Cineberg

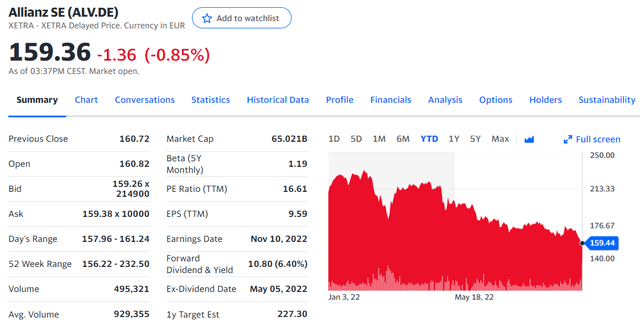

Year-to-date, Allianz’s stock price performance was not in line with Mare Evidence Lab’s expectations. Our favourite German insurer – i.e. Allianz (OTCPK:ALIZF, OTCPK:ALIZY) – has lost almost 35% of its total market capitalization. Once again, we would like to deep-dive into the company’s financials and reassure Allianz’s investors of the positive value proposition that it still offers. For our new readers, this might be an opportunity to take advantage of the negative market momentum and lock in an interesting and well-managed company with a compelling valuation and a tasty dividend yield.

Allianz SE stock price evolution (Yahoo Finance)

At the beginning of the year, Allianz’s stock price declined not only due to the conflict between Russia and Ukraine but also to the AllianzGi US structured alpha funds investigation. To follow up with the story, we advise our readers to check on the following company’s press release:

- 17/02/2022 – Allianz to book a provision related to the AllianzGI U.S. Structured Alpha Funds;

- 11/05/2022 – Allianz books provision in Q1 2022 for Structured Alpha;

- 17/05/2022 – Allianz announces resolution of U.S. government investigations concerning Structured Alpha.

Of course, here at the Lab, we already commented on the US investigation. In total, the German insurer paid the US Department of Justice (DOJ) and the Security Exchange Commission (SEC) a fine of $ 174.3 million and $675 million, respectively. In addition to the settlements, Allianz has been forced to compensate Structured Alpha investors for a total amount of approximately $ 5 billion. This provision was already reflected in Allianz’s Q1 results and explained why the company’s YTD stock price performance is behind AXA and Zurich Insurance, considering that they’re losing 27.43% and 9.28%, respectively.

Why are we still positive?

- Here at the Lab, we analyzed Allianz’s 10-year financial indicators and we can clearly see that the company manages to reduce its cost basis (lowering the expenses ratio) and increase its solvency requirements. Today, Allianz is much more solid than in the past and will be able to navigate short-term turbulence. The structured Alpha fund was just an unfortunate event that a company such as Allianz won’t easily repeat;

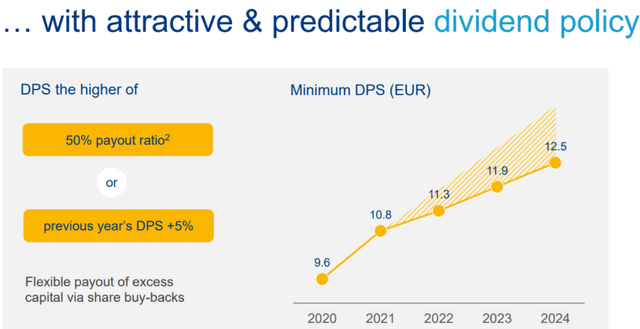

- Related to point 1), it is key to highlight the company’s new shareholder remuneration policy with an “attractive and predictable dividend“. Fig 1 is very clear and dividend distribution is based on the higher results based on 1) a 50% payout ratio or 2) the previous year’s dividend +5%. Wall Street analysts should take into account this interesting dividend progression;

- Regarding the valuation, we are confident that Allianz still offers an interesting valuation considering its internal asset management;

- In our 10-year analysis, we also focused on the lower reinvestment yield. Indeed, for the above reason, the whole insurance sector suffered a compression in earnings; however, with this inflationary environment, this might result in a headwind to price. Moreover, as explained by David Gillard (Allianz Global Investor CIO), more and more capital has been invested into private assets and private equity. These investments still offer long-lasting and constant cash flows, in line with the time horizons of Allianz’s liabilities. Even if it represents a minimal part of Allianz’s assets under management, this is considered to be a further upside for the insurer.

Allianz DPS policy (Allianz Q4 and FY Result)

Conclusion and valuation

Even if we don’t like to repeat other people’s phrases, we cannot quote the Oracle of Omaha:

“One reason we were attracted to the P/C business was its financial characteristics: P/C insurers receive premiums upfront and pay claims later. In extreme cases, such as claims arising from exposure to asbestos, payments can stretch over many decades. This collect-now, pay-later model leaves P/C companies holding large sums – money we call “float” – that will eventually go to others. Meanwhile, insurers get to invest this float for their own benefit. Though individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float..”

During the half-year presentation, Allianz reaffirmed its 2022 guidance and confirmed an ongoing buyback to support its share price development. Based on a Price to Book value, the company is currently trading at a discount compared to its closest peers and versus its historical average. For the ongoing macro challenges and the European energy crisis, the insurance sector was de-rated; however, we still believe that Allianz is offering a compelling investment proposition. Since the Alpha Fund investigation is now trading at circa 7x on our 2023 estimates, we believe that this discount is not justified. With a 5-year average at a P/E of 10x, we derive a target price of €220 per share, maintaining our buy rating.

Allianz PE ratio development (Ycharts)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment