Spencer Platt

Overview

Allbirds, Inc. (NASDAQ:BIRD) is a shoe company that is particularly focused on sustainable materials and manufacturing processes. Unlike most other sneaker companies, they leverage wool as the primary material in their products. As stated by the firm, this results in a manufacturing process that uses 60% less energy than typical synthetic shoes.

Founded in 2014, Allbirds has been a notable success story since and conducted an initial public offering in Q4 2021 at $15 a share.

SeekingAlpha.com BIRD 11.15.22

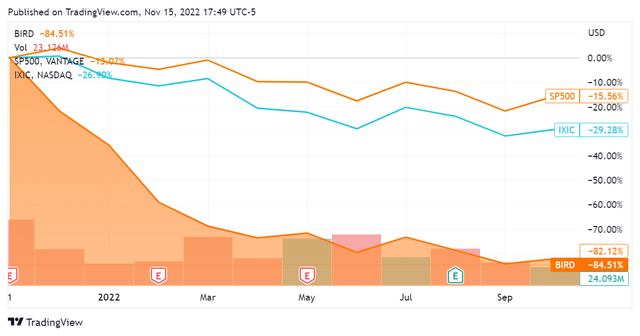

Since then, Allbirds has seen its valuation deteriorate significantly. The stock has depreciated more than 80% from its IPO trading day, well below the S&P and NASDAQ indices; it is trading at $3.03 as of this article. We will look to see if the company’s fundamental picture has done as poorly as the stock may suggest.

Financials

Starting with a look at quarterly revenues, we see that Allbirds’ growth has been volatile. As a consumer discretionary good, this is to be expected, although the volatility inherent in these revenue results is significant. Worth noting is that the company posted record revenues of $79.3M for Q4 2020 but has not yet achieved this milestone since.

SeekingAlpha.com BIRD 11.15.22

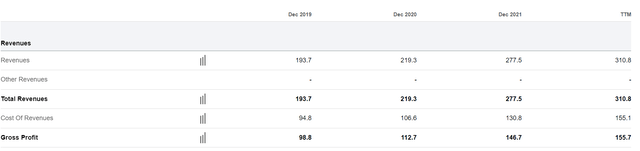

Breaking out numbers year-by-year shows a healthier picture with consistent growth. The trailing twelve months revenue number is also beyond that of any fiscal reporting period for the firm, indicating continued momentum on sales growth.

SeekingAlpha.com BIRD 11.15.22

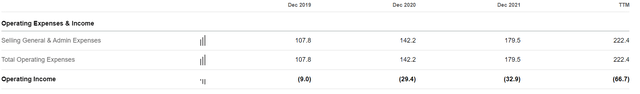

The trendline for operating income is less clear quarter-to-quarter, yet negative throughout.

SeekingAlpha.com BIRD 11.15.22

Unfortunately the company is experience an increasing operating loss, with its TTM figure the largest yet. While revenues may have also been at their peak on a trailing twelve month period, this actually yielded a lower capital efficiency for the business overall.

SeekingAlpha.com BIRD 11.15.22

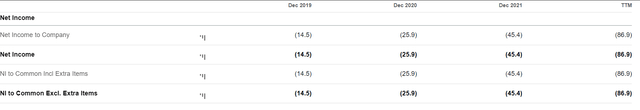

Along with this, the company’s overall cost of doing business appears to be increasing in line with its core operations. Year-over-year Allbird’s net income has decreased; the TTM measure even more so.

SeekingAlpha.com BIRD 11.15.22

Overall, the profitability trendline here is poor. Allbirds appears to be less capital efficient than it was at the time of its IPO. Since its main cost input is wool this may be due to commodity inflation.

Taking a quick look at Wool Futures (OL1:COM) as a reliable proxy for the price of wool, we see that this has not actually been the case:

SeekingAlpha.com OL1:COM Futures 11.15.22

Wool prices have actually decreased from their average price between 2018-2020, and even hit a significant low in Q4 2020.

This should have created increased operational efficiency and a lower cost of revenue for Allbirds; yet, we see the opposite in the accounting statements outlined above. This may be due to appreciation in other inputs or simple operational inefficiency. It is possible that the company’s focus on sustainability in its operations is damaging its bottom line.

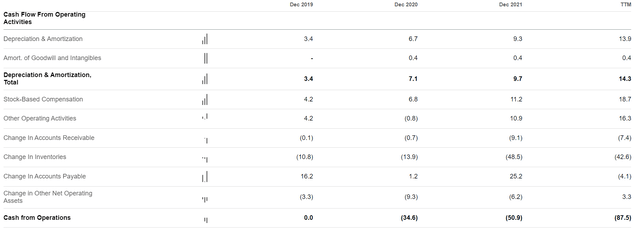

This belief is corroborated by a look at the company’s operating cash flows, which are also decreasing and accelerating on a TTM basis.

SeekingAlpha.com BIRD 11.15.22

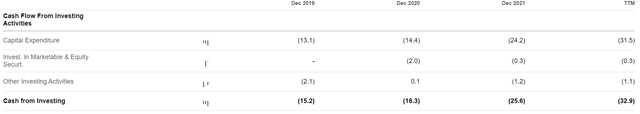

This picture is allayed by the fact that the company has material capital expenditures during these reporting periods.

SeekingAlpha.com BIRD 11.15.22

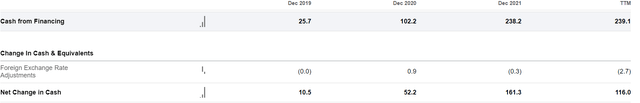

Capital expenditures aside, Allbirds is not able to maintain itself and grow through cash from operations and is instead scaling its financing:

SeekingAlpha.com BIRD 11.15.22

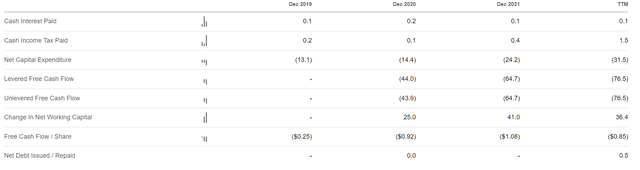

This will, of course, create an interest payment burden on the firm. While it does not appear to be faced with this at present, the company is experiencing a declining free cash flow:

SeekingAlpha.com BIRD 11.15.22

Conclusion

What these financials tell me is that this is a company focused on scaling out its operations. While revenues are increasing, capital expenditures as well as its cash loss are increasing. Unfortunately this is creating a negative trendline as to operating/capital efficiency, but this is common.

The question for any investor in Allbirds, Inc. stock then becomes a matter of the company’s product, production, and distribution capabilities throughout its lifespan. Since at one point there will no longer need to be capital expenditures for scaling out its operations, the product and distribution will have the final say. Since this is a consumer company with a heavy presence on the internet, a good first order estimation for this is Google Trends:

trends.google.com ‘Allbirds’ Worldwide 11.15.22

The graph tells me that Allbirds is right in the middle of its historical level of search interest, which we will take as a proxy for consumer interest. As such, I am hesitant to say that it is headed one way or another.

If Allbirds, Inc. can scale out its operations, achieve capital efficiency, and maintain the same level of consumer demand, then it can very well earn profits. Adding to the probability that this may happen is its unique product & brand positioning; there is no immediate comparison for a wool sneaker made by a company that is serious about sustainability. As such, I see the potential for both upside and downside long-term and would rate Allbirds, Inc. stock a hold.

Be the first to comment