THEPALMER

Since I added to my Allison Transmission Holdings Inc. (NYSE:ALSN) in June, the shares are down about 12.6% against a loss of about 5.25% for the S&P 500. The company has reported earnings since, so I thought I’d review the name again. I’ll decide whether or not to add, sell, or hold the shares I’ve got after reviewing those financials, and by looking at the updated valuation. I also want to write about the premia I’ve earned selling puts on this name, because I want to drive home the idea that these have the potential to generate very decent risk adjusted returns.

I imagine that my readers are always busy, making plans to visit exotic locations, solving world spanning problems, while dating starlets. I’m also busy, catching up with hours of soap operas that I’ve missed over the past month. Given that my readers are busy, I want to offer them the “gist” of my thinking in a handy single paragraph that sums up my thinking. I will be adding even more to Allison Transmission today, in spite of the fact that the financial results were slightly softer in 2022 than they were in 2019. The dividend remains well covered in my view, and I think there’s room to grow. More importantly, the valuation is sitting very near a multi-year low, and the dividend yield is sitting very near a multi-year high. When an investor pays less and gets more, that’s generally a positive. Although I’ve done well with puts on this name, I think shares represent slightly better value at the moment, so I’ll be simply buying more shares and not selling puts at this time. I doubt shares will be “put” to me, and I think the long term better option is in the stock at the moment, so I recommend simply buying the shares.

Financial Snapshot

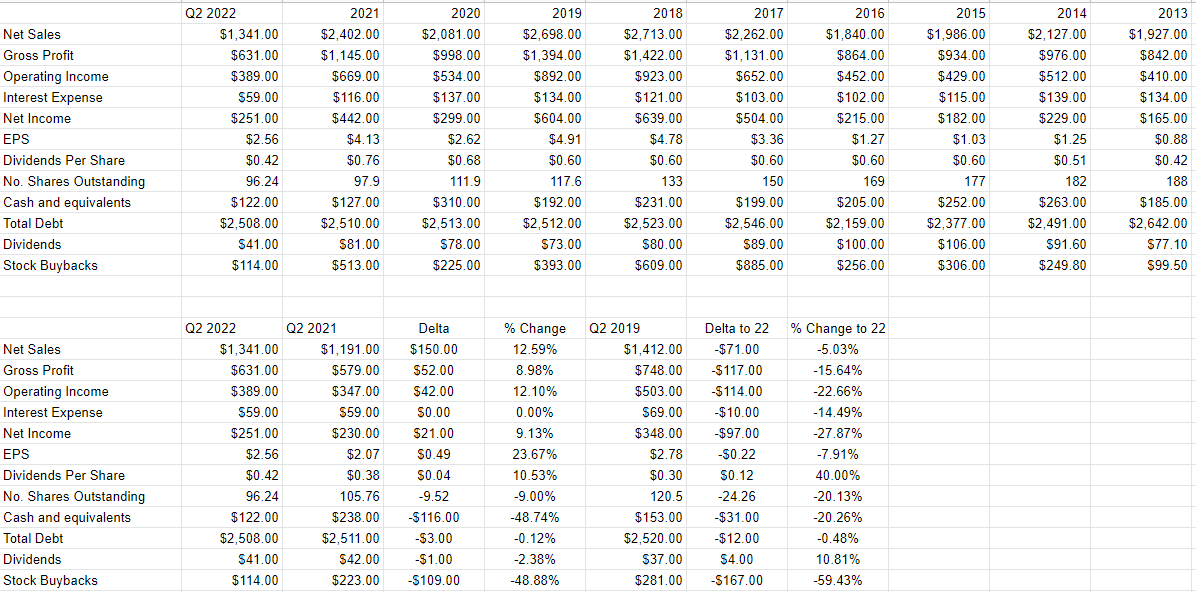

The recent financial results have been fairly decent in my view, and management has rewarded shareholders accordingly. Specifically, relative to this time last year, revenue, operating income, and net income are up by about 12.6%, 12.10%, and 9% respectively. At the same time, the level of indebtedness has dropped slightly, down 2.4% from the year ago period. As a result of all of this, management saw fit to increase the dividend by ~10.5% from the year ago period. I’ve argued previously that the dividend is very well covered, and nothing’s happened in the interim to change my view on that score.

Although the company has done much better in 2022 than it did in 2021, and the future may be relatively bright

Class 8 truck orders bounce back in August

That said, we should acknowledge that the financial performance in 2022 was softer than the same period in 2019. Revenue was about 5% lower, and net income was all of 28% lower than it was only three years ago. Although the dividend is reasonably well covered, anyone who buys this stock should be comfortable with the business cycle. A quick review of the financial history that I’ve enclosed for your enjoyment and edification should demonstrate that revenue goes up and down over time.

That written, I like sustainable dividends, and I’d be very happy to buy more of this stock at the right price.

Allison Transmission Financials (Allison Transmission investor relations)

The Stock

As my regulars know, I consider the “business” and the “stock” to be quite different things. In case you’re new here, I’ll tell you also. I consider the “business” and the “stock” to be quite different things. My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price”, but I’d rather miss out on some gains than lose capital. To continue with the theme that businesses and stocks are distinct things, consider the following. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for large transmissions, changing input costs and so on. It may be that some analyst decides that “future growth catalysts” are weaker than once thought, and the stock falls in price in sympathy, in spite of absolutely no change at the company. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

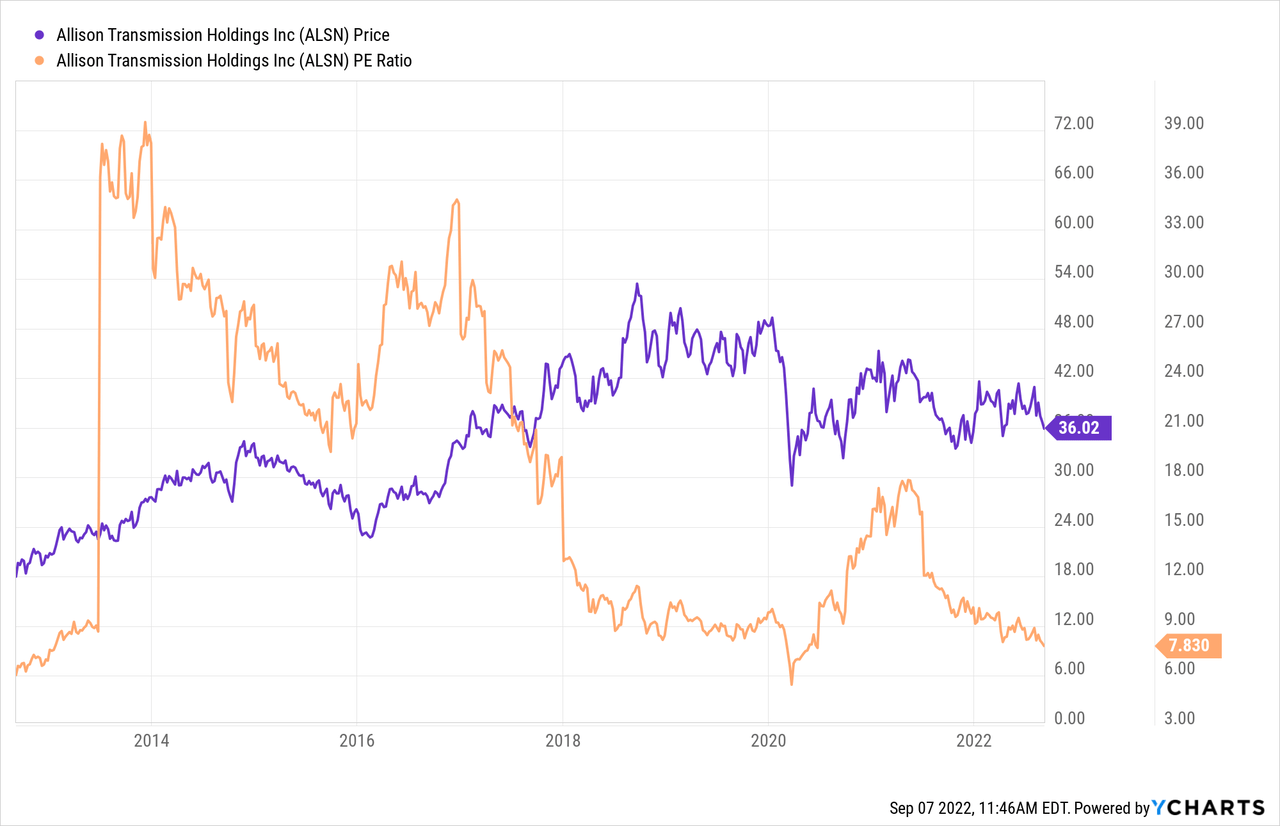

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I liked the fact that Allison Transmission was trading at a PE of 9.46 and was sporting a dividend yield of about 1.94%. Not only are the shares about 17% cheaper now, but they’re trading near the low end of the valuation range for the past decade. This is compelling in my view.

