SafakOguz/iStock via Getty Images

Investment Thesis

Alcoa (NYSE:AA) is well positioned to thrive as its European peers are forced to close their doors.

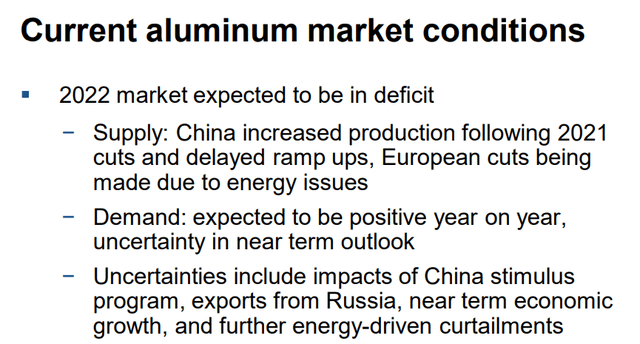

Meanwhile, investors have been concerned that there’s likely to be a near-term oversupply of aluminum brought about by a slowing economic environment in the US and China.

That being said, Alcoa’s results appear to continue to shine. Now the main question that looms large is how will Alcoa perform over the next couple of quarters, given this slowing economic demand.

And are investors sufficiently compensated for this risk? At 7x a conservative free cash flow multiple I believe they are.

Revenue Growth Rates Remain Strong

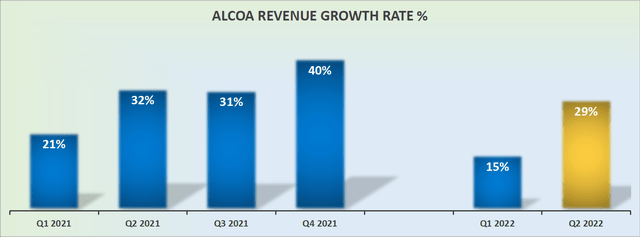

Alcoa sees its revenue growth rates positively impress as it beats analysts’ consensus to grow its revenue growth rates by 29% y/y.

Nevertheless, the stock is down a lot from the highs set just a few months ago. This is fully disheartening. The reason why the stock is down so significantly is that analysts continue to expect, as they have done for a few months now, Alcoa’s revenue growth rates to rapidly retrace lower in the second half of 2022.

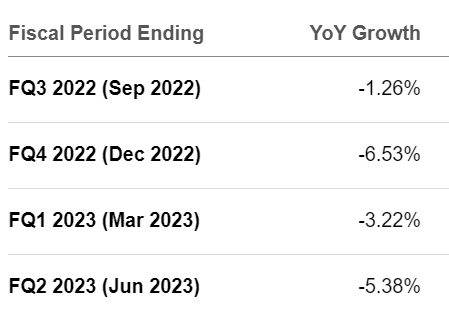

Analysts revenue consensus

Looking ahead for the next several quarters all the way into mid-2023, analysts expect that Alcoa’s revenue growth rates will move into negative territory.

Their estimates are based on the assumption that Alcoa’s strong revenue growth rates will revert lower in line with historical averages.

Nevertheless, the fact that aluminum prices on the spot market have sold off so significantly in the past few months can not be disregarded. That’s clearly very bearish and should be factored into any investment thesis.

For all the commentary around low aluminum inventories, this does not appear to be reflected in aluminum pricing in the spot market.

Along these lines, we’ll next discuss the bull and bear cases investors should think about.

Alcoa’s Near-Term Prospects

Everything one needs to know about the bull and bear cases is noted below.

On the supply side, there’s the overwhelming concern that increased production from China could lead to a near-term oversupply of aluminum. Meanwhile, the demand outlook is uncertain.

Those two are the main bearish considerations on the supply and demand side. Those two are keeping investors at bay, with the stock selling off significantly in the past few days.

