Ladanifer/iStock via Getty Images

Macro uncertainty hits so many ways. You might not think the maker of Invisalign would be that susceptible to rising interest rates and a higher dollar. But shares have moved in tandem with volatility in the S&P 500 this year. Is now a good time to buy? Let’s weigh the pros and cons fundamentally and technically.

According to Bank of America Global Research, Align Technology (NASDAQ:ALGN) is the dominant company in the ‘clear aligner’ orthodontic market, where its Invisalign brand competes with traditional metal braces (also known as ‘wires and brackets’). Align revenues come primarily from a family of clear aligner products (cases) used to treat malocclusion (crooked teeth and other dental cosmetic and medical issues), as well as some digital scanners, services, and non-case products, such as retainers and other ancillary offerings.

Align has the potential to be a solid long-term growth story, but the firm continues to struggle with harsh macro conditions, including geopolitical risks, a weakening consumer, and even negative FX moves. The management team did authorize a $200 million share repurchase program last month, but that does not necessarily mean that they will execute the full amount any time soon. The Invisalign franchise has staying power but is cyclical. Still, ALGN should benefit from Covid being a thing of the past. The stock could be an interesting play should the dollar reverse lower.

Downside risks include cyclical weakness should a recession strike – the high-cost Invisalign product could see much weaker demand. Moreover, uncertainty in China hurts sourcing activities.

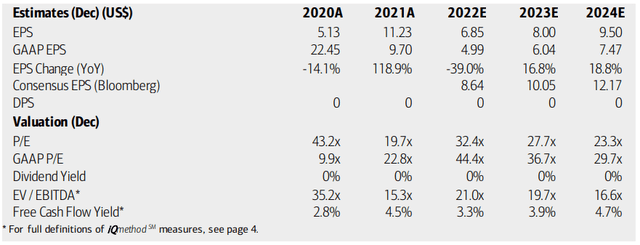

On valuation, analysts at BofA see earnings falling big this year, but then bouncing back in 2023 and 2024. I think those optimistic numbers might come down further, but the Bloomberg consensus forecast is even more sanguine. Align is not expected to pay a dividend any time soon. Unfortunately, the firm’s P/E ratios, both operating and GAAP, remain lofty after a steep stock price decline. Its EV/EBITDA multiple is also high while free cash flow is decent and steady. ALGN’s forward PEG ratio has fallen to 2.41, below its 5-year average of 2.95, but that is still pricey in this rate environment.

Align: Earnings, Valuation, Free Cash Flow Forecasts

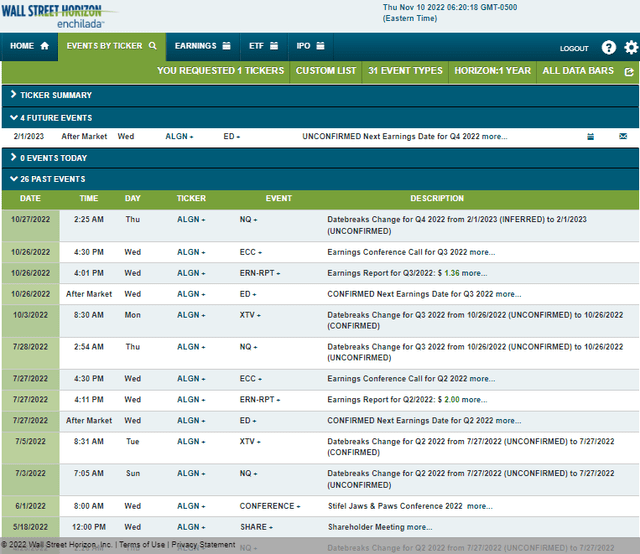

Looking ahead, ALGN has an unconfirmed Q4 2022 earnings date of Wednesday, February 1, AMC, according to Wall Street Horizon. The corporate event calendar is light until then.

Corporate Event Calendar

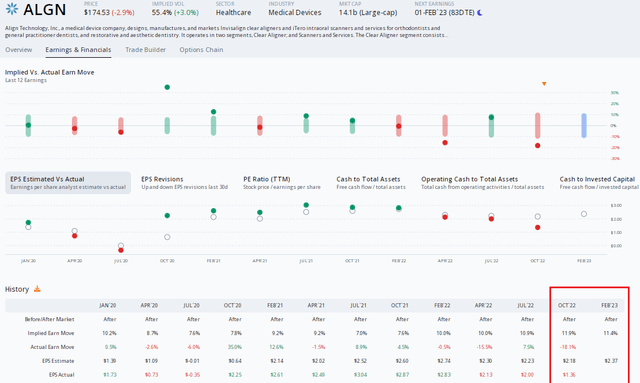

Looking back on the Q3 earnings report, Align reported a big bottom-line miss. Analysts were expecting $2.18 of per-share earnings, according to Option Research & Technology Services (ORATS), but it reported just $1.36 in EPS. There have already been two earnings downgrades of the stock since that report, per ORATS. Shares fell nearly 20% post-reporting last month.

For the upcoming Q4 report, traders see big volatility with an implied move of 11.4% priced in immediately after that release. Implied volatility is more than double that of the market at 55.4%.

ALGN: Big Volatility in the Options

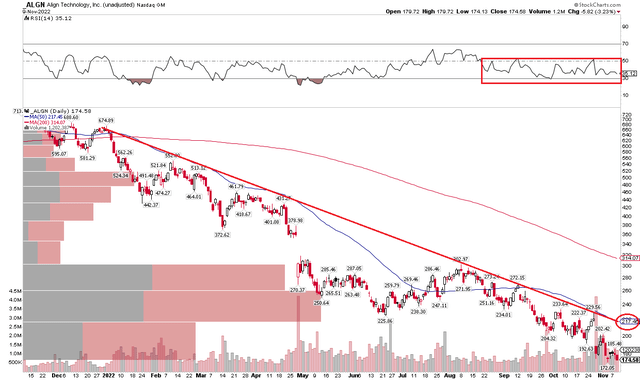

The Technical Take

ALGN continues to trade weakly. I was bearish on the stock back in August, and not a whole lot has changed. Notice in the chart below that there’s an obvious downtrend resistance line going back a year. Also, the 200-day moving average keeps moving lower while the RSI indicator up top is in the notoriously bearish 20 to 60 range. Shares closed at a fresh cycle closing low on Wednesday after a big-volume down day around earnings last month. There are just so few bullish signs here, and I do not see capitulation hallmarks.

ALGN: A Powerful Downtrend Lives

The Bottom Line

ALGN continues to look expensive and does not pay a dividend. Macro risks weigh, but shares could be a stealth weaker-dollar play if the USD reverses. The technical picture, though, remains decidedly bearish. I continue to have a sell recommendation on the stock.

Be the first to comment