Thomas Barwick

Investment Thesis

Airbnb (NASDAQ:ABNB) is the category-defining leader in the travel industry, with an incredibly strong brand known all around the world. The travel industry has been a difficult place to be for the past few years as the world ground to a halt, but the easing of lockdown restrictions saw demand for Airbnb come roaring back.

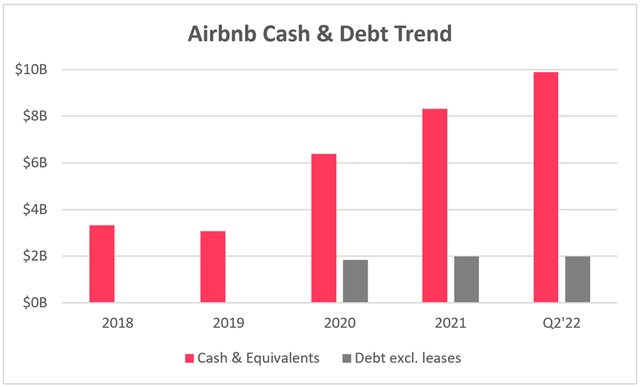

It’s been a wild few years for Airbnb, due to the ever-changing travel conditions caused by the Covid-19 pandemic. Yet, not only did Airbnb manage to survive the pandemic, but I believe it actually became a stronger company thanks to lockdowns. In fact, it’s fastest growing segment for a while has been long-term stays of 28 days or more; this is at least partially due to the pandemic changing the way we work, freeing up more people to do their jobs remotely and from any corner of the world. Combine that with a net cash position of ~$8 billion, and Airbnb is a much stronger business than it was pre-pandemic.

My personal investment thesis for Airbnb is quite simple, and I laid it out in more detail in a previous article. The company has a host of powerful economic moats, including one of the strongest network effects of any business, an absolutely stellar brand, and a high level of pricing power. I think Airbnb has the potential to truly transform the way we live, and its summer release demonstrated some of the different approaches it’s taking to holiday rentals. It has a stellar balance sheet, co-founders in leadership with an incredible amount of skin-in-the-game, a huge opportunity to continue growing, and a business model that could end up oozing free cash flow. All in all, there’s plenty to like about Airbnb.

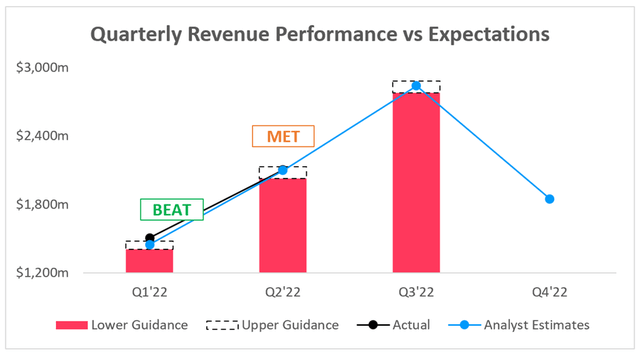

Airbnb had a decent Q2 earnings, with revenues in line with analysts’ expectations and a beat on EPS. The company continued its impressive run of generating strong financial results, and its free cash flow over the past 12 months of ~$2.9B is at the highest it’s ever been.

Yet, shares did fall on the day of Q2 results, mainly because Airbnb didn’t maintain its trend of beating analysts’ revenue expectations. Now, investors will be looking ahead to Q3 earnings for signs that Airbnb is continuing to succeed in a world that still has plenty of headwinds.

Latest Expectations

Airbnb is set to report its Q3 earnings on Thursday, 3rd November, and there are several key items that investors should keep their eyes on.

Starting with the headline numbers, and analysts are expecting Q3 revenue of $2.84B, representing YoY growth of ~27%, and slightly towards the top end of Airbnb’s $2.78-$2.88B guidance. Investors will be hoping that Airbnb can return to its trend of comfortably beating analysts’ estimates, given the slightly underwhelming figure in Q2.

Investing.com / Airbnb / Excel

Analysts are then expecting revenues to fall in Q4 to $1.85B, representing YoY growth of ~21%, as is normal with Airbnb due to fewer people taking holidays in Q4.

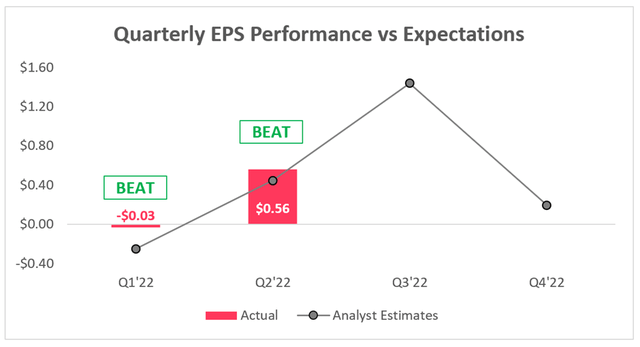

Moving onto the bottom line, and Airbnb doesn’t give guidance on EPS, so I don’t scrutinise it as much as I would if I knew the company was focussed on it. Yet it can still be a useful measure for investors to understand whether or not Airbnb is more or less profitable than expected, and the consensus estimate for Q3 EPS is $1.44.

