FatCamera/E+ via Getty Images

Alignment Healthcare, Inc. (NASDAQ:ALHC) has a noble mission to bring differentiated health care to seniors. However, I am wary of the business model, as its focus on Medicare Advantage members means profitability is capped. At the same time, I have yet to see any SG&A leverage, as the company has never generated an operating profit. I think investors should align themselves with insiders and avoid the shares.

Company Overview

Alignment Healthcare Inc. is a health insurer targeting seniors. Alignment partners with local providers to deliver high quality, affordable care to its members. Every Alignment member receives a tailored health plan that is customized for their needs. Alignment’s operations primarily consist of Medicare Advantage Plans in California, Nevada, Arizona, and North Carolina.

According to the company’s mission statement, Alignment was founded to

“bring differentiated, advocacy-driven healthcare experience to millions of senior consumers in the United States”.

Figure 1 – ALHC Mission Statement (ALHC Investor Presentation)

Membership and Revenues Have Been Growing At A Quick Pace

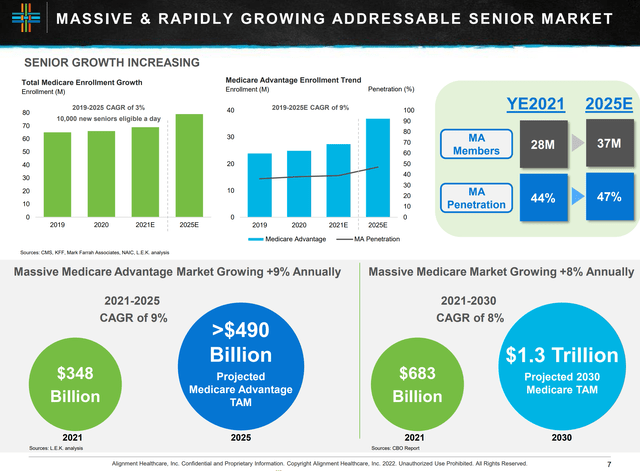

The Medicare Advantage (“MA”) market is enormous and rapidly growing due to the aging U.S. population. Through 2025, MA enrollment is forecast to grow at a 9% CAGR, and the premiums are expected to reach almost half a trillion dollars (Figure 2).

Figure 2 – Medicare Advantage Market (ALHC Investor Presentation)

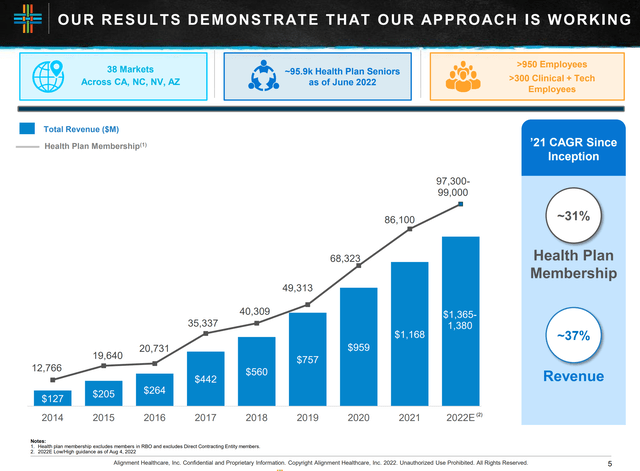

With this backdrop, Alignment Healthcare has seen exponential growth of its own. Since the company’s inception in 2014, plan membership and revenues have been growing at 31% and 37% CAGR respectively (Figure 3).

Figure 3 – ALHC Membership and Revenue Growth (ALHC Investor Presentation)

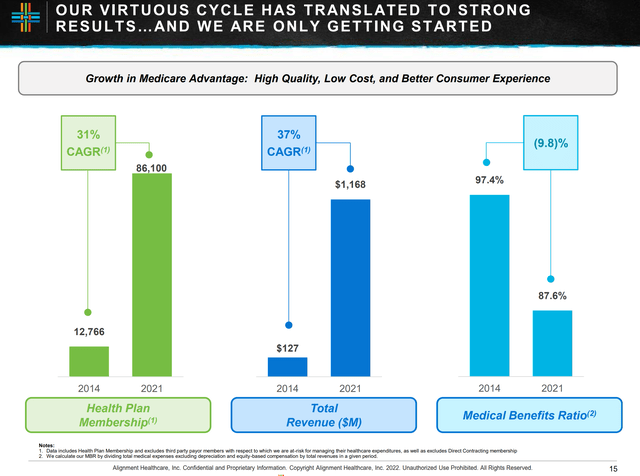

Strong growth has allowed ALHC to reap the benefits of scale in providing medical services, with its Medical Benefits Ratio (“MBR”) dropping to 87.6% in 2021.

