Prykhodov/iStock Editorial via Getty Images

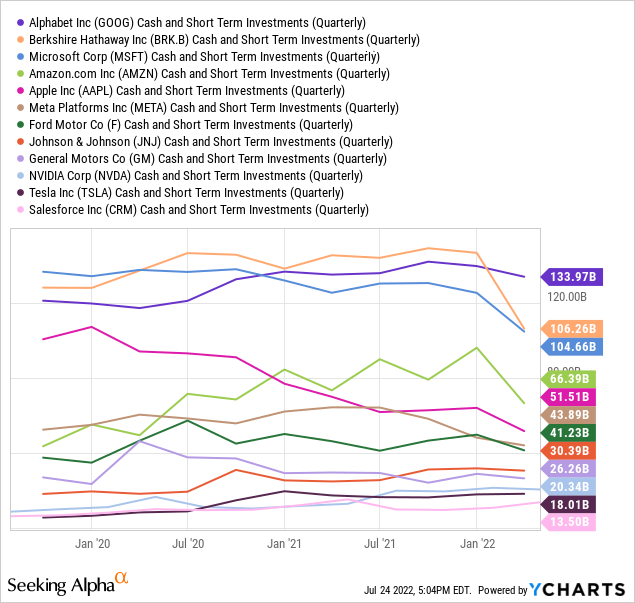

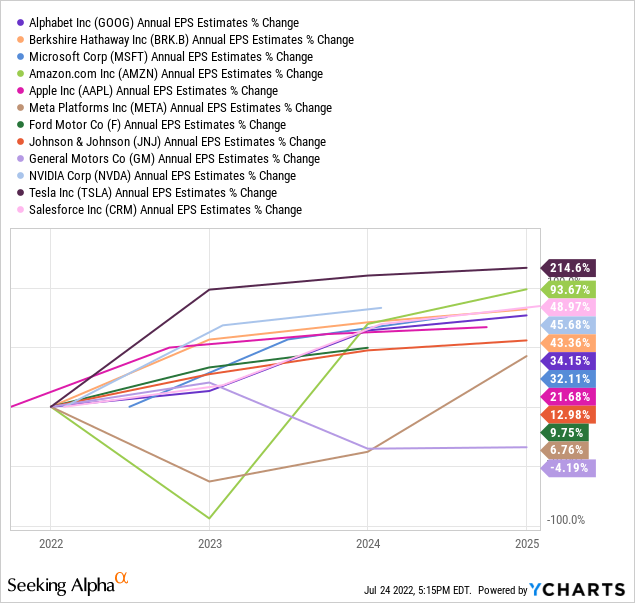

Outside of the traditional banking and insurance sectors, Alphabet/Google (NASDAQ:GOOG) (NASDAQ:GOOGL) today owns the leading cash stash in American business. Its total cash holdings are higher than Berkshire Hathaway (BRK.A) (BRK.B), Microsoft (MSFT), Amazon.com (AMZN), Apple (AAPL), Meta Platforms/Facebook (META), Ford (F), Johnson & Johnson (JNJ), General Motors (GM), NVIDIA (NVDA), Tesla (TSLA), and Salesforce (CRM). Using the latest available quarterly numbers, $134 billion in cash and current short-term investments ($10 per share) is the largest hoard of any publicly-traded U.S. company.

YCharts

In addition, Alphabet has some of the best free cash returns on assets, profit margins on sales, and free cash flow yields available from this group of the biggest cash owners. In my view, if your goal as an intelligent investor is high levels of cash up front, high levels of cash generation in the present, and likely stronger-than-normal growth rates in cash flow thrown off by the business model into the future, GOOG and GOOGL are hands down two of the best risk-adjusted equity choices available today.

