David Becker

Alibaba’s (NYSE:BABA) stock is getting hammered again. Shares are back below $90 as investors fret about growing delisting concerns and Jack Ma giving up control of Ant Group. Additionally, Alibaba’s earnings are coming up in August, and analysts expect the company to report its first quarterly revenue decline. Moreover, investors fear the earnings results could be worse than expected. Thus, Alibaba is being punished, with shares down by 30% from their high in early July.

Meanwhile, Alibaba’s valuation is remarkably low, and the stock is extremely cheap. Earnings and earnings estimates are probably around the bottom here. Moreover, the delisting concerns seem exaggerated, and the Jack Ma/Ant Group controversy appears overblown. The renewed uncertainty is leading to fear and panic selling in Alibaba shares. While owning Alibaba is an elevated-risk investment, the potential reward greatly outweighs the risks, in my view. Alibaba should return to growth and increase profitability in the coming years.

Furthermore, the delisting fears should subside, and the Ant IPO should occur as the company advances. Additionally, Alibaba’s earnings next month have a significant probability of coming in better than expected. Therefore, the uncertainty should clear as we move, and Alibaba may become one of the top-performing long-term investments for the next decade.

Here We Go Again

Just when it appeared like Alibaba got its footing back, the stock dropped again. This time the decline occurred from a near-term top of around $125, bringing the share price lower by approximately 30% inside one month. The fall was about 70% from Alibaba’s ATH of roughly $320 in late 2020.

So, Where to Now?

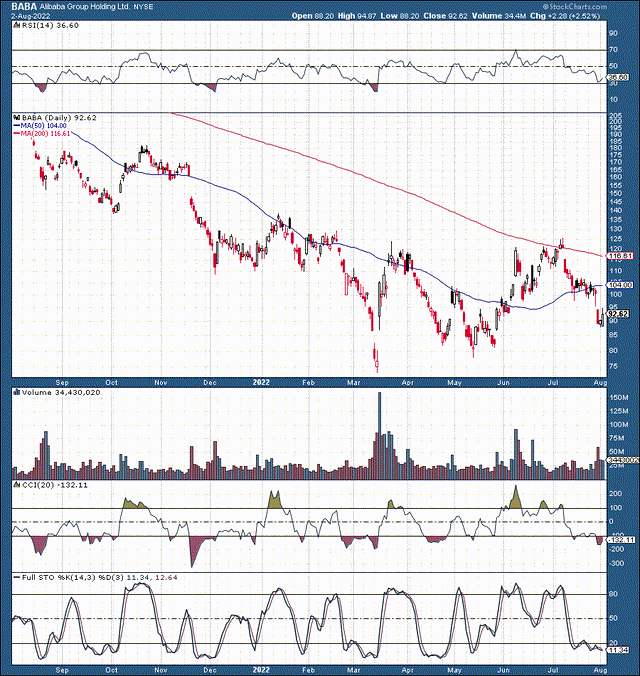

We see Alibaba trading sideways recently (last six months or so), and the trading range is roughly $80 – 125. Therefore, we could see slightly more downside (to about $80) in the near term. Yet, it is constructive that Alibaba stopped making new lows. Also, we see the RSI and other technical gauges illustrating oversold conditions. Therefore, the downside may be limited here, and there is a strong probability that Alibaba will soon bounce back from the oversold technical levels.

On the upside, we want the stock to return above $100, then break out above the $125 critical resistance point. Once above this crucial resistance level, Alibaba could start a new uptrend during which shares could rise to new highs. However, for new highs to materialize, we need several fundamental factors to go right.

The Delisting Fears Need to Go Away

Last Friday, Alibaba dropped by 10% as the SEC added the Chinese retail giant to their list of companies facing possible delistings. Beijing has been hesitant to allow U.S. officials to look at the accounting books of company auditors, including Alibaba’s. In 2020, a law was passed which gives companies a three-year window to abide by the SEC standards or face a possible delisting from U.S. exchanges. However, Alibaba said it would continue monitoring market developments and will strive to keep its listing status on the NYSE and the HKEX.

While Alibaba’s addition to the SEC’s possible delisting watchlist is a negative development, we must consider several factors. First, we knew this law existed, and we should have concluded that Alibaba may be on this list of companies U.S. authorities want to audit. Second, there are around 270 companies on the list, including Baidu (BIDU), Weibo (WB), Yum China (YUMC), and many other major Chinese firms. In fact, 270 companies represent all Chinese companies that trade in the U.S. In May 2022, 261 Chinese companies were trading on U.S. exchanges with a combined market cap of $1.3 trillion. Therefore, Alibaba is not being singled out here, it is simply the norm to put Chinese companies on this watchlist, and we must see where it brings us in the end.

Neither Alibaba nor the Chinese government is interested in seeing Alibaba and other major Chinese companies delisted from U.S. exchanges. Widespread delistings would be destructive to the Chinese economy and the country’s image around the world. Moreover, delistings would set China’s economic progress back decades, possibly leading to economic and civil unrest at home (the greatest fear of any authoritarian government).

Therefore, Alibaba will probably do everything it needs to comply with the SEC’s regulations to keep its listing in the U.S. Moreover, most Chinese companies should also do everything to comply. Furthermore, it is in the CCP’s interest to support China’s companies listed in the U.S. to maintain economic progress, stability, and social order. China has already removed some obstacles to enable its companies to comply with the SEC’s standards and will probably do more as we move on.

Also, we must remember that the law says three years of non-compliance before being considered for delisting. Alibaba was just put on this list, meaning in a worse-case outcome, the shares could be considered for delisting in around 2025. By then, the SEC and the Chinese government may have resolved all of the audit issues, and Alibaba’s share price could be much higher.

The Ant Group Incident

Before the SEC’s announcement regarding Alibaba’s placement on the infamous watchlist, Alibaba’s shares fell due to the Ant Group announcement. After about a year of pressure, Alibaba’s founder Jack Ma is giving up “control” of Ant Group. Ant Group is the most prominent fintech company in China and possibly the world. The company operates AliPay, a payment app with over a billion users. There was also going to be a massive $37 billion Ant Group IPO, which would have valued the company at around $200-300 billion or more. However, that IPO got blocked by the CCP about a month after Jack Ma made some critical comments about the country’s government and financial system.

Now, Jack Ma controls about 50.5% of Ant Group’s shares but will relinquish control by transferring some of his voting power to other Ant officials, including the company’s CEO. However, Jack Ma stepping away from Ant’s control is not a negative factor. Instead, it may be a very constructive development for Alibaba. Alibaba still owns a 33% stake in Ant Group. Jack Ma stepping away increases the chances of an Ant IPO, even if it comes a year or so down the line.

We’ve already seen some reports that Beijing may give the nod to Ant Group soon, and an Ant IPO would be massive for Alibaba shareholders. Alibaba’s market cap has dwindled to just around $240 billion recently. If the Ant IPO prices near the prior IPO’s expectations, we could see Alibaba’s share valued at $70 – 100 billion, implying that Alibaba’s market cap minus Ant is just around $140 – 170 billion now, silly.

What is Alibaba Worth?

Let’s look at the company’s earnings and revenues to get an idea of what Alibaba is worth.

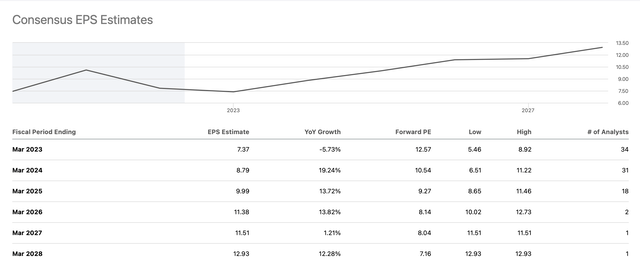

EPS Estimates

Alibaba is going through a transitory earnings decline phase. This year’s EPS growth should be off by about 6% YoY (consensus estimates), but double-digit EPS growth should return after that. If we go by next year’s consensus estimates, Alibaba is trading at a forward P/E of around ten. This valuation is relatively cheap, as comparable companies trade at much higher multiples. Amazon (AMZN) closely resembles Alibaba but trades at about 56 times next year’s EPS estimates or about 5.5x Alibaba’s valuation. Also, Alibaba’s future EPS estimates are likely lowballed, and the company could earn much more in fiscal 2025 and beyond.

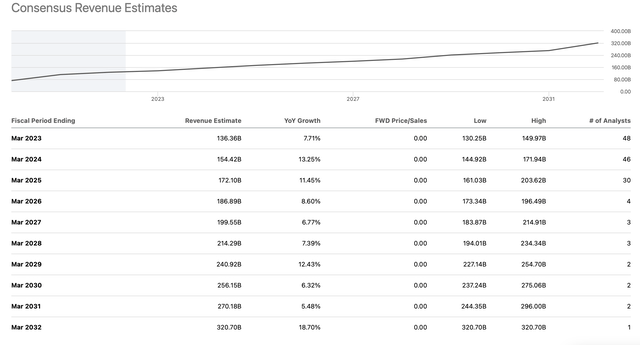

Revenue Estimates

Regarding revenues, Alibaba is trading at about 1.75 times this year’s consensus revenue estimates and about 1.55 times next year’s forward sales. Therefore, we’re looking at a 1.75-1.55 P/S valuation and expected revenue growth of approximately 8-12% in the coming years. Revenue estimates may also be lowballed here, and I suspect Alibaba could deliver growth of 10-15% as we advance.

