Petmal/iStock via Getty Images

Air Products and Chemicals, Inc. (NYSE:APD) is one of the Dividend Aristocrats (NOBL) I am looking to add to my long-term portfolio. Air Products already has a massive hydrogen business that could be even bigger as the world transitions to cleaner-burning fuels. The company offers a good, safe dividend and has low volatility [Beta of 0.94]. But, the company seems to be fully valued. It may be best to wait for any short-term weakness in the stock before buying at around $225.

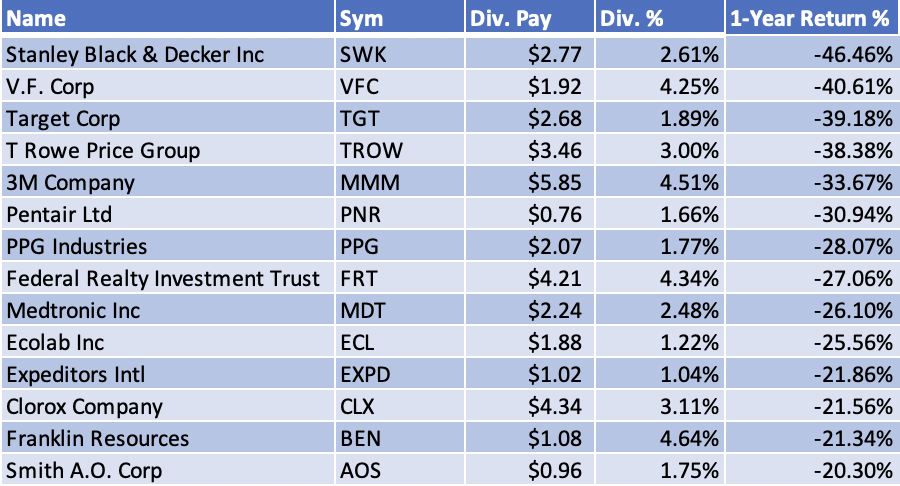

Losers on the Dividend Aristocrats List

Fourteen companies on the Dividend Aristocrats list have lost over 20% in the past year as of July 29, 2022 [Exhibit 1]. Six companies have lost over 30% of their value in the past year. I am looking to add more V.F. Corp (VFC) to my portfolio with its excellent dividend yield of 4.5%. The company has timeless brands, but as this article indicates, it may be facing headwinds to its cash flow and dividend growth. I currently own shares at an average price of $57.90 [down about 23%], but I am optimistic about the long-term prospects of this company.

Exhibit 1: Biggest Losers in Dividend Aristocrats as of June 29, 2022, Have Lost Over 20% in 1-Year

Biggest Losers in Dividend Aristocrats as of June 29, 2022, Have Lost Over 20% in 1-Year (iexcloud.io, barchart.com, author compilation)

Exhibit 2: Air Products & Chemicals Has Lost Over 14% of its Value in 1-Year

Air Products & Chemicals Has Lost Over 14% of its Value in 1-Year (iexcloud.io, barchart.com, author compilation)

Air Products is a Consistent Performer

Air Products and Chemicals has lost 14% of its value [Exhibit 2] in the past year compared to the 10.8% loss in value of the Vanguard Materials ETF (VAW). The company had an excellent Q2 FY 2022, with sales of $2.94 billion, an increase of 18% over the same quarter in FY 2021. Energy cost pass-through accounted for 6% of the increase in sales. The growth contribution from the energy cost increase can be subtracted from the overall growth rate. Volume and price increases amounted to 12% of the revenue growth. The company has steadily increased its profit margins over the years, and now its operating margin is regularly above 22% since 2018 [Exhibit 3].

