bunhill

Introduction

When the COVID-19 pandemic swept the globe in early 2020, Alliance Resource Partners (NASDAQ:ARLP) were one of the worst hit with their unit price plunging from circa $15 to as low as $3 by October, thereby representing a massive 80%+ loss. Following the global energy shortage that was kicked into overdrive in 2022 on the back of the Russian invasion of Ukraine, they have enjoyed a far stronger recovery than most investors expected, which even sees their unit price surpassing its former level to trade in the low $20 range, obviously seeing their recovery complete. Despite being very profitable for their unitholders who bought at the right time, when looking ahead, it appears to be time to pack your bags and leave because their thermal coal reliance sees scant prospects to generate alpha and thus by extension, to see their unit price rally much higher.

Background

It was not surprising to see their distributions reduced in early 2020 as the COVID-19 pandemic began wreaking havoc, although their subsequent suspension only one quarter later was very painful for their unitholders who quickly went from receiving generous payments to absolutely nothing. After reinstating their quarterly distributions one year later following the first quarter of 2021, they have since quickly grown from only a mere $0.10 per unit to $0.40 per unit most recently, which is now the same level as early 2020 before subsequently being suspended. Whilst this still remains below their former high level of $0.54 per unit from back in 2019 before COVID-19 existed, their very strong cash flow performance makes this final jump quite likely in the short term.

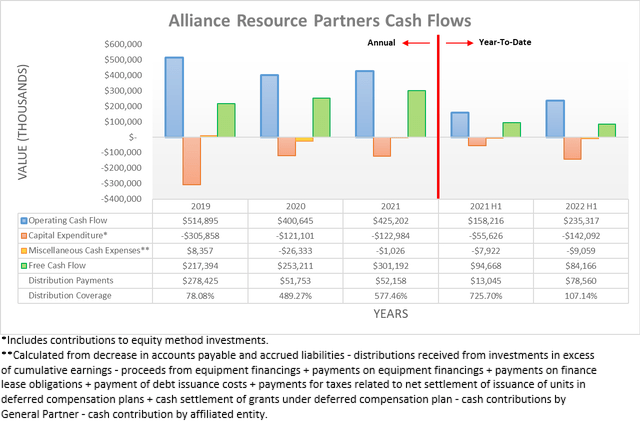

Thanks to the booming operating conditions across the entire energy sector during the first half of 2022, they have seen their operating cash flow surge to $235.3m, which represents an increase of 48.73% year-on-year versus their previous result of $158.2m during the first half of 2021. Even though this is already a massive increase, it was actually held back very significantly by their temporary working capital movements. If these are removed, their underlying operating cash flow for the first half of 2022 was another $125.9m higher, which by extension also boosts surface-level free cash flow from $84.2m to a far higher $210.1m.

Since this relatively very large working capital build should reverse in the coming quarters, they have scope to lift their quarterly distributions higher, quite possibly to their former level of $0.54 per unit from back in 2019. Given their latest outstanding unit count of 127,195,219 these would cost $68.7m every quarter, which is clearly possible to fund given their $200m+ of underlying free cash flow during the first half of 2022 easily exceeds this cost. Although given this would amount to $274.8m per annum, this would be the most that unitholders could realistically expect to receive for any consistent length of time. Outside of these booming operating conditions thus far into 2022, their highest free cash flow for an entire year was $301.2m during 2021 and thus does not provide sufficient scope to expect higher distributions for more than a year.

Whilst this still sounds very positive, which is definitely the case in the short-term, when thinking further ahead, they see serious risks from their reliance upon thermal coal, which during 2021 saw 81.60% of their volume sold to domestic electric utilities, as per their 2021 10-K. Even though they have produced stellar financial performance during recent quarters on the back of the global energy shortage, the days for thermal coal are still numbered in this age of clean energy.

It can be argued whether thermal coal will last for another ten years, thirty years or anywhere in between but it nevertheless remains undeniable that in the long-term, the world will continue moving away to clean energy and thus they face a secular decline. Even though unitholders may hope to see them diversify into new areas, whether they are successful is highly speculative. If interested in further details regarding their cash flow performance, financial position or plans to diversify into new areas, please refer to my previous article, which carries a deeper analysis of these topics, whereas the focus of this analysis centers on their current valuation following their strong unit price rally.