I would counter those considerations by arguing that exports from Russia are meaningfully curtailed given not only sanctions against the country, but the difficulty in paying Russian companies with its international banking system being taken offline, which will hamper excess aluminum from reaching global markets.

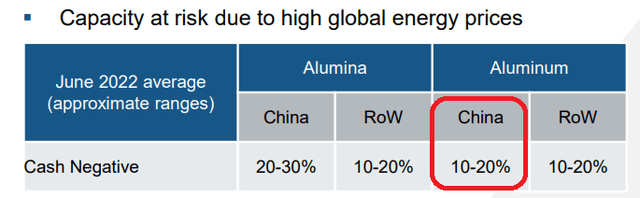

Then there are the other considerations at hand. Namely, the very high energy input costs that are putting a significant amount of capacity at risk.

Q2 2022 investors presentation

As you can see above, Alcoa estimates that somewhere around 10% to 20% of the Chinese aluminum production operates with cash negative margins.

I suspect that Europe has even worse cash negative volumes, as Europe suffers from a once-in-a-lifetime energy crisis. This makes producing aluminum unprofitable and uneconomical.

Capital Allocation Policy

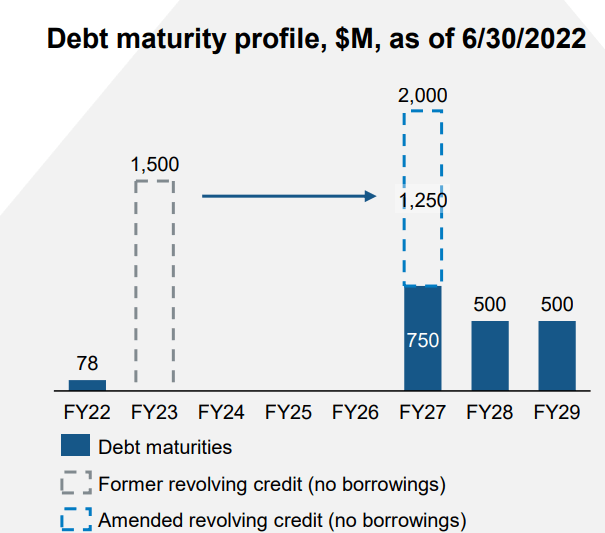

As you can see below, Alcoa has recently refinanced its debt stack so that it has no near-term debt maturity.

Q2 2022 investors presentation

Alcoa has an insignificant amount of debt to pay in 2022 and then the next stack won’t come around until much later in 2027. That’s it!

For context, this puts its net debt at $1.2 billion. For a business that’s reporting more than $800 million of EBITDA in a quarter, this debt level is very manageable and not significant to the investment thesis.

Given this strong fiscal position, Alcoa believes that after using capital for its number one priority, which is growing its business, it can return capital to shareholders.

This is what Alcoa said during the earnings call,

We have confidence in the strength of the company. And so we provided returns to shareholders in the second quarter as our cash balance was strong. Our cash generation was strong and we have confidence in the future ability of the company to weather through cyclical storms.

And so that’s why we provided it. Just we announced an additional $500 million buyback. We still have $150 million left on the prior buyback authorization.

During Q2 2022, Alcoa repurchased $275 million worth of stock, or 3.3% of its market cap returned to shareholders during Q2, which annualized at 13.3%.

Furthermore, Alcoa now announces that it has increased its repurchase authorization to $500 million. This is an open-ended repurchase program.

This puts its total authorized repurchase program at $650 million, or 7.8% of its market cap. Note, realistically, just because a company has a stock authorization program announced does not mean the company will necessarily exhaust its authorization.

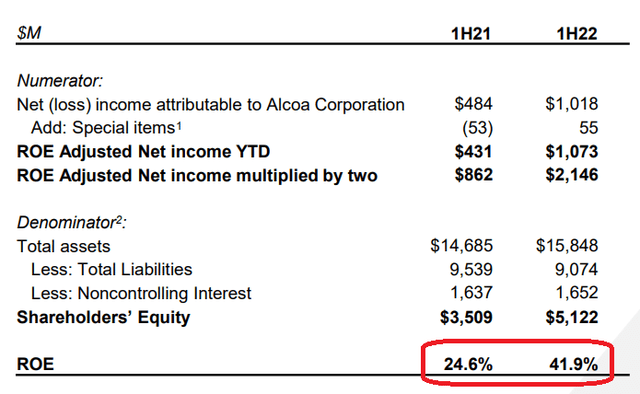

That being said, aside from capital being returned to shareholders, it’s important to keep in mind that Alcoa has very high returns on equity.

Q2 2022 investors presentation

As you can see above, Alcoa’s ROE right now would put to shame many so-called ”asset light” cloud companies’ profitability profiles.

Alcoa is seeing very strong ROE figures, backed by strong cash flows and returning capital to shareholders.

AA Stock Valuation — Priced at 8x Free Cash Flow

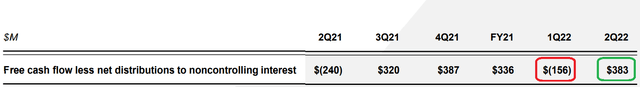

For the first half of 2022, Alcoa’s EBITDA stood at $2 billion. That being said, this high level of EBITDA has not translated into an equal and proportional level of free cash flow. To illustrate, free cash flow for H1 2022 stood at $390 million, as the vast majority of the EBITDA profitability is taken up by working capital.

However, keep in mind that back in Q1 2022, Alcoa stated at the time that it’s very large negative use of working capital would reverse throughout the whole of 2022.

Q2 2022 investors presentation

And that’s exactly what you see above in the red and green boxes above, from Q1 into Q2 free cash flow substantially improved given the improvement in working capital.

Looking further ahead for the remainder of 2022, Alcoa continues to contend as it did last quarter that it would see an improvement in working capital in the back half of 2022.

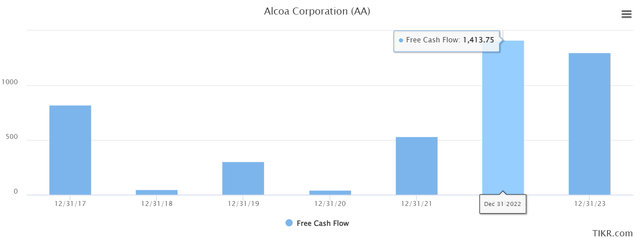

That could mean Alcoa’s free cash flow would probably reach $1 billion in 2022.

Meanwhile, analysts for their part continue to expect around $1.4 billion of free cash flow from Alcoa in 2022. While I believe that this estimate is too high, I do believe if Alcoa could provide further free cash flow potential, this would obviously further support its share price.

Using my estimate of $1 billion of free cash flow estimates for 2022, that would put Alcoa priced at 8x this year’s free cash flow.

The Bottom Line

Alcoa is a commodity company that is enduring very volatile demand, from both an economic global slow down as well as China’s Covid lockdown policy. Despite a lot of pessimism, the business appears to be performing strongly and generating very strong free cash flows. I believe that paying 8x free cash flow for this business is cheap and an attractive multiple.

I’ll leave the final words to Alcoa’s management team. In a recent conference call, Alcoa said:

So, we’ve had lower metal prices, some higher raw material costs, higher energy costs in Lista. And we’ve had some operational issues in Western Australia and that, I think, is going to cost us around $50 million in the third quarter. So, like I said, the third quarter is shaping up to be a tough one.

This is what I believe the market is thinking about right now., the challenging Q3 quarter. However, I’m looking beyond the next six months and trying to be positioned for what comes next after this challenging period.

In summary, the best time to buy into a cyclical stock is during these periods of negative outlooks. When nobody else wants to get involved. And the time to sell will be in about six to nine months when the outlook starts to slowly improve.

Be the first to comment