Juan Jose Napuri

It’s been a rough stretch for investors in the Gold Miners Index (GDX), with the ETF flipping from considerable outperformance in Q1 to recent underperformance vs. the S&P 500 (SPY) on the turn of a dime. This can be attributed to softness in the metal’s price and cost escalations for many miners, with several examples of companies massively under-delivering on guidance, like Argonaut Gold (OTCPK:ARNGF), Aurcana (OTCQX:AUNFF), and Alexco (AXU).

While this dent in sentiment has dragged down the whole sector, Alamos Gold (NYSE:AGI) continues to over-deliver, true to form, building La Yaqui Grande on schedule and unveiling a Phase III+ study that will make it the proud owner of Canada’s lowest-cost mine post-2025. This makes the recent pullback in the stock very surprising, with Alamos’ net asset value per share increasing considerably in the same period due to the new study. So, in a sector where margin expansion will be difficult (without help from the gold price), Alamos is relatively peerless, and its current valuation disconnect makes zero sense for a company with its organic growth profile.

All figures are in United States Dollars unless otherwise noted.

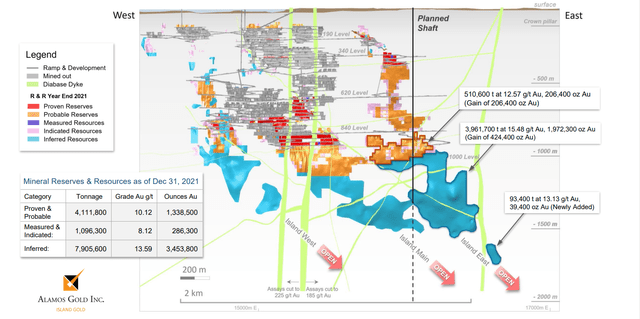

Island Gold Mineralization (Company Presentation)

Phase III+ Study

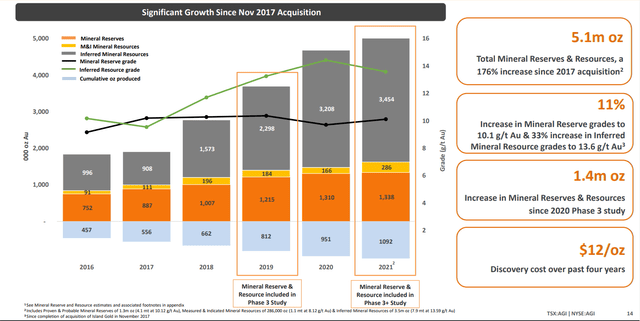

Alamos Gold has done a phenomenal job growing its resource base since its acquisition of Richmont Mines (RIC) in 2017, with resources at Island increasing from ~1.8 million ounces to ~5.1 million ounces, an increase of more than 170%. This considerable resource growth, combined with the fact that the ore body remains open laterally and down-plunge, prompted the company to look at a larger expansion to its already significant 2020 Phase III Expansion study, which involved sinking a shaft and upgrading its mill/infrastructure. The results from this new study were released last week and were outstanding.

Island Gold – Resource Growth Post-Acquisition (Company Presentation)

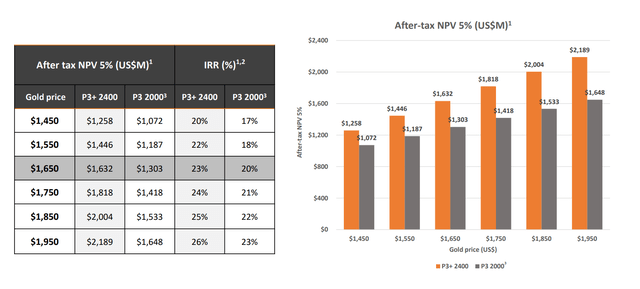

Under the updated study, Island expects to see its production more than double from current levels with significantly lower costs, with the new production profile estimated at 287,000 ounces post-completion (2026) at all-in sustaining costs of ~$580/oz. This is a 22% increase in production from the previous expansion study, and while capex has increased from ~$538 million to ~$756 million, this has been related mostly to scope changes (new 2-stage crushing circuit, larger ADR plant, tailings lift to accommodate larger resource), inflationary pressures, and accelerated development.

While a capex increase may frustrate some investors, it’s important to note that Alamos is well capitalized with nearly $150 million in net cash and ~$600 million in liquidity. Besides, although capex may be up from the previous period, this was expected due to the increase in scope (2,400 tonnes per day vs. 2,000 tonnes per day). In addition, even though capex has increased, the mine’s all-in sustaining costs [AISC] increased just 3% to ~$580/oz, and its total capital per ounce produced actually declined by 4% to $344/oz. The result is an After-Tax NPV (5%) of $1.63 billion at a conservative $1,650/oz gold price, significantly higher than the $1.30 billion After-Tax NPV (5%) at the same gold price assumption in 2020.

Island Gold Mine (Company Presentation)

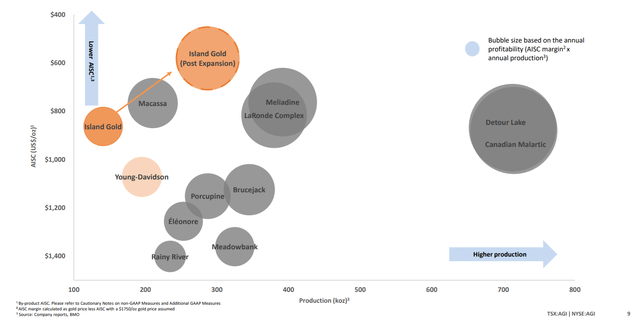

Amazingly, despite the higher production profile, Alamos’ Island Gold Mine now boasts an even longer mine life of 18 years, which is relatively unheard of for an underground mine. If we look at the chart below, we can see that its production profile relative to AISC will be unrivaled among other Canadian mines in operation. This makes Alamos stand out among its peers, with most of the large (250,000+ ounce) ultra-high margin operations owned by gold majors, not mid-tiers like Alamos. Finally, the shaft will decrease Alamos’ reliance on diesel and its greenhouse gas emissions, going from 18 trucks down to five.

Island Gold Mine Current vs. Future Compared To Canadian Mines (Company Presentation)

From a financial standpoint, this asset is expected to be considerably more profitable than Brucejack, just acquired for ~$2.9 billion and just behind the LaRonde Complex from a profitability standpoint. It also benefits from being extremely low cost, meaning that this mine can survive even the ugliest of potential downturns in the gold price. In fact, even at a $1,650/oz gold price, it will generate $223 million in average annual mine-site free cash flow, which would place Alamos Gold at a 9% free cash flow yield based on solely Island Gold using its current enterprise value (~$2.60 billion) and completely ignoring its other three mines.

Perhaps the most impressive statistic though about Island is the team’s discipline to buy incredible assets in a distressed environment, which it has accomplished with Island Gold and Lynn Lake. In Lynn Lake’s case, it paid less than $30 million for an asset that now sports an After-Tax NPV (5%) north of $300 million. In Island’s case, it acquired the project for less than $800 million, has already generated over $200 million in free cash flow, and the operation still has an estimated After-Tax NPV (5%) of ~$1.82 billion at a $1,750/oz gold price. Hence, it has nearly tripled its initial investment, which assumes no additional resource growth (highly unlikely).

This highlights Alamos’ nose for sniffing out great assets and its discipline to only pay the right price for them and buy in the lower portion of the cycle, not when assets are fairly valued or overvalued. In fact, if we compare Newcrest’s (OTCPK:NCMGY) purchase of Pretium for $2.9 billion last year with Alamos’ purchase of Richmont (Island) in 2017, Alamos has punched considerably above its weight given its size, acquiring a mine that’s considerably more profitable than Pretium that now boasts a higher After-Tax NPV (5%) for roughly one fifth the price.

This is how you create long-term shareholder value. So, investors can rest easy knowing that CEO John McCluskey and his team will not make a bold acquisition and overpay for assets like Fortuna (FSM) did last year, rightfully placing them in the penalty box. Instead, they seem to be content to be patient for the right time to strike and acquire and build value at the drill bit. This strategy has contributed to the considerable outperformance of Agnico Eagle (AEM) under CEO Sean Boyd vs. its peer group since 2000 (sporting a 1000% return in a period where the GDX has struggled to make upside progress).

So, what does the company look like once the project is complete in 2026?

Island Gold Operations (Company Video)

Future Production Profile

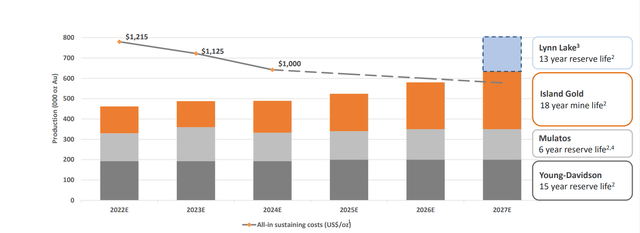

Looking at the chart below, we can see that Lynn Lake has been pushed out to 2027 from 2025, focusing on the larger-scope Phase III+ Expansion at Island Gold. While this has led to a downgrade in the estimated production profile vs. the previous potential of 700,000 ounces per annum at $800/oz costs by 2026, the company still has a very robust production profile. Under the new timeline, and assuming a full year of production from Lynn Lake in 2027, the company looks like it should be able to produce ~570,000 ounces at $860/oz costs in 2025 and ~770,000 ounces at $830/oz costs in FY2027.

Alamos Gold – Future Production & Cost Profile (Company Presentation)

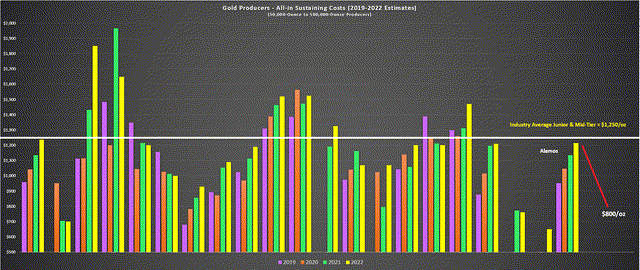

While this might not seem like much growth from the ~460,000-ounce production profile in FY2022 looking out to FY2026, it’s important to note that earnings and cash flow will increase considerably due to the changing margin profile. This is because consolidated AISC should dip from ~$1,220/oz to ~$860/oz, translating to a 57% increase in margins assuming a constant $1,850/oz gold price ($990/oz vs. $630/oz). A margin profile like this makes Alamos stand out among its peers, with the below chart showing the trend in costs for junior and mid-tier producers.

Gold Producers – All-in Sustaining Costs (2019-2022) & Estimates vs. Alamos Gold Future (Company Filings, Author’s Chart & Estimates)

Although some investors might be disappointed in the lower growth profile, I would argue that this growth profile is much more achievable, and just as important, the scope change at Island has boosted the long-term production profile. This is because, under the previous study, Alamos’ production profile looked like it would top out at 740,000 ounces based on ~200,000 ounces at Young-Davidson, and ~130,000 ounces at Mulatos, ~170,000 ounces at Lynn Lake, and ~240,000 ounces at Island Gold.

However, with a 50,000-ounce lift in average annual production at Island, its four current assets can now support an 800,000-ounce production profile potentially. This translates to more than 70% growth from current levels, making Alamos one of the highest-growth stories in the mid-tier producer space. While some other producers might boast similar production profiles, I would argue that Alamos is very straightforward, easily financed, and unlikely to be abandoned/postponed. This is because its two growth projects (Lynn Lake, Island Phase III+) have all-in sustaining costs below $1,000/oz, making them work even in a depressed gold price environment.

Valuation

Based on ~392 million shares outstanding and a share price of US$7.40, Alamos Gold trades at a market cap of ~$2.78 billion, or an enterprise value closer to $2.60 billion. This is a dirt-cheap valuation for a 500,000-ounce per annum producer with a path towards 800,000 ounces long-term with the following attributes:

- industry-leading reserve lives

- predominantly Tier-1 jurisdictional profile

- $1,000/oz AISC margins at a $1,850/oz gold price assumption

In fact, once the Phase III Expansion is complete, Alamos Gold will be relatively peerless among the sector and not just its peer group from a cost and jurisdictional standpoint. This is because it will have some of the highest margins in the sector at ~55% (~$840/oz costs / $1,850/oz gold price assumption), multiple operating assets, and 80% of production coming from Tier-1 jurisdictions. Post-2025, some producers might be in the same league as Alamos from a margin standpoint, like SilverCrest (SILV), K92 Mining (OTCQX:KNTNF), and Wesdome (OTCQX:WDOFF). However, they are either in non-Tier jurisdictions (K92, SilverCrest), lack diversification (3+ mines), or have smaller production profiles (SilverCrest, Wesdome).

Given this unique combination of top-ranked mining jurisdictions, diversification, and steadily improving margins to industry-leading levels, I believe a conservative P/NAV multiple for Alamos Gold is 1.05. However, if the company can execute successfully, I would not rule out a P/NAV multiple of 1.15 – 1.25 post-2025, which would be well below Kirkland Lake Gold’s multiple in its prime, but above the industry average. I believe this multiple is more than justified, given that post-2020/2021 inflationary pressures, producers with these margins in safe jurisdictions are nearly non-existent.

Island Gold Mine – Updated After-Tax NPV (5%) & Sensitivity (Company Presentation)

Based on an estimated net asset value of ~$1.71 billion for Island Gold at $1,700/oz and a combined net asset value of ~$2.40 billion for its other assets, I see a net asset value of ~$4.1 billion. After applying a conservative multiple of 1.05, this would translate to a fair value of more than US$11.00 per share. However, given the significant exploration upside at Island and the potential for multiple expansion in its P/NAV multiple as we reach the shaft sinking stage, there is considerable upside to this price target.

Island Gold – Exploration Upside (Company Presentation)

Summary

With the stock trading at $7.10, I see Alamos as one of the most attractive names sector-wide and one of the few investable names (not simply a trading vehicle), given the team’s discipline and track record of adding value to their assets. This is especially true from a valuation standpoint, given that Island’s NPV (5%) alone makes up 77% of the company’s enterprise value ($1,850/oz gold price assumption), meaning that investors are getting Mulatos, Lynn Lake, and much of Young-Davidson for free. Given this considerable disconnect, I see this pullback in the stock as a buying opportunity, with AGI being one of the clearest examples of the babies being thrown out with the bathwater sector-wide.

Be the first to comment