maybefalse/iStock Unreleased via Getty Images

Although fears of delisting for Alibaba Group Holding (NYSE:BABA) have subsided in recent weeks, the stock appears set to fall to new lows.

In this article, I will discuss Alibaba’s precarious situation and why I believe the stock is about to hit new lows in the near future.

With sales growth slowing and clouds forming over the global economy, Alibaba appears to be in a no-win situation.

Despite the fact that Alibaba recently gained momentum after achieving primary listing status in Hong Kong, I believe the stock is due for a significant decline, and I will explain why.

Short Position Disclosure

In the spirit of full disclosure, I want every reader to be aware that I am biased against Alibaba Group Holdings for three reasons before reading this article:

- Alibaba is going through an unprecedented sales slowdown;

- Delisting concerns are real and justified;

- Chinese economic growth is slowing.

Because of these three factors, I’m short through put options, and my short position is small, so my risks are low. In the worst-case scenario, I will lose the premium I paid when the put options expire worthless.

My brief thesis can be found here.

A Market In Peril: Prepare For Alibaba’s First Quarter With Less Than 0% Sales Growth

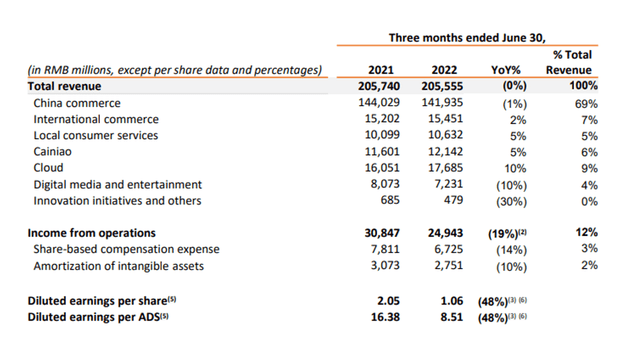

Alibaba’s slowdown in spending in the June quarter was due to consumers’ decreased willingness to spend money.

Flatlining sales growth was an unthinkable development for Alibaba just a year ago, but a confluence of factors, including (but not limited to) high inflation, slowing retail sales growth in China, deflating economic growth, and increasingly hawkish monetary policies, has brought Alibaba to this point.

This week, for example, the Bank of England expanded its emergency bond-buying program in response to distress signals in the bond market, indicating that the global economy is in jeopardy.

Other recession warnings came from J.P. Morgan chairman Jamie Dimon, who predicted that the United States would enter a recession in 6-9 months.

The IMF recently reduced its growth forecast for 2023 to 2.7%, a 0.2 percentage point decrease from its previous estimate, and warned that “the worst is yet to come”.

Because Alibaba is a true eCommerce behemoth with 1.1 billion customers and tentacles spreading across the globe, particularly in Southeast Asia, the eCommerce company is a bet on global growth.

Given the global economic headwinds, Alibaba may report its first quarter of sales growth below 0% next month. Alibaba’s growth already slowed to 0% in the June quarter, making it very likely that the Covid resurgence and headwinds to global economic growth resulted in a negative-growth quarter.

Sales Growth (Alibaba Group Holding)

A little more than two-thirds of Alibaba’s sales continue to come from the Chinese market, implying that, in the short to medium term, Alibaba, despite its increasing integration into the global economy, is still essentially a bet on the Chinese market as a whole. Unfortunately for Alibaba, the domestic market is currently in disarray.

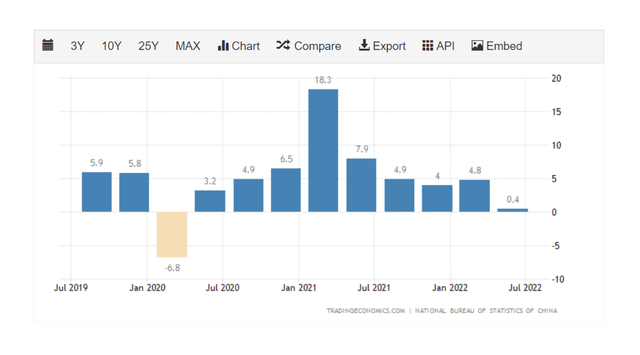

China’s Economy Experienced A Sharp Downturn In 2Q-22

As China’s largest eCommerce company, Alibaba is betting on the broad potential of the Chinese economy, which is in bad shape. China’s GDP increased by only 0.4% in the second quarter, far less than the 1.0% predicted by economists. China’s economic growth slowed from 4.8% in the first quarter, and prospects for 3Q-22 don’t look much better given the widespread resurgence of Covid-19 in the third quarter.

