Kevin Frayer/Getty Images News

Thesis

Alibaba Group Holding Limited (NYSE:BABA) investors should be feeling that they have been thrown under the bus again as Chinese President Xi Jinping is consolidating his power in the CPC’s 20th National Congress.

In our previous article, we discussed why the market needed to de-risk Alibaba’s execution risks as we entered into a pivotal two weeks for China. Therefore, investors should note that the market had already started the steep selloff in Chinese equities since its July highs.

Notwithstanding, we didn’t expect the market to force the selldown to re-test BABA’s March and May 2022 lows. Therefore, we believe it’s timely to reassess whether our thesis of a sustained bottom for BABA’s March lows still makes sense. We urge investors to be cautious about throwing in the towel at these moments.

It’s critical to understand that Alibaba is still positioned to ride the recovery in the Chinese economy from CQ3, even though the economic data release has been delayed. Therefore, we believe it could have struck fears even among the staunchest bulls who built their positions at March/May lows, capitulating with the other fearful investors.

While the “Xi Jinping risk” is set to rise (behooving a broad de-rating), investors are reminded that China’s long-term growth story remains intact. Just ask Europe’s leading automaker Volkswagen (OTCPK:VWAGY), as it looks to safeguard its market leadership in its most important market amid intense competition.

Newly-appointed CEO Oliver Blume “will travel to China [in November] as part of the automaker’s push to preserve its share of the world’s largest car market.” Blume is set to join a high-level delegation led by German Chancellor Olaf Scholz, even as the political relations between the EU and China could be headed for more controversy moving ahead.

Hence, top business executives know that ignoring the continued rise of China despite an increasingly polarized world is not wise, as they still depend on China tremendously for their business performance.

Therefore, even as the market is de-risking the risks as Xi holds steadfastly to power, we urge investors to take the long view at such beaten-down valuations.

With the re-test against its March lows in place, we believe the market has shaken out enough weak holders, including those who bought at its March lows.

As such, we revise our rating on BABA from Buy to Strong Buy.

The Market Was Arguably Disappointed

The market had likely anticipated Xi Jinping to announce measures to progressively lift its zero COVID strategy in China, which has hobbled the economy tremendously.

However, aside from a possibly shorter quarantine for inbound travelers, Xi appeared to hold on firmly to the convictions of his zero COVID approach, as he accentuated:

In responding to the sudden attack of Covid-19, we put the people and their lives above all else and tenaciously pursued a dynamic Zero Covid policy. We have protected the people’s health and safety to the greatest extent possible and made tremendously encouraging achievements in both epidemic response and economic and social development. – Bloomberg

Therefore, companies and investors waiting for a progressive easing of China’s stringent COVID restrictions are compelled to wait again, despite China’s economic malaise.

It proves Xi has been highly consistent with his decisions, and investors are urged to refrain from second-guessing him. CMB International Capital Corp. articulated: “The market is looking for catalysts, mainly in adjustments in the Covid-Zero policy and stronger support on the housing market. However, there are no major positive surprises to drive a re-rating in China and Hong Kong stocks, in particular consumer discretionary, property, and Internet sectors.”

Loomis Sayles Investments Asia also accentuated the lack of “concrete plans,” as it explained:

As investors, we are looking for concrete, analyzable and executable plans from the meeting. So far, we only see high-level words, commitment and long-term vision. While China does emphasize development, there are no concrete plans at the moment. – Bloomberg

Furthermore, Xi appears to be consolidating his power at the top, surrounding himself with “yes-men,” as his current No.2 Chinese Premier Li Keqiang is heading for the exit after the congress.

Hence, it should further strengthen Xi’s power at the top, entrenching his ability to influence and possibly “dictate” the outcome of Chinese politics and foreign affairs strategy to the detriment of its international partners. Associate Professor Alfred Wu from the National University of Singapore Lee Kuan Yew School of Public Policy highlighted:

Xi’s people will get a big win. Xi feels comfortable with these folks, and they will support Xi’s policies and even Xi’s fourth term. It will strengthen one-man rule. China’s relationship with the West will become worse. Xi is in an echo chamber. – Bloomberg

Therefore, we believe the market has attempted to de-risk these potential outcomes as Xi attempts to change the status quo. Thus, the question for long-term investors in Alibaba is whether the de-rating is sufficient.

BABA Back To March Lows. So How?

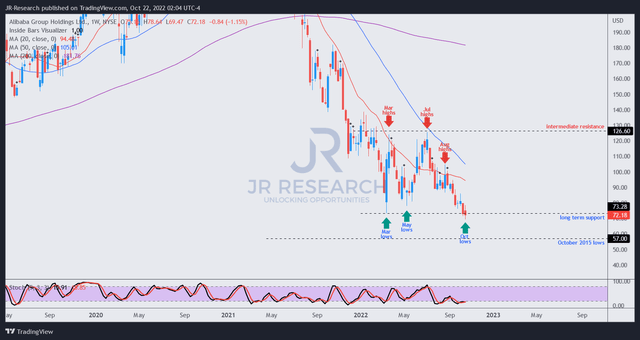

BABA price chart (weekly) (TradingView)

With BABA’s July bull trap validated at its intermediate resistance, investors can consider using those levels to cut some exposure if they decide to add at the current levels.

We gleaned that BABA has taken out its March and May 2022 lows. However, the downside break could also form a bear trap (not validated yet), drawing in sellers/weak holders into those levels.

Therefore, we urge investors not to cut exposure at the current levels in panic. We must remind everyone that the pessimism in Chinese equities in March and May also ran high as investors dumped Chinese stocks. Remember JPMorgan’s (JPM) “uninvestable” call that it rescinded subsequently? That’s what extreme pessimism does to even Street analysts and investors.

Remember, nothing falls in a straight line, even though it doesn’t feel that way at highly pessimistic levels, as investors are inundated with bearish articles by the media seeking out eyeballs.

However, keep calm and be composed. Know that BABA is still re-testing its March lows. Also, its all-time lows of $57 should proffer a robust support zone to defend its buying momentum. Hence, investors should dispel that sense of extreme fear from their investing toolkit and focus on the price action.

Given the much improved reward-to-risk profile, we believe the market has forced another panic selloff to shake out the weak holders from March/May lows.

Accordingly, we revise our rating on BABA stock from Buy to Strong Buy.

Be the first to comment