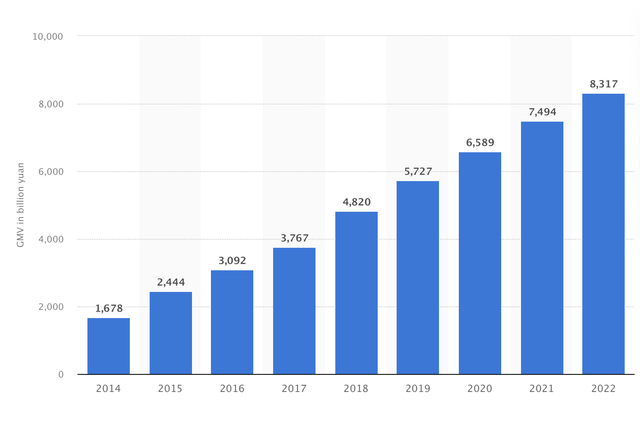

It isn’t easy to compare Alibaba to Amazon on a P/S basis as the companies compute revenues differently. However, if we look at gross merchandise volume (GMV), Alibaba’s was about double Amazon’s in 2021, $1.2 trillion vs. $600 billion. GMV may be the most accurate way to assess an e-commerce platform’s “revenues,” and we see that Alibaba looks remarkably undervalued based on this metric.

Alibaba (GMV) Billions Yuan (fiscal)

We see the strong growth in Alibaba’s core business continue here. Alibaba reported a GMV of $1.2 trillion in 2021, and its market cap is only about $240 billion. So, it is now trading at about 0.2, or 20% of its GMV. On the other hand, Amazon has a market cap of nearly $1.4 trillion, trading at more than two times its GMV, or roughly 10x the valuation of Alibaba right now.

If we look at other big techs for a P/S comparison, Microsoft (MSFT) trades at about nine times sales now. Alphabet (GOOG) (GOOGL) is down at about five times sales. Meta (META) is at about four times sales now. Also, these P/S ratios are relatively low, and most have come down a lot in recent months. However, we see nothing that resembles Alibaba’s 1.55-1.75 current/forward P/S valuation. Therefore, Alibaba is undervalued right now, and we’re not adjusting for the Ant IPO yet.

The Bottom Line: Alibaba Should Head Much Higher

Objectively, Alibaba should be worth at least around $300 right now. A $300 stock price would put Alibaba’s market cap at about $750 billion, giving the company a forward P/S multiple of around 5. This valuation would also put Alibaba’s price to GMV ratio at about 0.625, much better than the current depressed 0.2 figure. At $300, the forward P/E ratio of around 30 may look rich, but we need to consider that Alibaba’s earnings and EPS estimates are at a low point. Furthermore, at $300, Alibaba would still be nearly twice as cheap as Amazon with its 56 forward P/E multiple.

As we move on, fears regarding a possible Alibaba delisting should abide. Moreover, the Ant IPO looks more probable now that Jack Ma is giving up control of the financial giant. The Ant IPO could occur about a year from now and should unlock significant value for Alibaba shareholders. Additionally, the stock is remarkably undervalued right now. It’s trading around 2014 IPO levels when the company’s GMV was around 1.6 trillion yuan, a fraction of its current GMV. So, the market may not understand just how undervalued Alibaba is now. Minus the uncertainties and delisting concern, Alibaba’s stock price should be around $300 (minimum), in my view, and it is likely heading there as the situation clears up in time. Yes, and Alibaba should report earnings on August 4th, and the results will probably come in above the lowballed and depressed estimates. So, keep an eye on Alibaba, as the stock could fly.

What Alibaba’s financials could look like in the coming years:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $138 | $156 | $177 | $198 | $222 | $246 | $274 |

| Revenue growth | 13% | 13% | 12% | 12% | 11% | 11% | 10% |

| EPS | $8.10 | $10.10 | $12.63 | $15.16 | $17.88 | $21 | $25 |

| Forward P/E ratio | 9 | 15 | 17 | 20 | 19 | 18 | 17 |

| Price | $90 | $189 | $257 | $358 | $400 | $450 | $500 |

Source: The Financial Prophet

Risks to Alibaba

While I’m bullish on Alibaba, various factors could occur that may derail my bullish thesis for the company. For instance, the CCP could resume its tough stance and clamp down further on Alibaba and other Chinese tech giants. Moreover, despite the optimistic tone from Chinese authorities, U.S. regulators could still decide to delist the company’s ADRs. Increased competition could impact Alibaba’s growth and profits. The company’s growth could be worse than my current anticipation. Also, Alibaba’s profitability could continue to struggle for various reasons. This investment has multiple risks, so shares are very cheap right now. I believe Alibaba remains an elevated risk/high reward investment, and investors should carefully examine the risks before opening a position in Alibaba stock.

Be the first to comment