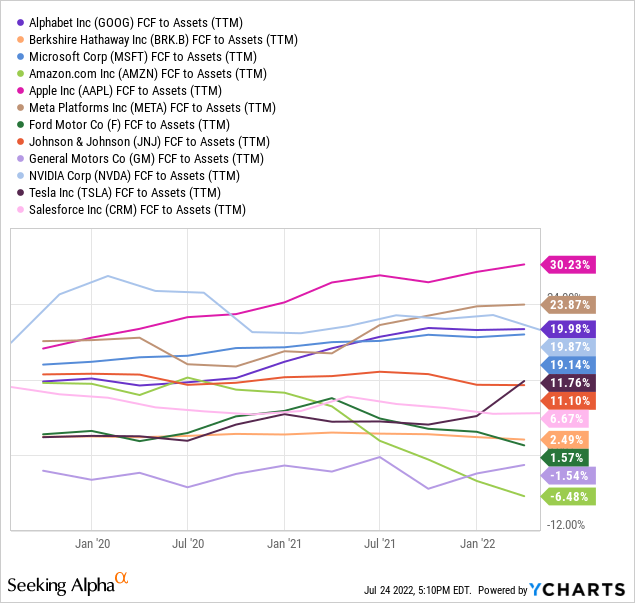

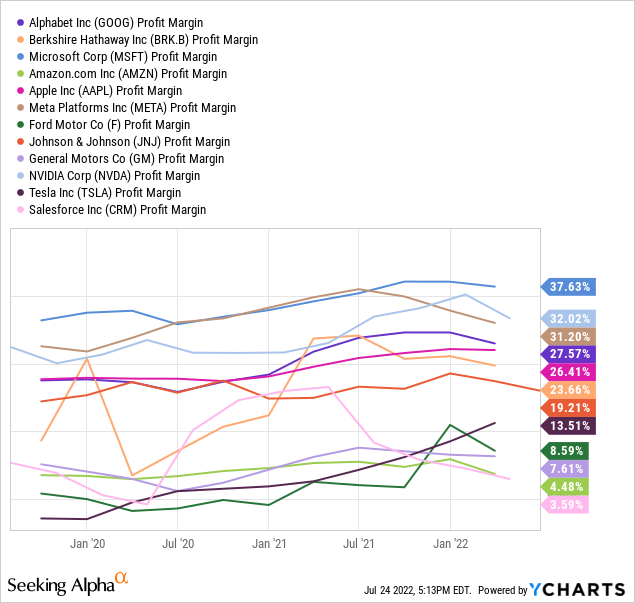

Cash Generation Statistics

Wall Street analysts and smart investors love to review cash generation and free cash flow numbers. What is a business actually putting in your pocket each year, if you owned the whole company, without affecting future growth prospects? In this regard, Alphabet/Google scores as well as any blue chip in the U.S. marketplace, as a function of returns on assets employed and profit margins on sales. Below are charts of free cash flow vs. total assets owned and final, after-tax profit margins by each of the cash-rich peer companies.

