Andrew Burton

Alibaba (NYSE:BABA) is increasingly looking very compelling at the current levels as the fundamentals of the business looks to be improving while sentiment is still rather negative. For investors looking for a contrarian opportunity, I think that Alibaba could be the stock to watch, and this article highlights why.

Investment thesis

I have written previous articles on Alibaba that can be found here. I think we are starting to see positive revisions for Alibaba’s forward estimates and with improving news flow and better financial results, the risk/reward opportunity skews towards more favorable and as such, a contrarian investor would buy at current levels because of the following:

- China commerce: With more than 1 billion users on its platforms with an average spend of $1,300 per year, the next growth driver will be to increase wallet per share and to monetize this huge platform of users, driving quality growth for the future.

- International commerce: With e-commerce penetration in Southeast Asia remaining the structural driver for growth in the long-term, Lazada continues to be a key pillar in Alibaba’s future growth. With the expertise in e-commerce in China, there are synergies to be reaped from Alibaba to leverage on in its expansion for Lazada in Southeast Asia.

- Cloud: With a market leadership position in the Asia-Pacific region, Alibaba Cloud will continue to maintain leadership and grow at a quick pace. With multiple levers to pull, there are international expansion opportunities that can drive the next phase of growth for the business.

- Investing for growth in the future: The company remains committed to strategic and technology investments that are necessary for the long-term growth of the company, which will ensure sustainable and quality growth in its business.

China commerce trends looking good

In June, Alibaba management saw signs of recovery in their China commerce business due to deliveries returning back to normal, as well as improvement in the logistics situation in China after the April and May period. This year’s 618 festival logged positive growth, which was encouraging given the difficult operating environment Alibaba was operating in within China during the period. Also, management continued to see the recovery in China commerce business in July as momentum for the business continues.

That said, I am also wary of how the changes in macroeconomic environment as well as consumer sentiment may affect e-commerce as consumption spend is reduced during periods of economic downturns. Based on the NBS data shared by the Chinese government, the spending as a percentage of disposable income fell from 69% in the first half of the prior year to 64% in the first half of this year. Furthermore, I would add that this fall in spend as a percentage of disposable income was more pronounced in urban areas relative to rural areas. What this tells me is that there is the potential for discretionary spending to come down as consumers focus more on staples in the current uncertain economic environment.

As such, although I think we are starting to see some progress and improvement in consumption in Alibaba’s numbers, we might need more time for the consumer sentiment and economy to be strong enough to have a full recovery in China commerce.

To address the rising concerns about threats from short form videos competitors like TikTok and Kuaishou (OTCPK:KUASF), management commented that they see short videos as a content format and that Alibaba as a business also uses these short form videos on its platforms. For example, on the Taobao app, more than half of the content consumers view are in the short video format. As Alibaba continues to face different competitors that may vie for the e-commerce market, management remains focused on adopting new technologies like it has in the past, be it through moving to mobile or adopting short form videos. Ultimately, I think that it is important that Alibaba as a company adapts to the rapidly changing e-commerce environment as any new innovation or change in the industry may affect the way people interact, the way they engage and the way they consume.

Cost control initiatives to drive quality growth

With Alibaba executing its optimization initiatives and cutting costs, the current quarter’s adjusted EBITDA margins of 20% came in as a beat on expectations.

The main focus for management in the near term is to optimize its cost structure, which it has been focusing on for close to one year now. In my view, the beat on EBITDA margins and especially so for the China commerce EBITDA beat, shows the effectiveness in management’s cost structure optimizations strategy. I think moving forward, we will continue to see management do a wide range of strategies across its different businesses to streamline the cost structure and execute on its cost optimization plans.

As Alibaba’s financial position remains healthy, the management has significant flexibility to balance between their current cost optimization strategy and to continue to make strategic and technology investments for the long-term growth of Alibaba. With China commerce, having passed the 1 billion annual active consumer mark, the next phase of growth comes from building this relationship with the customer to deepen the relationship and build better loyalty and trust with the customer. As a result, the company needs to continue to invest in high quality infrastructure and technology for the China commerce business for the long-term sustainable growth of the segment. With this improved relationship and better segmentation of the various types of users, as well as the continued investments made by the company, I think we will start to see China commerce growth reaccelerate again.

International commerce

I was slightly disappointed with the results from international commerce this quarter. However, to be fair, the segment is facing headwinds from the European Union’s VAT rules on international commerce retail. As a result, the international commerce revenues for the quarter increased only by 2% year on year to RMB15.5 billion. Headwinds from EU VAT rules on international commerce retail

In particular, the combined business of Lazada, AliExpress, Trendyol and Daraz fell by 4% year on year. This weakness was due to the declining orders from AliExpress due to the changes in the EU VAT rules highlighted above, as well as disruptions in the supply chain in the region and the weakness of the Euro relative to the US dollar.