Discounted Cash Flow Valuations

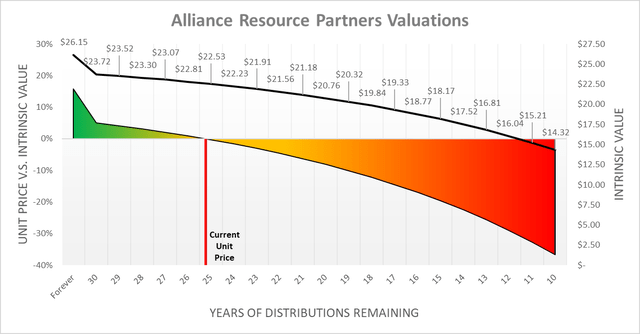

Since there are few industries as mature and late-stage as thermal coal and they are structured as an income-focused Master Limited Partnership, their distributions are clearly sitting at the center of their investment proposition. This means that their intrinsic value is heavily dependent upon the future income they can provide their unitholders and thus can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their distribution payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

There are numerous ways to approach these valuations but in the context of their uncertain long-term outlook as thermal coal demand wanes, it seems best to structure these around the terminal value of their remaining distributions. Due to the inherent volatile cash flow performance of their industry, it makes predicting their distributions in any particular year impossible but thankfully this issue can still be overcome by providing a range of scenarios, which assesses the threshold they have to pass to generate alpha and thus be considered a desirable investment opportunity.

Since their unit price has already rallied to a five-year high, it seems apt for these scenarios to utilize an optimistic outlook whereby their quarterly distributions are promptly reinstated to their former level of $0.54 per unit from back in 2019. This high level represents the most that income investors could realistically expect to receive for any consistent length of time given the constraints of their cash flow performance, as previously discussed. Even though their distributions during future years will ebb and flow along with their cash flow performance, the point is not to forecast their distributions every year but rather to provide a relevant basis to assess their terminal value.

In my view, the most bearish scenario would only see these distributions lasting for another ten years before subsequently ceasing due to the clean energy transition accelerating as the global energy shortage abates, thereby seeing countries turn their back on thermal coal once again. Conversely, I see the most bullish scenario as one where these distributions are sustained perpetually into the future, as thermal coal enjoys a very slow secular decline that allows them to easily diversify into other areas. Meanwhile, the remaining scenarios reside in between this range whereby their distributions cease at one-year intervals out to a limit of 30 years.

When reviewing the results, their current unit price of $22.60 aligns with the intrinsic value whereby their distributions are sustained at a high level for another 25 years, before subsequently ceasing. To phrase this another way, if an investor wishes to generate alpha, the partnership would not only have to increase their quarterly distributions back to $0.54 per unit, as I expect in the short-term but also sustain them at this high level for longer than the next 25 years, which is an extremely optimistic outlook. Whilst other investors may see a more bullish future for thermal coal than myself, energy shortage or not, I personally cannot possibly see this happening with their fuel being a choice of last resort in the age of clean energy and thus I feel their units are now significantly overpriced after their strong rally.

To make this already undesirable outlook even less desirable, if they somehow managed to sustain their distributions forever at the same high level, their intrinsic value of $26.15 is still only a mere 16% higher than their current unit price. This means that even if my views on the future of thermal coal prove far too bearish, investors would still barely generate any alpha with this being a disappointingly small gap to see from such a bullish scenario. By providing a variety of results, readers can cross-reference their own views with these valuations as they may vary from my own.

Valuation Inputs

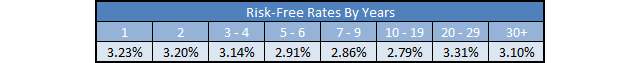

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 1.17 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on August 15th 2022, as the table included below displays.

Author

Conclusion

Even though their high 7% dividend yield seems desirable, it would be prudent for investors not to get tricked by this short-term income and forget that their intrinsic value remains heavily influenced by their medium to long-term future, which is not bright given their reliance upon thermal coal. Whilst we can debate the future decline of thermal coal, it nevertheless remains a secular decline in this age of clean energy. Since their ability to sustain their distributions forever at a high level would be almost impossible and even worse, would only generate modest alpha, their units appear overpriced and thus I believe that downgrading my rating from hold to sell is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Alliance Resource Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment