Boarding1Now

In a previous report, I marked Delta Air Lines, Inc. (DAL) and Alaska Air Group, Inc. (NYSE:ALK) as two companies that have strong management execution. However, after a steep selloff on the markets which was extra harsh on airlines, neither of the two companies has shown market outperformance. In fact, Alaska Airlines shares are tanking today, trading 5% lower despite beating expectations.

In this report, I will assess the company’s Q3 2022 results and I will mostly be looking for what part of the earnings is causing shares to sell off despite the stock market being in positive territory today.

Alaska Airlines: Stellar Results

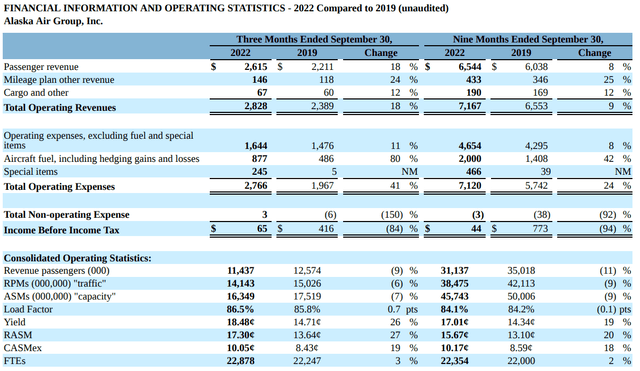

Q3 results Alaska Airlines (Alaska Airlines)

Alaska Airlines saw revenues grow by 18% compared to the comparable quarter in 2019, outpacing revenue growth at the majors. So, that most definitely is not something that I think explains Alaska’s stock price performance lagging. Operating expenses grew by 11%, which is not odd given inflationary pressures and airlines’ carrying costs for future performance. Seemingly, operating profits have not recovered quite well, being 15%, while for instance United Airlines (UAL) is at 99% and Delta Air Lines is at 70%.

However, there are special items that are pressuring Alaska Airlines. There was $155 million related to impairment and accelerated costs related to the fleet transition, as Alaska Airlines will be transitioning to a single fleet type for its mainline and regional carrier and another $90 million in one-time bonus for the labor ratification bonus as Alaska Airlines reached a labor agreement with its pilots. If we strip the special items, we get to operating profits being 72% recovered. United Airlines for instance is at 98.5%, American Airlines is at 93%. GAAP reporting also required some $131 million in mark-to-market fuel hedge adjustments to be recognized. Stripping this out as well, we get to Non-GAAP operating earnings being fully recovered. So, while the GAAP metrics point at lagging profit recovery, I don’t think the performance was weak when considering the core of the business.

Perhaps the reason why shares are not flying high today is that the year-over-year topline growth was only 45%, whereas we saw peers booking revenue growth in excess of 50%. I believe that partially is related to Alaska Airlines transforming its fleet. Airlines cannot get their aircraft fast enough, and while we see airlines like Delta Air Lines bringing back subfleets they previously were no longer planning on operating, Alaska Airlines is continuing to phase out its A320 fleet. During the quarter they retired six aircraft while taking delivery of five Boeing 737 MAX 9 jets, and at Horizon, nine Q400s were retired. So, they are not retaining the capacity to capitalize on demand. You might think it is a bad idea, but given the pilot shortage and the unit cost efficiency that Alaska Airlines is targeting as well as the operational reliability the airline is aiming for, I can understand the decision. However, it is going to be constraining the capacity into Q1 2023.

With their one-fleet solution at mainline and regional level, Alaska Airlines will be able to generate productivity and harmony benefits, but until that happens, they are going to be suffering a bit on the capacity repair. The last item I could think of that might have disappointed investors is that CASM-ex was 19% higher, reflecting labor deal costs that were not previously expected, pushing the CASM-ex figure towards the higher end of the 16%-19% range that was guided for Q3.

Guidance Displays Higher Costs

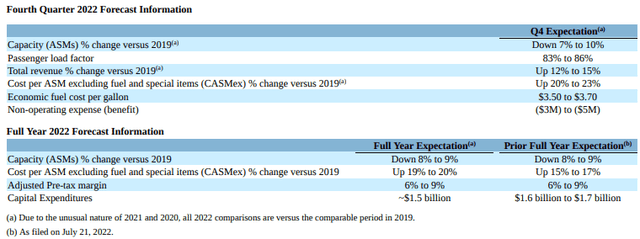

Guidance Alaska Airlines (Alaska Airlines)

For Q4, Alaska Airlines expects capacity down 7 to 10 percent, indicating that as the fleet transition continues, the capacity repair is temporarily on a hold until spring 2023. Revenues are still expected to be up, but less than what we saw in Q3, and CASM-ex is up 20 to 23 percent, reflecting a 4-point hit to the CASM due to three new labor deals and performance-based compensations. This is also reflected in full-year guidance.

Conclusion: Alaska Airlines Stock Down On Cost Growth, Outlook Positive

While I feel like the share price decline of 5% post-earnings and 4% by the time I am wrapping up this report is overdone, I can somewhat see why some investors are tapping out. Whereas airlines cannot get their hands on aircraft fast enough, Alaska Airlines is continuing its fleet transition, and that pressures their capacity and means they are somewhat overstaffed for the quarters to come and also carry higher training costs. Additionally, the unit cost guidance may be a bit off-putting, with costs up 20 to 23 percent in the fourth quarter and 19 to 20 percent for the full year.

The majors are guiding for CASM-ex to be up 13%, and Alaska’s guidance is much higher in that regard. However, it should be kept in mind that Alaska Airlines is keeping the capacity lower to execute on its longer-term effort to simplify the fleet and unlock lower costs. So, they are carrying some excess costs now to achieve their longer-term goals, and if there is one thing I can appreciate with airlines it is their longer-term focus on creating a more efficient airline instead of aiming for less efficient growth. On that end, I believe Alaska Airlines is positioning itself well, and their pre-tax guide remaining the same also shows their confidence in their strategy. Next year, we will be seeing the CASM come down year-over-year as capacity is brought back, networks recover, and productivity improves. The airline is also looking into returning value to shareholders, which next to the turnaround is another positive for investors.

Be the first to comment