maybefalse

Alibaba (NYSE:BABA) stock popped around 8% after reporting 2Q23 earnings, despite missing revenue expectations. The Chinese tech and e-commerce giant has had its roughest year since going public, facing pressures from COVID-19 lockdowns, weakening consumer spending, and macroeconomic headwinds. Still, the company stays afloat. Our bullish sentiment on the stock is based on our belief that the worst of the macroeconomic headwinds and lockdown restrictions have been priced in, leaving the company’s valuation too attractive to ignore.

We recommend investors buy the stock pullback because we believe Alibaba’s core fundamentals remain intact. We expect the company to recover and grow meaningfully in CY2023 on the back of Alibaba Cloud and easing lockdown restrictions in China.

Headwinds are priced in, for the most part

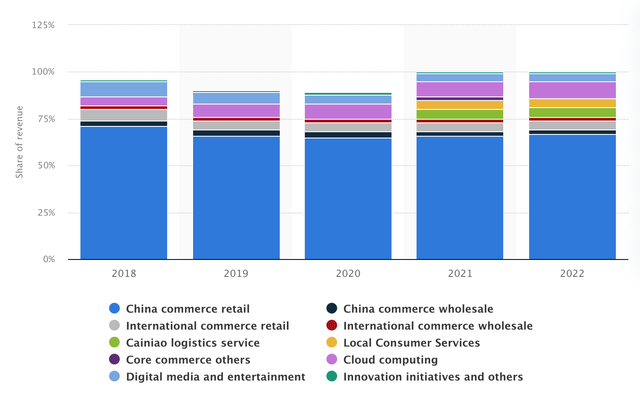

Alibaba has been under significant pressure in its money-making department: China E-commerce. While Alibaba has expanded its business to integrate tech, the company remains a retailer at heart. The devaluation of the yuan currency, alongside the global weakening consumer spending, took a bite out of Alibaba’s revenue this past quarter. Alibaba reported revenue of $29B, achieving a 3% Y/Y growth but falling short of expectations by $490M. Despite the 2Q23 earnings report, we believe Alibaba is well-positioned to grow in the e-commerce business in the long run. We believe Alibaba’s customer base is more resilient than the market is giving it credit for. While 2Q23 reported a decline in the number of total buyers, we believe the company’s Business-to-Business (B2B) model provides Alibaba with high-spending customers that will support sales even during market downtrends. We believe the company is trading cheaply for its position in the e-commerce market in China- with over 60% of the market share in 2021. We believe most of the weak consumer spending and lockdown restriction headwinds have been priced into the stock.

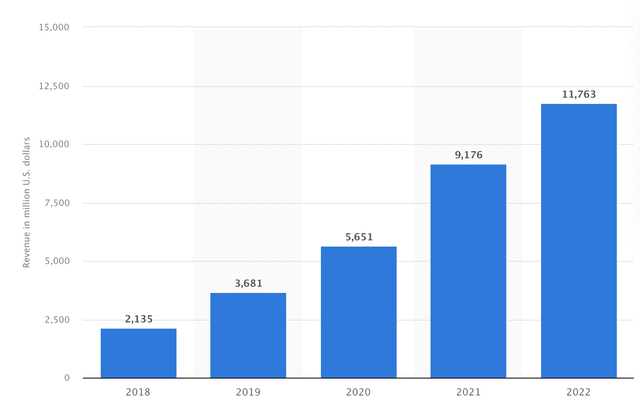

The following graph outlines Alibaba’s annual revenue distribution between 2018-2022.

The stock has taken a hit- but we expect e-commerce to recover when 1) global consumer spending picks up and 2) as China eases the COVID-19 lockdown restrictions. The latter has already taken effect with China announcing restrictions are being lifted– despite China reporting that 25,353 individuals tested positive for COVID-19 on Friday. We expect China’s ‘Zero-COVID’ policies to remain uncertain towards the end of the year, but we believe the government is taking measures to fine-tune the restrictions so they do not disrupt business and daily life. We’re more constructive on Alibaba’s e-commerce business going forward and believe the stock’s valuation is too attractive to ignore.

Alibaba Cloud is the third-largest cloud provider

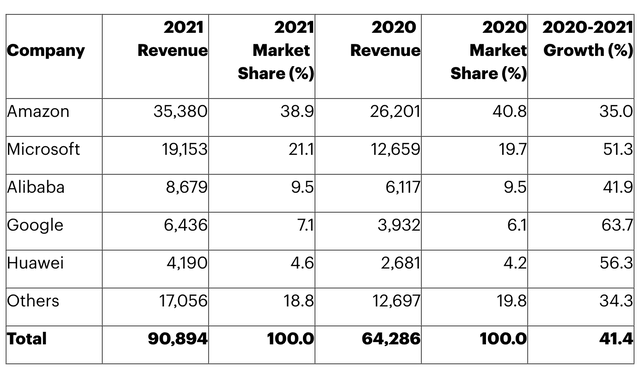

Alibaba Cloud was the company’s second revenue driver in its 2Q23 earnings report, growing 4% Y/Y. Alibaba is expanding its position as a cloud provider investing $1B in a “global partner ecosystem upgrade.” The Chinese Cloud provider is now the world’s third-largest cloud provider after competitors Amazon (AMZN) and Microsoft (MSFT), with a worldwide market share of 9.5% in 2021, according to Gartner.

The following graph outlines Alibaba’s position among the top cloud providers globally.

We like Alibaba’s position in the cloud market forecasted to grow at a CAGR of 19.9% between 2022-2029. We expect Alibaba cloud to be at the core of advancing China’s digitalization and expect the stock to benefit from the upward trend in the cloud market. The company’s cloud business is already growing significantly.

The following graph outlines Alibaba Cloud’s growth between 2018-2022.

Stock Performance

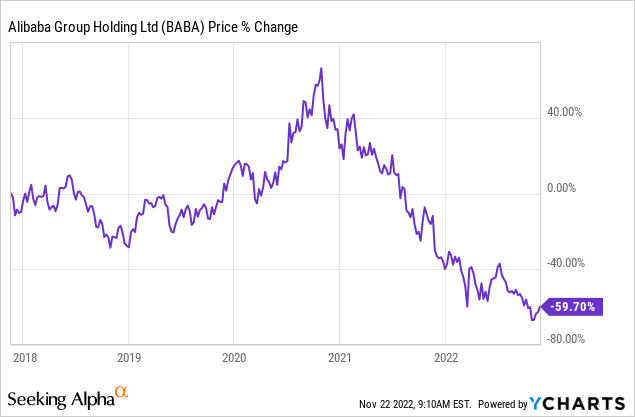

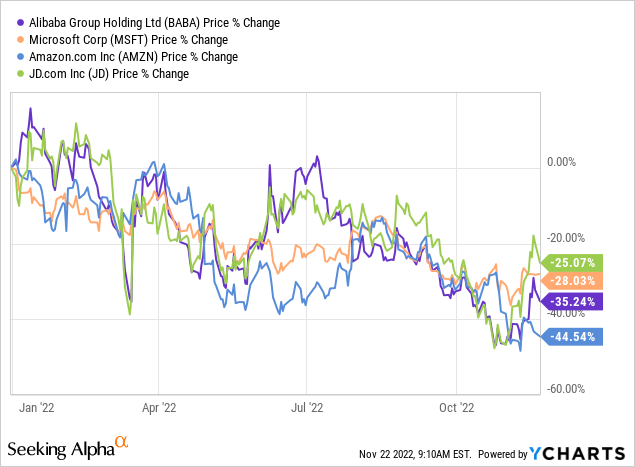

Alibaba stock is down around 63% over the past five years. YTD, the stock is down almost 35%. YTD, Alibaba is down alongside most of its peer group, with JD.com (JD)(HKG: 9618) dropping nearly 25%, Microsoft (MSFT) almost 28%, and Amazon (AMZN) around 56%. Our bullish thesis on the stock is based on our belief that the stock pullback creates an attractive entry point to invest in the company’s 2023 growth.

The following graphs outline the company’s stock performance over the past five years and YTD compared to the competition.

TechStockPros

TechStockPros

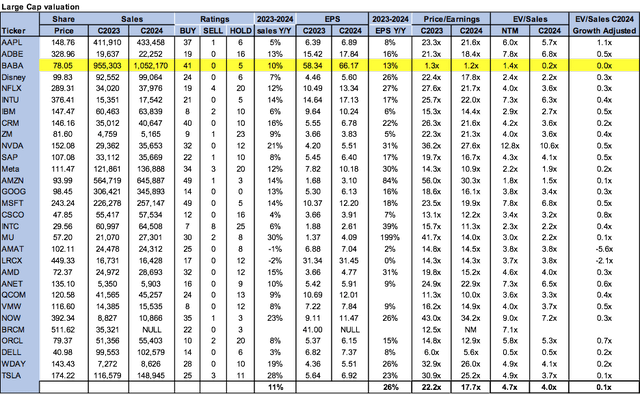

Valuation

Alibaba is exceptionally cheap, trading at 1.2x C2024 on a P/E basis EPS $66.17 compared to the peer group average of 17.7x. The stock is trading at 0.2x EV/C2024 Sales versus 4.0x. Alibaba’s valuation is central to our buy thesis. The stock is down around 44% from its 52-week high of $139, and we believe the company provides an attractive entry point into a major retail and tech company.

The following table outlines BABA’s valuation compared to the peer group.

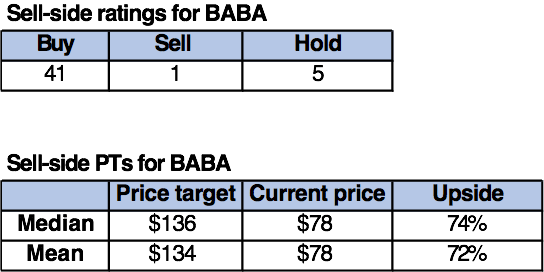

Word on Wall Street

Wall Street is overwhelmingly buy-rated on the stock. Of 47 analysts covering the stock, 41 are buy-rated, five are hold-rated, and the remaining are sell-rated. The stock is trading at $78. The median and mean price targets are set at $136 and $134, respectively, with a major potential upside of 72-74%.

The following table outlines BABA’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

Alibaba stock dropped 75% from its high of $317.14 in October 2020. We believe the stock provides an attractive entry point into one of the world’s largest e-commerce and cloud providers at a discount. We expect Alibaba to grow on two fronts: cloud and e-commerce. We believe Alibaba Cloud will benefit from the global shift to the cloud. We’re also constructive on the company’s e-commerce business once consumer weakness and lockdown restrictions in China ease. We recommend investors buy the stock before it rallies.

Be the first to comment