Exhibit 3: Air Products and Chemicals Operating Margin [2007-2021]

Air Products and Chemicals Operating Margin [2007-2021] (SEC.GOV, Author Compilation)![Air Products and Chemicals Operating Margin [2007-2021]](https://static.seekingalpha.com/uploads/2022/7/4/saupload_RGfzHjFitrkeGXi_G_trDWo9RQ8qJ43_D2VGTdQmAhHTyKo3oMKxxeUr5drPh7KEiWmYl1HvPLiD7gTrvW3PeuVGw97U7nQEIbycOP3IDYrlzrtRfsaOI2lwHf7xob_M6wphf69683PBLcORPss.png)

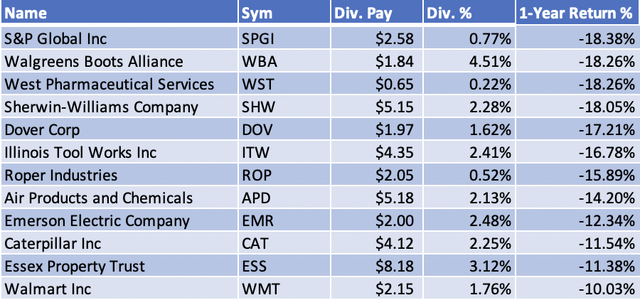

The company has increased its dividend for 40 consecutive years and has good management willing to prioritize multi-billion dollar investments in projects with potential for good returns. The stock currently yields 2.6% with a distributable cash flow payout of 45% [Exhibit 4]. The company has a manageable debt to EBITDA ratio of 2x compared to 1.5x for Linde and 3.1x for DuPont.

Exhibit 4: Air Products and Chemicals Cash Flow and Dividend Payout

Air Products and Chemicals Cash Flow and Dividend Payout (Air Products and Chemicals Investor Presentation)

Valuation and Financial Performance

With a fear of a recession hanging over the market, Air Products may be fully valued at this time. Air Products forecasts an adjusted EPS of between $10.20 and $10.40 for FY 2022. At that EPS, the company would trade at a forward GAAP P/E of 23x and a forward GAAP EV to EBITDA multiple of 13.8x. The company has a good return on equity [ROE] of 16.6% compared to an average of 14.7% ROE of the companies in the Vanguard Materials ETF (VAW). The company delivered a 10.3% return on invested capital [ROIC]. The company’s current ROIC was good when the interest rates were low, but it may be deficient in today’s rising interest rate environment. But, Linde’s (LIN) ROIC was a meager 6.5%, and DuPont’s (DD) was even lower at 4%.

I estimated Air Products and Chemical’s weighted average cost of capital [WACC] at 8.6% at the current 10-year treasury rate of 2.8%. It is good that the company generated a return above its current estimated WACC. But, investors will have to watch the ROIC metric closely in the future, given that any new debt the company issues may come with a higher interest rate. For example, the company has a Senior Note outstanding for $950 million at an interest rate of 2.8% until 2050. Today, the 10-year U.S. Treasury bond pays 2.88%.

