Jeremy Poland

Investment Thesis

Airbnb (NASDAQ:ABNB) is the category-defining leader in the travel industry, and has an incredibly strong brand that is known all around the world. The travel industry has been a difficult place to be for the past few years as the world ground to a halt, but the easing of lockdown restrictions saw demand for Airbnb come roaring back.

When I was on holiday recently (admittedly, not an Airbnb), I read a book called Antifragile: Things That Gain From Disorder by Nassim Nicholas Taleb. The concept is fascinating, and the general overview is this: we cannot predict Black Swan events such as the pandemic or the financial crisis in 2008 – although we fool ourselves into thinking we can – instead, we should set up our lives, our professions, or our businesses in a way such that they can actually get stronger when subjected to a certain level of stress. Fragile things break under stress, robust things stay the same, antifragile things get stronger.

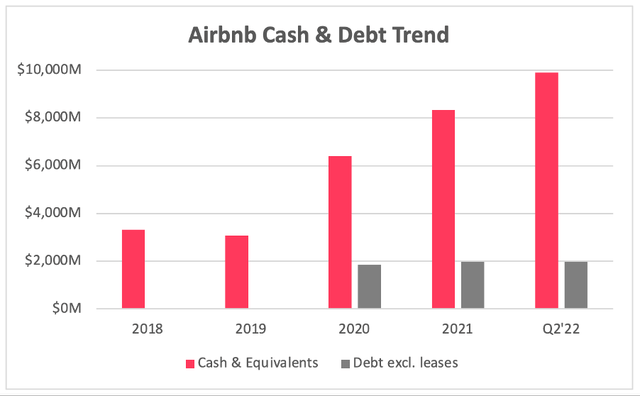

There are several ways that I believe a business can achieve this: having a substantial cash balance, operating an asset-light, high margin business model, and displaying a good amount of optionality. In my view, Airbnb has displayed this in abundance throughout the last few years. The company’s asset-light business model enabled it to get through the pandemic relatively unscathed, and it boasts a net cash position of almost $8 billion.

So it survived, but did it thrive? Most certainly. The pandemic totally changed the way that we live our lives, with many more companies now operating a hybrid or a completely remote approach to working. This has freed up people to live and work wherever they want, and as a result, a lot of people are now deciding to take long-term Airbnb stays whilst working. Once again in Q2, long-term stays of 28 days or more remained Airbnb’s fastest-growing category by trip length compared to 2019. These stays have increased nearly 25% YoY, and are up almost 90% from Q2’19.

Being able to benefit from stressors is the ultimate business model, and I think Airbnb have achieved this. My investment thesis for this company has a similar rationale (detailed in a previous article); it is founder-led, has a powerful brand, an asset-light business model that should turn it into a cash flow machine, and it has a huge network of Guests and Hosts which provides the company with a lot of optionality.

Its mission is ‘to create a world where anyone can belong anywhere’, and this new idea of living for over a month in Airbnbs demonstrates how Airbnb can achieve its mission by transforming the way we think about living, all whilst rewarding shareholders with impressive financial performances.

All this is great, but is the thesis for Airbnb still on track? Let’s see what the Q2’22 results have to say.

Earnings Overview

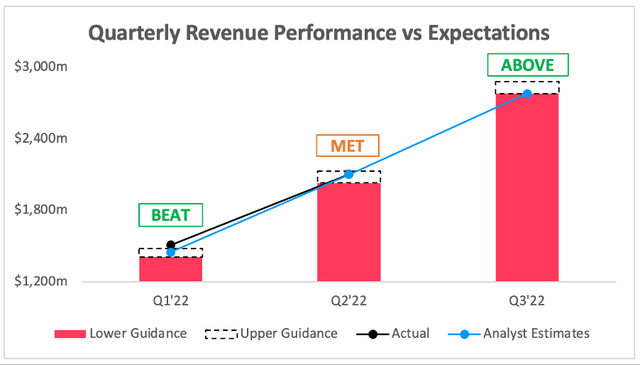

Airbnb reported Q2’22 revenues of $2,104m, which was in-line with analysts’ estimates of $2.1B, and also towards the top end of Airbnb’s $2,030-$2,130m guidance. Whilst this is a good result, it’s worth highlighting that Airbnb has a reputation for beating analysts’ estimates – so, in reality, Wall Street may have been expecting a higher revenue figure. This could go some way to explaining why shares fell ~10% on the announcement of these results.

Investing.com / Airbnb / Excel

It’s also worth highlighting that Airbnb, like many other global businesses, was hit by the strengthening of the US dollar. The Q2’22 revenue represented YoY growth of 58%, but excluding foreign exchange movements, that growth would have actually been 64% YoY – this goes some way to explaining why investors didn’t see another substantial revenue beat.

On the bright side, Airbnb’s outlook for Q3’22 was impressive, with guidance of $2,780-$2,880m coming in ahead of analysts’ estimates of $2,780m.

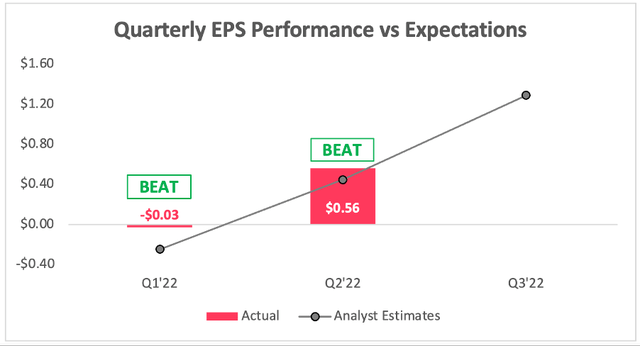

The company doesn’t give guidance for EPS, so I don’t pay too much attention to how the company performed vs analysts’ estimates. It can be useful to understand whether or not the profitability of the company is coming in line with what analysts are expecting, and Airbnb did pretty well on this front, reporting EPS of $0.56 with analysts expecting $0.45.

Investing.com / Airbnb / Excel

So, financially, a very good quarter, but not a blowout quarter. I’m still happy to see these results as an Airbnb shareholder, particularly since travel could be seen as a discretionary spend that will be cut back in a recession & it is seeing resilience right now.

Diving Into The Numbers

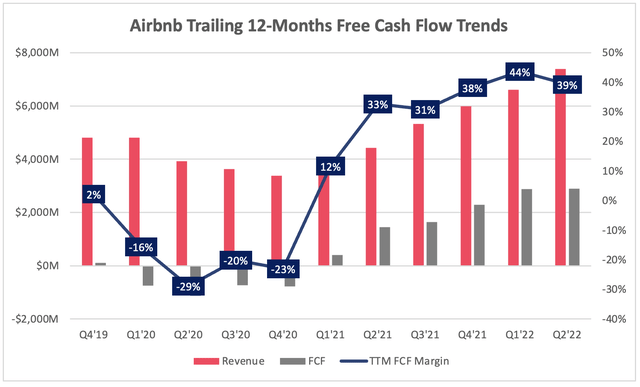

Sometimes I find it difficult to ascertain exactly what’s going on with Airbnb’s results for two reasons: it is extremely seasonal, and 2020-21 were exceptional years. Given this, I often like to take a look at some trends on a trailing 12-month basis, in order to try and wash away the seasonality impact.

I’ll start by taking a look at free cash flows, and this is what I mean when I say Airbnb can become a FCF machine.

Airbnb has been boasting TTM FCF margins in excess of 30% since Q2’21, and hit a 44% margin in Q1’22 – that is pretty incredible. If you look back to 2019, Airbnb generated FCF margins of 2%, so clearly this company has come out of the pandemic much more streamlined & ready to generate bundles of cash. This has enabled Airbnb to reinvest, work on its product, and it also announced a $2B share buyback. As CEO Brian Chesky put it on the earnings call:

So again, during the 2020 pandemic curve, just to recap, we got really focused. We got back to basics. And over the last 2 years, I think we’ve really, really benefited by perfecting our core product. That being said, we are now looking and we are thinking very expansively. So you should look at our stock buyback as our confidence in our long-term growth and profitability. That’s all you should believe that stock buyback’s about.

Basically, the company is generating so much cash that it can both reinvest aggressively & also return value to shareholders – happy days!

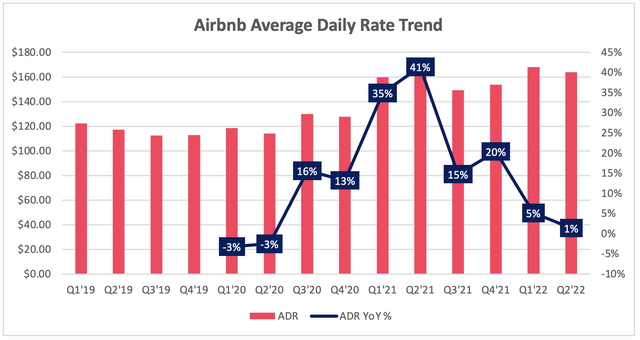

Another big contributor to Airbnb’s success in recent quarters was the growth in ‘Gross Booking Value per Night and Experience Booked’ aka average daily rate, or ADR – basically, the average cost of one night in an Airbnb over the period. This remained fairly stable in 2019, but after the pandemic there was clear demand for Airbnbs & therefore the company was able to increase its ADRs substantially.