Figure 4 – ALHC MBR Ratio (ALHC Investor Presentation)

Understanding MBR

MBR is a measure of how much premium revenue is paid out as medical expenses, sort of like a ‘gross margin’ for health insurers. The key thing to understand for investors and analysts is that the MBR is capped due to the Affordable Care Act. If an insurer spends less than the mandated minimum on medical expenses, it must issue a rebate to its members. For Alignment Healthcare, it must spend at least 85% of premiums earned on medical expenses, as it mostly operates in the government insurance space (Medicare Advantage).

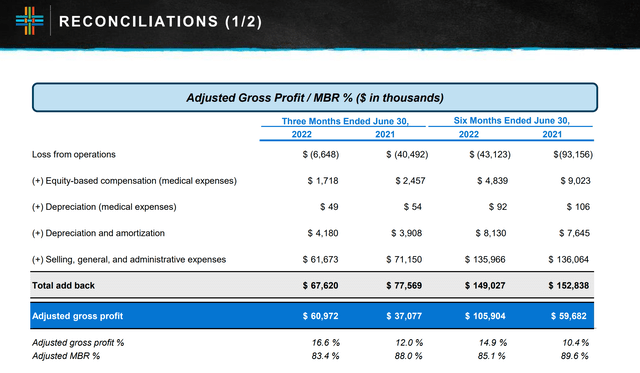

YTD, ALHC’s MBR ratio has dropped even lower than 2021’s level, to 85.1% for the first half of 2022. However, I believe this is about as low as it could go, since, by government mandate, it must spend at least 85% of premiums on eligible medical expenses. Note, the exact figure reported to the Centers for Medicare and Medicaid Services (“CMS”) include certain expenses related to quality of care and exclude certain taxes and fees (Figure 5)

Figure 5 – ALHC H1/2022 MBR Ratio (ALHC Investor Presentation)

Operating Loss Despite Strong Growth

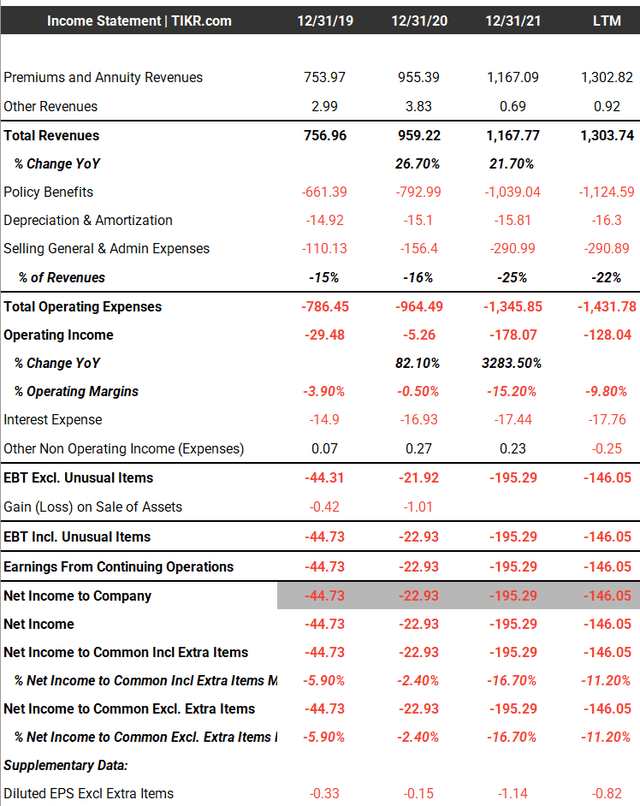

Despite the rapid growth in members and revenues mentioned above, ALHC is not profitable, even on an operating level. While medical benefits have enjoyed economies of scale, with the MBR falling from 97.4% in 2014 to 87.6% in 2021 (the COVID pandemic also played a big part in the lower MBR, as many seniors chose to forego elective surgeries), SG&A expenses as a % of revenues have actually been on an increasing trend, rising to 25% of revenues in 2021. A big part of the SG&A increase is due to stock-based compensation expense of $107 million in 2021. Even excluding that amount, SG&A was still $184 million or 15.7% of revenues in 2021 (Figure 6).

Figure 6 – ALHC Condensed Financials (TIKR.com)

Simply put, the financial model does not work if the CMS mandates policy benefits to be at least 85% of premium revenues, and corporate SG&A expenses are over 15% of revenues.

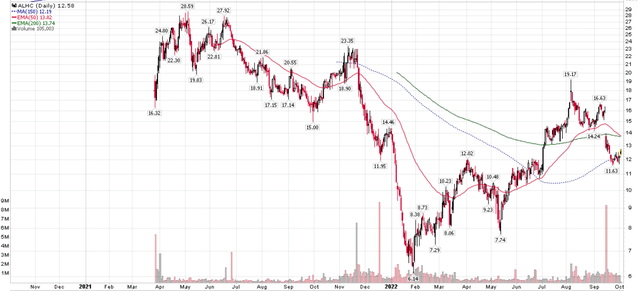

IPO In A Hot Market

Alignment Healthcare came public through an IPO in March 2021. The company offered 27.2 million shares to the public at $18/share, with 21.7 million of the shares coming from treasury and 5.5 million shares from selling shareholders. The shares initially found some momentum, as the company came public during a bullish window. However, by May of 2021, the shares peaked out at $28 and the company began missing on earnings.

Figure 7 – ALHC Stock Price (StockCharts.com)

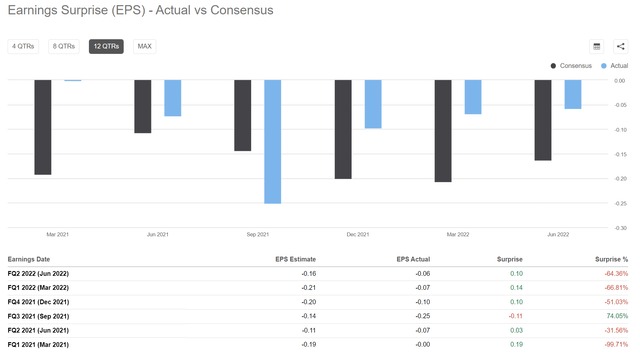

Missing financial estimates seems to be a common theme for Alignment Healthcare’s earning reports. Since it came public, ALHC has reported earnings six times, and 5 of the earnings were misses, often by a large percentage.

Figure 8 – ALHC Earnings Surprise (Seeking Alpha)

Insiders Are Voting With Their Feet, Are You Aligned With Them?

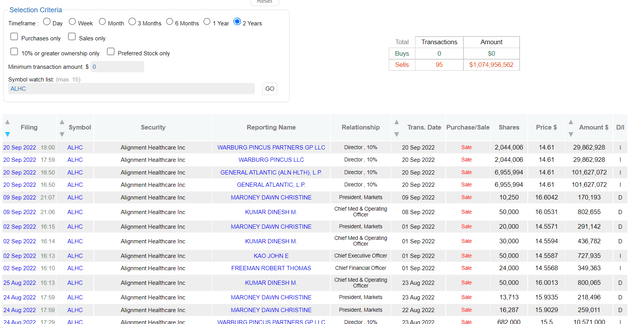

Since the company’s IPO, insiders have been selling shares at a furious pace. First, insiders exercised the IPO over-allotment option and sold an additional 3.3 million shares at the IPO price of $18. Then in November 2021, they sold an additional 9.2 million shares through a secondary offering at $21/share. Recently in September 2022, the company completed yet another secondary offering of 9 million shares at $14.75/share.

All told, insiders, including Private Equity firm Warburg Pincus and the management team, have collectively sold over $1 billion in stock since the company became public (Figure 9). This is an incredible figure given the relatively small market cap ($2.2 billion) of the company.

Figure 9 – Insiders have Sold $1 billion of ALHC (dataroma.com)

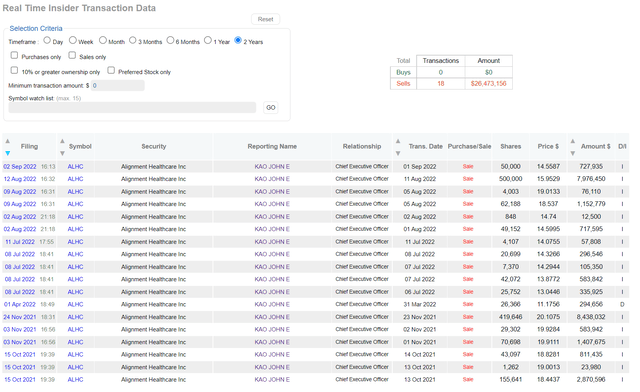

John Kao, the CEO himself, has also been selling his shares non-stop since October, cashing out over $26 million (Figure 10).

Figure 10 – CEO John Kao has Sold $26 million (dataroma.com)

If insiders, who normally have the best information regarding a company’s prospects, are selling at such a rapid pace, should outside investors rush to buy from them?

Risk

The biggest risk I can see for Alignment Healthcare is that the MBR ratio begins to head back higher, as seniors emerge from the pandemic ready to take on elective surgeries that they postponed in the last few years. Note that while the CMS mandates at least 85% of premiums must be paid out as policy benefits, there is no upper limit. In other words, profits are capped, but losses are not.

Another worry is that like many of the companies that have come public in the last few years, I think ALHC has an arguably flawed business model that likely pushed growth at all costs. With the way the company is currently set up, SG&A as a percentage of revenues simply does not allow for any corporate profitability. Until that changes, it is hard to get excited about the story.

Conclusion

While ALHC’s corporate mission to bring differentiated healthcare to seniors sounds very noble, as an investor, I fail to see the attractiveness of a business model that has capped profits. Combined with a spendthrift management team, ALHC has not once generated an operating profit. Furthermore, insiders appear to be selling shares at every opportunity. I think investors would be wise to align themselves with insiders and avoid the shares.

Be the first to comment