Investing.com / Airbnb / Excel

Due to the impact of seasonality in Airbnb’s business, it’s standard for the company to see a spike in earnings in Q3 followed by a significant drop-off in Q4 – as we also see with revenue.

So those are the headline numbers that analysts’ and the market will be looking at, but what else should investors be watching out for?

Several Key Metrics To Watch

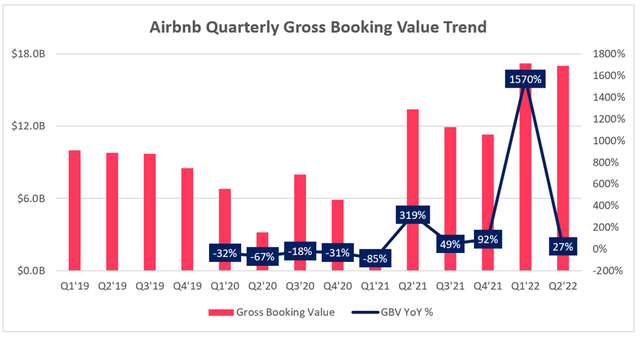

There are a number of other metrics that Airbnb reports for investors, and one of the most important is gross booking value. This is defined as the dollar value of bookings on Airbnb’s platform inclusive of Host earnings, service fees, cleaning fees, and taxes, net of cancellations and alterations.

Basically, revenue is recognised when a stay actually takes place, but gross booking value gives us an idea of how much people have spent in Q3 on Airbnb bookings (even if their stay itself is booked for outside of the quarter). This can be a great early indicator for future revenues; a sharp decline in GBV will see a knock on effect of lower revenue in upcoming quarters, and similarly a spike in GBV will result in a higher revenue outlook.

As the below chart shows, monitoring the seasonal trends in GBV recently has been fairly impossible, given the permutations throughout the pandemic.

Judging by 2019 (non-pandemic), it would appear that GBV stays relatively consistent throughout the year, slightly declining from Q1-Q3 with an eventual tail off in Q4. In 2019, GBV declined by ~1% QoQ from Q2 to Q3; if the same trend follows in Q2’22, we’d see GBV of ~$16.8B, so this is a useful benchmark for Airbnb’s performance.

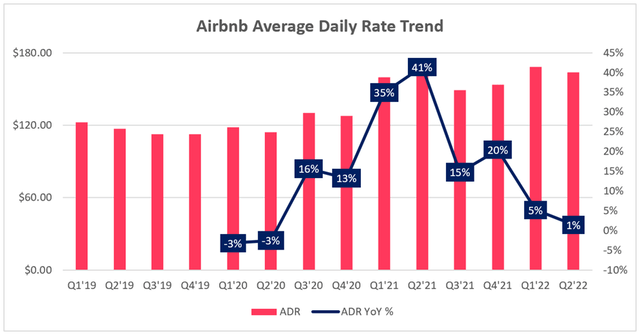

Investors should also be looking at average daily rates, which is the average price paid per day of a stay in properties on Airbnb’s. As can be seen below, the ADR stayed consistently between $112-$122 from Q1’19 to Q2’20, but really shot up in 2021.

This makes sense, as there was substantial pent-up demand for travel, and we all know that there’s been a little bit of inflation going around in the economy. Yet most impressive is the fact that Airbnb have been able to maintain these substantially higher rates into 2022, and the company gave the following guidance in its Q2 shareholder letter:

In Q3 2022, we expect Nights and Experienced Booked year-over-year growth to be stable with the year-over-year growth in Q2 2022. In Q3 2022, we anticipate slightly higher ADRs than we had in Q3 2021 resulting in a modest acceleration in GBV growth

The company expects higher ADRs than the $149.15 it had back in Q3’21, and this would notably lead to an increase in gross booking value that we previously looked at. All in all, investors should expect Airbnb to deliver on both these metrics once again.

… or should they?

A New Host Of Headwinds?

Airbnb might be thinking “phew that pandemic’s over, time to go back to normal” – turns out, it’s not that easy. Inflation is running rampant, the dollar is strengthening, and economies around the world are facing a looming recession. All of these will hurt Airbnb, but hey, at least a stronger dollar might make Europe more appealing for Americans.

