Andrea Verdelli/Getty Images News

After starting a widespread crackdown against China’s tech sector, there are signs that Beijing is finally changing its policy in order to save the weakened economy caused by severe lockdowns that were aimed at curbing the spread of COVID-19 in major cities. This is undoubtedly a positive development for Alibaba (NYSE:BABA), which suffered the most from Beijing’s actions, as its shareholders lost hundreds of billions of dollars due to the state interference that pushed the company’s stock to new lows. If Beijing allows Alibaba to proceed with Ant Group IPO, then we could safely say that the worst for the company is behind it for now. However, the latest regulations against Alibaba have already decreased its investment attractiveness and the company will nevertheless continue to operate under the strict oversight of Beijing in the post-crackdown environment. As a result, it still becomes hard to justify a long-term long position in the company at this stage.

If Beijing Finally Backs Off?

Even though Alibaba received a record $2.8 billion fine more than a year ago, its stock continues to fall and in the last 12 months depreciated by around 50% due to the passage of new tech-related regulations along with the increased interference of Beijing into the company’s affairs.

However, after inflicting a major blow to the Chinese economy by imposing strict lockdowns in cities like Shanghai, Beijing is now in hurry to revive the economy in order to reach its 2022 GDP growth rate of 5.5%, the lowest in decades. In recent months, Chinese municipalities started to issue new bonds to drive growth, rumors start to surface that the current tax cuts for buying new vehicles will remain in place in order to spur up to $30 billion in consumer spending, while Xi Jinping signaled that more economic policies are on the way during the BRICS Summit earlier this month. Reaching an official GDP growth rate is important for the leader of the Central Committee of the CCP since later this year a National Congress of the Chinese Communist Party will be held in which Xi Jinping will stand for reelection for the third term. That’s why successfully dealing with the negative lockdown effects on the economy is important for him, since the street expects only a 4.1% GDP growth rate in China this year.

Considering that China’s tech sector accounts for around 30% of the country’s GDP, making peace with the companies from the industry is vital in order to achieve a 5.5% GDP growth rate this year. There’s an indication that Beijing is no longer pressuring the tech industry as much anymore, as in recent months there has been an increase in harsh rhetoric from Chinese officials regarding the sector. At the same time, earlier this month JD.com (JD) officials noted that regulations become more rational now than before, which is a positive sign for the whole industry.

However, it’s still hard to tell whether Beijing will succeed in its endeavors, given that it plans to stick with a zero-COVID strategy, which could lead to another lockdown if there’s going to be a new COVID-19 outbreak in the following quarters. In addition, the latest China Beige Book survey recently showed that there’s no bounce back in China’s economy, which indicates that the current policy measures are not enough to revive growth. Even the official housing market measures are currently failing, as the demand for new houses is not growing as expected after the new home prices have been cut in half in April and May in major Chinese cities. What’s also worse is that the slowing economy has negatively impacted consumer spending and Fitch now expects slower online retail growth this year, while Bernstein sees weaker ad spending, which is a negative sign for Alibaba since eCommerce and online ads are one of its main businesses.

Could Ant Group Save The Day?

Even if the Chinese economy doesn’t grow as much as officials expect, the possible Ant Group IPO later this year could nevertheless help Alibaba minimize the downside of weak consumer spending. Earlier this month Reuters reported that the Chinese regulators received the initial approval from Beijing to start working on reviving an IPO, which pushed Alibaba shares up ~10% when it was reported, as the Chinese behemoth has a ~33% stake in Ant Group. However, last week the Chinese officials denied the story about a possible IPO, which itself was supposed to take place in late 2020 until Beijing’s crackdown against Ant Group and Alibaba started. Despite this, Bloomberg sources were saying that this month Ant Group would at least apply for a key license to become a financial holding company before proceeding with an IPO, so we will likely get some news whether it happened or not in July.

Ant Group itself has been engaged in a lengthy process of restructuring to meet the regulators’ requirements, which were presented to the company after the IPO was canceled. Therefore, a possible IPO is not something out of reach at this stage. At the same time, cashing out and selling its stake in Ant Group in an open market would be beneficial for Alibaba in the long term. In the past, I have highlighted how the rise of the Digital Yuan could break Ant’s duopoly with Weibo in the Chinese online payments market. Digital Yuan itself is an efficient tool for Beijing to encourage spending and revive the economy, so making it more accessible is in the interest of the state officials. There are already 261 million Digital Yuan wallets, which account for around one-fifth of the Chinese population. At the same time, Digital Yuan already reached nearly $14 billion in transaction volume despite it being in the pilot phase. Therefore, an Ant Group IPO will be beneficial for Alibaba shareholders, as the financial business could lose the ability to generate substantial returns over time due to the inability to compete with Beijing. Therefore, positive developments regarding an Ant Group IPO could push Alibaba’s stock higher and we’ll likely read more news about it in July.

What’s The Real Value of Alibaba?

In my recent article on Alibaba, I have already covered the company’s latest earnings and a disastrous outlook for the current quarter. Without a doubt, lockdowns will play a negative role during the June quarter, as the street expects a negative revenue and earnings growth rate during the three months. However, it seems that the downside for the current quarter is already priced in, so I decided to create a DCF model to find out the fair value of Alibaba and where it could trade in the future.

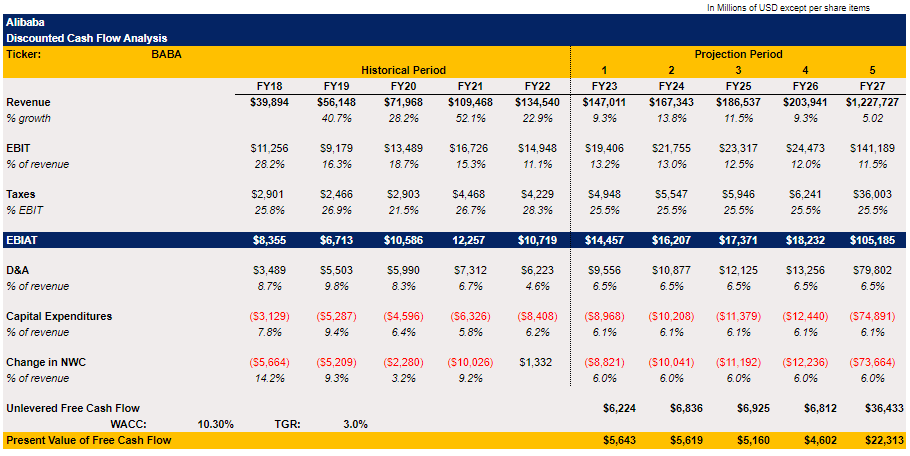

Since there are over 40 advisory firms that cover Alibaba, I decided to take the streets’ consensus revenue growth rate, which could be found here, for the base case scenario. The other rates in the model are mostly averages from the previous historical periods.

Alibaba’s DCF Model (Historical Data from Seeking Alpha, Forecasts Are Made By The Author)

The terminal growth rate in the model is 3%, which is higher than the 2.5% rate that I applied when I valued Western Big Tech. However, China continues to grow at a greater rate than the rest of the developed world and since most of Alibaba’s business is conducted at home, it makes sense to give it a higher growth rate.

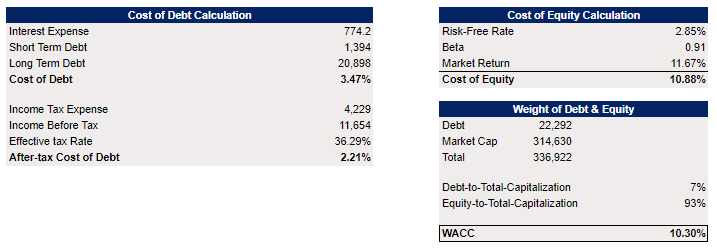

The WACC calculations are below. Interest and tax expenses along with the type and amount of debt when calculating the cost of debt have been taken from Alibaba’s financial statements here on Seeking Alpha. Beta in the cost of equity calculations stands at 0.91, for the risk-free rate, I have used a Chinese 10-year government bond yield, while for the market return I used the average performance of the Hong Kong stock market in recent decades. The WACC in the model stands at 10.30%.

Alibaba’s WACC (Historical Data from Seeking Alpha, Forecasts Are Made By The Author)

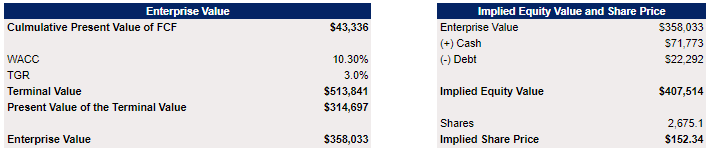

The equity value in this model stands at $407 billion, which gives us an implied share price of $152.34 per share, which represents an upside of ~30% from the current levels.

Alibaba’s Enterprise and Equity Value (Historical Data from Seeking Alpha, Forecasts Are Made By The Author)

Is BABA Investable?

While Alibaba trades at a slight discount to its fair value solely on the fundamentals, there are several reasons why I still think that its stock is not a decent long-term play and is not worth pursuing.

First of all, the fate of Alibaba’s stock on the American exchanges depends on things that are outside of its control. In the past, I have already mentioned how the regulators from both sides of the Pacific still can’t reach an audit deal to this day and there’s a risk that if no progress has been made by the end of this year, then the possibility of a possible delisting will increase.

In addition, I have already mentioned that it makes sense for Alibaba to make Ant Group a public company and generate substantial net proceeds from its current ~33% stake in the business. However, once and if that’s going to happen in the foreseeable future, the main question would be how Alibaba will be able to improve its bottom-line performance in the future. In Q4, Ant Group made Alibaba $1.15 billion in profits, which helped it to ease the weak bottom-line performance, as the company’s total net loss in Q4 was -$2.9 billion. Once and if Ant Group is gone and proceeds from the IPO are collected, it will become harder for Alibaba to find a similar source of profits in the future.

On top of that, the upside in the model is based solely on fundamentals, which is not enough to make the stock a buy since any policy changes by Beijing could create more uncertainty in the future. Nothing stops the state from returning to its practice of interference next year if the economy stabilizes or when Xi Jinping gets another term and doesn’t have to worry about his future as a head of state in the upcoming years.

We should also not forget that a significant portion of strict regulations have already been passed and will not go anywhere even if Beijing makes peace with the tech sector. We could see from the model that the street gives Alibaba a smaller revenue growth rate in the future, and new regulations among other things likely have a lot to do with it.

Considering this, I stick to the opinion that it’s hard to justify a long-term long position in Alibaba given how fragile the current stable relations with Beijing could be and how everything could change in an instant. A new set of regulations along with a constant risk of further state interference will likely continue to keep pressure on the stock in the long run.

Mark Your Calendars For July 7

I’m happy to announce that on July 7 I’ll be launching my own marketplace service here on Seeking Alpha called BlackSquare Capital. As we’re entering a new geopolitical reality, the goal of the service will be to assist you in building an event-driven portfolio, which can weather any storm and thrive in volatile environments. There will be a very special introductory price for a limited number of the first subscribers, so stay tuned!

Be the first to comment