Source: YCharts

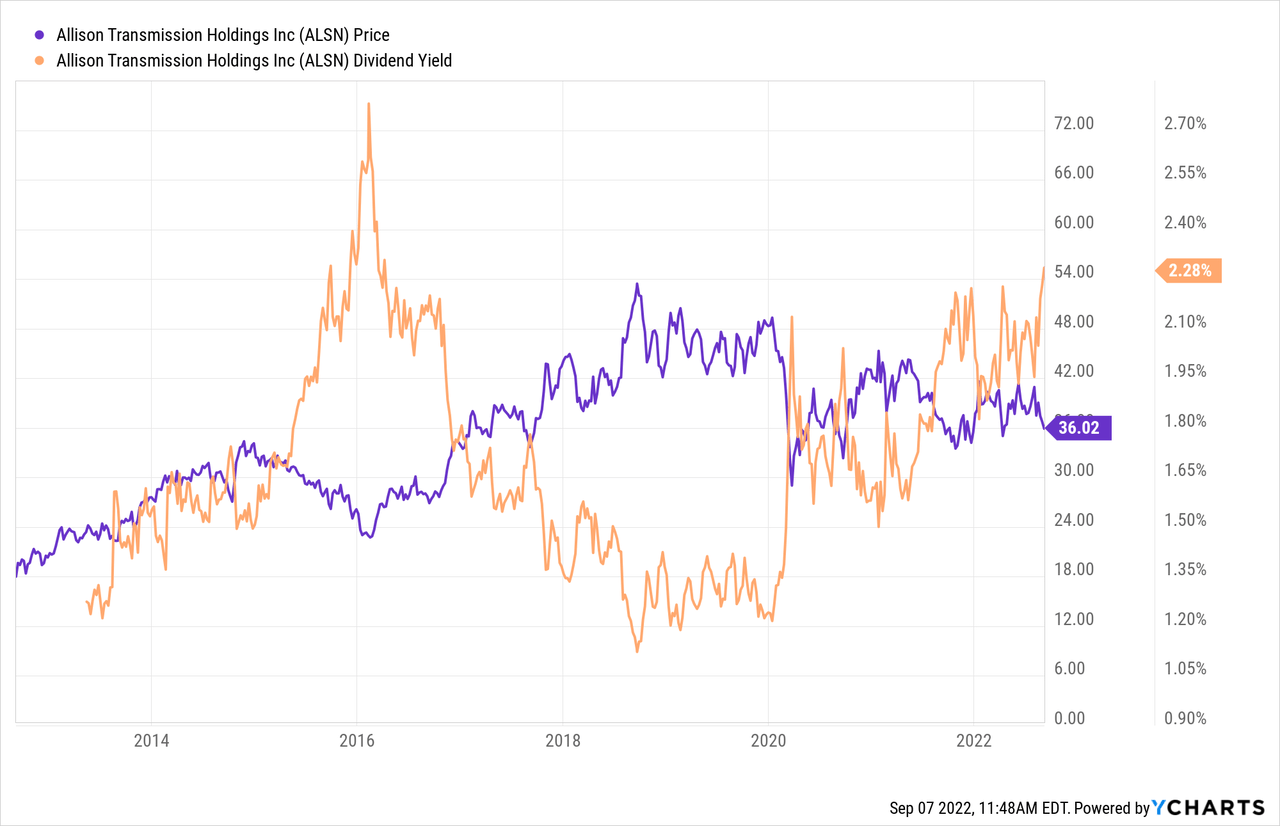

At the same time, the dividend yield is sitting near multi year highs, per the following:

Source: YCharts

I like being an investor who pays less and gets more, so this is an even more compelling investment to me now.

In addition to looking at simple ratios, I actually use a large number of other, more complex valuation measures, one of which involves trying to understand the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses the stock price itself as a source of information. It involves “reverse engineering” the assumptions that cause the current price. When I apply this approach to Allison Transmission, it seems the market is assuming growth of negative 10% at the moment. This is a wonderfully pessimistic forecast in my view. Given the multi year low valuation, the multi year high dividend yield, and the wonderfully pessimistic forecast, I will be adding even more shares of Allison Transmission this morning.

Options Update

I don’t want to brag, but I feel the need to write about how much I’ve earned in options premia with this name. That’s a lie, and I’m sorry for it. I absolutely want to brag, so I’m about to do so. I’ve generated $5.92 per share by selling deep out of the money put options on this excellent business over time. In fact, a series of puts expired last month. This demonstrates the risk reducing, yield enhancing power of these options. The shares that were “put” to me were exercised at a net price of $33.50, which is lower than the most recent insider buy prices, so I consider these shares to be quite low risk.

While I generally like this strategy, I think the shares represent superior value to any short put options at the moment. This is because the premia on offer isn’t sufficiently high relative to the potential upside from the stock in my view. For example, the November puts with a strike of $35 are bid at $1.15 at the moment. This is reasonable enough, but given the multi year low valuations, I think the probability of being exercised on these is remote. In that context, the $1.15 of premia represents less long term value than the stock at this point, and so I’m simply going to buy more shares.

Be the first to comment