Bulat Silvia

Introduction

After Alcoa (NYSE:AA) initiated their first-ever dividends in late 2021, their future was looking brighter for free cash flow and shareholder returns heading into 2022, as my previous article highlighted. Whilst this was certainly the case during the first half, the rapidly deteriorating operating conditions during the third quarter now see them sitting at a micro-macroeconomic crossroads with a geopolitical twist, as discussed within this refreshed analysis.

Coverage Summary & Ratings

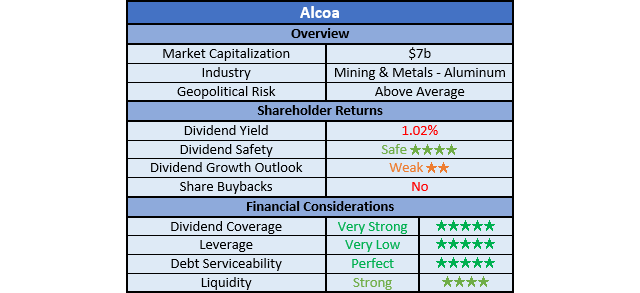

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

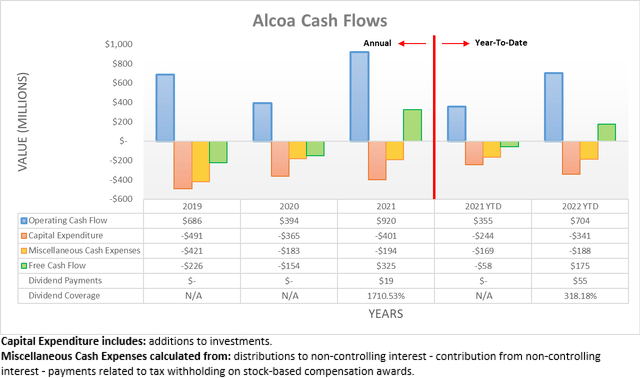

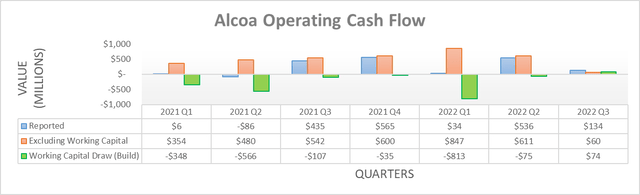

Following their very strong cash flow performance during 2021, on the surface, it seems 2022 is tracking equally as strong with their operating cash flow landing at $704m during the first nine months and thus broadly annualizing towards their $920m full-year result during 2021. Apart from also being circa 100% higher year-on-year versus their previous result of $355m during the first nine months of 2021, beneath the surface, there is very high volatility, even sequentially quarter-to-quarter as operating conditions swing wildly.

Notwithstanding their very large working capital build of $813m during the first quarter of 2022 weighing down their operating cash flow of $34m, they actually saw a very strong underlying result of $847m after removing their working capital movements. Whilst the second quarter was still strong with an underlying result of $611m, this promptly fell off a cliff during the third quarter as operating conditions quickly deteriorated over economic concerns, thereby sending both aluminum and alumina prices heading south by July. As a result of this suppressing their financial performance, the third quarter only saw their underlying operating cash flow at $60m, which on the surface was boosted to $134m given their $74m working capital draw.

When it comes to commodities, volatility is inherently always a problem but the extent and rate of change during the first nine months of 2022 is nevertheless still quite surprising. On the geopolitical front, this could be set to continue further as the United States considers a ban on Russian aluminum and the London Metal Exchange considers whether to extend bans to aluminum, along with other unrelated commodities. Whilst this could help support aluminum prices in the short-term, regardless of any potential geopolitical boost, too much aluminum and alumina supply is loss-making for these operating conditions to persist indefinitely into the future.

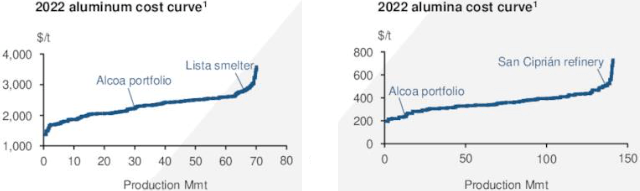

Alcoa Third Quarter Of 2022 Results Presentation

When viewing the global cost curve for aluminum supply, the current prices in the low-$2,000 per tonne level see only roughly 10Mmt out of the total circa 70Mmt supply producing a profit, as per the graph on the left. Meanwhile, a similar story is shared by the alumina supply global cost curve with current prices in the low-$300 per tonne level only seeing roughly 25Mmt out of the total circa 140Mmt supply producing a profit, as per the graph on the right.

Even if Russian supply is not banned, the microeconomic view sees the laws of supply and demand ensuring higher prices in the future as the market rebalances, as these prices obviously cannot incentivize sufficient medium to long-term supply. Whether this happens via higher demand or less supply remains to be seen but given the macroeconomic view, the latter seems far more likely given the gloomy economic outlook as central banks send interest rates surging and talk of a recession is seemingly a question of when, not if. Thankfully, the majority of their production is weighted towards the bottom half of the global cost curve for aluminum, whilst their alumina production is even better positioned within the bottom quartile, as per the two graphs included above, thereby leaving them structurally well-positioned to wait for a recovery.

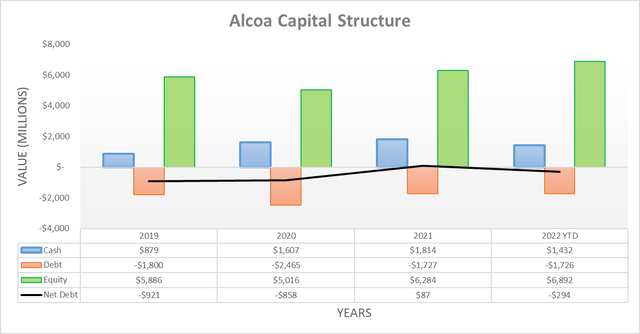

After seeing their net debt eliminated during 2021 as the year ended with net cash of $87m, largely due to divestitures, the first nine months of 2022 saw a return to net debt of $294m, due to their $500m of share buybacks during the third quarter. Whilst tempting to think that a return to net debt is negative, realistically, running with a safe amount of net debt is actually preferable to net cash, as it allows for maximum shareholder returns, whilst not necessarily forgoing anything because the benefit of reducing already low debt is immaterial due to the laws of diminishing returns. To put it simply, making an already safe investment a little safer does not materially help nor create material value for shareholders, whereas repurchasing $500m of shares provides a permanent benefit.

Since they have not announced another share buyback program and their dividends are relatively small, their net debt should remain reasonably stable when looking ahead into the fourth quarter of 2022 and 2023. Although the very high volatility of their industry, especially in these economically uncertain times leaves open the possibility of unexpectedly large movements but thankfully, they are well positioned if this were to eventuate.

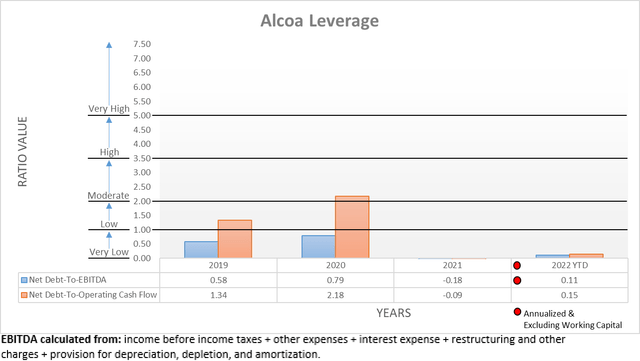

This situation is even clearer upon reviewing their leverage, as even with their capital structure seeing net debt returning, their net debt-to-EBITDA and net debt-to-operating cash flow still ended the third quarter of 2022 at only 0.11 and 0.15 respectively. As easily apparent, these are towards the bottom of the very low territory that sees its upper threshold at 1.00, which obviously is not problematic.

To be fair, their results are enhanced by the very strong start to 2022 but even if their net debt of $294m is compared against their suppressed underlying operating cash flow of $60m during the third quarter, it still only produces a net debt-to-operating cash flow of 1.23, once annualized. Since this remains towards the bottom of the low territory of between 1.01 and 2.00, it not only highlights how their financial position is ready to endure any further upcoming turbulence but importantly, how boosting shareholder returns with net debt did not materially degrade their safety.

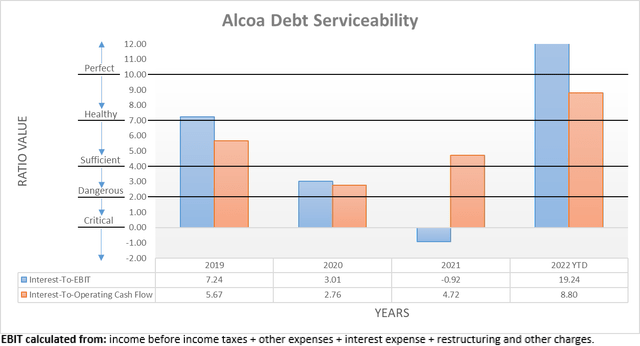

Unsurprisingly, their very low leverage following the third quarter of 2022 was accompanied by perfect debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. This holds true, regardless of whether viewed via an accrual or cash-based lens with their results of 19.24 and 8.80 compared against their EBIT and operating cash flow, respectively. Once again, even without the boost from the start of the year, their results would have been lower but still not problematic. If comparing their $25m of interest expense during the third quarter against their accompanying underlying operating cash flow of $60m gives an interest-to-operating cash flow of 2.4 and whilst this is much lower, it nevertheless remains sufficient, especially as it stems from suppressed financial performance.

If turning to their strong liquidity, it provides further support to endure anything the future may throw their way given their current ratio of 1.81 and cash ratio of 0.48. When looking ahead, this should persist, especially because their net debt remains relatively minor and they are a dominant company within their industry, which means they should not have any issues accessing debt markets as required to source liquidity or refinance debt maturities, even if central banks further tighten monetary policy.

Conclusion

Since they sport a healthy financial position, they are a prime contrarian investment opportunity to wait for a recovery, whilst the battle between micro and macroeconomics plays out in the global aluminum market. Whether the potential ban on Russian supply provides a geopolitical boost remains uncertain but either way, from the microeconomic view, too much global supply is loss-making and thus one way or another, higher prices lay in the future. As a result, I believe that upgrading to a buy rating is now appropriate but at the same time, this is one for medium to long-term investors who can endure volatility because from the macroeconomic view, the short-term gloomy economic outlook makes for a bumpy ride.

Notes: Unless specified otherwise, all figures in this article were taken from Alcoa’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment