Robert Way

Article Thesis

Alibaba Group Holding Limited (NYSE:BABA, BABAF) reported its most recent quarterly results on Thursday morning. The company fared better than expected profit-wise, and the underlying performance was far from bad when we consider the macro environment. With the valuation remaining ultra-low, Alibaba remains a pick with significant upside potential, although the risks should not be neglected.

What Happened?

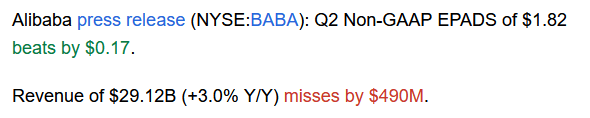

Alibaba reported fiscal Q2 2023 results that missed estimates on the top line, but profitability was stronger than what analysts had predicted:

Seeking Alpha

Revenues were up 3%, which missed estimates, as analysts had predicted growth in the 4%-5% range. At the same time, Alibaba outperformed earnings per share estimates by more than 10%, however. That’s arguably more important than the top-line miss, as profit (and cash flow) is what ultimately counts for investors.

Performance: Not Bad Considering The Macro Environment

When a former growth high-flyer delivers revenue growth of 3%, that brings up some questions, of course. But there are many things to consider here. First, Alibaba is by far not valued like a growth stock any longer. Instead, it’s trading in deep value territory right now. There is not a lot of growth priced into the stock any longer — one could even argue that Alibaba is priced as if it were not to grow again, ever, as the stock trades with an earnings yield of 9%-10% right here.

Second, the macro environment matters. Alibaba is a China consumer story, and Chinese consumers face several headwinds. Issues with the Chinese real estate market have hurt consumer sentiment, which results in a hit to discretionary spending. Also, harsh COVID measures, including big lockdowns, continue to hurt economic growth in the country. In an environment like that, retailers, even online retailers, have a hard time generating business growth. The good thing is that Alibaba will likely see its sales growth and business performance improve once the economic picture in China lightens up. When COVID measures in China are eased — the timing of that is not known, but it will happen eventually — then economic growth should pick up again, and consumers will be more eager to spend their money. Once that happens, Alibaba should see its revenues grow more again, I believe. The rather low growth we are seeing today is thus driven by macro headwinds to a large degree, and not a company-specific issue.

It is also important to see Alibaba’s revenue growth relative to that of American peers. Many other tech stocks aren’t delivering a lot of business growth, either. Amazon (AMZN), for example, saw its revenue grow by 7% during the first half of the year — at a time when inflation was as high as 9%. Alibaba’s revenue growth during the most recent quarter was lower, at 3%, but inflation is way lower in China versus the U.S. and Europe as well. For the current year, consumer inflation is forecasted at 2%-3% in China, thus the growth in real terms is relatively comparable when we look at Amazon and Alibaba — the major difference being that BABA trades at a very low valuation, while Amazon trades at a very high valuation (90x trailing net profits).

Looking at Alibaba’s underlying business performance, there are some encouraging trends. The company’s EBITA, for example, improved by a sizeable 29% year over year, despite the lowish revenue growth figure. This showcases that Alibaba has increased its focus on driving profitability, which is a good thing for investors. A growth-at-all-costs mindset that results in a more pronounced revenue growth rate but that goes hand in hand with overspending on operating expenses isn’t creating value for shareholders. A less pronounced revenue growth rate that goes hand in hand with significant operating leverage and that drives a more meaningful earnings growth rate is good for investors, however.

Alibaba also saw its cash flows improve dramatically. Operating cash flow came in at $6.6 billion, which was up by a hefty 31% year over year, largely driven by the company’s improved profitability. Since Alibaba also scaled down its growth spending to the most promising areas, free cash flows grew even more (as the company held back on capital expenditures). Free cash flows during the quarter totaled $5.0 billion, which was up by more than 60% year over year. That’s $20 billion annualized, which compares very favorably to the market capitalization of $210 billion Alibaba trades at right now. In other words, the company trades at just around 10.5x the current free cash flow run rate. If Alibaba were to never grow its cash flows again, and if the company was content with just returning its cash flows to its owners, investors could expect annual returns of close to 10% a year, as the free cash flow yield is 9.5% based on the most recent quarterly results. That’s not an especially bullish scenario, as I believe that there is a pretty good chance that free cash flows will grow in the long run — especially once China’s economy is opening up again, as that should result in a boost to BABA’s business growth.

Alibaba is already utilizing its huge cash flows for shareholder returns. Under its $25 billion share repurchase program, BABA has bought back $18 billion worth of stock already — around 9% of the current market capitalization. I believe this will continue, potentially at an even higher rate, as BABA has just increased its authorization by another $15 billion. This gives Alibaba a $22 billion unused share repurchase authorization — more than 10% of the current market capitalization. Since BABA has strong free cash flows and a sizeable net cash position on top of that, it could theoretically buy back shares at a pretty hefty pace. Its net cash position, defined as cash and cash equivalents, short-term investments and other treasury investments included in equity securities and other investments on the consolidated balance sheets, totaled $68 billion at the end of the quarter. That’s equal to around one-third of BABA’s market capitalization. This means that the company could theoretically buy back around one-third of its shares if it were to blow all of this cash on buybacks (which is unlikely, though). At the same time, the major net cash position suggests that BABA’s valuation is even lower than it appears at first sight. When we adjust the earnings multiple and the free cash flow multiple for Alibaba’s net cash, the company is not valued at 10x to 11x net profit/free cash flow. Instead, the cash-adjusted valuation drops to around 7x net profit or free cash flow, which is very cheap both in absolute terms and relative to how Alibaba was valued in the past.

Opportunities And Risks

The low valuation and the potential for improving business results once China’s economy is opening up again results in significant upside potential for BABA’s shares — if things go right. When China worries were to calm down over time, it would not be outrageous at all for Alibaba to trade at 15x to 20x net profit again. I do not expect that in the near term, but it could happen over a couple of years as long as no major new problems emerge. Alibaba is thus a stock with a pretty good return potential if things go right.

At the same time, risks shouldn’t be neglected, of course. The biggest risk in the eye of many investors isn’t tied to BABA as a company, but rather to the country it primarily operates in. Chinese equities are unloved, due to uncertainties about COVID policy and due to worries about a potential escalation of the Taiwan conflict. That would indeed hurt Alibaba quite a lot, but that being said, many non-Chinese companies that either depend on China or Taiwan as an end market or manufacturing partner would be heavily hit as well — think NVIDIA (NVDA), Tesla (TSLA), Apple (AAPL). Since none of these companies are priced for disaster, despite their pronounced vulnerability versus an escalating Taiwan conflict, it’s surprising to see that Chinese equities oftentimes are priced as if major problems were pretty certain.

I do thus believe that investors should definitely keep an eye on the risks when it comes to investing in BABA. But investors should not necessarily see these risks as a reason to not even look at BABA, as it looks to me that risks are already accounted for in BABA’s very depressed share price and valuation.

Takeaway

Alibaba Group didn’t grow much during the quarter, but that was to be expected. The macro environment is harsh for consumer players in China today, and Alibaba actually made solid progress in growing its profits and cash flows.

Since Alibaba shares are priced for disaster, there is considerable upside potential if disaster can be avoided. For those that are willing to stomach the risks, BABA could thus be an opportune choice at the current ultra-low valuation.

Be the first to comment