As for Lazada in Southeast Asia, we continue to see resilience order growth of 10% in the region year on year. There is some deceleration to be expected in the business as I think this is due to the impact from consumers moving into a post pandemic world as mobility restrictions improve in the region. However, I continue to have conviction in e-commerce in Southeast Asia in the long term as there are structural tailwinds driving the business that the short-term deceleration will not deter. Also, for Lazada, the company’s efforts to focus on improvements in operating efficiency resulted in narrowing of loss for the business in the current quarter.

Trendyol saw strong growth in the segment as the business grew 46% year on year. The company plans to focus more into high-frequency local consumer services business. Also, Trendyol served more than 225K merchants on its marketplace platform in the quarter.

Cloud computing recovering from non-internet sectors

In the current quarter, we saw the cloud computing revenues grow by 10% year on year, and the growth was driven by the recovery of non-internet industry. The recovery in the non-internet sector was driven by sectors like financial services, public services for example. However, this was offset by weakness from the internet, online education sectors. The internet sector, in particular, was rather weak due to Alibaba’s largest customer gradually stopping the use of Alibaba Cloud for its overseas business due to certain requirements, as well as softer demand from other internet customers.

As a result of the weakness from the internet sectors, non-internet sectors accounted for 53% of cloud revenues in the current quarter, up 5 percentage points from the prior year.

Alibaba Cloud continues to innovate and remain committed to be competitive in the industry. For example, to ensure it maintains its competitive edge, Alibaba Cloud continues to focus on new proprietary technology such as Cloud Infrastructure Processing Unit (CIPU), to provide customers with new product offerings and industry-specific solutions.

Positive GMV growth for local consumer services

Due to COVID-19 disruptions, Eleme’s restaurant orders declined during the quarter while this was offset by the stronger non-restaurant delivery orders during the quarter. As a result, the revenues for the segment grew at 5% year on year to RMB10.6 billion. On a positive note, the company is seeing the GMV growth turn positive in June 2022 as the business conditions normalize in June after a difficult April to May period.

Valuation

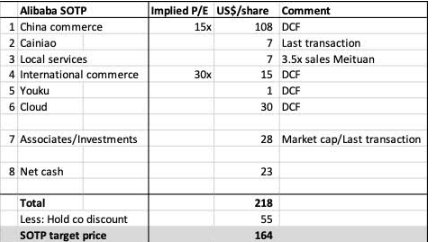

I continue to use a sum of the parts valuation model for Alibaba, segregating the business into its respective segments. For the China commerce, international commerce, Youku and the cloud businesses, these are valued by DCF while the investments as well as Cainiao were based on recent market capitalization of these companies as well as valuation at last transaction. With a holding discount of 55% applied, the target price for Alibaba is $164, implying 86% upside from current levels.

SOTP Valuation for Alibaba (Author generated)

Risks

Competition

While Alibaba continues to invest and position itself for the future, the company’s leadership position in the e-commerce segment in China may come under pressure if local competitors attempt to take market share from the company. These players include JD.com (JD) and Pinduoduo (PDD) that can cause increased competitive pressures in the market. With international players like Amazon (AMZN) and Sea Limited’s (SE) Shopee competing in its overseas markets, this could pose competitive pressures in Alibaba’s overseas markets.

Regulatory and political risks

This remains one of the biggest risks with big tech firms in China, but there are signs of easing of the crackdown. In addition, China has now completed the overhaul of the antitrust laws that aims to target big tech firms in China over anti-monopolistic behaviors. However, there are always risks that China may once again take aim at Alibaba or other big tech firms that may cause further pain to shareholders.

Cloud risks

As a result of intensifying competition from Huawei, Tencent (OTCPK:TCEHY) and China Telecom, Alibaba Cloud could face increased pressures for growth. Given its market leadership in the segment, this makes the company more vulnerable should other enterprises shift away from Alibaba.

Conclusion

The investment case for Alibaba is looking ever more compelling. The China commerce business is recovering from the early covid disruption and the next phase of growth driven by increased wallet share will reaccelerate the revenue growth for the segment. The international commerce and local consumer services segments will continue to grow rapidly as there are strong structural tailwinds supporting these businesses. Lastly, Alibaba Cloud will leverage on new growth opportunities in the form of the non-internet sector and international expansion to maintain its leadership cloud position. The target price for Alibaba is $164, implying 86% upside from current levels. With the improving fundamentals and negative sentiment for the stock, I do see Alibaba as one of the best contrarian investments in our generation.

Be the first to comment