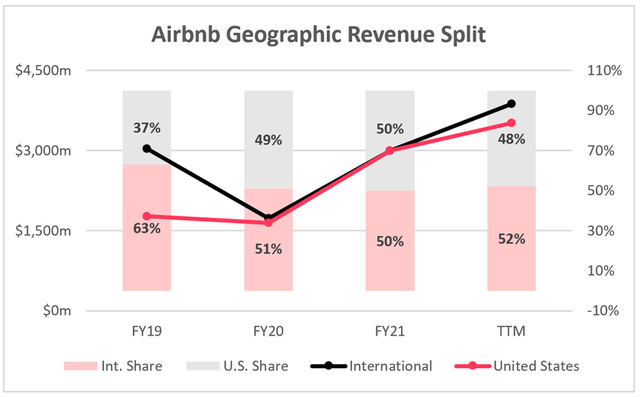

Interestingly, I have been looking for a reversal of one specific headwind that Airbnb has faced over the last year or two. Its international segment has never seen its revenue recover as strongly as its U.S. segment, and I believe this could be a potential catalyst for future growth.

As can be seen in the below chart, revenue from the U.S. made up just 37% of total revenue in 2019, compared to 48% over the past twelve months. It’s also apparent that whilst U.S. revenue strongly accelerated from 2019 through to the last twelve months, international revenue took two years just to recover to 2019 levels.

This was touched on by CFO David Stephenson in the Q2 earnings call:

EMEA is still lagging behind the acceleration that we’ve seen in North America, and we think that, that is actually one of the opportunities for future acceleration of the business. I mean, clearly, things like the impact of the war in Ukraine certainly has had an impact. And there’s obviously the economic impact of even just foreign exchange rates, lower euro and British pound relative to the U.S. dollar. So there are some reasons why Europe has been lagging. It’s still a strong business for us. It’s still doing well, but it could even do better.

This will be a real interest aspect to watch. As someone from the U.K. who also analyses a lot of U.S. earnings reports, it’s clear to me that the U.S. economy is doing better than the economies of its European counterparts. So, whilst I might expect less inter-European travelling, I think the allure of a strong dollar might drive increased travel from the U.S. into Europe. Just a thought, but I’m intrigued to see how these tailwinds and headwinds converge in Airbnb’s results.

Valuation Seems More Than Reasonable

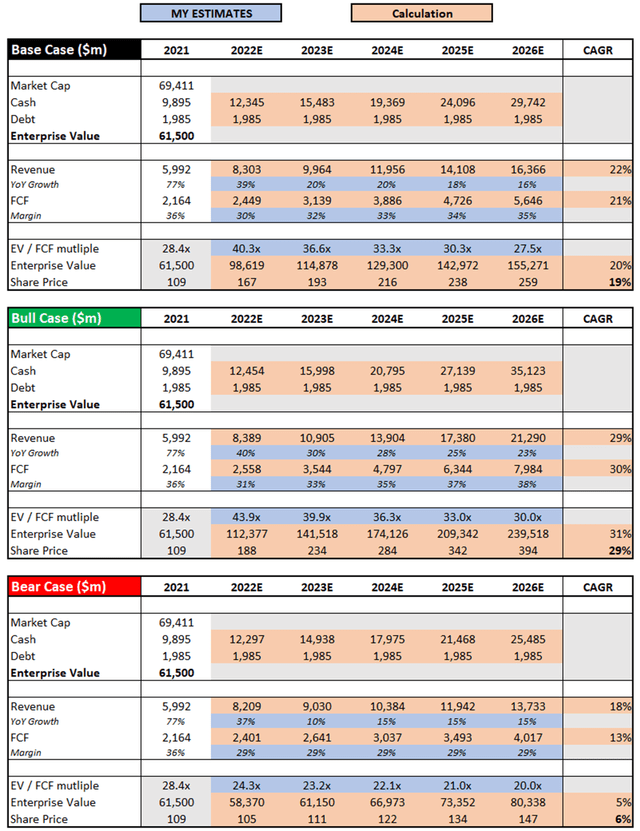

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Airbnb is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have updated my valuation model since my previous article, as I feel it now better shows the potential upside and downside in my bull and bear case scenarios. The base case scenario uses similar assumptions to my previous article.

My bull case scenario assumes that Airbnb is able to continue growing at an impressive rate, and I believe this could be achieved through the momentum it is seeing in longer stays. The post-pandemic travel boost showed that Airbnb can be a cash flow machine at scale, and so I believe FCF margins will improve if Airbnb can achieve the 29% revenue CAGR that I assume in this scenario.

The bear case scenario effectively assumes the complete opposite, and specifically that Airbnb is hard hit in 2023 due to all the macroeconomic factors that we see at play now.

Put all this together, and I can see Airbnb shares achieving a CAGR through to 2026 of 6%, 19%, and 29% in my respective bear, base, and bull case scenarios.

Bottom Line

Despite some commentators saying that Airbnb is overvalued, I would disagree; I believe that its current price is actually fairly attractive, and clearly is pricing in a number of macroeconomic headwinds that the business faces.

Given what I perceive to be a lot of negativity surrounding, then a good Q3 earnings for Airbnb could result in a great boost for shareholders. As such, I am reiterating my ‘Buy’ rating on Airbnb shares.

Be the first to comment