With COVID-19 hitting the travel industry hard, there also is a renewed focus on aircraft sales patterns. For the past few years, I have been providing monthly updates on Boeing (BA) and Airbus (OTCPK:EADSF) orders and deliveries. Over time that has given me a lot of data where orders and deliveries can be connected to order and delivery values. With the focus on how orders and deliveries are progressing vs. let’s say a year ago, we will be having a look at how Airbus orders and deliveries moved during the first quarter of the year. The data used for this analysis is available to subscribers of The Aerospace Forum, allowing you to slice data interactively in almost any way you want.

Airbus Q1 2020 Orders

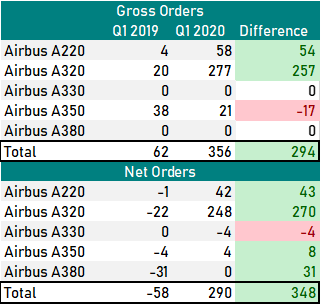

Table 1: Airbus commercial aircraft sales Q1 2019 and Q1 2020 (Source: AeroAnalysis)

How orders developed year-over-year is noteworthy. Based on current market conditions you would expect a significant decline in order activity and the first quarter orders do not reflect that. On the single aisle programs, we observed a significant uptick in order activity while wide body sales were lower. What drove gross order inflow in the first quarter of 2020 were mega orders for 203 aircraft from Spirit Airlines (SAVE) and Air Lease Corporation (ALC). Another way to view it is that 60% of the Q1 2020 order inflow came from aircraft lessors pushing gross order inflow higher by 213 units. From the gross orders, we actually haven’t seen an impact from COVID-19. At the same time, orders placed now are intended to be delivered years from now, so there will be a delay in the COVID-19 impact showing up in the order numbers.

Last year, Airbus received 120 cancellations in Q1 versus 66 cancellations this year. So, we aren’t seeing the COVID-19 impact. Last year the Q1 figures where driven by Etihad Airways canceling 42 Airbus A350 orders, the cancellations of the Airbus A380 program reducing the order book by 31 units. Furthermore, Avianca restructured its order book last year and orders from bankrupt Germania were removed from the order book bringing 42 cancellations to the order book.

From Q1, there’s not apparent cooling in order activity. However, we do see something that looks like cooling when looking at the distribution within the quarter:

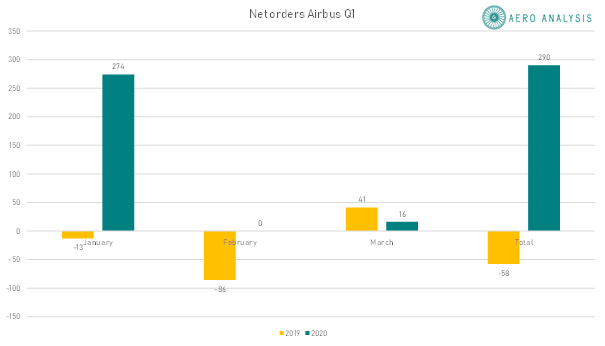

Figure 1: Net orders Airbus Q1 (Source: Aeroanalysis.net)

What clearly shows is that virtually all of Airbus’ Q1 orders were collected during the first month of the year. In February and March with the COVID-19 virus spreading globally we could see that order inflow fell. Somewhat deforming the picture are the order numbers from February last year which included major pressure due to order book restructuring from airlines that couldn’t cope with increasing oil prices and the termination of the Airbus A380 program.

Either way, by dollar value we are looking at a $15.2B worth of net orders booked in the first three months of 2020 vs. a $7.6B order loss in the same months last year. So, COVID-19 might have impacted sales in February and March this year, though we do not know it for sure. Net orders are significantly higher this year due to strong order volumes in January. I don’t expect this strength to be carried over to future quarters, but the backlog should definitely be considered a shock absorber during the crisis. Whatever shock the backlog cannot absorb is going to be absorbed by the deliveries so it’s also important to have a look at the deliveries.

Airbus Q1 2020 Deliveries

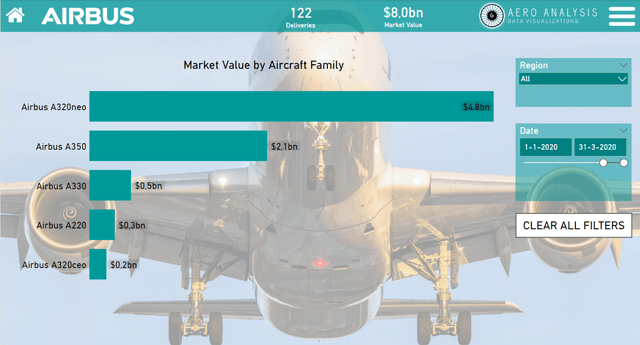

Figure 2: Commercial aircraft deliveries Airbus Q1 2020 (Source: Aeroanalysis.net)

The above figure shows a screengrab from our interactive data model available to subscribers of The Aerospace Forum splitting out the Q1 2020 deliveries by type and putting a market value on these aircraft. Airbus delivered 122 aircraft in Q1 2020 valued $8B. Airbus reported revenues of €7.65B. Accounting for services revenues and conversion to dollar values the revenues for commercial aircraft deliveries were indeed $8B.

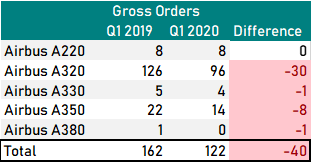

Table 2: Airbus commercial aircraft deliveries Q1 2019 and Q1 2020 (Source: AeroAnalysis)

What we observed is that year-over-year, deliveries decreases on all programs except for the Airbus A220 program. Lower deliveries on the Airbus A330 and Airbus A380 program can be attributed to timing, but the lower Airbus A320 and Airbus A350 deliveries definitely reflect an immediate reduction in demand for air travel resulting in a decline of 38 deliveries during the quarter, which negatively affected Airbus’s revenue by $3B.

Conclusion

The Airbus orders for the first quarter show that net order inflow was more or less flat during February and March. Airbus relied on strong order inflows in January for its year-over-year increase in orders. Currently I’m expecting pressure on net order inflow as airline customers and lessors might be less inclined to place new orders and some might even cancel orders. It doesn’t mean that we won’t be seeing any orders at all, but there definitely will be a damper on order inflow. Some of the demand shock is going to be absorbed by the order inflow, another part by the backlog but we are also seeing that deliveries are directly affected. Combined with challenges to produce the jets amidst a lockdown, it really reflects how immediate the cut off in demand has been and how much pressure it unleashed on airlines. Going forward, production rates have been reduced to recalibrate for a new reality. It remains interesting to see how well the backlog will hold up in the coming months, as healthy backlogs will be part of the jet maker’s assessment to increase production again in the future.

*Join The Aerospace Forum today and get a 15% discount* The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.

The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.

Disclosure: I am/we are long BA, EADSF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment