Sezeryadigar/E+ via Getty Images

Investment Thesis

Over the last few months, the broad market has seen increased volatility and price multiple contractions. Increased inflation, monetary tightening, and slower economic growth have led to price multiple contractions. Ally Financial Inc. (NYSE:ALLY) stock price declined by c.13% year to date and in general, the financial sector has been suffering over the last few weeks due to worries around a possible recession. The stock currently trades 25% below its 52-week high. In this article, we argue that this is a good entry point for ALLY and shareholders should expect double-digit returns.

Fundamentals

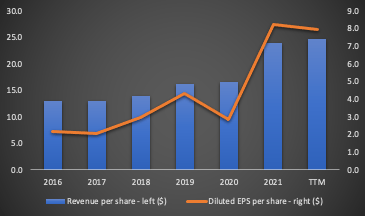

To start with, we will have a look at fundamentals. The company has been growing its revenue per share and diluted earnings per share steadily over the last 5 years, with an acceleration over 2021. Revenue per share and diluted EPS grew by an average of 12.8% and 30.8%. This growth has accelerated since 2020 as EPS grew by 186% between 2022 and 2021 primarily driven by the provision for loan losses as it decreased from $1,400m to $241m between 2020 and 2021.

Own analysis

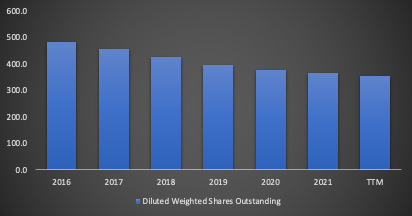

The EPS growth was also driven by the significant share buyback program that management has completed over the last 5 years and is currently on track to purchase an additional $2bn in 2022. Since 2016 management has purchased 33% of the total shares outstanding, and as Q1 2022 results show they are not planning to slow down. At the current market cap of ALLY, the $2bn share buyback is c.14% returned to shareholders via buybacks. A lower stock price means that the buyback will work harder for current shareholders.

Own analysis

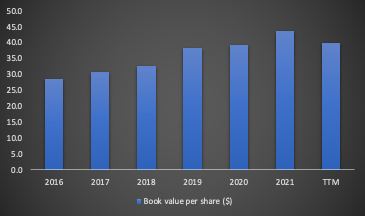

Book value per share increased from $28.52 to $39.99 over the last 5 years, a 40% increase.

Own analysis

Overall, management did a great job over the last 5 years. Looking at the Q1 2022 results there are some highlights that indicate the efficiency of the management which shareholders should pay attention to. Management achieved a high return on common equity and for Q1 2022 this stood at 18%. This is higher than the big 4 US banks (Wells Fargo, Morgan Stanley, JPMorgan Chase and Citigroup) and higher than the median ROE, which is 500bps lower. This is primarily driven by the automotive industry focus, digital nature, continued customer growth and introduction of new product and service offerings.

More recently, they have announced wealth management advisory services, for example, and we expect them to continue to add new services and products. In addition, the retail deposits have over doubled from 1.1m to 2.5m since 2016 and at the same time, the percentage of retail customers that have more than one product with the bank jumped from 2% to 9%. These are some impressive growth numbers and any growth that can be sustained at these levels will yield significant upside for shareholders.

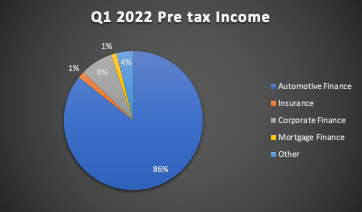

The largest segment of the bank is automotive financing. On a pre-tax income basis, this accounts for 86% as of Q1 2022. As new services are provided we expect this to come down but for now, ALLY’s business is mainly automotive financing.

Own analysis

Hence, car sales will impact ALLY. Firstly, car sales are cyclical in nature. As recessions hit car sales decline and in good times they rise. Car sales have already started to slow down based on May 2022 data as auto sales dropped by 29.9% year on year. But the company held up well.

Secondly, as monetary tightening takes place, the cost of financing a car purchase should go up and hence the demand should pull back. This in combination with the real wages squeeze should be a challenge.

Lastly, we think car prices matter for 2022 and the coming years due to a couple of reasons. Between January 2021 and January used car prices increased by a staggering 40%. Hence, even though demand was high in 2021 we expect demand to remain high over the coming years due to a price anchoring effect. Sky-high prices in 2021 will seem cheap if prices come down slightly. This in addition to new regulations coming into effect regarding the electrification of the industry is likely to hold demand up over the coming years. Biden announced that by 2030 the goal is for 50% of the car sales to be electric cars. The new norm with additional incentives to buy electric cars to achieve these goals will likely keep demand for automotive financing high over the coming years.

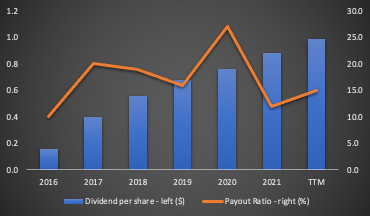

Dividend and Relative Valuation

ALLY’s dividend increased 375% since 2016, from $0.08 to $0.30 per share per quarter. In addition, the most recent dividend increase reflected an increase of 58% year-on-year and shareholders should receive $0.3 per share for Q2, a forward annual dividend yield of 2.8%. This growth also came with the payout ratio remaining as low as 15% which suggests that management has plenty of room to continue to grow the dividend. This in addition to the share buybacks that we discussed above leads to a c.17% distribution to shareholders within a year.

Own analysis

On a relative basis, ALLY looks to be undervalued.

|

P/B |

1.1 |

0.6 |

1.1 |

1.5 |

1.6 |

|

ROE % |

20.5 |

9.5 |

11.9 |

16.1 |

14.6 |

Source: Seeking Alpha

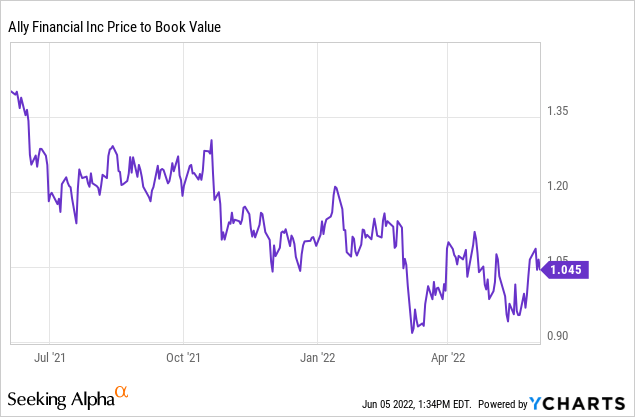

ALLY seems to be relatively undervalued when compared to the big 4 U.S. banks as it offers a higher return on common equity whilst having a low price to book ratio. We see this ratio as crucial for banks as they tend to carry most of their book value at fair value due to accounting standards. Hence, the price to book ratio indicates the price of ALLY stock based on the value of the assets the bank is holding at fair value. Relatively low price to book and higher ROE makes ALLY undervalued. As we can see from the graph below, this is a better time to buy ALLY as the price to book multiple is down 23% in the last year.

In addition, if the company continues to aggressively buy back shares shareholders should benefit. The $2bn for 2022 means that at the current market capitalization management would be able to buy back all shares in 7 years. Taking into account the impact of the dividend savings this is likely to be even faster. The combination of below price to book median (c.13%), share buyback (c.14%) and dividend yield (c.2.8%) shareholders should expect a 30% return assuming no growth.

Risk

The major risk for ALLY is a potential recession. This will lead to lower car sales and will slow down the growth of the company. This will also likely lead to increasing the provision for loan losses reducing the bottom line and contracting the price multiple further. In addition, consumers are going through a real wage squeeze. There are signs that the used car sales are cooling down however, car prices remain high due to low supply and increased costs in the supply chain. Higher prices will likely lead to lower demand for automotive financing and hence will impact the company negatively.

In their recent earnings, call management stated that they are looking at these risks. They even went further to say that their forecasts are the recession scenario, but they still expect to return close to 20% on tangible common equity.

Final Remarks

ALLY stock is a buy. Management has done a great job over the last 5 years. 2022 will see a share repurchase of around 14% based on the current market cap. In addition, the company is relatively undervalued as it has a low price-book ratio whilst offering a significantly higher return on equity compared to the big 4 U.S. banks. Adding up share buybacks, dividend yield and a reversion to the mean shareholders could see a return of over 20%.

Be the first to comment