Khosrork

Alexander’s, Inc. (NYSE:ALX) offers real estate services to massive corporations in the city of New York, which is, I believe, a decent reason to have a look at its portfolio. It is also worth noting that considering future cash flows, in my view, ALX appears undervalued. Without making meaningful transactions, if ALX continues to reduce its debt obligations, I think the fair price is significantly more valued than the current market price. There are risks from further increases in the interest rates and concentration of clients, but I don’t consider them that worrying.

Alexander’s Works With Wealthy Tenants

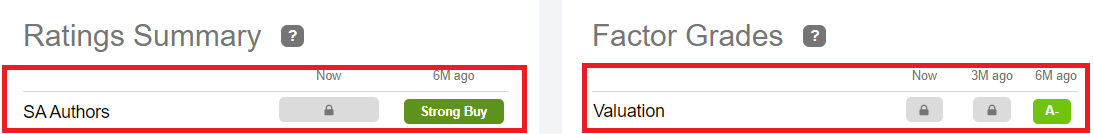

Based in Paramus, New Jersey, Alexander’s, Inc. is a real estate investment trust with six properties in New York city.

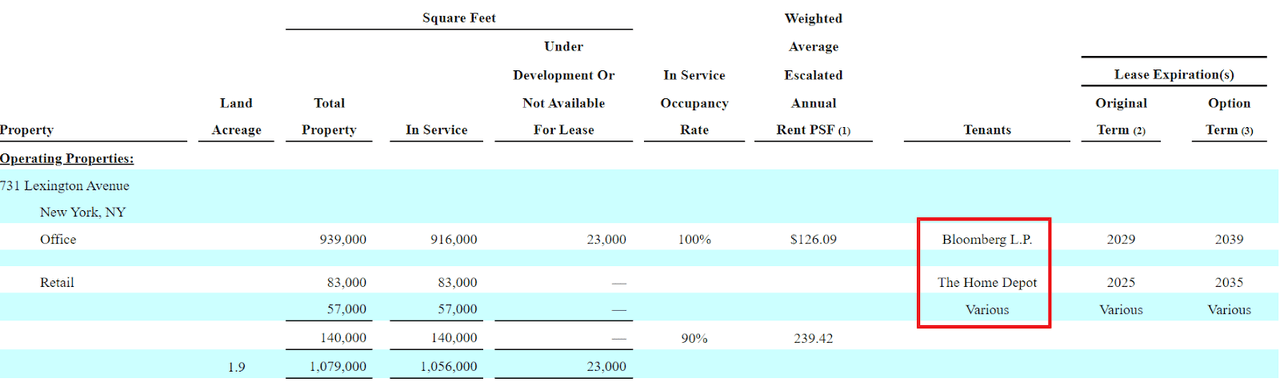

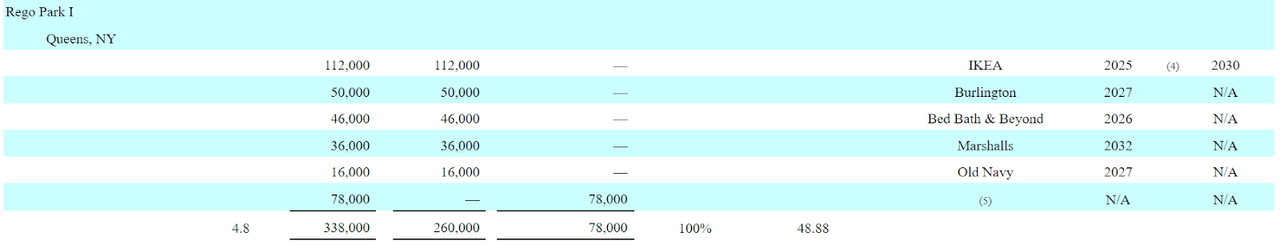

The tenants are all well-known conglomerates like Bloomberg, The Home Depot (HD), Old Navy, Bed Bath & Beyond (BBBY), or Costco (COST). In my view, the risk of these clients not paying the rent is low. It is also worth mentioning that most lease agreements expire around 2027, 2029 and 2031. Management appears to have sufficient time to look for other tenants if necessary.

Source: 10-k Source: 10-k Source: 10-k

Considering the most recent quarterly results and the rating given by Seeking Alpha authors, I decided to study Alexander’s business model. We are talking about a business that reports quarterly positive funds from operations close to $4.4 per diluted share and total amount of assets close to $1.4 billion. With a market capitalization close to $1.2 billion, even if it is a bit unknown, Alexander is not a small company.

Source: SA Ratings

Funds from operations for the quarter ended September 30, 2022 was $22.5 million, or $4.40 per diluted share, compared to $21.2 million, or $4.13 per diluted share for the quarter ended September 30, 2021. Source: Alexander’s Announces Third Quarter Financial Results

Stable Balance Sheet And Beneficial Expectations From Analysts

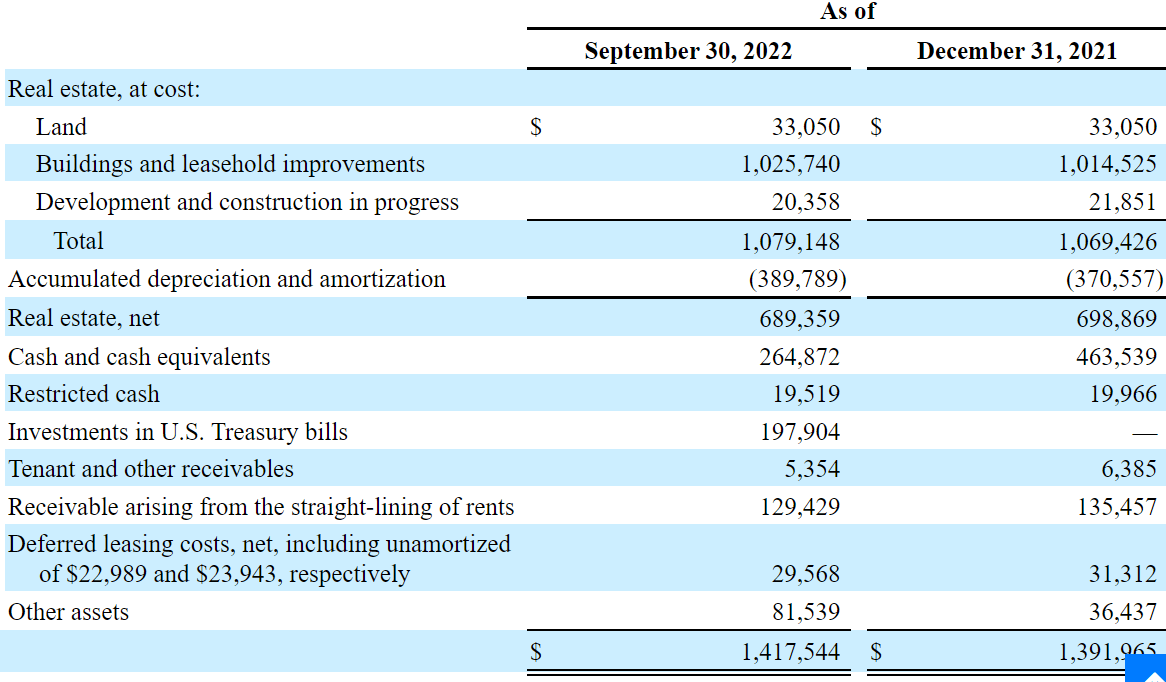

The results for September 30, 2022 included land worth $33.050 million, with a building and leasehold of $1.025 billion and accumulated D&A of $389.789 million. In addition, the net real estate assets stand at $689 million.

Alexander’s, Inc also reported cash and cash equivalents of $264.872 million, investments in the US worth $197.904 million, and receivable arising from the straight lining of rents worth $129.429 million. Finally, total assets stand at $1.417 billion. Let’s keep in mind that the total amount of assets increased by close to 2%. More assets per share will likely mean more fair price valuation.

Source: 10-Q

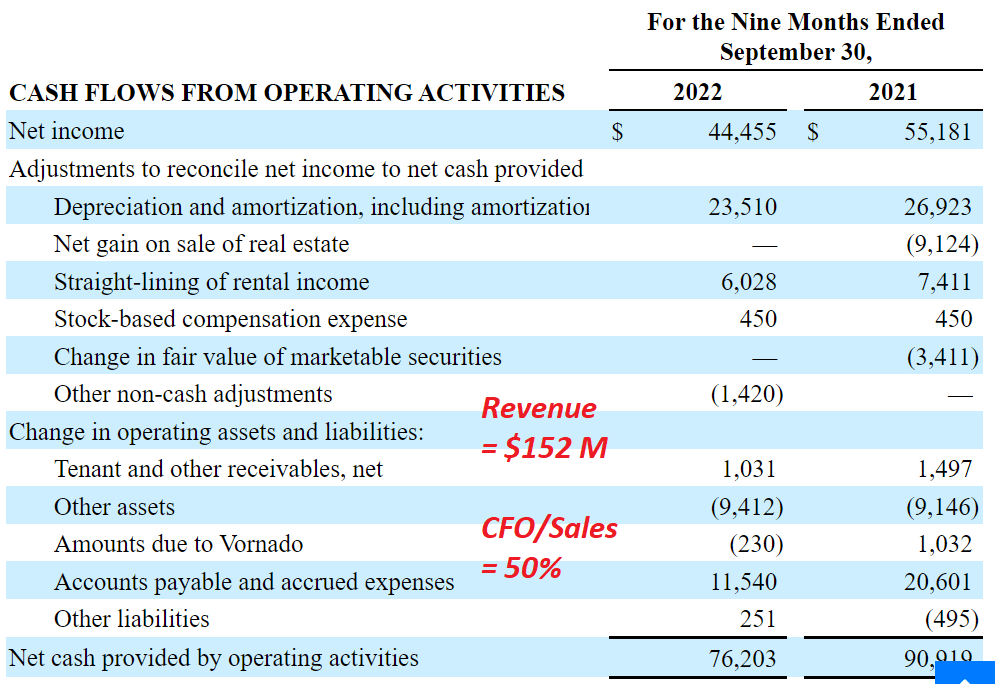

Moving on to the liabilities, management reported mortgages worth $1.09 billion, along with payable accounts worth $57 million and total liabilities of $1.169 billion. The asset/liability ratio stands at close to 1x, so I would say that the balance sheet stands in good shape.

Source: 10-Q

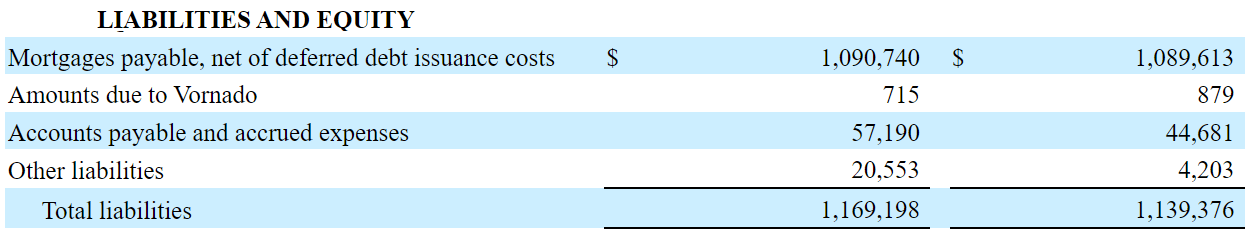

In my view, the expectations of analysts are beneficial. They mostly expect sales growth and positive net income results. As soon as more equity investors learn about the expectations in the financial community, I would expect demand for the stock to increase. By 2024, analysts expect net sales of $210 million, with a net sales growth of 1%, in addition to EBIT of $27.4 million and an operating margin of 13%. 2024 EBT would stand at $42.1 million, and the net income will likely be positive, and equal to $42.1 million.

Source: Marketscreener.com

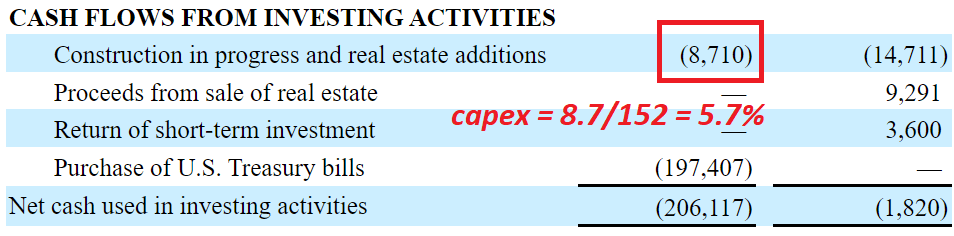

A Close Look At The Cash Flow Statement Reveals Significant Cash Flow From Operations And Construction In Progress/Sales Close to 5.7%

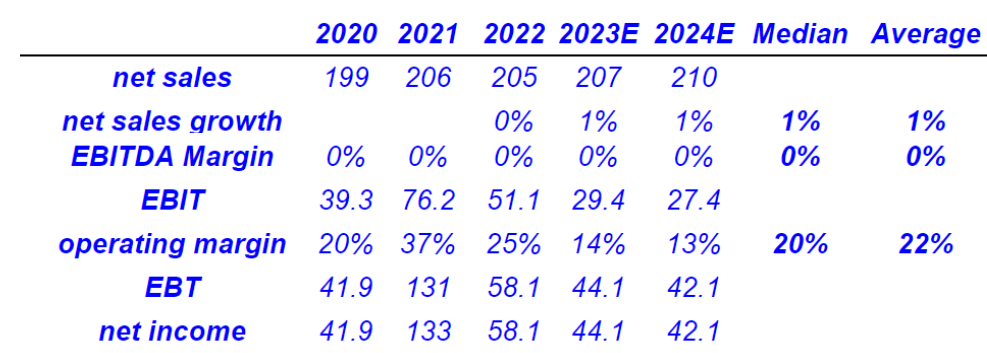

A closer look at the company’s cash flow statement shows a lot of cash flow from operations. In the nine months ended September 30, 2022, the company reported a net income of $44.455 million, with a depreciation and amortization of $23.510 million and net cash from operations worth $76.203 million. Given that management reported net revenue of $152 million in the same period, CFO/Revenues stand at close to 50%.

Source: 10-Q

The construction in progress was worth -$8.710 million, which represents close to 5.7% of the total amount of revenue. I used these figures for my financial model.

Source: 10-Q

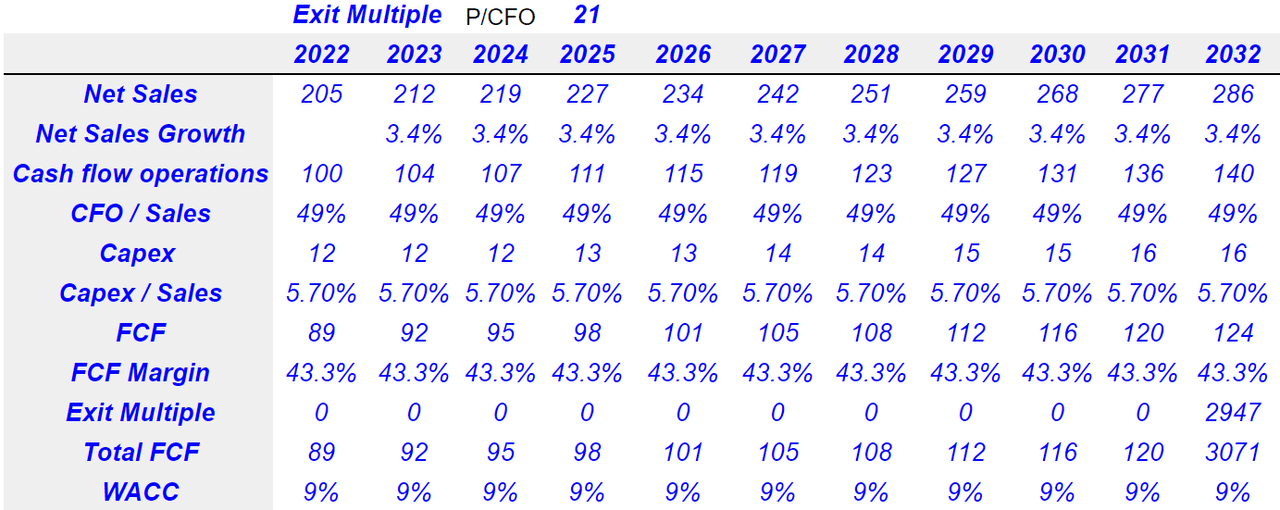

Under My DCF Model, Alexander’s Could Be Worth $240 Per Share

If we assume 2032 net sales of $286 million and net sales growth of 3.4%, I believe that CFO could stand at $140 million with a CFO/sales ratio of 49%. I also expect construction in progress to be close to $16 million, so capex/sales would be 5.70%. Finally, FCF would stand at $124 million with a FCF margin of 43.3%. Let’s also keep in mind that I decided to discount future free cash flow at close to 9%, which is approximately the rate reported by other analysts.