We can see, however, that in 2022 the huge YoY growth has eased up substantially – this is no surprise, as management told investors not to expect the same level of ADR growth; they guided for ‘stable’ ADR growth for Q2’22, and that’s what we got. Management have guided for ‘slightly higher ADRs’ in Q3’22 YoY, which is great to see – especially since 2021 was such a strong year for ADRs.

It’s also worth highlighting that ADRs in Q2 actually increased 7% YoY on an FX-neutral basis, and were up across all major regions YoY by this measure. The increased ADRs were purely driven by higher prices, being partially offset by the fact that urban destinations saw a rebound in demand, and these generally have lower ADRs.

Basically, despite so many headwinds, ADR growth was still positive. I made a case for Airbnb’s pricing power in my previous article, and I think we are seeing it on display here.

Valuation

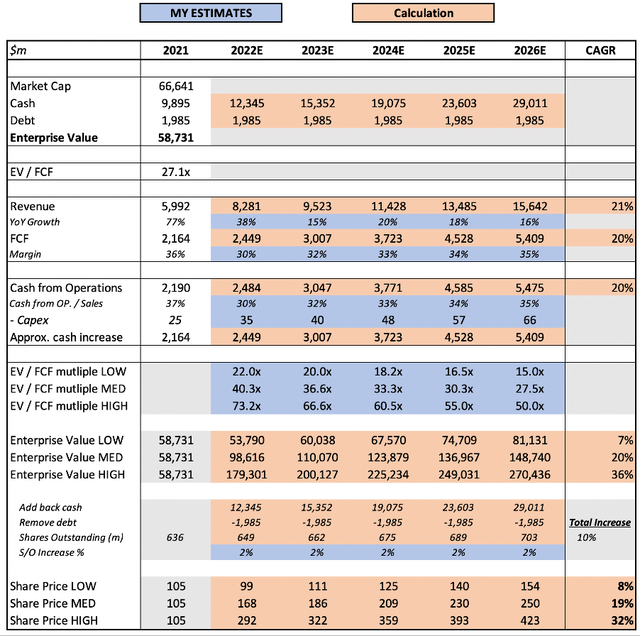

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Airbnb is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I had previously chosen to create a valuation model based on an EV / EBIT multiple, however on reflection I believe that EV / FCF is the most appropriate for Airbnb. I have assumed 38% YoY growth in 2022, taking into account the H1 actuals & Q3 guidance from management. I have allowed for a difficult, recession-impacted 2023 with only 15% YoY growth, however this does recover in 2024.

My long-term growth rate assumptions are higher than in my previous model, as Airbnb continues to gain traction with long-term stays, which I believe could be transformational for the business. The company has also demonstrated an ability to be resilient, even in difficult macroeconomic times, which further explain why I assume a 21% revenue CAGR over this period.

I have also assumed gradually expanding FCF margins, and an unwinding of the unusually high FCF in 2021. I’ve also used what I believe to be an appropriate 2026 EV / FCF multiple of 27.5x given my growth assumptions, however I have given a range.

Put all this together, and I can see Airbnb shares achieving a 19% CAGR through to 2026 in my mid-range scenario.

Investment Thesis: On Track

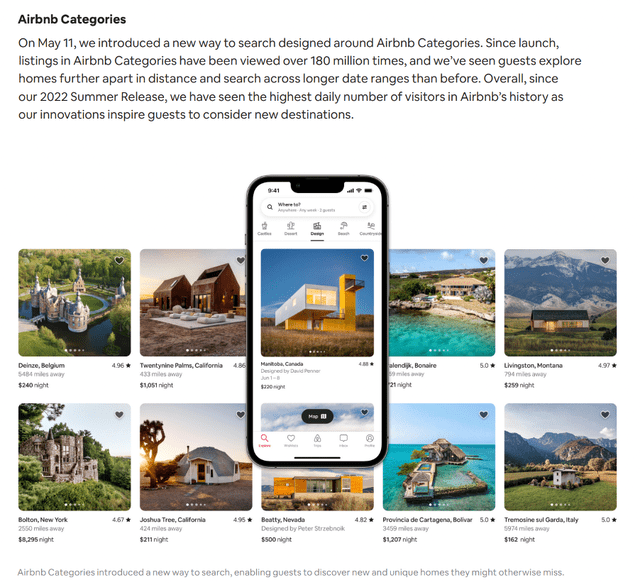

It would appear that all the trends for Airbnb are heading in the right direction, and the business itself is continuing to execute on its strategy. The company is still seeing recoveries in various parts of its business, and the recent Airbnb Summer Release continued to transform the way that we all think about travel.

Airbnb Q2’22 Shareholder Letter

A recession might result in Airbnb taking a short-term hit, but this company has already demonstrated an ability to roll with the punches & come out stronger. The antifragility of Airbnb gives me confidence going forward, and I can see myself being a shareholder of this company for a long, long time.

Be the first to comment