YCharts YCharts

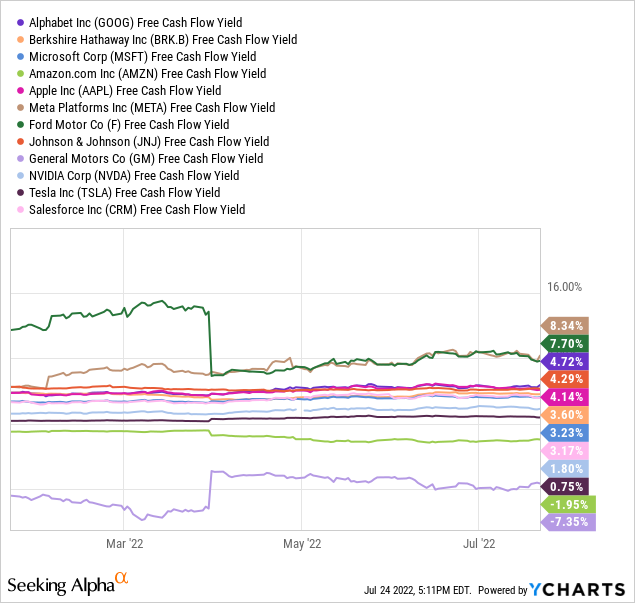

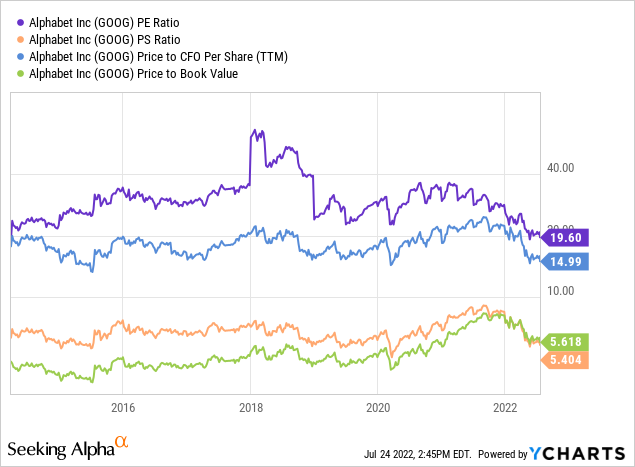

Even better news, readers buying the company under $110 are getting a higher-than-normal 4.7% free cash flow yield on your purchase price. You would expect the opposite from this high-return, high-margin, high-cash ownership business (with fewer total liabilities of $103 billion than cash on hand). Under normal market trading circumstances, Alphabet usually sells for a nice premium valuation vs. peers (lower free cash yield).

YCharts

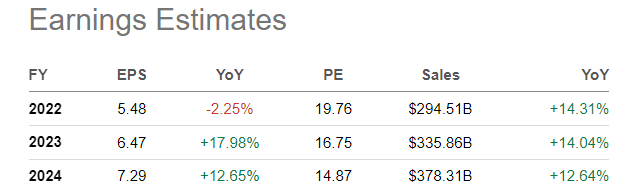

The best news for shareholders is growth estimates remain above average vs. the S&P 500 list of businesses. Below is a table of 2022-24 Wall Street analyst earnings and sales projections.

Seeking Alpha, Analyst Consensus Estimates – GOOG – July 24th, 2022

Compared to the peer group of companies with cash holdings well into the tens of billions each, income growth rates of 15% annually are projected after 2022 (a proxy for cash generation), far better than a majority of alternatives. Over the next 3 years, GOOG/GOOGL income per share is projected to expand faster than even Microsoft and Apple.

YCharts

How cheap is Alphabet vs. past trading? That’s a great question. Measured against historical trading ranges, basic fundamental ratios of price to earnings (19.6x), sales (5.4x), and cash flow (15x) are approaching their lowest readings in 10 years. Price to book value (5.6x) is nearer its decade average.