Source: Bersit’s DCF Model

The net present value of future free cash flow would be $1.840 billion. Now, if we also take into account the mortgage of $1.090 billion, cash, and treasuries the equity would stand at $1.230 million, and the fair price would be $240 per share.

Source: Bersit’s DCF Model

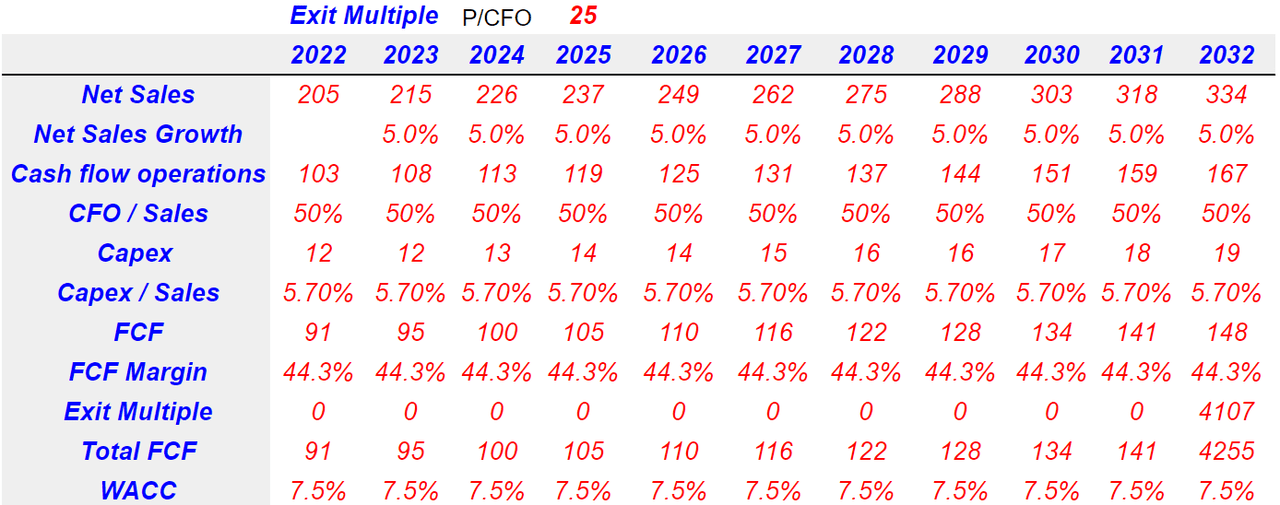

Under My Best Case Scenario, With A WACC Of 7.5% And Sales Growth Of 5%, The Implied Valuation Would Be $405 Per Share

Considering the total amount of debt reported by Alexander’s, in my opinion, new acquisitions are a bit unlikely. With that, in my view, if management convinces debt owners, new acquisition of properties could happen. Keep in mind that Alexander’s may help existing tenants rent new locations in New York. I believe that debt holders would most likely offer further financing if Bloomberg is willing to sign a new lease agreement with Alexander’s.

We may acquire, develop or redevelop properties when we believe that an acquisition, development or redevelopment project is otherwise consistent with our business strategy. Source: 10-k

In the best of scenarios, we have a net sales of $334 million with sales growth of 5%. I expect cash flow operations of $167 million with a CFO of 50%. The capex will be $19 million with a capex/sales of 5.70%. The FCF would be $148 million with the FCF margin of 44.3%. The exit multiple will be $4107 million with a total FCF of $4.255 million and the WACC of 7.5%.

Source: Bersit’s DCF Model

Moving on to other data, the NPV of FCF will be $2.682 million, and the mortgage will be $1090 million. With an equity of $2072 million and $5.107 million shares, the price would be $405.8 million.

Source: Bersit’s DCF Model

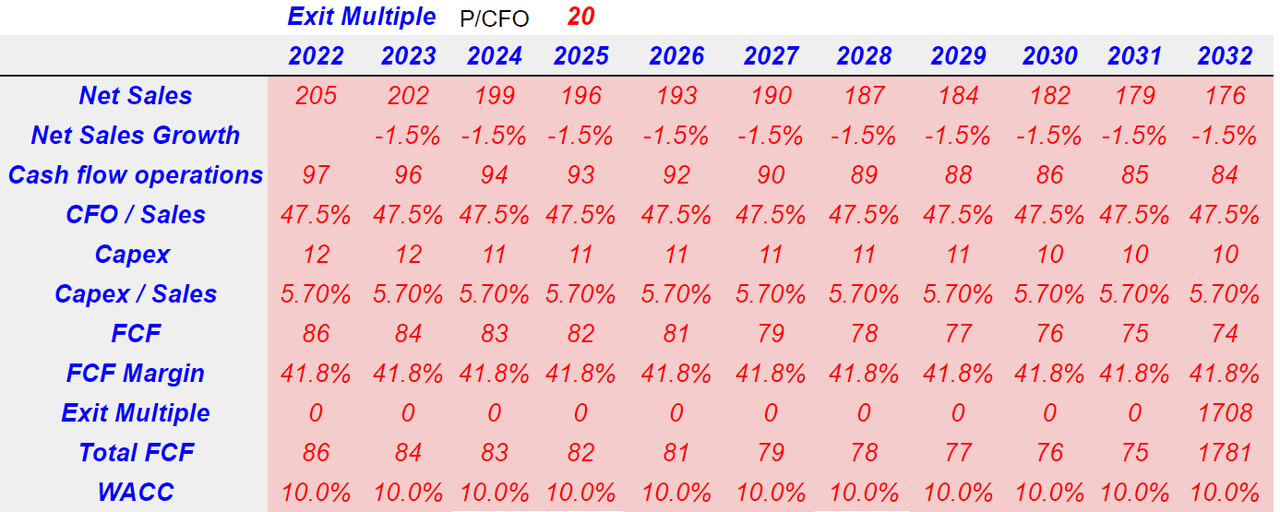

My Worst Case Scenario Would Result In A Fair Price Of $100 Per Share

The fact that some clients represent a significant amount of the total net revenue may not be appreciated. If there is an issue with any of the tenants, the decline in sales growth could be substantial. Let’s keep in mind that one of the clients represents more than 50% of the total amount of revenue.

Bloomberg L.P. accounted for revenue of $81,536,000 and $85,057,000 for the nine months ended September 30, 2022 and 2021, respectively, representing approximately 53% and 54% of our total revenues in each period, respectively. Source: 10-Q

The debt may also be a concern for shareholders. If interest rates continue to creep up, management may have to pay more financing costs, which would push the WACC up. Investors may also dislike the total amount of debt outstanding. They may decide to buy less shares, which would increase the cost of equity. In sum, the fair price would decline.

As of December 31, 2021, total debt outstanding was $1,096,544,000. We are subject to the risks normally associated with debt financing, including the risk that our cash flow from operations will be insufficient to meet required debt service. Our debt service costs generally will not be reduced if developments in the market or at our properties, such as the entry of new competitors or the loss of major tenants, cause a reduction in the income from our properties. Should such events occur, our operations may be adversely affected. Source: 10-k

I assumed 2032 net sales of $176 million, with cash flow operations of $84 million and CFO/sales of 47.5%. With 2032 capex of $10 million, FCF would stand at $74 million, and the FCF margin would be 41.8%. Finally, let’s note that in this case I am using a WACC of 10%.

Source: Bersit’s DCF Model

My results include a discounted sum of FCF of $1.1235 billion and a fair price of $100 per share. The internal rate of return would be close to -13%.

Source: Bersit’s DCF Model

Takeaway

I believe that debt holders would most likely consider the company’s know-how in the future. Keep in mind that Alexander’s expertise in the Real Estate industry was sufficient to convince wealthy clients. In my view, the sum of future cash flow could justify higher price marks than the current market price. Yes, there are risks coming from concentration of clients and increases in the interest rates. With that, like other analysts on Seeking Alpha, I believe that the stock remains in undervalued territory.

Be the first to comment