Kevin Frayer

The Thesis

While the risks are undeniable, the reward appears to justify an allocation to Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF) and Tencent Holdings Limited (OTCPK:TCEHY, OTCPK:TCTZF). These stocks look a lot like Alphabet Inc. (GOOG, GOOGL) (“Google”) in 2009. We’ll dig into why this opportunity exists, analyzing the macro uncertainties and geopolitical risks. While this is not for the faint of heart, it often pays to “buy when there’s blood in the streets.”

As Cheap As Google In 2009?

| 2022, Tencent | 2022, Alibaba | 2009, Google | |

| P/E Ratio | 13.1 | 11.8 | 11.6 |

| Price To Sales | 4.2 | 1.8 | 2.2 |

| Price To Book | 3.2 | 1.6 | 3.4 |

| Return On Equity (ROE) | 22% | 13% | 16% |

| Net Margin | 32% |

15% |

19% |

Note: Used forward estimates for Alibaba’s PE, ROE, and Net Margin to adjust for significant asset write-downs and other non-cash items. Image created by author with data from YCharts.

As you can see, Tencent is valued at a premium to Google in 2009, and Alibaba is valued at a discount to Google in 2009. However, Google was an inferior business to Tencent on a profitability basis and a superior business to Alibaba on the same metrics (Net Margin & ROE).

In 2009, the American financial system appeared to be melting down. Businesses and households were capitulating and entering bankruptcy, while major banks like Lehman Brothers went under. A domino effect could have been set off if the federal reserve had not stepped in. This caused Google, a company with extremely strong fundamentals, to trade at such a depressed level that it went on to 10x over the decade ahead.

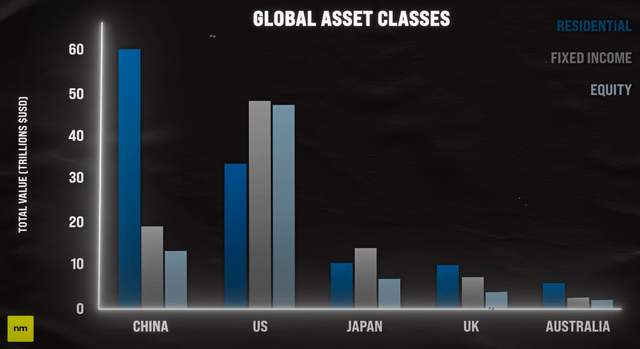

Likewise, in 2022, the real estate bubble in China appears to be slowing imploding. Many estimate that China’s enormous property developer, Evergrande Group could also go under. Not unlike the United States in 2008, Chinese citizens are heavily invested in real estate, and structurally underinvested in stocks. In fact, Chinese residential real estate is currently the world’s largest asset class:

Global Asset Classes (New Money)

With Alibaba and others targeting a primary listing in Hong Kong, Chinese citizens will be able to trade its shares domestically for the first time. Like the U.S. over the past decade, we expect more and more Chinese capital to flow into the equity market. Consumption should also resume in the country, coming out of a difficult period of COVID-19 lockdowns and economic troubles. All of this should be a boon for the shares of Tencent and Alibaba.

Deep Economic Moats

While Tencent and Alibaba enjoy market leading positions in China within industries like gaming (Tencent) and the cloud (Alibaba), we believe each of these businesses has a key asset, which ties everything else together. For Tencent, that asset is WeChat and for Alibaba, that asset is Taoboa.

WeChat could be the most dominant mobile app in the world; it’s a super-app that encompasses Chinese social media, messaging, and mobile payments. While Alibaba’s Alipay is a strong rival in mobile payments, WeChat is essentially the king in messaging and social media with 1.24 billion users. This is an exceptionally strong advertising avenue for Tencent. The company can boost its investees by pushing products on the app. Famed investor Mohnish Pabrai described WeChat as a “bazooka” that Tencent can fire at its competition.

Alibaba’s Taoboa has a similar network effect. Taoboa is the number one shopping platform in China. Combined with Alibaba’s other commerce avenues, the company reaches more than 900 million consumers in China. Its brands are intertwined with businesses throughout the country, and entrenched in the minds of consumers. This allows Alibaba to sell advertising, cloud services, and premium memberships, while “making is easy to do business anywhere.” Consumers in the Alibaba ecosystem enjoy the convenience of services like Ele.me delivery, Amap navigation, and Alipay mobile payments. Charlie Munger’s lollapalooza effect applies to Taobao’s shopping experience, which encompasses a great product, powerful stimulants, availability, clever marketing, and social proof.