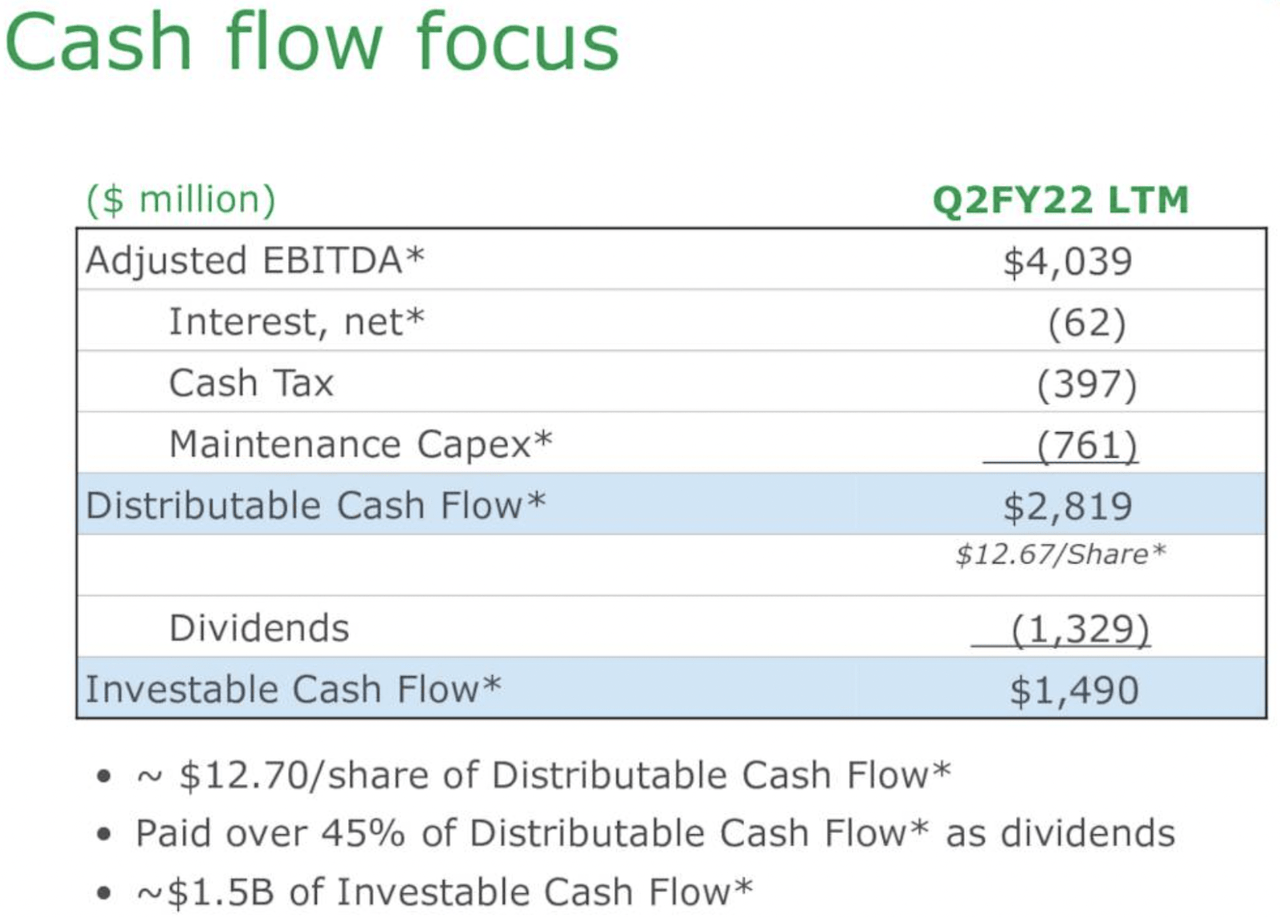

The company has $2.9 billion in debt maturing between now and 2030, which were issued at rates ranging from 1.5% to 3.35%. Given the U.S. Treasury rates today, it is safe to say that the company may see its borrowing costs increase in the future. The company is investing vast sums of money in capital projects that should pay off good dividends in the future. Air Products may have front-loaded much of its capital expenditure and thus may not need vast cash outlays in the future. For example, Air Products has four joint ventures coming online in FY 2023 [Exhibit 5].

Exhibit 5: Air Product’s Joint Venture Coming Online in FY 2023

Air Product’s Joint Venture Coming Online in FY 2023 (Air Products and Chemicals Investor Presentation)

The company’s CEO – Seifi Ghasemi – said in the latest earnings call that the company is currently focused on investing in projects with a good return rate. He sees massive project opportunities in energy security and the energy transition space. Here’s the quote from the earnings call:

“The focus on energy security and the transition is creating significant new project opportunities now and in the future. Therefore, we firmly believe investing in high-return projects rather than share buyback is the right way forward to support the energy transition, continued profitable growth for Air Products, and an appropriate return for our investors.”

Daily Price Return Comparison

Air Products’ daily price return data between May 31, 2019, and July 1, 2022, showed an average return of 0.042% or 4.2 basis points (Exhibit 6). Air Products’ daily return was below 1% or 100 basis points 75% of the time [third quartile in Exhibit 6]. Since the beginning of 2022, the sentiment has turned negative for the stock and the materials sector, with a -0.164% average daily return for Air Products and Chemicals.

The stock’s daily return has a strong positive correlation with Vanguard Materials ETF, with a correlation of 0.77. Linde’s daily returns were much more positively correlated [0.83] with the Vanguard Materials ETF.

Exhibit 6: APD Daily Price Change (%) [May 31, 2019 – July 1, 2022]

APD Daily Price Change (%) [May 31, 2019 – July 1, 2022] (iexcloud.io, author calculations)![APD Daily Price Change (%) [May 31, 2019 - July 1, 2022]](https://static.seekingalpha.com/uploads/2022/7/4/28462683-16569740406978524.png)

Income Generation Via Covered Calls or Cash-Secured Puts

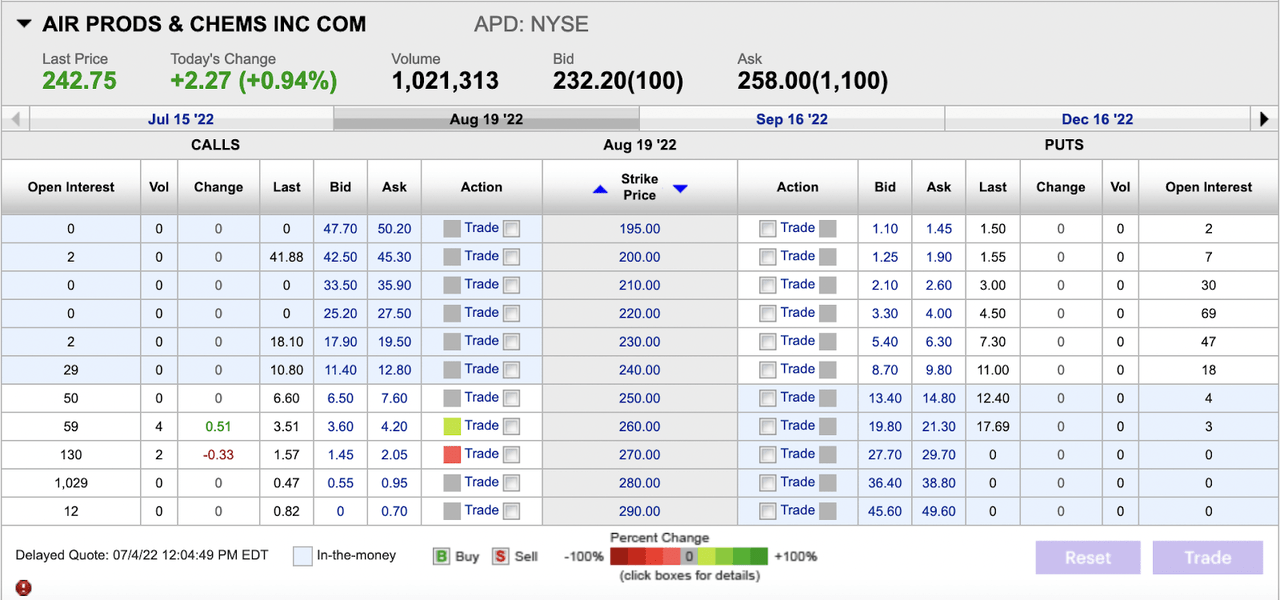

If an investor already owns over 100 shares of Air Products, selling a covered call may generate a good income stream. The August 19, ‘22, $260 call last sold for $3.51 and has an open interest of 59 contracts [Exhibit 7]. The $3.51 premium yields a reasonable 1.3% return over seven weeks. The stock would have to rise another 7% from its current price of $242.75 to be called away. The probability of being called away may be low, given that the stock already looks fully valued amid a slowing economy. The August 19, ‘22, $210 strike price last sold for $3.00. That premium would amount to a 1.4% return in seven weeks [Exhibit 7].

A cash-secured put would require a massive $21,000 cash outlay that could be locked up for seven weeks. Investors who wish to own Air Products and Chemicals for the long-term will have to approach a covered call or a cash-secured put strategy cautiously. One can consider a higher strike price call or a lower strike price put, accept a lower premium, and still generate an income when executing a covered call or a cash-secured put strategy.

Exhibit 7: An Options Strategy Can Generate an Income

An Options Strategy Can Generate an Income (E*Trade)

Conclusion

Air Products and Chemicals is a Dividend Aristocrat worth owning for the long term. But, it may be best to wait for a better entry point in this stock. I will wait for a price of $225 or below before building a position in this stock. The company already has a large hydrogen business which can grow even more prominent as the global economy transitions to a mix of green fuels that will reduce greenhouse gas emissions. Investors should observe the stock and look for any short-term market turmoil to build a position.

Be the first to comment