Mario Tama

Introduction

Albertsons (NYSE:ACI) is expected to be acquired by Kroger (KR). After the merger, the company will become the third largest food and drugstore in the United States. The terms of the acquisition include the distribution of a special dividend and the separation of some Albertsons stores.

It is still uncertain whether the acquisition will proceed and whether the distribution of the special dividend will be approved. If the acquisition will proceed, Albertsons investors can expect a 33% return. Consequently, Albertsons has a good risk/reward ratio.

Merger With Kroger Is Uncertain But Can Offer 33% Return

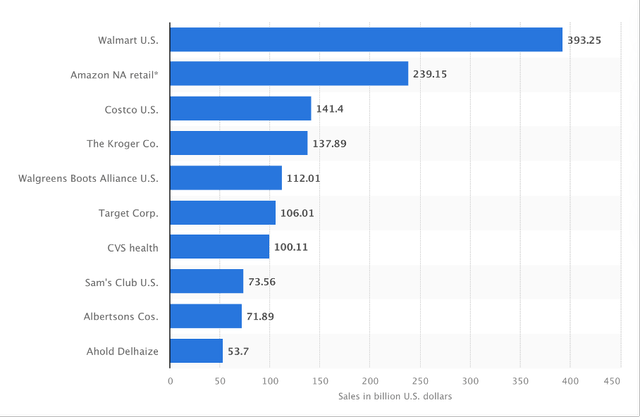

Kroger announced a merger with Albertsons on Oct. 14, 2022. The acquisition will create strong synergies that lead to cost savings and give both companies a strong competitive advantage over competitors. Albertsons stores are located in areas where no Kroger stores operate, so the consolidated company will provide a better geographic distribution of sales. The combined company will generate sales of about $210 billion a year. This will make it the third-largest food and drug store in the United States.

Sales of the leading food and grocery retailers in the United States in 2021 (in billion U.S. dollars)* (Statista)

Rodney McMullen, Chairman and Chief Executive Officer of Kroger, wrote the following:

Albertsons Cos. brings a complementary footprint and operates in several parts of the country with very few or no Kroger stores. This merger advances our commitment to build a more equitable and sustainable food system by expanding our footprint into new geographies to serve more of America with fresh and affordable food and accelerates our position as a more compelling alternative to larger and non-union competitors. … We believe this transaction will lead to faster and more profitable growth and generate greater returns for our shareholders.

The terms of the merger:

- Albertsons will be acquired for a total enterprise value of $24.6 billion.

- Kroger will pay Albertsons shareholders $34.10 per share.

- Before the acquisition:

- Albertsons shareholders will receive $6.85 special dividend, payable on Nov. 7, 2022 to shareholders of record as of the close of business on Oct. 24, 2022.

- 100 to 375 Albertsons stores will be spun off and incorporated into a spin-off company. Albertsons shareholders will receive shares in this company.

The share price of $20.52 suggests that investors are not enthusiastic that the merger will succeed. They are skeptical because they expect the company will not receive approval of the merger because of the formation of a strong monopoly.

Also, several state lawyers disagree with the payment of the special dividend. They would rather see the cash invested in the company to achieve further growth. A preliminary hearing in Washington state has been postponed until Dec. 9. They believe both Albertsons and Kroger are violating antitrust and consumer protection laws. Payment of the special dividend will be postponed to a later date. Albertsons spoke out in the following statement:

Albertsons Cos. continues to believe that the claim brought by the State of Washington is meritless and provides no legal basis for canceling or postponing a dividend that has been duly and unanimously approved by Albertsons Cos.’ fully informed Board of Directors.

Albertsons has $3.4B in cash, while the special dividend is about $4B. As a result, the company will have to take out a loan to distribute the special dividend.

The share price of $20.50 is very favorable if the merger will succeed. After distributing the special dividend of $6.85 per share, the stock’s return will be about 33%. Albertson’s shareholders will still have shares in the split-off company. However, the acquisition will not take place until 2024, and in the meantime the payment of the special dividend may be canceled by state lawyers.