China’s GDP (Tradingeconomics.com)

$50 Price Level Would Be An Attractive Purchase Level

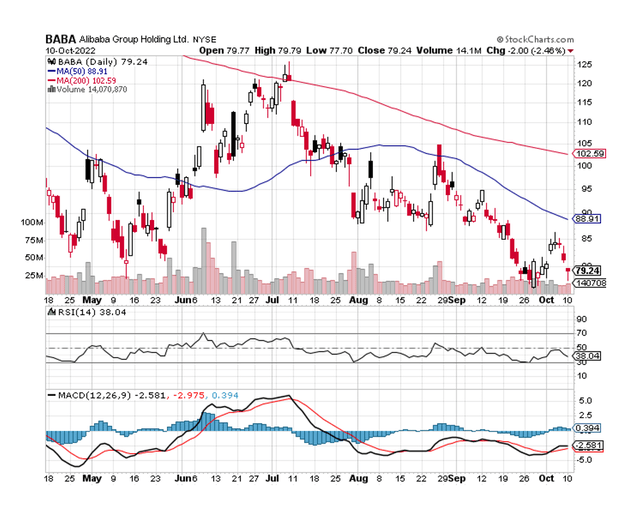

Alibaba’s chart also does not look promising. BABA stock failed to sustainably breach through the 50-day moving average in August (and then again in October), which could have significantly improved Alibaba’s chart situation.

Despite a brief surge in August following Alibaba’s primary listing in Hong Kong, the general stock price trend has been one of weakness and low trading volume, indicating that the market is waiting for news to react to.

Moving Average (Stockcharts.com)

I intend to close my short position around the $50 mark, at which point Alibaba’s stock price will have fallen by more than 50% since I began my short position. It is also a valuation level at which I would feel comfortable reversing my trade and going long Alibaba.

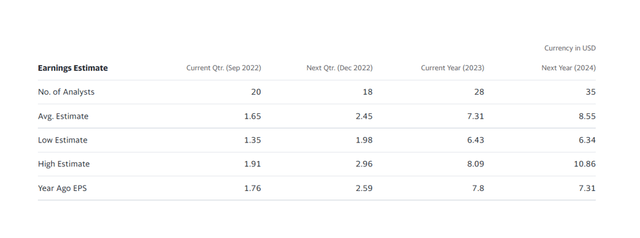

The market currently forecasts $7.31 per share in Alibaba earnings for the fiscal year 2023, which may be an overly optimistic estimate given that the market is generally in decline and BABA is already down 6% as I write this. I believe $5 per share is a more reasonable assumption.

A $50 price target and $5 earnings per share imply a P/E ratio of 10x, which represents a high enough margin of safety for me to consider closing my short position and going long Alibaba.

Earnings Estimate (Yahoo Finance)

Why Alibaba Could See A Higher Stock Price

The Chinese economy may regain its footing, resulting in a rebound in retail sales growth, which will most likely support Alibaba’s overall sales growth. An end to the Covid-19 pandemic would also benefit eCommerce sales growth and Alibaba’s industry prospects.

Alibaba’s valuation could rise if the market gains confidence in its ADR shares’ ability to remain listed on a U.S. stock exchange, a possibility that investors have recently begun to discount.

My Conclusion

The fact that Alibaba failed to reclaim the 50-day moving average in early October and that the stock continues to fall is concerning.

Because the eCommerce company is very likely to report less than 0% sales growth in the last quarter, the stock could be headed for new lows.

Furthermore, excitement over a Hong Kong primary listing faded quickly, indicating that the market is concerned about Alibaba on a much deeper level.

The catalyst for a renewed push to the downside could be next month’s earnings report, which is expected to be disappointing by all accounts. With the Chinese economy slowing rapidly throughout the quarter, I believe Alibaba will report its first ever negative sales growth as a public company in November.

With the risks still outweighing the potential rewards, I believe Alibaba’s stock price will fall significantly.

Around $50, I’ll close my short position and consider a long position.

Be the first to comment