Alphabet (NASDAQ:GOOG) has taken a nosedive along with negative general market sentiment. Since February 19, its share price has dropped from $1,525 to only $1,057, wiping out $327 billion in market value within just one month. While many investors worry that the current virus outbreak might cause Google ad revenue to decline significantly, it is the only short-term issue. From the investment standpoint, we should take advantage of the widespread fear in the market to buy in with the big discount.

COVID-19 has negative impact on global economy, but it is a short-term issue

COVID-19 has become the global pandemic. To prevent the virus from spreading further, countries have to shut their borders and impose travel bans. Almost everybody around the world is required to stay at home. Most of restaurants, cafes, schools and factories are closed. Most of the global economic activities are on hold. However, do not be pessimistic. Bill Gates has said that if a country shut down, and do the good job as testing, basically within 6-10 weeks it can open back up. With the current advanced technology, we can scale up testing, vaccines and drugs faster than ever. That is why, in our view, COVID-19 has serious but short-term impact on our global economy.

As countries close borders, airlines cancel flights, few people travel in this period. Google’s travel ad revenue will definitely take a hit. Laura Martin, Needham & Co analyst, has estimated that Google’s ad revenue, which accounted for around 10% of its total advertising revenue, would decline by $1 billion in the first quarter and $3 billion in the second quarter. That means a $4 billion in ad revenue, or 4% of the total ad revenue will be lost this year. She also thought the virus situation is a short-term issue, and the travel advertising will be back to normal by the second half 2020.

Beside the core search engine business, Alphabet also has many other wonderful businesses including YouTube, Google Cloud, Waymo, X and other investments which can disrupt our future in a meaningful way. Let’s look at each business segment to determine the sum-of-the-parts valuation of Alphabet.

Google Search: $356 billion

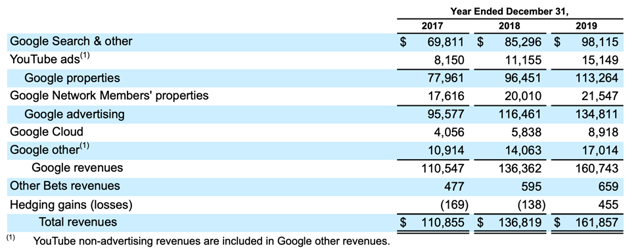

Alphabet’s core business is still search engine. In 2019, Google Search brought in $98.1 billion in revenue, accounting for 60.6% of the total revenue. In addition to Google Search, YouTube ads and Google Network Members’ properties (AdMob, Adsense and Google Ad Manager) generated around $15.15 billion and $21.55 billion, respectively in revenue in 2019.

Source: Alphabet’s 10-K filing

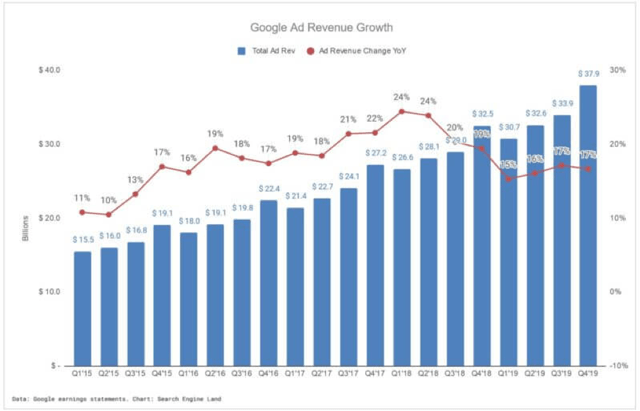

However, Alphabet has been facing the growth slowdown of Google ad revenue in the past two years, driven mainly by Google Search.

Source: Searchengineland.com

In 2019, the year-over-year growth of Google Search ad revenue came in at only 15%. If we assume the growth is slow down further to 10% per year in the next two years. By 2021, its Search ad revenue will reach $118.8 billion. Applying 3x Price-to-Sales (P/S) ratio, Google Search could be valued at around $356 billion.