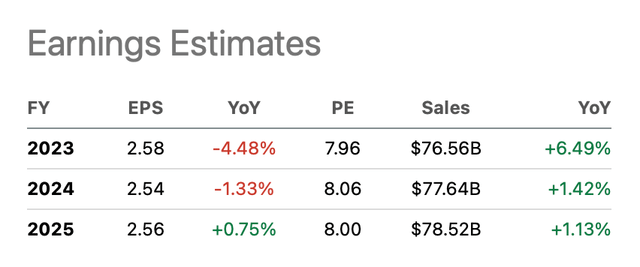

If the merger will not succeed, investors will be left with their Albertsons shares. In that case, is interesting to take a closer look at revenue and earnings growth. However, these figures do not seem optimistic. Earnings per share are expected to decline by low-single digits, according to 16 analysts on the Seeking Alpha ACI ticker page. For fiscal 2024, earnings per share is expected to rise 0.75%, not very impressive. Because earnings per share will not rise sharply, it is important to examine whether the stock is currently undervalued.

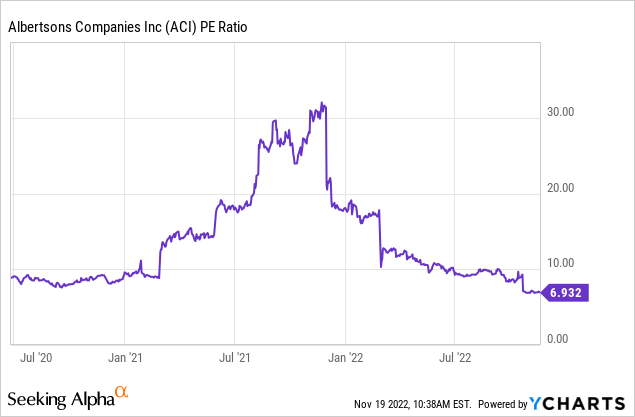

Stock Valuation Metrics In Line With Historic Averages

Merger with Kroger greatly benefits Albertsons shareholders. Kroger proposed to acquire Albertsons for an enterprise value of $24.6 billion. Albertsons shareholders will receive a special dividend of $6.85 per share before the acquisition. In addition to the special dividend, 100 to 375 stores will be divested before the acquisition. Albertsons shareholders will then receive shares upon divestiture.

Assume Albertsons divests 375 out of 2276 stores (worst-case scenario), I estimate that EBIT is 16% lower (rough estimate). Annual EBIT is expected to be $2B. Kroger acquires Albertsons for an EV/EBIT ratio of 12. It’s a good move by Kroger because both companies are valued at an EV/EBIT ratio of 12.

If the acquisition fails, it is important to look at future profits. In 2023 and 2024, profits are expected to decline. In 2025, profits are expected to increase by only 0.75%. Sales for fiscal year 2023 are expected to increase by 6.5% and low single-digit growth is expected for the following years. These are not blockbuster expectations.

16 analysts expect earnings per share of $2.56 for fiscal 2024. The PE ratio has averaged about 8 in recent years. The share price for fiscal 2024 is calculated to be $20.50, representing no share price growth for the next few years. Albertsons is reasonably valued for fiscal 2024 earnings per share, but the share price offers no potential for further increases.

Earnings estimates for Albertsons (ACI Seeking Alpha Ticker Page)

Conclusion

Kroger’s acquisition of Albertsons will result in strong synergies and cost savings; it will also provide a better distribution of geographic sales. The combined company will become the third largest food and drugstore in the United States. Albertsons shareholders will receive a special dividend prior to the acquisition. Also, 100 to 375 food and drugstores will be spun off and placed in a separate entity in which Albertsons shareholders will receive shares.

The current share price provides room for opportunity. Investors are skeptical about approval of the acquisition and distribution of the special dividend. Several state lawyers disagree on the distribution of the special dividend. State lawyers believe that both Albertsons and Kroger are violating antitrust and consumer protection laws. Distribution of the dividend is delayed.

The current stock price allows an expected return of 33%. Investors will also receive shares in the company that includes 100 to 375 Albertsons food and drug stores.

Because Albertsons’ prospects are not bright, it is less attractive to continue investing in the company if the merger does not go through. Nevertheless, the stock’s valuation is in line with the historical average. The stock is worth buying because of its favorable risk/reward ratio.

Be the first to comment