AndreyPopov

Introduction

I don’t know about you, but I’m being spammed with ads from companies that offer (what they consider to be) attractive ways to invest in the future through overpriced ETFs or startups that are riskier than playing Russian roulette with a fully loaded revolver. This included crypto, artificial intelligence, cloud computing, and hydrogen. In this article, I want to focus on a stock that offers its investors high-quality exposure to the last thing on my list: hydrogen. Air Products and Chemicals (NYSE:APD) is one of the global leaders when it comes to investments in hydrogen. Not only that, but investors also buy exposure to its existing business, which provides a consistently rising and sustainable dividend. While massive investments are required for ambitious hydrogen products, the company enjoys a fortress balance sheet and high income from its non-growth business.

Long story short, in this article, we will discuss why Air Products and Chemicals is a great investment for dividend growth investors looking for no-nonsense investments in new energies.

So, let’s get to it!

The Future Of Hydrogen

The first priority of Air Products and Chemicals is to run its business as efficiently as possible. This includes every single chemical it produces, processes, and ships. However, the emerging market the company is focusing on is hydrogen. According to the company:

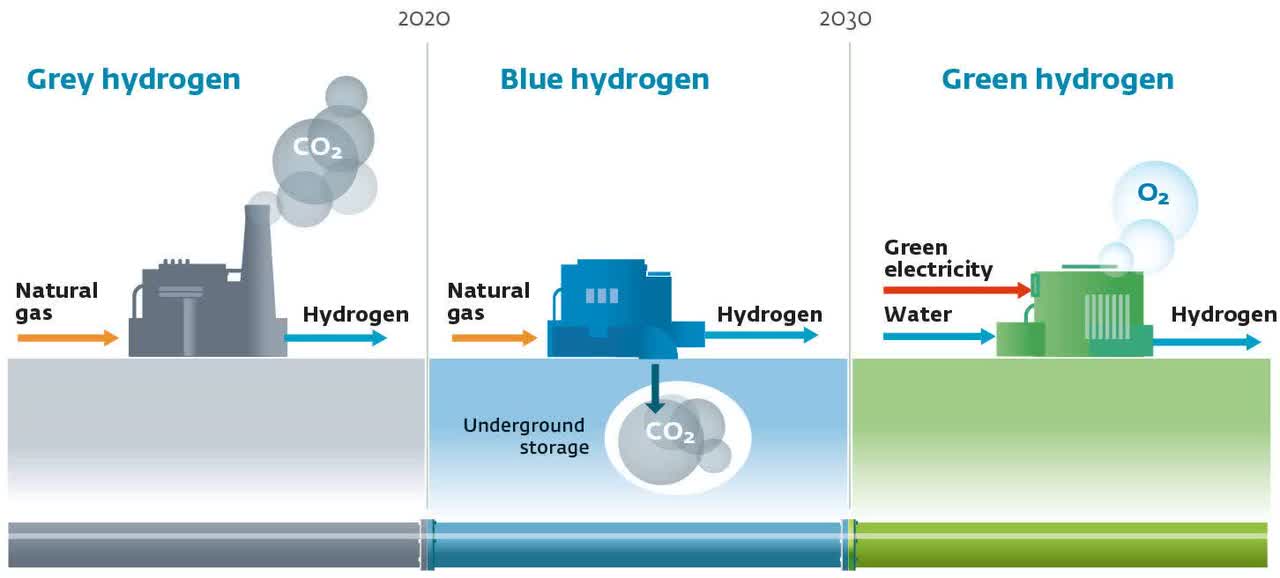

The second pillar of our strategy is to focus on zero and low carbon hydrogen projects that produce the hydrogen energy of the future. Air Products today is the leader in the production of gray hydrogen worldwide.

Our strategy is to have a natural extension of that leadership position and to be the leader in the production of green hydrogen based on renewable resources and blue hydrogen, which is the production of hydrogen from hydrocarbons combined with CO2 capture.

Like pretty much every “new” technology in the energy space, there are pros and cons to hydrogen. Grey hydrogen, for example, is the production of hydrogen using natural gas or fossil fuels, in general. I’m not a big fan of that as it basically wastes energy. Producing hydrogen from natural gas, for example, means some energy is lost in the process.

The World Of Hydrogen

However, in general, I do like hydrogen as it is a better alternative than electric cars (I think). Hydrogen makes it easier to store energy and it can use existing infrastructures like most pipelines and modern heating systems. Hence, I am a big fan of using dense energy sources like nuclear to produce hydrogen. I think that’s one of the best ways to pave the road for net-zero and to allow for decarbonization without risking an implosion of economic activity like we’re currently witnessing in Europe and elsewhere.

With that said, the International Energy Agency (“IEA”) has been on top of the whole energy transition as it advises governments. I have often said that I disagree with the IEA and believe that its policies are actually bullish for fossil fuels. However, I did like its 284-page hydrogen outlook as it explains the most likely scenario going forward.

The management summary alone was four pages long as it included a few important comments that I want to use in this article. For example:

The global energy crisis underscores the need for policy to align energy security needs with climate goals. Hydrogen can contribute to energy security by decreasing dependency on fossil fuels, either by replacing fossil fuels in end-use applications or by shifting fossil-based hydrogen production to renewable hydrogen.

In 2021, hydrogen demand reached 94 million tonnes, which broke the pre-pandemic record of 91 MT. The IEA estimates that based on current policies and measures put in place by governments, we could see demand accelerate to 115 MT by 2030. Less than 2 MT would come from new uses.

The IEA estimates that 130 MT is needed to meet existing climate pledges. 200 MT would be needed in 2030 to be on track for net zero by 2050.

Needless to say, these numbers are wild. 200 MT in demand by 2030 to accomplish net zero by 2050 would mean that demand doubled in the 7/8 years that lie in front of us.

I believe the chances of that happening are as high as me becoming a backup quarterback for the Dallas Cowboys. However, the trend is up and we will, without a doubt, see accelerating demand. Especially once the world figures out that the transition to EVs isn’t so great after all.

That’s where the Air Products and Chemicals company comes in.

APD Stands For Smart Investments And High Growth

With a market cap of $52.6 billion, Air Products is the largest stock-listed chemicals company in the United States.

Headquartered in Allentown, Pennsylvania, the company’s roots go all the way back to 1940. The company has been involved in hydrogen for more than 60 years (the technology itself isn’t new) and it has added value to more than 250 global hydrogen projects in more than 20 countries.

This month, the company announced a new project: the construction of a second liquid hydrogen plant in Rotterdam. According to the company:

This new source is in addition to the company’s existing liquid hydrogen plant in Botlek, the Netherlands. Once operational in 2025, the plant will double Europe’s total current liquid hydrogen capacity.

Liquid hydrogen produced at the plant will be used to supply increased demands from high-tech industries as well as the mobility market. It will contribute to the decarbonization of heavy-duty vehicles on Europe’s path to climate neutrality by 2050.

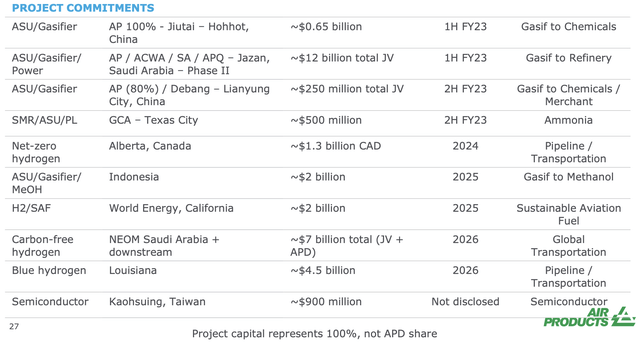

The table below shows the company’s future project commitments, which go well-beyond (green and blue) hydrogen as it includes ammonia, sustainable aviation fuels in California, and related projects.

Air Products and Chemicals

The “problem” is that engaging in major projects is expensive. Building, for example, energy infrastructure not only requires knowledge and expertise (APD excels at that) but also a lot of capital.

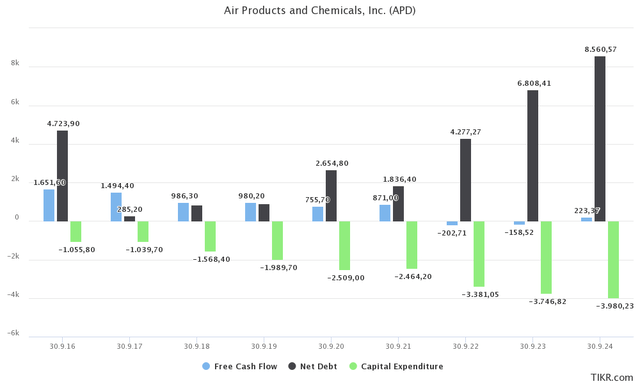

Unlike almost every single dividend stock I discuss on this website, APD does not have positive free cash flow. Not only that but accelerating CapEx requirements are boosting net debt to $8.6 billion in 2024 (expected).

TIKR

The company estimates that it needs roughly $35.0 billion of capital in the 2018-2027E period. Between 1Q18 and 3Q22, the company spent $10.3 billion. Including backlog, the company has spent just 30%. As a result, CapEx expectations are $3.4 billion in 2022, with steady increases to $4.0 billion in 2024 and beyond.

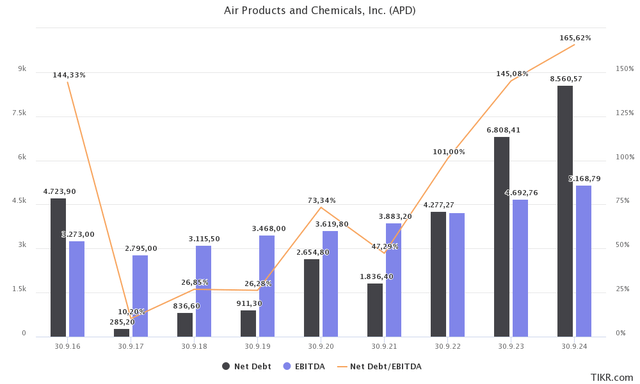

While this is boosting net debt to almost $9.0 billion, the company benefits from a number of tailwinds.

First of all, the company invests in value-adding projects, not useless vanity stuff. Hence, thanks to rising EBITDA, the net leverage ratio is rising to just 1.7x. In other words, the company is boosting net debt from almost zero in 2017 to almost $9.0 billion in 2024 (expected), yet it is still expected to maintain a sub-2.0x net leverage ratio. That is truly impressive and it shows how well-prepared this company is to deal with costs that most companies simply cannot cope with.

TIKR

As a result, S&P Global affirmed the company’s credit rating at “A” with a stable outlook. While the comparison isn’t scientifically correct, APD has a higher credit rating that Italy, Mexico, and a lot of other countries.

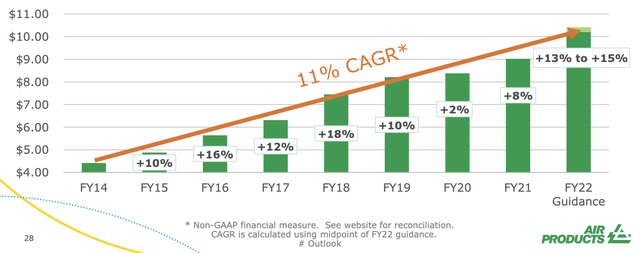

Moreover, the company has a very strong basis, to begin with as I mentioned. The company isn’t a startup that just decided to get into hydrogen. No, APD has a huge global footprint covering all major industrial chemicals, which has allowed it to grow earnings per share by 11% per year between 2014 and 2022E.

Air Products and Chemicals

Even this year, the company is looking at 13% to 15% in EPS growth. Even in Europe, the current hotspot of the energy crisis, the company is doing rather well. In its third fiscal quarter of 2022, the company saw 23% higher sales despite 3% lower volumes. Pricing was up 17% with energy cost pass-through growth of 24%. This offset even 15% currency translation headwinds and resulted in a 3% higher operating income.

While I believe that Europe is on the verge of longer-term deindustrialization due to horrible energy policies I have to say that APD remains in a good spot as it is focusing on hydrogen, the one thing Europeans are currently throwing billions at. Moreover, it doesn’t have that many competitors and a dominant spot in the chemical market. When adding pricing, I think APD is in a good position to weather the storm.

So, what about the dividend? After all, that’s the main reason I’m writing this article.

The APD Dividend

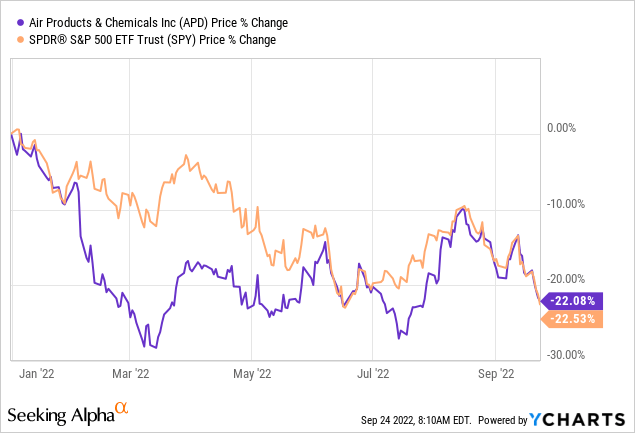

Air Products and Chemicals is having a tough time. However, despite its European exposure of roughly 25%, the company is not underperforming the S&P 500. Both APD shares and the S&P 500 are down 22% year to date as the market started another leg down in June – fueled by fears that aggressive Fed hiking is making a “hard landing” a base case. I discussed that in this article.

While these sell-offs aren’t fun, they provide us with better valuations. And after all, I believe that using sell-offs to buy quality dividends is the best way to generate long-term wealth.

This is also the part where I justify the title I am using. This month, Morgan Stanley came out, publishing a list (via Seeking Alpha) of dividend stocks it believes are “top dividend stocks to own” and a list of stocks to avoid.

The list included Air Products and Chemicals, which Morgan Stanley believes has 30% upside (from September 19 levels).

According to the investment bank:

“This methodology compares upside/downside to price target, projected dividend yields, and bull-bear spread, and 1-year volatility to optimize risk and return metrics,” Nicholas Lentini and team wrote in a note. “We then ran the final ‘To Own’ and ‘To Avoid’ stocks by our coverage analysts as a fundamental overlay.”

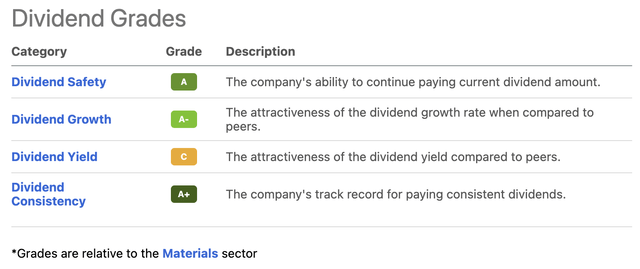

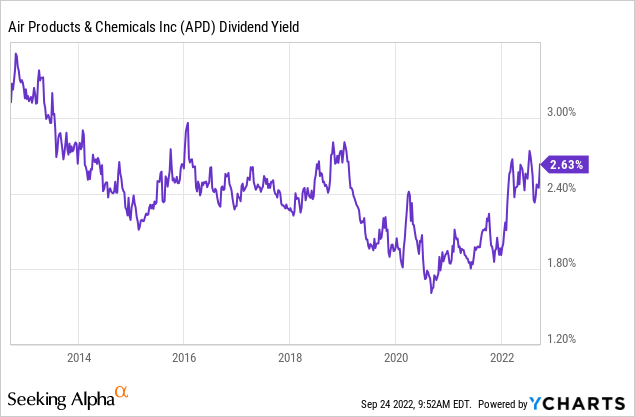

Since mid-September, APD’s yield has increased due to stock price weakness. The company currently yields 2.7%, which is based on its $1.62 per quarter dividend. That’s a decent dividend yield, but it still results in a “C” grade on the Seeking Alpha dividend scorecard. That’s caused by the fact that a lot of material companies have higher yields. For example, mining companies or older companies with very slow growth and high payout ratios.

Seeking Alpha

APD is different. The company is a dividend aristocrat (hence its high consistency score) with a 56% payout ratio using the EPS estimate for the next twelve months.

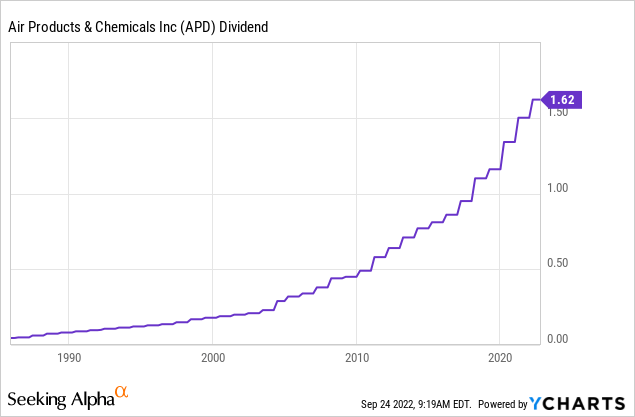

It also has high dividend growth. Over the past 10 years, the average annual dividend growth rate was 10.7%, which explains why the company is scoring high on dividend growth.

These are the most “recent” hikes:

- February 2022: 8.0%

- January 2021: 11.9%

- January 2020: 15.5%

- January 2019: 5.5%

That’s not too bad, is it?

Especially considering that this is happening at a time when the company is ramping up its CapEx plans. That’s true confidence from management, and I couldn’t agree more.

Also, we’re now dealing with a 2.7% yield. Long-term dividend growth of close to 10% works wonders on a yield that comes close to 3%. The compounding effect is very strong.

That also explains the company’s outperformance.

APD’s Outperformance & Valuation

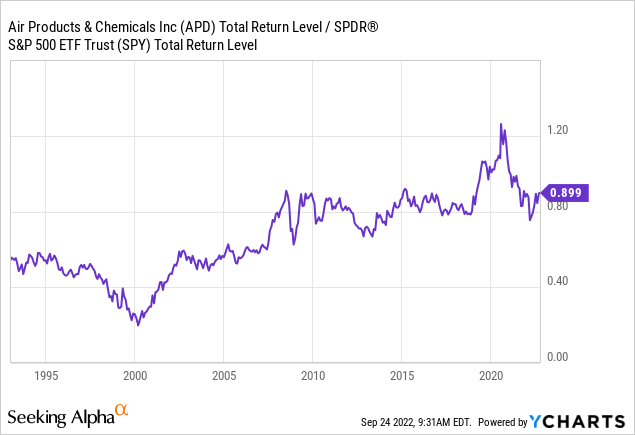

APD isn’t a high-flying stock. However, it is a stock that is consistently outperforming the S&P 500. The chart below shows the ratio between the APD total return and the S&P 500 total return. The last time the stock significantly underperformed the market was in the 1990s. Since then, the stock has kept up with the market, even between 2011 and 2021 when low inflation and zero rates when the market prioritized “tech” and “growth” over boring basic materials.

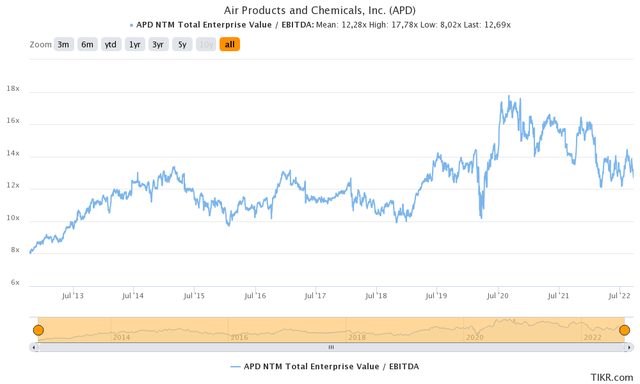

With regard to the valuation, APD shares are now trading at 12.8x 2023E EBITDA. That’s based on a $60.3 billion enterprise value consisting of its $52.6 billion market cap, $6.8 billion in 2023E net debt, as well as $570 million in minority interest and $280 million in pensions. This valuation erases the entire post-pandemic surge, which puts the company in a favorable position, I believe.

TIKR

The same goes for the dividend yield, which has rebounded nicely from the post-pandemic lows of less than 1.80%.

Takeaway

I believe that APD shares offer a lot to (potential) investors. The company is a household name in the global chemical industry. It has a tremendous track record of growing its business thanks to increasing volumes, pricing, and investments in “future” growth niches like hydrogen.

The company is investing tens of billions in new hydrogen applications until at least 2027 as it has the knowledge and skills to pull off big projects (like the one to be started in Rotterdam) and the balance sheet to deal with higher debt while maintaining a decent and steadily growing dividend for its investors.

It’s truly a phenomenal company that allows investors to benefit from a great dividend and future technologies like hydrogen without the need to invest in risky startups or overpriced ETFs (meaning high expense ratios).

APD is a no-nonsense dividend growth stock. In other words, I completely agree with Morgan Stanley as APD is truly one of the best dividend stocks to own.

(Dis)agree? Let me know in the comments!

Be the first to comment