YCharts

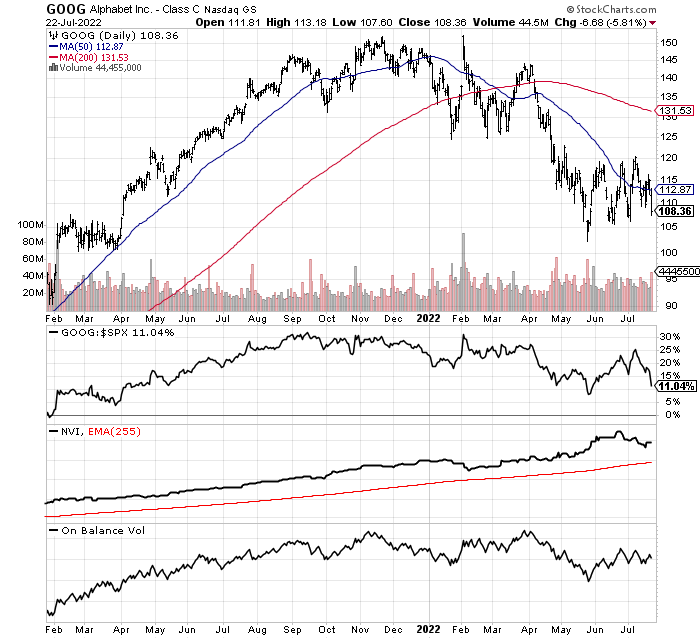

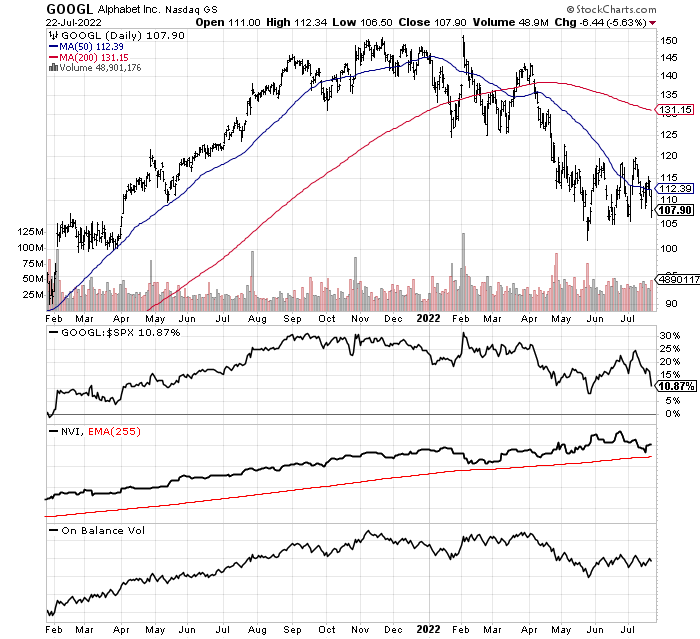

Technical Trading Charts

Despite a -30% price decline in 2022 (from peak to trough), Alphabet has still bested the S&P 500 total return over the last 18 months by about +10%. My summary of the primary volume/price momentum indicators I follow is GOOG/GOOGL have not witnessed outsized selling pressure, like many other Big Tech names.

My two favorite measurements, the Negative Volume Index and On Balance Volume, have actually remained in decent uptrends as price has stair-stepped backwards. My read of the situation is plenty of bullish interest has appeared after large down days (rising NVI trend), while heavy buying volume on up days in price has outpaced the selling on down days (rising OBV trend). I have slightly stronger-than-average momentum scores over the short and intermediate-term for the two classes of Alphabet stock vs. a universe of thousands of equities. This technical trading setup is a tremendous improvement over a long list of Meme and Big Tech names crashing in 2022. The “relative strength” in Alphabet vs. technology peers is quite bullish for future returns, in my experience.

StockCharts.com StockCharts.com

Final Thoughts

I rate Alphabet a Buy around $110 per share. The long-term outlooks for Google Search, Google Cloud, Gmail, Android, Chrome, Nest, Fitbit, and video streaming service YouTube remain quite positive. If its upcoming earnings report for the June Q2 period proves weaker than expected or guidance for the rest of the year disappoints, prices under $100 could be next. Given sub-$100 quotes, I would rate shares a Strong Buy, with an expectation for a sharp reversal higher next year. At a minimum, I expect GOOG and GOOGL to outperform the U.S. equity market, represented by the S&P 500 index, over the next 12-24 months.

What are the risks to an investment in Alphabet? Two possible downside drivers bother me the most. The first revolves around the expanding odds for a deep global recession. While I do not expect a huge drop in earnings under a severe recession scenario, company growth (mostly advertising dollar related) would disappear for a year or two. However, with a steady $5.50 to $6.00 in EPS, I doubt prices would fall below $80 for long in a worst-case scenario (14x income).

The second major risk is governments around the world may get serious about new internet regulations and taxes that negatively affect operations and income levels. The odds are decent such will eventually materialize, in my mind. If regulators decide to break up the company or mandate ranking formulas for ads in Google Search, among other government intervention possibilities, long-term growth rates could slip from 15% annually closer to 10%. Would it be the end of the world for Alphabet shareholders? No, but stock price changes could morph into a market performer realm.

In the end, I find it hard to ignore Alphabet’s value and growth proposition today. If it is able to decline appreciably from here, I would suspect the majority of other equity investment alternatives in America will drop even faster. Looking at exceptional cash holdings, cash returns, and cash margins, few peers are in the same league for ownership consideration. Assuming company growth continues at above-average rates, the current valuation is incredibly cheap, and should be contemplated for purchase by nearly every individual and institutional investor. After this month’s 20-for-1 stock split, a price around $100 is more easily digested and integrated into all types of small portfolio construction efforts.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment