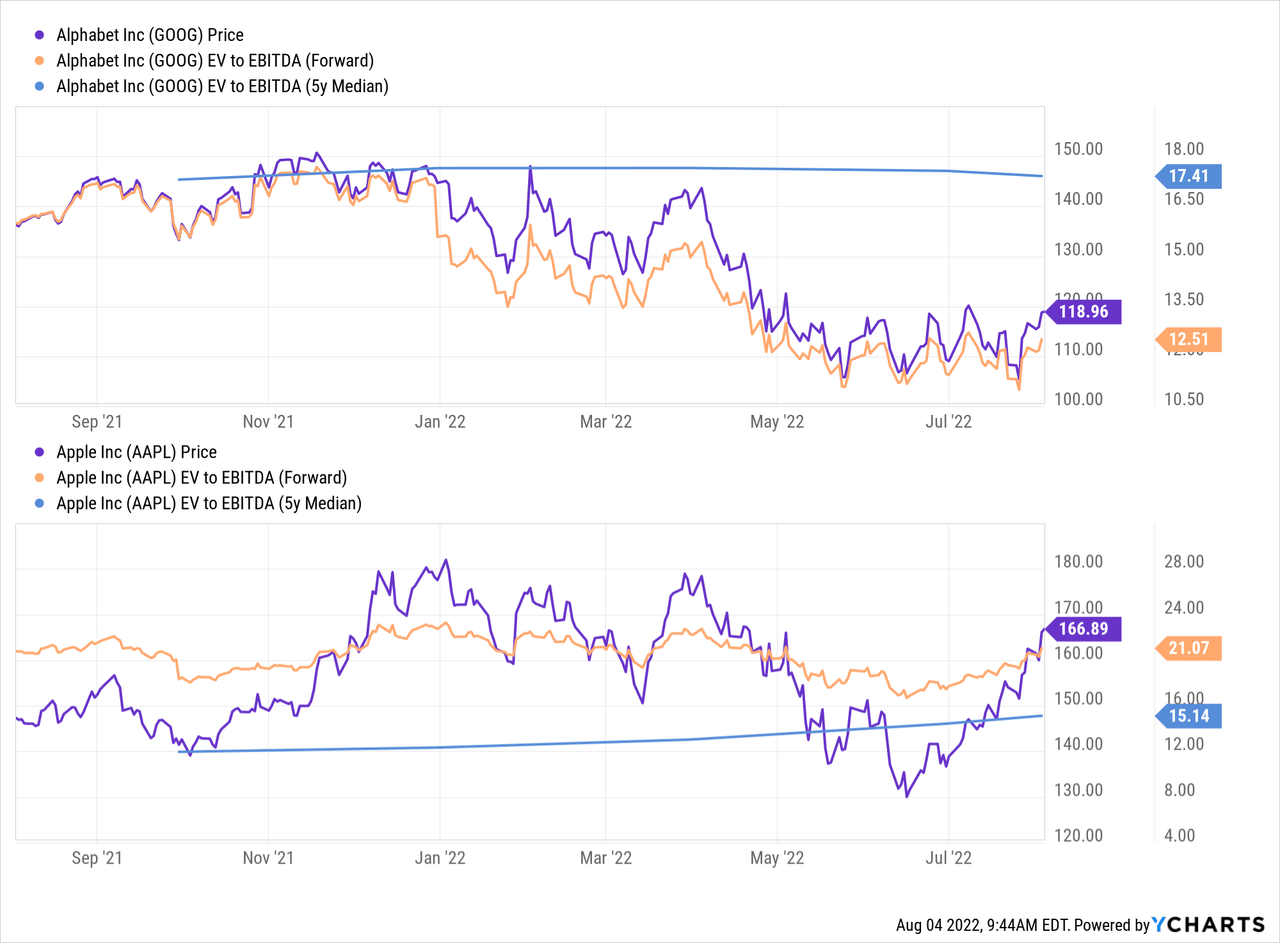

Both on a company-to-company basis, as well as when we look at historic valuation norms, Alphabet is cheap and Apple is expensive. The same holds true when we look at EV/EBITDA instead of earnings per share, which accounts for differences in debt usage:

Alphabet trades at a way lower EV/EBITDA ratio today, despite being the higher-growth company. It actually could see its enterprise value expand by close to 70% if it were to trade at the same 21x EBITDA multiple Apple trades at. Again, GOOG trades at a meaningful discount of 30% compared to how the company was valued in the past, whereas Apple trades at a 40% premium compared to its own historic valuation average. From a valuation perspective, the winner is Alphabet, I believe.

Takeaway

The FAANG stocks have been strong investments in the past, and both GOOG and AAPL have delivered compelling returns over the years. But I do believe that they aren’t equally good investments today. Instead, I do believe that Alphabet is a superior choice among these two FAANG picks. Not only is Alphabet growing faster during the current recession, but it has also historically performed better during crises. Its long-term growth outlook is better, and yet, it trades at a lower valuation. By its own standards/historic valuation norm, Alphabet is cheap today, whereas Apple is pricey. Apple is a good company, but growth is slowing down and it’s too expensive for me today. I see Alphabet as a way more attractive pick for now, especially since it hasn’t meaningfully rebounded from the recent sell-off, which means that prices are still attractive.

Be the first to comment