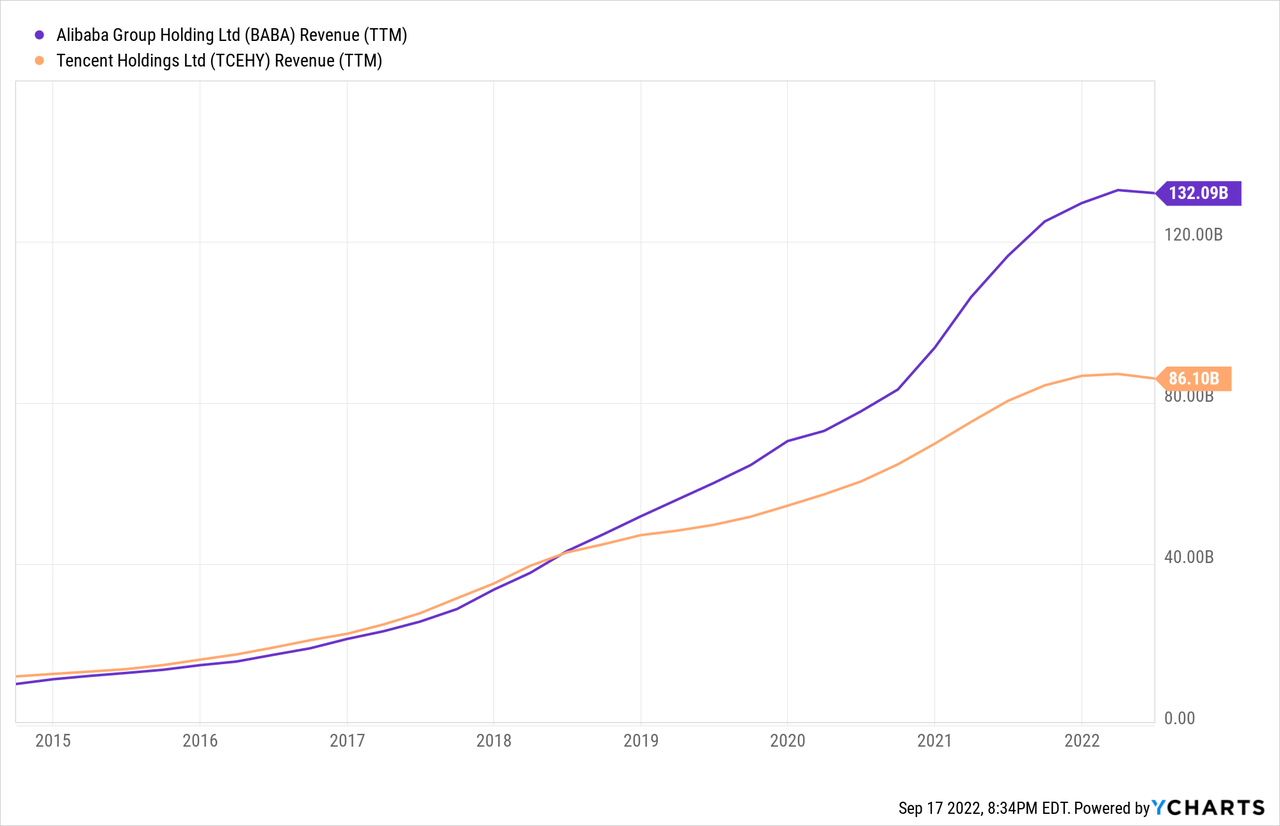

Tencent and Alibaba’s economic moats are evident in their revenue growth:

Over the past 8 years, Alibaba has grown its revenue at 35% per annum and Tencent at 23% per annum, all the while maintaining strong balance sheets.

Fear And Uncertainty

When it comes to Alibaba and Tencent, the discount exists not only due to economic hardship in China, but due to fear and uncertainty surrounding the geopolitical landscape. When Russia invaded Ukraine, sanctions were used as a deterrent. Russian stocks were barred from trading on many international exchanges. Recent tensions in the Taiwan Strait have caused many to fear war between China and Taiwan. Between this, the VIE structure, and China’s CCP, the risks stretch far beyond internal operations. Just because these are financially and competitively resilient companies doesn’t mean the stocks can’t go to zero. Investors must weigh this risk appropriately within a diversified portfolio, more on this latter.

The Valuation

Tencent has a lot of investees; its equity portfolio is said to be worth $88 billion. Tencent is an early-stage investor, and its portfolio was once worth much more. The equity holdings had a lot of exposure to unprofitable tech, which melted down over the past year. Still, Tencent’s portfolio represents 25% of its market cap. We suspect the equity portfolio is now closer to fair value as the excess drains out of the tech sector, especially in China.

Alibaba, on the other hand, has a significant amount of cash on its balance sheet, approximately $66 billion, which represents 29% of its market cap. Both companies appear poised to buy back a lot of shares.

Here’s our expected returns through to 2032:

| EPS | Expected Annual Growth Rate | 2032 EPS Estimate | Terminal Multiple | 2032 Price Target | Annualized Returns | |

| Alibaba | $7.34 (Forward) | 15% | $30 | 17.5 | $525 | 20% |

| Tencent | $2.76 | 15% | $11 | 17.5 | $193 | 18% |

Despite the strong tracks records, this level of earnings growth appears ambitious. But, keep in mind, we’re starting from a fairly depressed level of earnings in a challenging macro environment, one that Alibaba’s CEO called “the most severe in decades.” Also, China is still in the early stages of cloud adoption. Alibaba and Tencent look like Amazon (AMZN) and Microsoft (MSFT) did in 2015 in terms of their cloud businesses. These are multi-engine growth machines, with capital-light models. The longer the Chinese bear market lasts, the more they can buy back shares at a steep discount and acquire cheap businesses.

Our terminal multiples are quite conservative compared to U.S. tech giants, if Tencent and Alibaba continue to grow, and trade at a terminal multiple of 20 in 15 years’ time, one could see a 10x return on their investment.

Getting The Allocation Right

If one is presented with 10x upside and 1x downside, probabilistically, it’s not a question of if one should bet, but how much one should bet. This depends on you. While Alibaba and Tencent have remarkably strong financial positions, the macro and geopolitical storm they’ve found themselves in comes with real risk. So, you have to ask yourself, what percentage of my portfolio am I willing to risk to capture this upside? We like an allocation of less than 10%, which means you’ll make a considerable amount on the upside, but won’t be wiped out if the downside materializes.

Be the first to comment