YouTube advertising: $256 billion

YouTube is one of the Alphabet’s jewels. It has around 2 billion monthly users, accounting for 26% of the world population, and equivalent to 80% of Facebook’s monthly active users. Netflix (NASDAQ:NFLX), a global juggernaut in subscription TV, drawfs YouTube in terms of both watched hours and users. Netflix has only 167.1 million subscribers, equivalent to only 8% of YouTube monthly users. Users spend total 1 billion hours to watch YouTube per day, while Netflix’s subscribers spend the same number of hours within one week.

It is interesting to note that 2019 was the first time Alphabet reveal the financial number for YouTube, distracting investors from the slowdown in the growth of Google search revenue.

YouTube revenue has grown by 35.8% in 2019. If we assume that YouTube ad revenue’s growth is only 30% per year in the next two years, YouTube ad revenue will be $25.6 billion. At the time of writing, Netflix is trading at 7x P/S. And we estimate YouTube should be valued at higher valuation in Netflix. If we apply 10x sales valuation to YouTube, it should be worth $256 billion by 2021.

Source: Alphabet’s 10-K filing

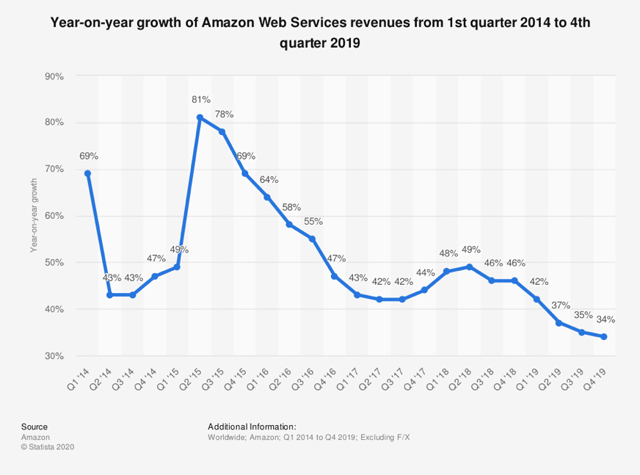

Alphabet’s future high growth can also rely on Google Cloud business. In 2019, it brought in $8.92 billion, a year-over-year growth of 52.7%. Amazon AWS (NASDAQ:AMZN), the similar service, has becoming one of the fastest growing segments in the company.

Source: Statista

At first, Amazon AWS has also posted very high growth in 2014-2015, then its year-over-year growth declined gradually to around 34%-35%. For Google Cloud, we still expect the annual growth of at least 40% in the next two years. That would translate to a $17.5 billion in revenue by 2021. If we also apply a 10x P/S valuation to the high-growth Google Cloud business, it should be worth $175 billion.

Google’s other business: $175 billion

Google’s other business, including YouTube’s non-advertising revenue, including subscription and commerce. YouTube’s subscription and commercial business has a lot of unexploited potential. If YouTube charge its users only $1 per month to watch videos, YouTube can have additional $2 billion in revenue per month, or $24 billion per year in subscription revenue alone in potential revenue. Meanwhile, Google’s other business generated $17 billion in 2019, a 21.2% growth from 2018. If the same growth is achieved in the next two years, Google’s other business revenue can reach $25 billion by 2021. Due to lower growth than YouTube’s advertising revenue, a 7x P/S is applied, making Google’s other business worth $175 billion.

Other bets: $6.6 billion

Other investments which Alphabet invest with the mission disrupt the futures for the better, including Waymo, the autonomous vehicle initiative, Google Glass, Malta, the renewable energy storage systems by using molten salt tanks, etc. It is venture capital investments, meaning some of the companies in this category can be hugely successful, and some might fail, causing Alphabet to lose money on them. Companies which already generate revenue will have higher probability of success. Alphabet categorizes them in “Other bets”, bringing in $659 million in 2019. With a valuation of 10x P/S on this category, those bets would have a valuation of around $6.6 billion.

Putting it all together

Our sum-of-the-parts analysis values Alphabet at around $967 billion. After adjusting nearly $120 billion in cash and $4.55 billion in debt, Alphabet should be worth $1,082 billion, or $1,548 per share, nearly 50% upside from the current trading price.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment